Amsterdam Stock Market Opens Down 7% On Trade War Concerns

Table of Contents

Trade War Uncertainty as the Primary Culprit

The current state of global trade tensions is the undeniable primary culprit behind the Amsterdam Stock Market's sharp decline. The ongoing trade disputes between major global economies, particularly the US and China, have created a climate of uncertainty that is severely impacting investor confidence worldwide, and the Netherlands is not immune. This uncertainty directly affects the Amsterdam Stock Exchange (AEX), a key indicator of the Dutch economy's health.

- Rising tariffs imposed by major global economies: Increased tariffs on goods traded between nations disrupt supply chains and increase production costs, leading to reduced profitability for Dutch companies involved in international trade.

- Uncertainty surrounding future trade agreements impacting Dutch exports: The Netherlands, with its highly export-oriented economy, is particularly vulnerable to trade war disruptions. Uncertainty over future trade agreements creates hesitancy among businesses and investors, impacting investment decisions and growth prospects.

- Negative investor sentiment due to trade war unpredictability: The unpredictable nature of trade negotiations fuels negative investor sentiment. This uncertainty makes it difficult for investors to plan long-term strategies, leading to a sell-off in the stock market.

- Impact on specific Dutch sectors heavily reliant on international trade (e.g., agriculture, technology): Sectors like agriculture and technology, heavily dependent on global markets, are significantly affected. Companies exporting agricultural products face reduced demand and lower prices, while tech companies may face difficulties with supply chains and international sales.

- Mention specific companies significantly affected by the drop: For example, [mention specific publicly traded Dutch companies and their percentage drops, citing reliable sources]. This highlights the real-world impact of the trade war on individual businesses listed on the Amsterdam Stock Market.

Impact on Key Amsterdam Stock Exchange Sectors

The downturn hasn't impacted all sectors equally. Some sectors of the Amsterdam Stock Market were hit harder than others, reflecting their differing degrees of exposure to global trade.

- Technology sector performance: The tech sector, often a bellwether for global economic health, experienced a significant drop, indicating concerns about disrupted supply chains and reduced global demand for tech products. [Cite specific data and company examples].

- Financial sector vulnerability: The financial sector also displayed vulnerability, reflecting anxieties about global economic stability and the potential for increased credit risk. [Cite specific data and company examples].

- Energy sector fluctuations: The energy sector experienced fluctuations, reflecting uncertainty in global energy markets and the impact of trade tensions on energy prices. [Cite specific data and company examples].

- Consumer goods sector impact: Even consumer goods companies, while perhaps less directly exposed, felt the impact of decreased consumer confidence and potential supply chain disruptions. [Cite specific data and company examples].

- Provide data on percentage drops for each sector: Presenting quantitative data on percentage drops for each sector will provide a clearer picture of the market's vulnerability.

Analysis of Investor Behavior

Investor reaction to the trade war concerns was swift and decisive. The market witnessed a clear demonstration of risk-averse behavior.

- High volume of sell orders: A high volume of sell orders overwhelmed the market, contributing significantly to the 7% drop.

- Decrease in trading activity: Beyond the sell-offs, a general decrease in trading activity indicated a lack of confidence and investors adopting a wait-and-see approach.

- Flight to safety assets: Investors sought refuge in "safe haven" assets like gold and government bonds, reflecting a lack of confidence in riskier investments.

- Impact on investor confidence: The sharp decline significantly impacted investor confidence, creating a negative feedback loop that exacerbates the market downturn.

Potential Long-Term Consequences for the Dutch Economy

The Amsterdam Stock Market's downturn has significant implications for the broader Dutch economy.

- Reduced economic growth projections: The decline suggests a potential downward revision of economic growth projections for the Netherlands.

- Potential job losses: Companies facing reduced demand and profitability may be forced to reduce their workforce, leading to job losses.

- Impact on consumer spending: Decreased economic confidence could lead to reduced consumer spending, further dampening economic growth.

- Government response and potential interventions: The Dutch government may need to implement fiscal or monetary policies to mitigate the negative economic impact.

Global Market Reactions and Correlations

The Amsterdam Stock Market's decline is not an isolated event. It reflects broader global concerns and shows correlations with other major markets.

- Comparison with other European stock exchanges (e.g., London, Frankfurt): Similar declines were observed in other European stock exchanges, indicating a widespread response to global trade war concerns.

- Correlation with US and Asian markets: The Amsterdam Stock Market's performance also correlates with the US and Asian markets, highlighting the interconnectedness of global financial markets.

- Analysis of global investor sentiment: The overall global investor sentiment is currently negative, reflecting widespread anxieties about the trade war's potential economic consequences.

Conclusion

The 7% drop in the Amsterdam Stock Market reflects a significant blow stemming from escalating global trade war concerns. This downturn has impacted various sectors, particularly those heavily reliant on international trade, leading to reduced investor confidence and potential long-term consequences for the Dutch economy. The correlation with other global markets underscores the interconnectedness of the global financial system and the widespread impact of trade uncertainties.

Call to Action: Stay informed about the evolving situation of the Amsterdam Stock Market and its response to global trade uncertainties. Continue monitoring news and analysis related to the AEX index and its constituent companies. Regularly check for updates on the Amsterdam Stock Market's performance to understand its trajectory and make informed decisions. Understanding the dynamics of the Amsterdam Stock Market is crucial for navigating these uncertain times.

Featured Posts

-

Escape To The Country Redefining Rural Living

May 25, 2025

Escape To The Country Redefining Rural Living

May 25, 2025 -

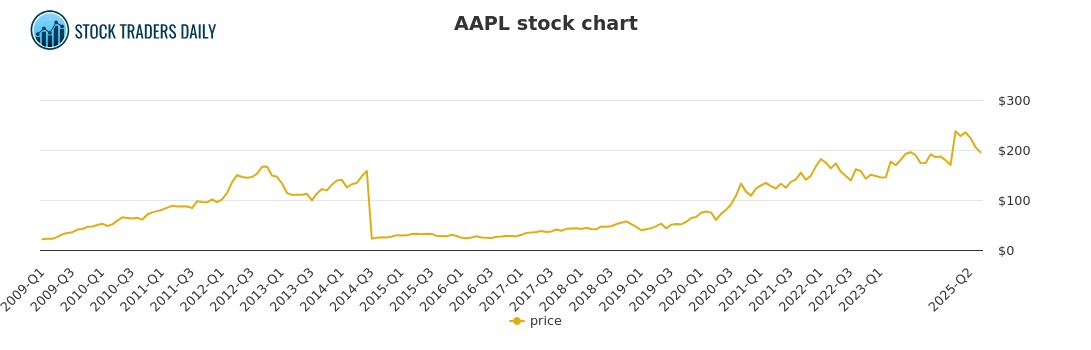

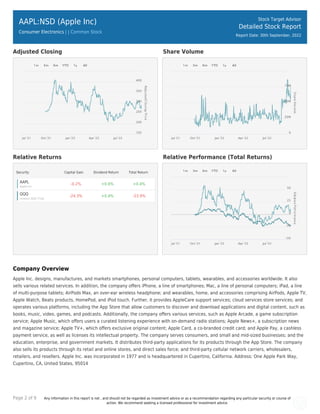

Aapl Stock Forecast Important Price Levels And Trading Strategies

May 25, 2025

Aapl Stock Forecast Important Price Levels And Trading Strategies

May 25, 2025 -

Apple Stock Price Action Ahead Of Fiscal Q2 Report

May 25, 2025

Apple Stock Price Action Ahead Of Fiscal Q2 Report

May 25, 2025 -

Artfae Daks Alalmany Mwshr Ela Teafy Alaqtsad Alawrwby

May 25, 2025

Artfae Daks Alalmany Mwshr Ela Teafy Alaqtsad Alawrwby

May 25, 2025 -

Mathieu Avanzi L Evolution Du Francais Au Dela Des Salles De Classe

May 25, 2025

Mathieu Avanzi L Evolution Du Francais Au Dela Des Salles De Classe

May 25, 2025

Latest Posts

-

Public Reaction To Thames Waters Executive Bonus Payments

May 25, 2025

Public Reaction To Thames Waters Executive Bonus Payments

May 25, 2025 -

Thames Waters Executive Bonuses A Case Study In Corporate Governance

May 25, 2025

Thames Waters Executive Bonuses A Case Study In Corporate Governance

May 25, 2025 -

High Stock Valuations Bof As Reason For Investor Calm

May 25, 2025

High Stock Valuations Bof As Reason For Investor Calm

May 25, 2025 -

Malaysias Najib Razak Faces New Accusations In French Submarine Bribery Case

May 25, 2025

Malaysias Najib Razak Faces New Accusations In French Submarine Bribery Case

May 25, 2025 -

Ignoring The Hype Bof As Argument Against Stock Market Valuation Concerns

May 25, 2025

Ignoring The Hype Bof As Argument Against Stock Market Valuation Concerns

May 25, 2025