Analyzing XRP (Ripple): A Practical Guide To Potential Financial Growth

Table of Contents

XRP is a digital asset created by Ripple Labs, designed to facilitate fast and cost-effective international payments. Unlike Bitcoin or Ethereum, XRP's primary function is not as a standalone currency but as a bridge currency within the Ripple network, enabling near-instantaneous cross-border transactions. This article will equip you with the knowledge to understand XRP's technology, market performance, and investment implications.

Understanding XRP's Technology and Functionality

The Ripple Protocol

The Ripple Protocol Consensus Algorithm (RPCA) underpins the Ripple network, a distributed ledger technology (DLT) enabling secure and efficient transactions. Unlike proof-of-work systems like Bitcoin, RPCA uses a network of validators to confirm transactions, resulting in significantly faster processing times and lower energy consumption. This consensus mechanism ensures the integrity and security of the network.

XRP's Role in the Ecosystem

XRP plays a crucial role within the Ripple ecosystem, acting as a bridge currency to facilitate seamless transactions between different fiat currencies. Its key advantages include:

- Lower transaction fees: Compared to other cryptocurrencies and traditional banking systems, XRP transactions boast significantly lower fees.

- Faster transaction speeds: Transactions are processed within seconds, a stark contrast to the days or even weeks required by traditional banking systems.

- Increased transparency and security: The distributed ledger technology ensures transparency and reduces the risk of fraud.

Technological Advantages Over Competitors

XRP’s technology offers several advantages over competitors:

- Speed: XRP transactions are considerably faster than many other cryptocurrencies.

- Scalability: The Ripple network is designed to handle a large volume of transactions, making it more scalable than some blockchain networks.

- Energy Efficiency: RPCA consumes significantly less energy than proof-of-work consensus mechanisms.

| Feature | XRP | Bitcoin | Ethereum |

|---|---|---|---|

| Transaction Speed | Seconds | Minutes to Hours | Minutes to Hours |

| Transaction Fees | Very Low | Relatively High | Relatively High |

| Energy Consumption | Significantly Lower | Very High | High |

| Scalability | High | Low | Moderate |

Analyzing XRP's Market Performance and Price History

Historical Price Trends

XRP's price has experienced significant volatility throughout its history. Key events, such as regulatory announcements, partnerships with financial institutions, and broader market trends, have dramatically influenced its price. Analyzing historical price charts can reveal patterns and potential indicators of future price movements. [Insert Chart Showing XRP Price History Here]

Market Capitalization and Volume

Market capitalization, representing the total value of all XRP in circulation, and trading volume, indicating the amount of XRP traded within a specific period, are crucial metrics for assessing XRP's market strength and liquidity. High market capitalization and consistent trading volume often suggest a more stable and liquid asset.

Identifying Key Indicators

Technical analysis indicators, such as moving averages (MA), Relative Strength Index (RSI), and others, can be helpful tools in predicting short-term price trends. However, it's crucial to remember that these indicators are not foolproof and should be used in conjunction with fundamental analysis. Investing in cryptocurrencies involves significant risk, and losses are possible.

Assessing the Risks and Rewards of Investing in XRP

Regulatory Landscape

The regulatory environment surrounding XRP is currently complex and evolving. The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) significantly impacts XRP's price and future prospects. Staying updated on regulatory developments is crucial.

Market Volatility

Cryptocurrency markets are inherently volatile. XRP's price can fluctuate dramatically in short periods due to various factors, including market sentiment, news events, and regulatory changes. This volatility presents both opportunities and substantial risks.

Diversification and Risk Management

Diversification is crucial for any investment portfolio, including cryptocurrency investments. Don't put all your eggs in one basket. Consider diversifying beyond XRP into other assets to mitigate risk.

Potential for Growth

Despite the risks, XRP's potential for growth remains significant. Its adoption by financial institutions for cross-border payments and its role in the broader fintech space suggest potential for long-term growth.

Practical Strategies for Analyzing XRP Investments

Fundamental Analysis

Fundamental analysis involves evaluating XRP's underlying value based on factors such as its technological advancements, adoption rate by financial institutions, partnerships, and the overall utility of the Ripple network.

Technical Analysis

Technical analysis utilizes charts and indicators to predict short-term price movements. Learning to interpret charts and indicators is a valuable skill for any cryptocurrency trader.

News and Sentiment Analysis

Staying informed about news and market sentiment related to XRP is crucial. Monitoring reputable news sources and social media sentiment can provide insights into potential price movements.

Utilizing Trading Platforms

Choosing a secure and reputable trading platform is essential. Research different platforms and compare their fees, security features, and user interfaces before making a choice.

Conclusion

Analyzing XRP (Ripple) requires a comprehensive understanding of its technology, market performance, and the inherent risks involved. By considering its role in the Ripple network, its price history, and the regulatory landscape, you can form a more informed investment strategy. Remember that thorough research and responsible risk management are paramount. Begin your XRP analysis today and learn more about analyzing XRP before making any investment decisions. Start your journey into the world of XRP investment responsibly, recognizing both its potential for financial growth and the inherent risks.

Featured Posts

-

Understanding The Papal Conclave Choosing The Next Pope

May 08, 2025

Understanding The Papal Conclave Choosing The Next Pope

May 08, 2025 -

Sonos Ikea Partnership Ends Impact On Smart Home Speakers

May 08, 2025

Sonos Ikea Partnership Ends Impact On Smart Home Speakers

May 08, 2025 -

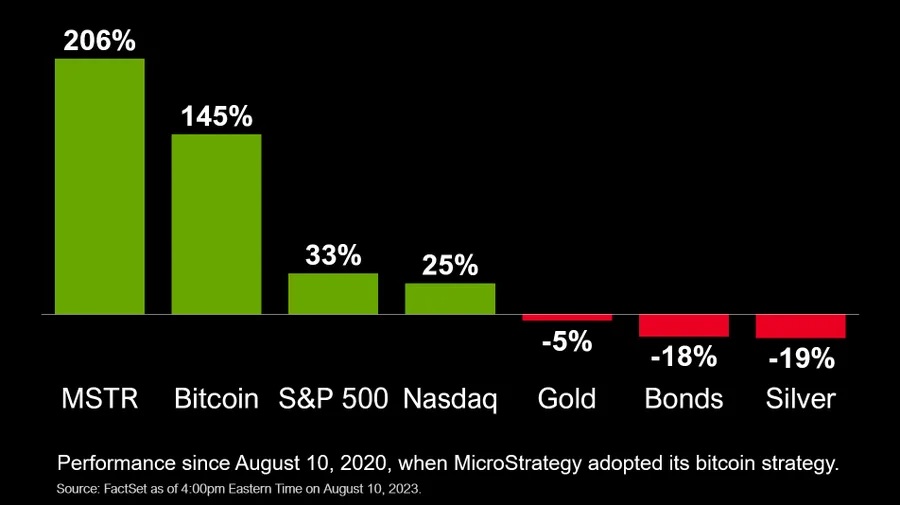

Bitcoin Or Micro Strategy Stock A Smart Investment Strategy For 2025

May 08, 2025

Bitcoin Or Micro Strategy Stock A Smart Investment Strategy For 2025

May 08, 2025 -

Grftary Jely Dstawyzat Awr Gdagry Myn Mlwth Tyn Khwatyn

May 08, 2025

Grftary Jely Dstawyzat Awr Gdagry Myn Mlwth Tyn Khwatyn

May 08, 2025 -

Aym Aym Ealm Ky 12 Wyn Brsy Pakstan Bhr Myn Yadgar Tqrybat

May 08, 2025

Aym Aym Ealm Ky 12 Wyn Brsy Pakstan Bhr Myn Yadgar Tqrybat

May 08, 2025