Is Apple Stock Headed To $254? Analyst Prediction & Buying Opportunities

Table of Contents

Analyst Predictions and Their Rationale

Several prominent analysts have weighed in on Apple's future, offering varying price targets. While not all predict a $254 price point, the convergence of positive factors suggests a significant upside potential.

Factors Supporting a $254 Target

Several key factors contribute to the optimistic outlook for Apple stock reaching $254:

-

Strong iPhone Sales: Despite economic headwinds, iPhone sales remain robust, consistently exceeding expectations. Recent data shows a [insert percentage]% year-over-year growth in iPhone shipments, demonstrating enduring consumer demand for Apple's flagship product. This sustained performance fuels Apple's overall revenue and profitability, directly impacting its stock price. Keywords: Apple iPhone sales, Apple revenue growth.

-

Growth in Services Revenue: Apple's services segment (including iCloud, Apple Music, Apple TV+, etc.) is experiencing exponential growth. This recurring revenue stream offers greater stability and predictability than hardware sales alone, bolstering Apple's long-term valuation. The services sector showed a [insert percentage]% increase in the last quarter, indicating a healthy trajectory. Keywords: Apple services revenue, Apple subscription services.

-

Innovative Product Pipeline: Apple consistently releases innovative products and services, maintaining its competitive edge. Upcoming product launches (e.g., new iPhones, AR/VR headsets) are anticipated to drive further sales and enhance Apple's market position. Keywords: Apple innovation, Apple new products, Apple product pipeline.

-

Expansion into New Markets: Apple is actively expanding into new and emerging markets, tapping into vast untapped potential. Increased penetration in [mention specific regions] will fuel revenue diversification and growth. Keywords: Apple market expansion, Apple international sales.

-

Positive Investor Sentiment: Positive investor sentiment reflects confidence in Apple's long-term prospects. This is evidenced by [mention specific indicators, e.g., high institutional ownership, strong buy ratings from analysts]. Keywords: Apple investor sentiment, Apple stock rating.

Potential Risks and Headwinds

Despite the bullish outlook, several factors could hinder Apple stock from reaching $254:

-

Supply Chain Issues: Global supply chain disruptions could impact Apple's production capacity and lead to delays in product launches. Keywords: Apple supply chain, Apple production.

-

Global Economic Slowdown: A potential global recession could dampen consumer spending and negatively affect demand for Apple products. Keywords: Apple economic outlook, Apple recession impact.

-

Increased Competition: Intensifying competition from rivals in various markets (smartphones, wearables, services) could erode Apple's market share. Keywords: Apple competition, Apple market share.

-

Regulatory Hurdles: Increasing regulatory scrutiny and antitrust investigations could pose challenges for Apple's operations and profitability. Keywords: Apple regulation, Apple antitrust.

Evaluating the Likelihood of Reaching $254

Assessing the likelihood of Apple stock reaching $254 requires a balanced consideration of the positive and negative factors discussed above.

Technical Analysis of Apple Stock

Technical analysis of Apple's stock chart, including examination of moving averages, support and resistance levels, and trading volume, offers valuable insights. [Mention specific technical indicators and their implications, e.g., a breakout above a key resistance level could signal a move towards $254]. Keywords: Apple stock chart, Apple stock technical analysis, Apple stock trading signals.

Fundamental Analysis of Apple's Financials

A thorough fundamental analysis of Apple's financial statements (revenue, earnings per share, debt-to-equity ratio, etc.) is crucial. Analyzing these metrics reveals the underlying health and profitability of the company, providing a strong foundation for valuation. Keywords: Apple stock financials, Apple earnings, Apple revenue growth, Apple P/E ratio.

Identifying Potential Buying Opportunities

For investors considering buying Apple stock, several strategies can help mitigate risk and potentially capitalize on the $254 prediction.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy reduces the risk of investing a lump sum at a market peak. Keywords: Apple stock investing, Apple stock strategy, long-term Apple stock investment.

Timing the Market vs. Buy-and-Hold

"Timing the market" attempts to buy low and sell high, while the "buy-and-hold" strategy involves long-term ownership regardless of short-term volatility. Both approaches have merit, but the buy-and-hold approach is often preferred for established companies like Apple with strong long-term growth potential. Keywords: Apple stock timing, Apple stock buy and hold.

Diversification and Risk Management

Diversifying investments across different asset classes is crucial for mitigating overall portfolio risk. Never invest more than you can afford to lose. Keywords: Apple stock diversification, risk management.

Conclusion

The potential for Apple stock to reach $254 is supported by several positive factors, including strong iPhone sales, growing services revenue, and a robust product pipeline. However, potential risks like supply chain issues and economic headwinds must be considered. This analysis provides a framework for evaluating the "Apple Stock $254" prediction. Is Apple stock headed to $254? Begin your own research to determine your next move. Remember to conduct thorough due diligence and consider your own risk tolerance before making any investment decisions. Consult with a financial advisor for personalized guidance.

Featured Posts

-

Nimi Muistiin 13 Vuotias Liittyy Ferrarin Kuskiakatemiaan

May 24, 2025

Nimi Muistiin 13 Vuotias Liittyy Ferrarin Kuskiakatemiaan

May 24, 2025 -

Apple Stock Trading Below Key Levels Q2 Earnings Preview

May 24, 2025

Apple Stock Trading Below Key Levels Q2 Earnings Preview

May 24, 2025 -

Green Spaces As Sanctuaries A Seattle Womans Pandemic Experience

May 24, 2025

Green Spaces As Sanctuaries A Seattle Womans Pandemic Experience

May 24, 2025 -

Beursupdate Negatief Sentiment Vs Positieve Aex Ontwikkeling

May 24, 2025

Beursupdate Negatief Sentiment Vs Positieve Aex Ontwikkeling

May 24, 2025 -

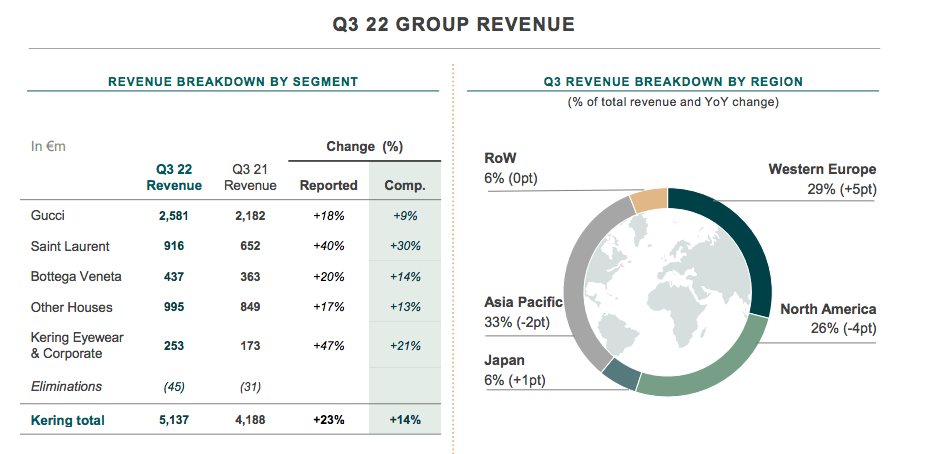

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025

Latest Posts

-

Exclusive Inside Sam Altman And Jony Ives Top Secret Device Development

May 24, 2025

Exclusive Inside Sam Altman And Jony Ives Top Secret Device Development

May 24, 2025 -

Stock Market News Tax Bill Passed Bond Market Reaction Bitcoin Surge

May 24, 2025

Stock Market News Tax Bill Passed Bond Market Reaction Bitcoin Surge

May 24, 2025 -

House Passes Tax Bill Impact On Stock Market Bonds And Bitcoin

May 24, 2025

House Passes Tax Bill Impact On Stock Market Bonds And Bitcoin

May 24, 2025 -

Alix Earle And The Dancing With The Stars Effect A Gen Z Influencers Journey

May 24, 2025

Alix Earle And The Dancing With The Stars Effect A Gen Z Influencers Journey

May 24, 2025 -

Shooting Outside Jewish Museum Israeli Embassy Employees Killed

May 24, 2025

Shooting Outside Jewish Museum Israeli Embassy Employees Killed

May 24, 2025