Amundi MSCI World II UCITS ETF Dist: Understanding Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. It's calculated daily, providing a snapshot of the ETF's underlying holdings' worth.

-

Defining NAV: The NAV calculation is straightforward: The total market value of all the assets held by the ETF (stocks, bonds, cash, etc.) is determined. From this total, all liabilities (expenses, management fees, etc.) are subtracted. The result is then divided by the total number of outstanding ETF shares to arrive at the NAV per share.

-

NAV and ETF Pricing: The ETF's market price typically closely tracks its NAV. However, a small difference, known as tracking error, can exist due to market supply and demand fluctuations.

- How NAV influences trading price: The NAV serves as a benchmark for the ETF's trading price. Ideally, the market price should be very close to the NAV.

- Factors affecting tracking error: Trading volume, market sentiment, and arbitrage opportunities can contribute to a slight divergence between the NAV and market price.

-

NAV's Role in Investment Decisions: Investors use the NAV to gauge the ETF's intrinsic value. By comparing the NAV to the market price, you can identify potential buying or selling opportunities. Tracking the NAV over time helps assess the ETF's overall performance.

- Comparing NAV to market price: A lower market price than NAV might indicate a buying opportunity, while a higher market price might suggest considering selling.

- Identifying potential buying or selling opportunities: Analyzing NAV trends can help investors identify entry and exit points that align with their investment strategy.

- Assessing ETF performance over time: Tracking the NAV helps investors evaluate the long-term performance of the ETF, enabling comparisons with other investments and benchmarks.

Understanding the Amundi MSCI World II UCITS ETF Dist's NAV

The Amundi MSCI World II UCITS ETF Dist tracks the MSCI World Index, providing broad global diversification across developed markets. This diversification impacts the NAV calculation as it reflects the performance of a large basket of international stocks.

-

Specifics of the ETF: This ETF aims to replicate the performance of the MSCI World Index, which includes large and mid-cap companies across developed countries. Changes in the composition of the index directly influence the ETF's NAV.

-

Where to Find the NAV: You can easily find the daily NAV for the Amundi MSCI World II UCITS ETF Dist from several reliable sources:

- The Amundi website

- Major financial news websites (e.g., Bloomberg, Yahoo Finance)

- Your brokerage account platform

-

Interpreting the NAV Data: Analyzing the daily NAV, comparing it to previous days' NAVs, and observing upward or downward trends provide insights into the ETF's performance. Comparing the ETF's NAV performance to the benchmark index (MSCI World Index) helps assess how effectively the ETF is tracking its target.

- Highlighting upward and downward trends: Consistent upward trends generally indicate positive performance, while downward trends signal potential concerns.

- Comparing to benchmark indices: Tracking the NAV against the MSCI World Index helps determine how well the ETF is replicating the index's performance.

Factors Affecting the Amundi MSCI World II UCITS ETF Dist's NAV

Several factors influence the Amundi MSCI World II UCITS ETF Dist's NAV. Understanding these factors is crucial for interpreting NAV movements and making informed investment decisions.

-

Market Fluctuations: Bull markets generally lead to increased NAV, while bear markets usually result in decreased NAV. Market volatility can cause significant daily NAV fluctuations.

- Examples of market events affecting NAV: Economic news, geopolitical events, and changes in interest rates can all impact the NAV.

-

Currency Exchange Rates: Since the ETF holds assets in multiple currencies, fluctuations in exchange rates can impact the NAV, especially during periods of significant currency volatility.

- Explain how currency fluctuations can positively or negatively affect NAV: A strengthening of the Euro (or the currency in which the ETF is denominated) against other currencies in which the underlying assets are held, will increase the NAV, and vice-versa.

-

Dividend Distributions: The "Dist" in Amundi MSCI World II UCITS ETF Dist signifies that it distributes dividends to shareholders. On the ex-dividend date (the date the stock trades without the dividend), the NAV will typically decrease to reflect the distributed amount.

- Explain the ex-dividend date and its effect on NAV: On the ex-dividend date, the NAV will drop by the amount of the dividend per share.

Conclusion: Mastering the Amundi MSCI World II UCITS ETF Dist Through NAV Understanding

Understanding the Net Asset Value (NAV) is paramount for successful investing in the Amundi MSCI World II UCITS ETF Dist. By regularly monitoring the NAV, comparing it to the market price, and analyzing its movements in relation to market conditions and dividend distributions, you can make more informed investment decisions and assess the performance of your holdings. Remember to always consult reliable sources for the most accurate NAV data. Regularly check your Amundi MSCI World II UCITS ETF Dist NAV and use this knowledge to optimize your investment strategy. For further insights into ETFs and NAV calculations, explore resources offered by your broker or financial advisors. Mastering the use of NAV will significantly improve your ability to manage your Amundi MSCI World II UCITS ETF Dist investment effectively.

Featured Posts

-

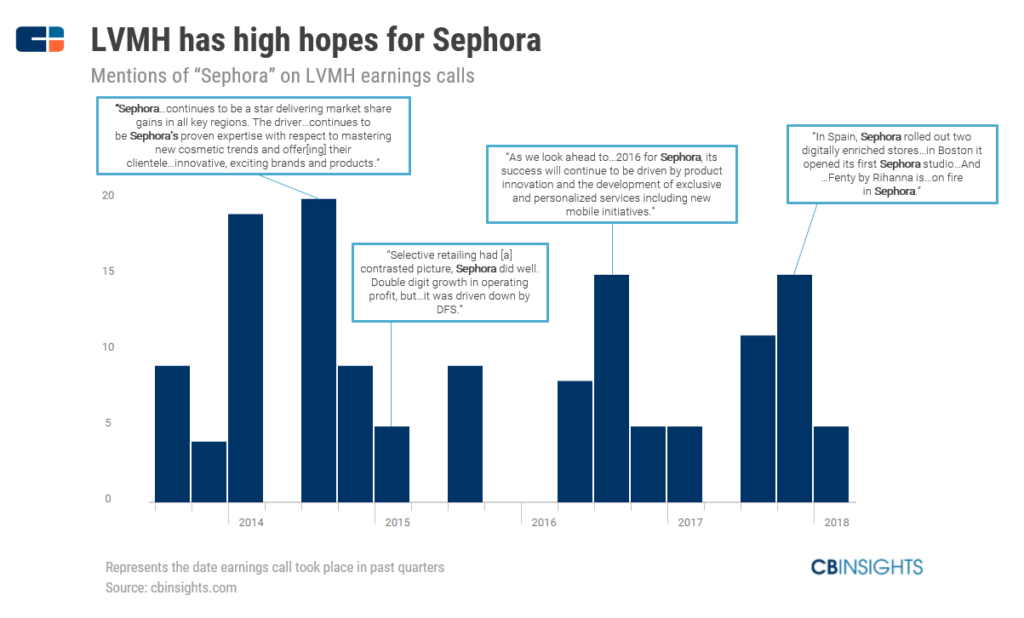

Lvmh Q1 Sales Miss Expectations Shares Fall 8 2

May 24, 2025

Lvmh Q1 Sales Miss Expectations Shares Fall 8 2

May 24, 2025 -

Markets React Trumps Tariff Comments And Lvmhs Sharp Drop

May 24, 2025

Markets React Trumps Tariff Comments And Lvmhs Sharp Drop

May 24, 2025 -

The Perils Of Change When Seeking Improvement Leads To Punishment

May 24, 2025

The Perils Of Change When Seeking Improvement Leads To Punishment

May 24, 2025 -

Konchita Vurst Pobeditel Evrovideniya 2014 Kaming Aut V 13 Let I Mechta O Bonde

May 24, 2025

Konchita Vurst Pobeditel Evrovideniya 2014 Kaming Aut V 13 Let I Mechta O Bonde

May 24, 2025 -

Glastonbury 2025 Charli Xcx Neil Young And The Artists You Cant Miss

May 24, 2025

Glastonbury 2025 Charli Xcx Neil Young And The Artists You Cant Miss

May 24, 2025

Latest Posts

-

French Cac 40 Index Friday Losses Offset By Weekly Stability March 7 2025

May 24, 2025

French Cac 40 Index Friday Losses Offset By Weekly Stability March 7 2025

May 24, 2025 -

Paris Facing Economic Headwinds The Impact Of The Luxury Goods Market Slowdown March 7 2025

May 24, 2025

Paris Facing Economic Headwinds The Impact Of The Luxury Goods Market Slowdown March 7 2025

May 24, 2025 -

Gucci Industrial Chief Massimo Vians Exit Analysis And Future Outlook

May 24, 2025

Gucci Industrial Chief Massimo Vians Exit Analysis And Future Outlook

May 24, 2025 -

Cac 40 Index Week Ends Lower But Remains Steady Overall March 7 2025

May 24, 2025

Cac 40 Index Week Ends Lower But Remains Steady Overall March 7 2025

May 24, 2025 -

Luxury Goods Slump Hits Paris Economic Impact Of Market Downturn March 7 2025

May 24, 2025

Luxury Goods Slump Hits Paris Economic Impact Of Market Downturn March 7 2025

May 24, 2025