Markets React: Trump's Tariff Comments And LVMH's Sharp Drop

Table of Contents

Trump's Tariff Comments and Their Context

Former President Trump's recent statements regarding potential new tariffs sent ripples through global markets. While not explicitly targeting the luxury goods sector, the general tone and historical context of his comments fueled uncertainty. His rhetoric often focused on protecting American industries and rebalancing trade relationships, potentially leading to broad-based tariff increases on imported goods.

- Historical Context: Trump's presidency was marked by significant trade disputes and the imposition of tariffs on various goods from countries like China and the European Union. This history created an environment of heightened sensitivity to any suggestion of renewed protectionist measures.

- News Sources: [Link to a reputable news source reporting on Trump's comments]. [Link to another reputable news source].

- Reasons Behind the Comments: The exact motivations behind Trump's comments remain open to interpretation. They could be attributed to various factors, including political posturing, attempts to influence ongoing negotiations, or a genuine belief in the need for further trade protectionism. The comments likely reflected ongoing tensions regarding trade imbalances and the desire to bolster specific domestic industries.

LVMH's Stock Market Reaction

LVMH, a major player in the global luxury goods market, felt the immediate impact of Trump's comments. Its stock price experienced a sharp decline, dropping by [Insert Percentage]% within [Timeframe] of the statements being released. This significant drop underscores the vulnerability of even the most successful companies to shifts in global economic sentiment.

- Stock Price Movement: [Insert chart or graph illustrating LVMH's stock price movement around the time of Trump's comments].

- Market Capitalization Impact: The drop in LVMH's stock price resulted in a substantial decrease in its market capitalization, signifying a loss of investor confidence. This loss represents billions of dollars in shareholder value.

- Analyst Reactions: Following the stock drop, analysts offered mixed predictions, with some emphasizing the short-term nature of the impact and others expressing concerns about the potential for long-term damage to consumer confidence and spending.

The Broader Impact on the Luxury Goods Sector

The reaction to Trump's comments wasn't limited to LVMH. The broader luxury goods sector experienced a period of uncertainty, with other major players seeing similar, though potentially less dramatic, stock price fluctuations. This highlights the interconnectedness of the luxury market and its susceptibility to global economic and political events.

- Vulnerability to Economic Uncertainty: The luxury goods market is inherently vulnerable to economic downturns and uncertainty. High-end consumers are often the first to curtail spending during periods of instability.

- Dependence on International Trade: Luxury brands heavily rely on international trade for both sourcing materials and distributing their products globally. Tariffs and trade disputes can disrupt these supply chains and significantly impact profitability.

- Long-Term Consequences: The potential long-term consequences for the luxury goods industry depend on several factors, including the duration and extent of any new tariff measures, the overall global economic climate, and consumer responses to changing prices and availability.

Analyzing the Economic and Geopolitical Implications

The events surrounding Trump's comments and LVMH's stock drop highlight the complex interplay between political rhetoric, market sentiment, and global economic stability. The impact extends far beyond the luxury goods sector, potentially affecting investor confidence and consumer spending more broadly.

- Ripple Effects: The uncertainty created by such statements can ripple through various sectors of the economy, affecting investor decisions and potentially slowing down investment and economic growth.

- Investor Sentiment and Market Psychology: Market psychology plays a crucial role. Fear and uncertainty can trigger sell-offs, even if the underlying fundamentals of a company remain strong.

- Potential for Further Volatility: The incident serves as a reminder of the potential for sudden and significant market volatility driven by unpredictable geopolitical events and policy changes.

Conclusion

Trump's comments on tariffs triggered a significant drop in LVMH's stock price, highlighting the vulnerability of even the largest luxury goods companies to political uncertainty. This event underscores the interconnectedness of political rhetoric, market sentiment, and the financial performance of multinational corporations. The broader impact on the luxury goods sector and the global economy remains to be seen, but the incident serves as a stark reminder of the potential for significant market fluctuations driven by geopolitical factors.

Call to Action: Stay informed about the ongoing impact of Trump's trade policies and their effects on the market by following reputable financial news sources. Understand how these shifts in the global economy can impact your investments and financial strategies. Keep monitoring the situation regarding Trump tariffs and their influence on LVMH stock and the luxury goods market. Understanding the impact of Trump tariffs is crucial for informed investment decisions.

Featured Posts

-

Tathyr Atfaq Altjart Byn Alsyn Walwlayat Almthdt Ela Mwshr Daks

May 24, 2025

Tathyr Atfaq Altjart Byn Alsyn Walwlayat Almthdt Ela Mwshr Daks

May 24, 2025 -

Rekomendasi Dayamitra Telekomunikasi Mtel And Merdeka Battery Mbma Pasca Masuk Msci Small Cap Index

May 24, 2025

Rekomendasi Dayamitra Telekomunikasi Mtel And Merdeka Battery Mbma Pasca Masuk Msci Small Cap Index

May 24, 2025 -

Amsterdam Stock Exchange Opens Down 7 Trade War Intensifies

May 24, 2025

Amsterdam Stock Exchange Opens Down 7 Trade War Intensifies

May 24, 2025 -

Neden Porsche 956 Araci Tavanindan Asili Durumda Sergileniyor

May 24, 2025

Neden Porsche 956 Araci Tavanindan Asili Durumda Sergileniyor

May 24, 2025 -

New Era Of Cooperation Bangladesh And Europes Commitment To Growth

May 24, 2025

New Era Of Cooperation Bangladesh And Europes Commitment To Growth

May 24, 2025

Latest Posts

-

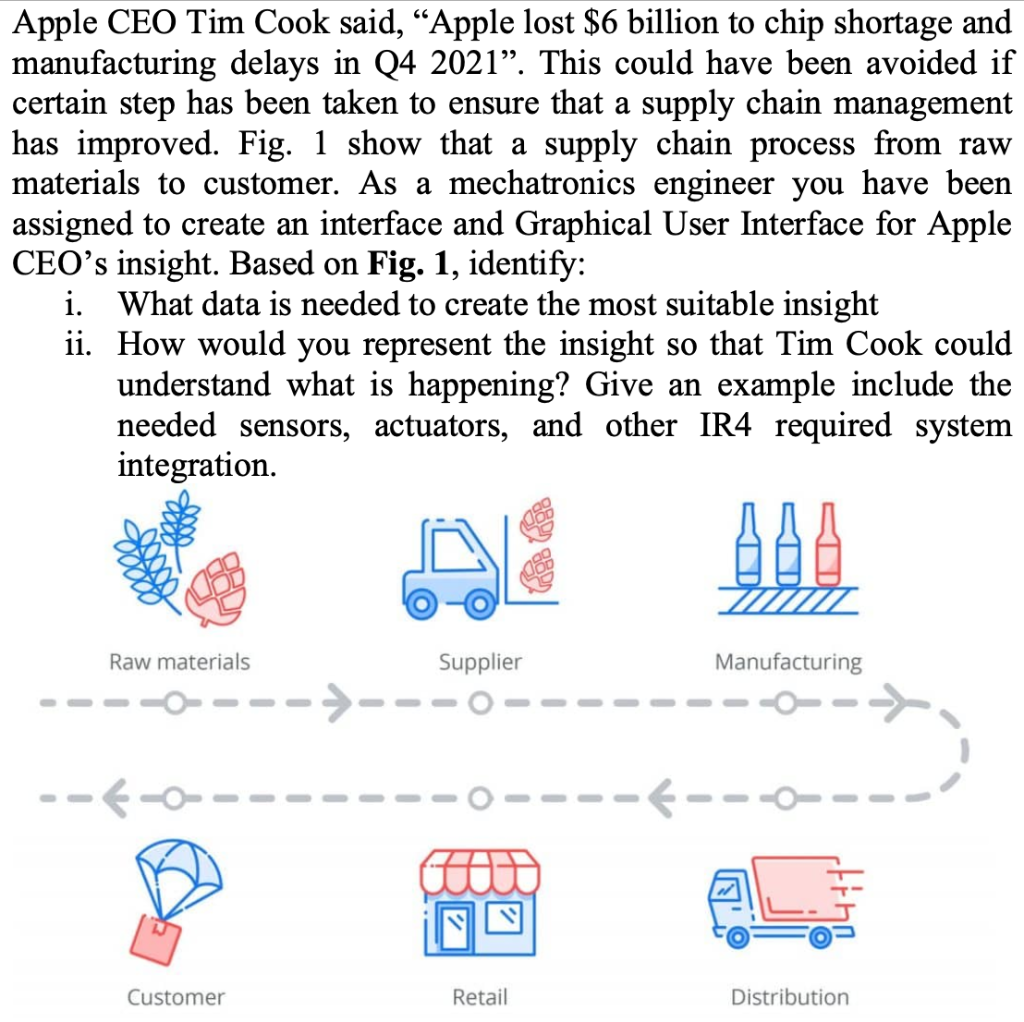

Analyzing Apples Performance Under Trumps Tariffs

May 24, 2025

Analyzing Apples Performance Under Trumps Tariffs

May 24, 2025 -

The Future Of Apple Navigating Trump Tariff Impacts

May 24, 2025

The Future Of Apple Navigating Trump Tariff Impacts

May 24, 2025 -

Is Apple Stock Headed To 254 Analyst Prediction And Buying Opportunities

May 24, 2025

Is Apple Stock Headed To 254 Analyst Prediction And Buying Opportunities

May 24, 2025 -

Tim Cooks Tariff Warning Triggers Apple Stock Sell Off

May 24, 2025

Tim Cooks Tariff Warning Triggers Apple Stock Sell Off

May 24, 2025 -

Buffetts Apple Investment Impact Of Trump Tariffs

May 24, 2025

Buffetts Apple Investment Impact Of Trump Tariffs

May 24, 2025