Analyzing Uber Technologies (UBER) As An Investment

Table of Contents

Understanding Uber's Business Model and Revenue Streams

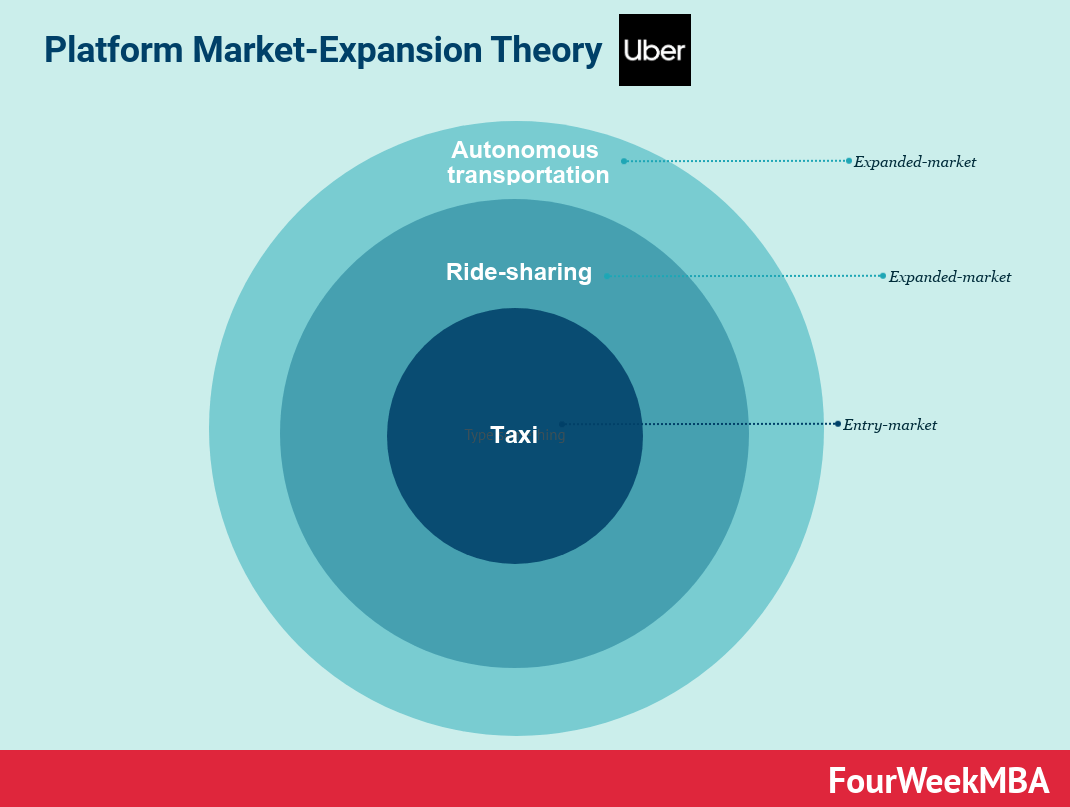

Uber's success hinges on a diversified business model extending beyond its core ride-sharing services. Let's analyze each key revenue stream:

Core Ride-Sharing Services: Dominating the Mobility Market

Uber's core business, ride-hailing, provides mobility services globally. Its market penetration is significant, with market dominance in many major cities worldwide. This success is driven by:

- Global Presence: Uber operates in numerous countries and cities, providing widespread accessibility.

- Market Dominance: In many key markets, Uber holds a significant market share in the ride-hailing sector.

- Revenue Generation: Uber generates revenue primarily through commissions and fees charged on each ride.

Uber offers a range of ride options, from budget-friendly UberX to premium services like Uber Black, catering to diverse customer needs and contributing to varied revenue streams. Understanding this tiered service approach is crucial when analyzing Uber Technologies (UBER) as an investment.

Uber Eats and Food Delivery: A Growing Appetite for Growth

Uber Eats, Uber's food delivery service, represents a substantial and rapidly expanding revenue stream. Its success is attributed to:

- Market Share Growth: Uber Eats competes aggressively with other food delivery platforms, steadily increasing its market share.

- Growth Trajectory: The online ordering and food delivery market shows consistent growth, presenting significant opportunities for Uber Eats.

- Revenue Contribution: Uber Eats is becoming an increasingly important contributor to Uber's overall revenue and profitability.

Strategic partnerships with restaurants and expansion into new markets are key factors driving Uber Eats' expansion and profitability.

Freight and Other Emerging Businesses: A Look to the Future

Uber is actively diversifying its business beyond ride-sharing and food delivery. Uber Freight, focusing on logistics, and exploration of autonomous vehicles are examples of this strategy. Key aspects to consider include:

- Potential for Growth: The logistics and autonomous vehicle markets present significant growth opportunities.

- Market Opportunity: Uber's established technological infrastructure and brand recognition give it a competitive edge in these emerging sectors.

- Technological Advancements: Investment in autonomous vehicle technology could significantly reshape Uber's future.

These emerging businesses represent long-term bets that could substantially impact Uber's overall valuation and future profitability.

Financial Performance and Key Metrics

Analyzing Uber's financial health involves scrutinizing key metrics to assess its investment potential.

Revenue Growth and Profitability: Tracking the Bottom Line

Examining Uber's revenue growth and profitability provides insights into its financial performance:

- Year-over-Year Revenue Growth: Analyzing annual revenue growth reveals the company's expansion rate.

- Net Income: Net income shows Uber's profitability after all expenses are deducted.

- Earnings Per Share (EPS): EPS indicates the portion of a company's profit allocated to each outstanding share.

Factors influencing profitability include driver costs, marketing expenses, and competition. Consistent revenue growth alongside increasing profitability is a positive indicator for investors.

Debt and Cash Flow: A Look at Financial Health

Evaluating Uber's financial health requires assessing its debt levels and cash flow:

- Debt Levels: High debt levels can indicate financial risk.

- Cash on Hand: Sufficient cash reserves are crucial for weathering economic downturns and funding future growth.

- Operating Cash Flow: Positive operating cash flow indicates the company is generating cash from its operations.

A healthy balance sheet with manageable debt and strong cash flow is vital for long-term sustainability and future investments.

Competitive Landscape and Risks

The ride-sharing industry is fiercely competitive, and Uber faces significant challenges.

Major Competitors and Market Share: Navigating a Crowded Field

Uber faces stiff competition from various players globally:

- Key Competitors: Lyft, Didi Chuxing, and other regional players are significant competitors.

- Market Share Comparison: Analyzing market share helps assess Uber's competitive positioning.

- Competitive Strategies: Understanding competitors' strategies is crucial for predicting market dynamics.

Intense competition impacts pricing, market share, and profitability, making competitive analysis crucial when analyzing Uber Technologies (UBER) as an investment.

Regulatory Risks and Legal Challenges: Navigating the Legal Landscape

Uber operates in a highly regulated industry, facing various legal and regulatory challenges:

- Regulatory Environment: Regulations concerning driver classification, insurance, and safety standards vary significantly across jurisdictions.

- Legal Risks: Legal challenges related to labor practices, data privacy, and antitrust concerns pose significant risks.

- Compliance: Meeting diverse regulatory requirements across different markets is essential for continued operations.

These regulatory and legal risks can significantly impact Uber's operations, profitability, and overall valuation.

Future Growth Potential and Investment Outlook

Uber's future growth potential depends on several factors.

Growth Opportunities and Expansion Plans: Charting a Course for the Future

Uber's future growth hinges on several strategic initiatives:

- Geographic Expansion: Expanding into new, underserved markets can drive significant growth.

- New Service Offerings: Introducing new services beyond ride-sharing and food delivery can diversify revenue streams.

- Technological Advancements: Investments in autonomous vehicles and other technologies could offer significant advantages.

These strategic initiatives represent potential catalysts for future growth and market share expansion.

Valuation and Investment Recommendation: A Final Assessment

Determining whether UBER is a buy, sell, or hold requires careful consideration of various factors:

- Current Stock Price: The current market price of UBER stock influences investment decisions.

- Price-to-Earnings Ratio (P/E): The P/E ratio provides insights into market valuation relative to earnings.

- Potential for Future Returns: Analyzing future growth prospects helps estimate potential returns on investment (ROI).

Based on our analysis, considering current market conditions and potential future growth, [Insert your investment recommendation here – Buy, Sell, or Hold, and justify this with a brief explanation based on your analysis of the points above].

Conclusion: Making Informed Decisions about Investing in Uber (UBER)

Analyzing Uber Technologies (UBER) as an investment requires a thorough understanding of its business model, financial performance, competitive landscape, and future growth prospects. We've explored these key areas, highlighting both opportunities and risks. Our analysis leads to the recommendation that [reiterate your investment recommendation]. However, remember that this is just one perspective. Before making any investment decisions, conduct your own thorough due diligence, carefully considering your personal risk tolerance and investment goals when analyzing Uber Technologies (UBER) as an investment. The information provided here is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Seattle Mariners Bryce Miller Out 15 Days Due To Elbow Issue

May 17, 2025

Seattle Mariners Bryce Miller Out 15 Days Due To Elbow Issue

May 17, 2025 -

Honda Production Shift Us Tariffs And Canadian Export Opportunities

May 17, 2025

Honda Production Shift Us Tariffs And Canadian Export Opportunities

May 17, 2025 -

Uber Pet Service Now Available In Delhi And Mumbai

May 17, 2025

Uber Pet Service Now Available In Delhi And Mumbai

May 17, 2025 -

Financial Planning Strategies For Student Loan Borrowers

May 17, 2025

Financial Planning Strategies For Student Loan Borrowers

May 17, 2025 -

Crude Oil Market Report News And Insights For May 16

May 17, 2025

Crude Oil Market Report News And Insights For May 16

May 17, 2025

Latest Posts

-

Jalen Brunsons Ankle Injury Knicks Lakers Game Update

May 17, 2025

Jalen Brunsons Ankle Injury Knicks Lakers Game Update

May 17, 2025 -

Analyzing The Knicks Performance Without Jalen Brunson

May 17, 2025

Analyzing The Knicks Performance Without Jalen Brunson

May 17, 2025 -

The Knicks Post Brunson Problems A Long Road To Recovery

May 17, 2025

The Knicks Post Brunson Problems A Long Road To Recovery

May 17, 2025 -

Analyzing The Impact Jalen Brunson Vs Luka Doncic Trade Which Setback Hurt The Mavericks More

May 17, 2025

Analyzing The Impact Jalen Brunson Vs Luka Doncic Trade Which Setback Hurt The Mavericks More

May 17, 2025 -

The New York Knicks And Their Unexpected Depth A Brunson Less Success Story

May 17, 2025

The New York Knicks And Their Unexpected Depth A Brunson Less Success Story

May 17, 2025