Analyzing The Feasibility Of Trump's Plan To Reshore Manufacturing

Table of Contents

Economic Viability of Reshoring

The core of any successful reshoring initiative lies in its economic viability. Can American companies realistically compete with the lower production costs often found overseas?

Cost Analysis: Domestic vs. Foreign Manufacturing

A critical factor is the cost comparison between domestic and foreign manufacturing. This involves a multifaceted analysis:

- Labor Costs: While wages in the US are generally higher than in many developing nations, automation can mitigate this difference.

- Material Costs: Access to raw materials and the cost of transportation within the US must be considered.

- Energy Costs: Energy prices significantly influence manufacturing costs, varying considerably across regions and impacting the overall competitiveness of domestic production.

- Tariffs and Trade Agreements: Trump's trade policies significantly impacted import costs, influencing the relative cost-competitiveness of domestic production. The long-term effects of these policies remain a subject of ongoing analysis.

- Government Incentives: Tax breaks, subsidies, and other government incentives can help offset higher domestic costs, potentially making reshoring more economically attractive.

Studies show that while labor costs remain a challenge, advancements in automation and the potential for government support can reduce the cost gap. However, a comprehensive cost-benefit analysis for each specific industry is crucial before drawing definitive conclusions.

Market Demand and Consumer Preferences

Reshoring is not only about cost; it also hinges on market demand. Will consumers readily embrace "Made in America" products, even if they are more expensive?

- Consumer Surveys: Market research consistently indicates a segment of consumers willing to pay a premium for domestically manufactured goods, prioritizing factors like quality, ethical production, and support for American jobs.

- Brand Loyalty: Strong brand loyalty and a commitment to domestic sourcing can also offset higher prices.

- Price Sensitivity: The extent to which price increases affect market competitiveness varies greatly depending on the product category and consumer demographics.

Logistical and Infrastructural Challenges

Even with economic viability, significant logistical hurdles exist. Shifting production back to the US requires a robust infrastructure.

Supply Chain Disruptions

Rebuilding domestic supply chains presents considerable challenges:

- Transportation Infrastructure: The US transportation network, while extensive, faces capacity constraints, especially concerning efficient last-mile delivery for many sectors.

- Bottlenecks and Delays: Reliance on a smaller pool of domestic suppliers increases vulnerability to disruptions, as any bottleneck can significantly impact production.

- Global Supply Chain Integration: Many businesses benefit from the established efficiency and scale of global supply chains, and breaking away from those can entail substantial costs and complexities.

Skilled Labor Shortages

Another crucial factor is the availability of a skilled workforce:

- Vocational Training: Investing in robust vocational training programs is essential to meet the skills demands of reshored manufacturing.

- Immigration Policies: Immigration policies and their impact on the availability of skilled labor directly influence the feasibility of reshoring initiatives.

- Automation as a Solution: Automation can alleviate labor shortages but also raises questions about job displacement and the need for workforce retraining initiatives.

Political and Regulatory Landscape

The political environment greatly influences reshoring efforts.

Trade Policies and Tariffs

Trump's trade policies, including tariffs, aimed to make imports more expensive, thereby encouraging domestic production.

- Tariff Effectiveness: The actual effectiveness of tariffs in reshoring varies widely across industries. Some experienced minimal impact, while others faced significant challenges due to retaliatory measures.

- Retaliatory Measures: The imposition of tariffs frequently led to retaliatory actions from other countries, negating some of the intended benefits of these policies.

Government Incentives and Regulations

Government support plays a significant role:

- Tax Breaks and Subsidies: Tax incentives and subsidies can make domestic production more economically attractive, but their effectiveness depends on their design and implementation.

- Environmental Regulations: Strict environmental regulations, while vital for sustainability, can also increase manufacturing costs, impacting the competitiveness of domestic production relative to countries with less stringent regulations.

Conclusion: Assessing the Feasibility of Reshoring Manufacturing Under Trump's Plan

The feasibility of Trump's plan to reshore manufacturing is a multifaceted issue. While the desire for increased domestic production and job creation is understandable, the economic realities, logistical complexities, and political dynamics create considerable challenges. While some industries may find reshoring economically viable with the right mix of automation, government incentives, and consumer support, others may face insurmountable hurdles. The impact of trade policies and the availability of a skilled workforce remain key factors influencing the long-term success of any reshoring initiative.

Further research is crucial to understand the sector-specific nuances involved in reshoring manufacturing initiatives. A more nuanced approach, combining strategic investment in infrastructure, workforce development, and targeted government support with careful consideration of economic realities, is needed to assess the true feasibility of reshoring and develop effective domestic manufacturing strategies. The ongoing debate on the feasibility of reshoring necessitates a comprehensive and data-driven examination of these complex economic and political factors.

Featured Posts

-

Is De Nederlandse Huizenmarkt Betaalbaar De Standpunten Van Abn Amro En Geen Stijl

May 21, 2025

Is De Nederlandse Huizenmarkt Betaalbaar De Standpunten Van Abn Amro En Geen Stijl

May 21, 2025 -

Bwtshytynw Ystdey Thlatht Laebyn Jdd Lmntkhb Alwlayat Almthdt

May 21, 2025

Bwtshytynw Ystdey Thlatht Laebyn Jdd Lmntkhb Alwlayat Almthdt

May 21, 2025 -

A Cannes Tradition The Traverso Familys Photographic Legacy

May 21, 2025

A Cannes Tradition The Traverso Familys Photographic Legacy

May 21, 2025 -

Groeiend Autobezit Drijft Occasionverkoop Bij Abn Amro Omhoog

May 21, 2025

Groeiend Autobezit Drijft Occasionverkoop Bij Abn Amro Omhoog

May 21, 2025 -

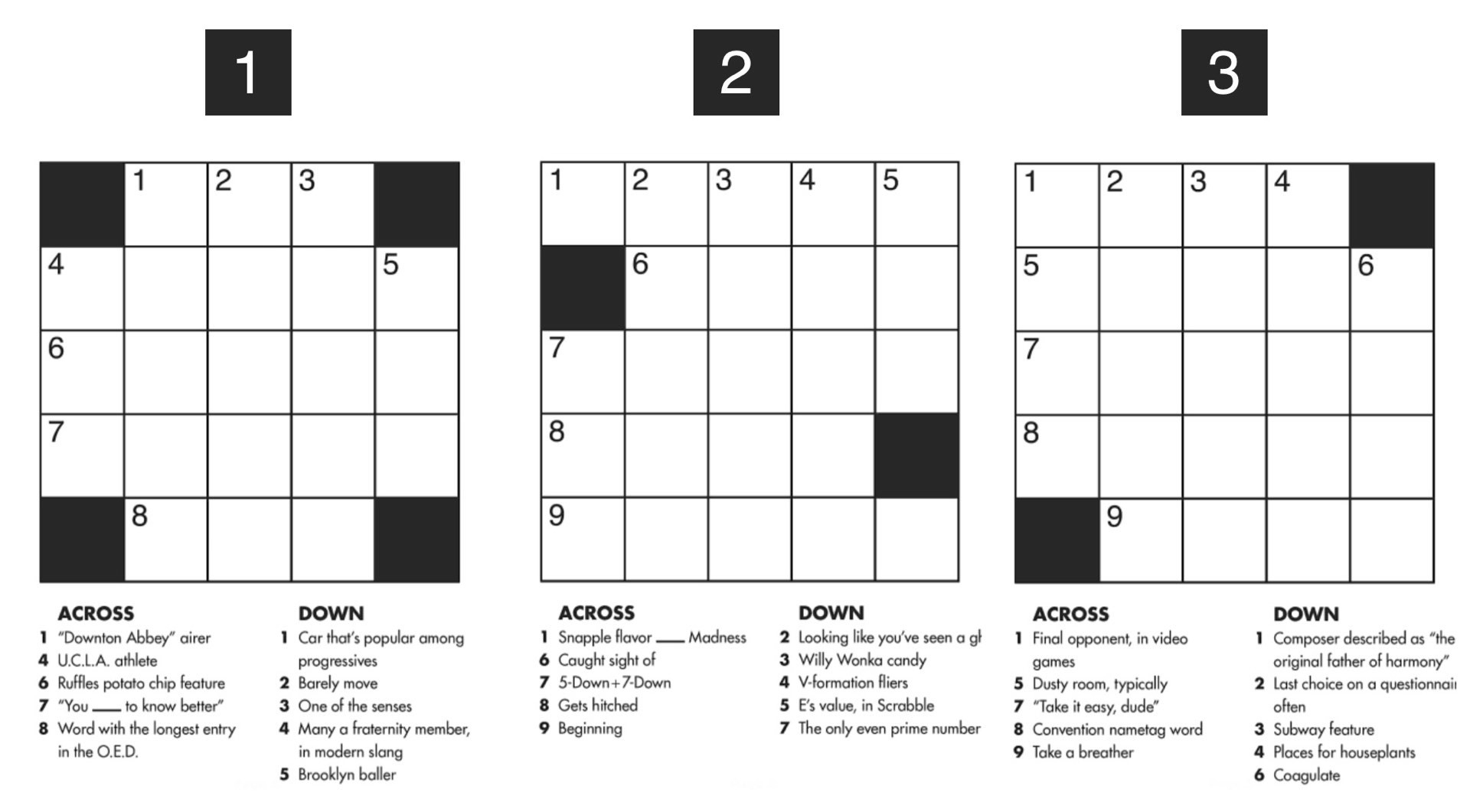

Easy Nyt Mini Crossword Hints April 26 2025

May 21, 2025

Easy Nyt Mini Crossword Hints April 26 2025

May 21, 2025

Latest Posts

-

D Wave Quantum Qbts Stock Investigating Thursdays Price Decrease

May 21, 2025

D Wave Quantum Qbts Stock Investigating Thursdays Price Decrease

May 21, 2025 -

Bbai Stock Assessing The Impact Of The Recent Analyst Downgrade

May 21, 2025

Bbai Stock Assessing The Impact Of The Recent Analyst Downgrade

May 21, 2025 -

Analyzing The 2025 Drop In Big Bear Ai Bbai Stock Key Insights

May 21, 2025

Analyzing The 2025 Drop In Big Bear Ai Bbai Stock Key Insights

May 21, 2025 -

Big Bear Ai Bbai Stock Analyst Downgrade Sparks Investor Uncertainty

May 21, 2025

Big Bear Ai Bbai Stock Analyst Downgrade Sparks Investor Uncertainty

May 21, 2025 -

Market Reaction Deciphering D Wave Quantum Qbts Thursday Stock Decline

May 21, 2025

Market Reaction Deciphering D Wave Quantum Qbts Thursday Stock Decline

May 21, 2025