Amundi MSCI World Ex US UCITS ETF: Understanding Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV)?

The Net Asset Value (NAV) represents the net worth of an ETF's underlying assets. Simply put, it's the total value of all the assets the ETF holds (like stocks, bonds, etc.) minus its liabilities (such as expenses and debts). This differs from the market price of the ETF, which fluctuates throughout the trading day based on supply and demand. The NAV, however, represents the intrinsic value of the ETF's holdings.

The NAV calculation incorporates several key components:

- Total market value of the underlying assets: This is the sum of the current market prices of all the securities held within the ETF's portfolio. For the Amundi MSCI World ex US UCITS ETF, this would include the market values of numerous international stocks excluding those in the US.

- Liabilities of the ETF: This includes any debts or obligations the ETF has.

- Expenses: Operating costs, management fees, and other expenses incurred by the ETF are deducted.

- Any accrued income: Interest earned on bonds or dividends received from stocks are added to the total value.

Understanding the difference between NAV and market price is crucial. While the market price reflects short-term trading activity, the NAV provides a more accurate picture of the ETF’s underlying asset value.

How is the NAV of the Amundi MSCI World ex US UCITS ETF Calculated?

The NAV of the Amundi MSCI World ex US UCITS ETF, like other UCITS ETFs, is calculated daily, typically at the close of market trading for the underlying assets. This process involves several steps:

- Asset valuation: The market prices of all the underlying securities in the ETF's portfolio are gathered. This often involves using closing prices from the relevant stock exchanges.

- Currency conversion: As the ETF invests globally, any holdings in currencies other than the ETF's base currency need to be converted using prevailing exchange rates.

- Deduction of expenses and liabilities: All relevant expenses and liabilities are subtracted from the total asset value.

- Calculation of NAV per share: The final net asset value is then divided by the total number of outstanding shares to determine the NAV per share.

This process is overseen by an independent pricing agent, ensuring transparency and accuracy. This independent verification is a key aspect of ensuring the integrity of the NAV calculation for the Amundi MSCI World ex US UCITS ETF.

Why is Understanding the NAV of the Amundi MSCI World ex US UCITS ETF Important for Investors?

Understanding the NAV of the Amundi MSCI World ex US UCITS ETF is vital for several reasons:

- Accurate valuation of your investment: The NAV provides a true reflection of the value of your investment in the ETF, allowing you to track its performance accurately.

- Performance measurement: Comparing the NAV against the benchmark index (MSCI World ex US) helps you assess the ETF's performance against its intended target.

- Identifying potential mispricing: By comparing the NAV to the market price, investors can identify potential arbitrage opportunities where the market price deviates significantly from the underlying asset value.

- Informed investment decisions: A thorough understanding of NAV allows for better-informed buy and sell decisions, ensuring you're investing at a price aligned with the true value of the underlying assets.

Monitoring the NAV helps you make better, more strategic investment decisions.

Where to Find the NAV of the Amundi MSCI World ex US UCITS ETF?

The daily NAV for the Amundi MSCI World ex US UCITS ETF is readily available through several official sources:

- Amundi's official website: The ETF provider's website is the primary source for the most accurate and up-to-date NAV information.

- Financial data providers: Reputable financial data providers like Bloomberg, Refinitiv, and Yahoo Finance also publish the NAV for this ETF.

Remember that there might be a slight time lag between the market close and the official publication of the NAV.

Conclusion: Mastering the Net Asset Value (NAV) of your Amundi MSCI World ex US UCITS ETF Investment

Understanding the Net Asset Value (NAV) is fundamental to successful investing in the Amundi MSCI World ex US UCITS ETF. We've covered its definition, the calculation process, and its critical role in assessing the true value of your investment and making informed decisions. Regularly monitoring the NAV, readily available on Amundi's website and through reputable financial data providers, empowers you to track your investment's performance effectively and capitalize on potential opportunities. Make sure to consult the Amundi website for the most up-to-date information on the Amundi MSCI World ex US UCITS ETF NAV. [Link to Amundi's website]

Featured Posts

-

Porsche Indonesia Classic Art Week 2025 Perayaan Seni Dan Otomotif

May 24, 2025

Porsche Indonesia Classic Art Week 2025 Perayaan Seni Dan Otomotif

May 24, 2025 -

Frankfurt Equities Opening Dax Continues Record Breaking Rise

May 24, 2025

Frankfurt Equities Opening Dax Continues Record Breaking Rise

May 24, 2025 -

Aex Stijgt Terwijl Amerikaanse Beurs Daalt Analyse En Vooruitzichten

May 24, 2025

Aex Stijgt Terwijl Amerikaanse Beurs Daalt Analyse En Vooruitzichten

May 24, 2025 -

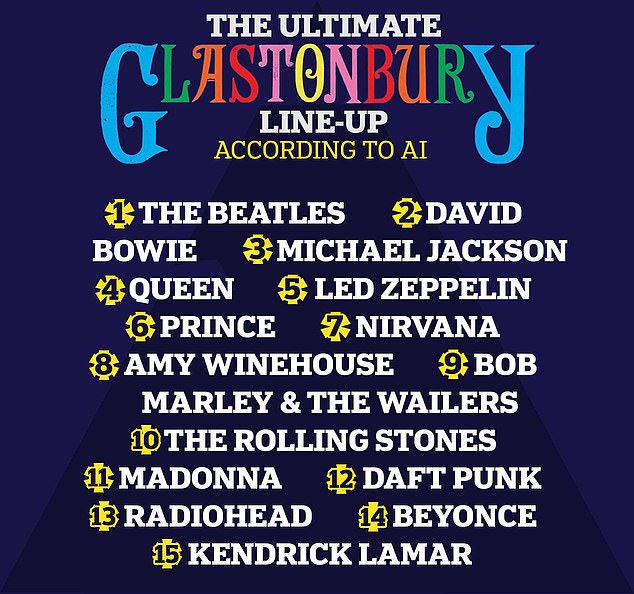

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025 -

Portrait Des Acteurs Du Brest Urban Trail Benevoles Artistes Et Partenaires

May 24, 2025

Portrait Des Acteurs Du Brest Urban Trail Benevoles Artistes Et Partenaires

May 24, 2025

Latest Posts

-

Buffetts Apple Holdings A Post Trump Tariff Analysis

May 24, 2025

Buffetts Apple Holdings A Post Trump Tariff Analysis

May 24, 2025 -

Apples Resilience Withstanding The Impact Of Tariffs

May 24, 2025

Apples Resilience Withstanding The Impact Of Tariffs

May 24, 2025 -

Analyzing Apples Performance Under Trumps Tariffs

May 24, 2025

Analyzing Apples Performance Under Trumps Tariffs

May 24, 2025 -

The Future Of Apple Navigating Trump Tariff Impacts

May 24, 2025

The Future Of Apple Navigating Trump Tariff Impacts

May 24, 2025 -

Is Apple Stock Headed To 254 Analyst Prediction And Buying Opportunities

May 24, 2025

Is Apple Stock Headed To 254 Analyst Prediction And Buying Opportunities

May 24, 2025