Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the underlying value of an Exchange Traded Fund (ETF) share. For the Amundi Dow Jones Industrial Average UCITS ETF (Distributing), the NAV reflects the total value of the assets held within the ETF, minus any liabilities, divided by the total number of outstanding shares. This differs from the market price, which is the price at which the ETF is currently trading on the exchange.

- NAV represents the underlying asset value per share. This is a crucial distinction; it represents the intrinsic value of the ETF, not its perceived market value.

- Calculation involves total assets minus liabilities, divided by outstanding shares. This straightforward calculation provides a snapshot of the ETF's net worth. The assets include the holdings that mirror the Dow Jones Industrial Average. Liabilities could include management fees and other operational costs.

- Market price can fluctuate throughout the trading day, while NAV is typically calculated daily. This is why you might see the ETF trading at a slight premium or discount to its NAV.

- Understanding the difference between NAV and market price is crucial for informed investment decisions. Knowing the difference allows you to identify potential buying opportunities (when the market price is below NAV) or to avoid overpaying (when the market price is significantly above NAV).

Factors Influencing the Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors influence the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF. Understanding these factors is crucial for predicting potential NAV movements.

- The ETF's NAV directly mirrors the performance of the underlying Dow Jones Industrial Average index. If the Dow Jones Industrial Average rises, the ETF's NAV will generally rise proportionally. Conversely, a decline in the index will usually lead to a decrease in the NAV.

- Currency exchange rates can impact the NAV if the ETF holds assets denominated in different currencies. While this ETF primarily tracks a US-dollar denominated index, any underlying holdings in other currencies could be affected by exchange rate fluctuations.

- Dividend payouts from underlying companies will typically reduce the NAV. When companies within the Dow Jones Industrial Average pay dividends, this income is initially reflected in the ETF's assets, but after distribution to shareholders, the NAV decreases accordingly.

- Regular distributions to shareholders affect the NAV, decreasing the post-distribution NAV. The Amundi Dow Jones Industrial Average UCITS ETF is a distributing ETF, meaning it distributes dividends to shareholders regularly. This distribution lowers the NAV, but it's important to remember that this is a return of capital.

How to Interpret the Amundi Dow Jones Industrial Average UCITS ETF NAV

Interpreting the NAV effectively requires understanding where to find the data and how to use it for analysis.

- Daily NAV is typically available on the ETF provider's website and major financial data platforms. Amundi's website, as well as sites like Bloomberg and Yahoo Finance, usually provide this data.

- Monitoring NAV fluctuations provides insight into the ETF's performance relative to the underlying index. Tracking the NAV over time allows you to assess the ETF's tracking efficiency – how closely it mirrors the Dow Jones Industrial Average's performance.

- Comparing NAV to the market price helps identify potential buying or selling opportunities (premium/discount). A significant difference between the NAV and market price could indicate a mispricing, presenting a potential trading opportunity.

- Long-term NAV trends can reveal the ETF's overall investment strategy effectiveness. Analyzing the long-term NAV trend reveals the overall performance of the investment strategy implemented by the ETF.

Using NAV for Investment Decisions

NAV is a valuable tool in making investment decisions, but it shouldn't be the sole factor.

- Significant deviations between NAV and market price could signal opportunities. A prolonged discount could indicate a buying opportunity, while a sustained premium might suggest a time to consider selling.

- Monitoring NAV helps manage investment risk by providing a clearer picture of the underlying asset value. By understanding the intrinsic value of the ETF, you can make more informed risk assessments.

- NAV should be considered alongside other factors, such as expense ratios and trading volume. Expense ratios directly impact your returns, and trading volume can impact liquidity.

Conclusion:

Analyzing the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) is crucial for informed investment decisions. Understanding the factors influencing the NAV, interpreting its changes over time, and using this information alongside other market indicators allows for a more comprehensive assessment of the ETF's performance and risk. By consistently monitoring the Amundi Dow Jones Industrial Average UCITS ETF NAV, investors can make more strategic and effective investment choices. Learn more about optimizing your investment strategy with a thorough understanding of Amundi Dow Jones Industrial Average UCITS ETF NAV analysis and related ETF metrics.

Featured Posts

-

Net Asset Value Nav Of The Amundi Msci World Catholic Principles Ucits Etf Acc

May 25, 2025

Net Asset Value Nav Of The Amundi Msci World Catholic Principles Ucits Etf Acc

May 25, 2025 -

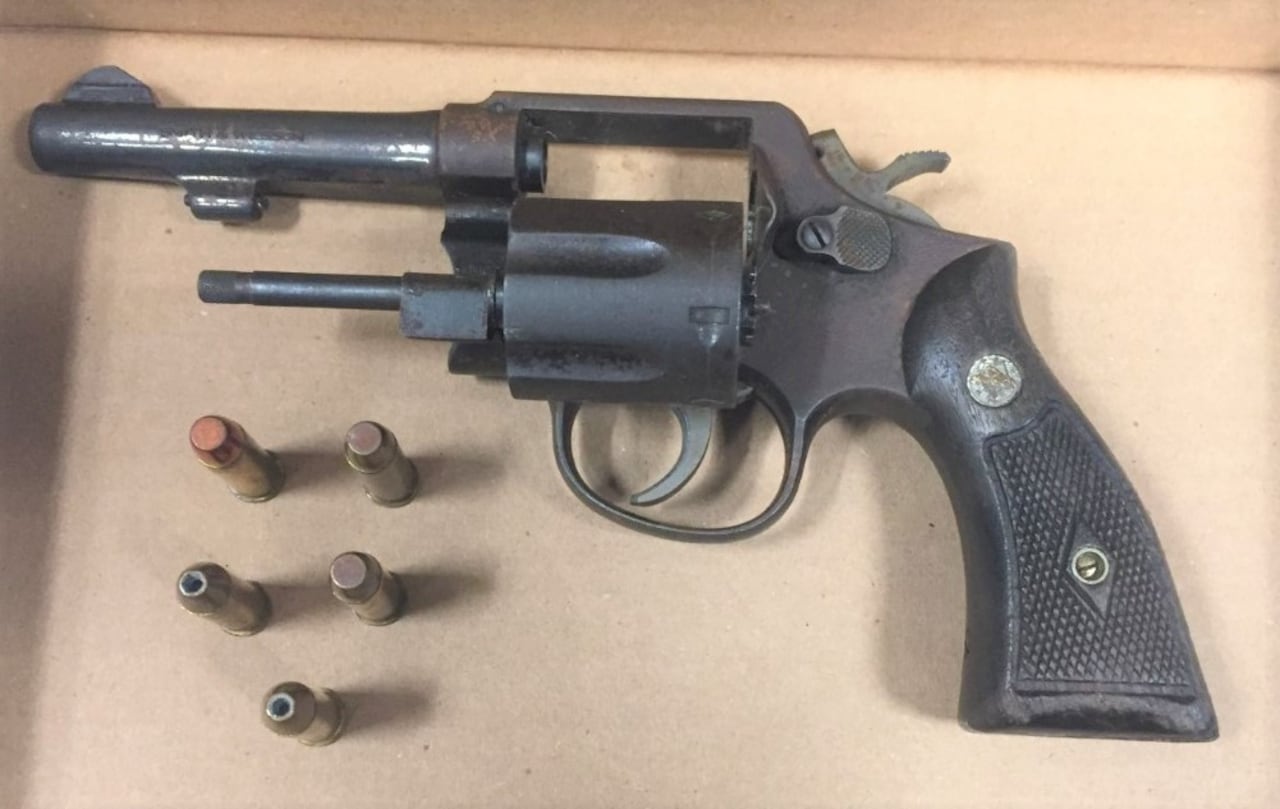

Massachusetts Authorities Seize Over 100 Firearms Arrest 18 In Gun Trafficking Case

May 25, 2025

Massachusetts Authorities Seize Over 100 Firearms Arrest 18 In Gun Trafficking Case

May 25, 2025 -

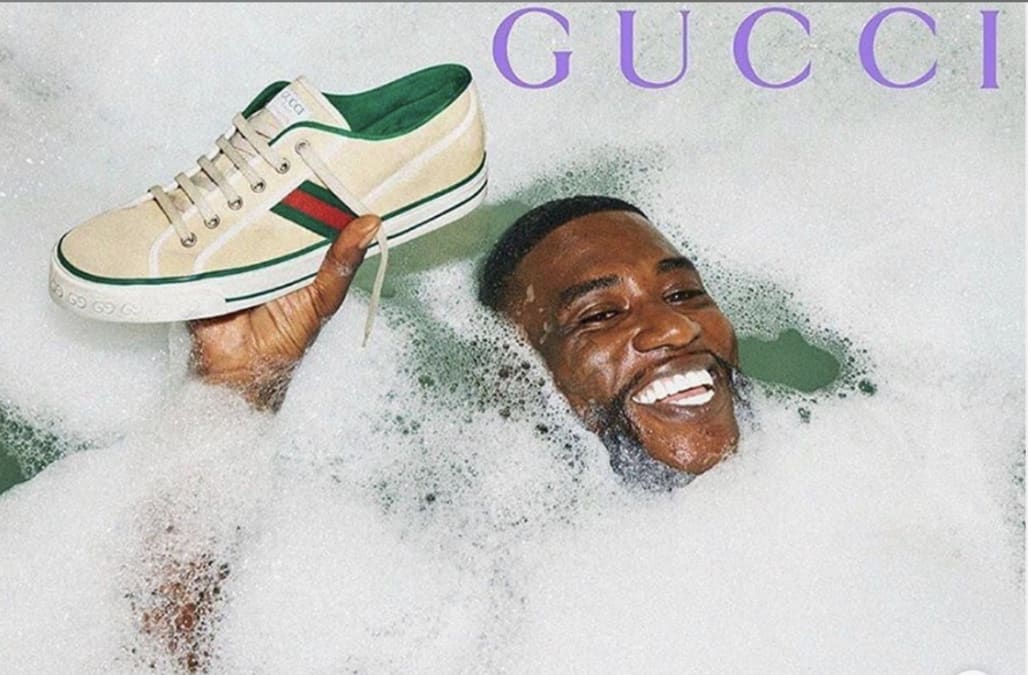

What Demna Brings To The Gucci Brand

May 25, 2025

What Demna Brings To The Gucci Brand

May 25, 2025 -

Test Drogowy Porsche Cayenne Gts Coupe Subiektywna Ocena

May 25, 2025

Test Drogowy Porsche Cayenne Gts Coupe Subiektywna Ocena

May 25, 2025 -

Nashemu Pokoleniyu Chto To Udalos Dostizheniya I Vyzovy Vremeni

May 25, 2025

Nashemu Pokoleniyu Chto To Udalos Dostizheniya I Vyzovy Vremeni

May 25, 2025

Latest Posts

-

De Toekomst Van Europese Aandelen Wat Betekent De Recente Marktdraai

May 25, 2025

De Toekomst Van Europese Aandelen Wat Betekent De Recente Marktdraai

May 25, 2025 -

Amsterdam Stock Market 7 Drop Reflects Growing Trade War Concerns

May 25, 2025

Amsterdam Stock Market 7 Drop Reflects Growing Trade War Concerns

May 25, 2025 -

Europese En Amerikaanse Aandelen Vergelijking En Vooruitzichten Na Recente Verschuiving

May 25, 2025

Europese En Amerikaanse Aandelen Vergelijking En Vooruitzichten Na Recente Verschuiving

May 25, 2025 -

Significant Losses For Amsterdam Stocks 7 Fall On Trade War Anxiety

May 25, 2025

Significant Losses For Amsterdam Stocks 7 Fall On Trade War Anxiety

May 25, 2025 -

Analyse Snelle Marktdraai Europese Aandelen Een Voorbode Van Meer

May 25, 2025

Analyse Snelle Marktdraai Europese Aandelen Een Voorbode Van Meer

May 25, 2025