Are You A Universal Credit Recipient? Check For Potential Hardship Payment Refunds.

Table of Contents

Understanding Universal Credit Hardship Payments

Universal Credit hardship payments are designed to provide temporary financial assistance to claimants facing unexpected difficulties. These payments are distinct from your standard monthly Universal Credit allocation and aim to help bridge a short-term gap. They are not a right, but rather a discretionary payment offered at the discretion of the Department for Work and Pensions (DWP).

- Definition of hardship payments within the Universal Credit system: These are additional payments offered to help claimants meet essential expenses during a period of financial difficulty.

- Circumstances that typically qualify for a hardship payment: These can include unexpected bills (e.g., boiler repair, urgent medical expenses), loss of employment, or a sudden reduction in income. Each case is assessed individually.

- How hardship payments differ from standard Universal Credit payments: Hardship payments are one-off or short-term payments to address immediate needs, unlike the regular monthly Universal Credit payments.

- The temporary nature of hardship payments: These are not intended as long-term solutions, and the DWP will assess each case to determine the appropriate amount and duration of the payment.

Identifying Potential Overpayments and Reasons for Refunds

Overpayments of Universal Credit, including hardship payments, can happen for various reasons, potentially leading to a need for a refund. It's crucial to understand these situations to ensure you're not inadvertently paying back money you shouldn't owe.

- Changes in circumstances: A significant increase in income, a change in household composition (e.g., a partner moving in or out), or a new job might result in an overpayment if not reported promptly to the DWP.

- Errors made by the Department for Work and Pensions (DWP): Administrative mistakes can sometimes lead to overpayments. The DWP has a process for rectifying these errors.

- Incorrect information provided during the application process: Providing inaccurate information on your application could lead to an overpayment that you may need to repay. Always ensure all information is accurate and up-to-date.

- Cases of duplicate payments: In rare cases, duplicate payments might occur. If you receive two payments for the same period, it's essential to contact the DWP immediately.

How to Check for Potential Universal Credit Hardship Payment Refunds

Checking for potential refunds involves reviewing your payment history and contacting the DWP if necessary. Here's a step-by-step guide:

- Accessing your online Universal Credit account: Log into your online account via the government website to access your payment history.

- Reviewing your payment history for inconsistencies: Look for any payments that seem unusually high or duplicate payments. Note the dates and amounts.

- Contacting the DWP directly to inquire about potential overpayments: If you identify any inconsistencies, contact the DWP via phone or their online service to discuss your concerns.

- Gathering necessary documentation to support a claim: Collect bank statements, correspondence with the DWP, and any evidence related to the potential overpayment.

- Understanding the appeals process if a claim is denied: If the DWP denies your claim, you have the right to appeal their decision. Familiarize yourself with the appeals process.

Important Documents to Keep

Maintaining thorough records is crucial for any potential Universal Credit claim, including hardship payment refunds. Keep the following documents safely:

- Bank statements showing Universal Credit payments: These provide clear evidence of your payment history.

- Correspondence with the DWP: Keep copies of all emails, letters, and other communications with the DWP.

- Evidence of hardship circumstances: If you received a hardship payment, retain bills, medical certificates, or other documentation supporting the circumstances that led to the payment.

Reclaiming Your Money: The Application Process

If you believe you've been overpaid, you'll need to follow a specific process to reclaim the money.

- Gathering required documentation: This might include bank statements, correspondence with the DWP, and any evidence related to the overpayment.

- Completing the necessary forms accurately: Ensure all information is correct and complete. Inaccurate information can delay your application.

- Submitting the application correctly: Follow the DWP's instructions carefully to ensure your application is processed efficiently.

- Expected timeframe for processing the application: The DWP will provide an estimated timeframe for processing your application.

- Contacting the DWP for updates: If you haven't received a response within the estimated timeframe, follow up with the DWP.

Conclusion

Many Universal Credit recipients might be entitled to hardship payment refunds due to overpayments or errors. By carefully reviewing your payment history and contacting the DWP, you can proactively check for and reclaim any money you're owed. Remember to keep thorough records of your Universal Credit payments and communications with the DWP.

Call to Action: Are you a Universal Credit recipient? Don't miss out on potential hardship payment refunds! Check your account today and contact the DWP if you believe you're eligible for a refund. Take control of your finances and ensure you receive all the benefits you're entitled to.

Featured Posts

-

Five Year Bitcoin Forecast 1 500 Potential Gains

May 08, 2025

Five Year Bitcoin Forecast 1 500 Potential Gains

May 08, 2025 -

Bitcoin Price Surge Trade Tensions Boost Crypto Market

May 08, 2025

Bitcoin Price Surge Trade Tensions Boost Crypto Market

May 08, 2025 -

Xrp Trading Volume Outpaces Solana Amidst Etf Speculation

May 08, 2025

Xrp Trading Volume Outpaces Solana Amidst Etf Speculation

May 08, 2025 -

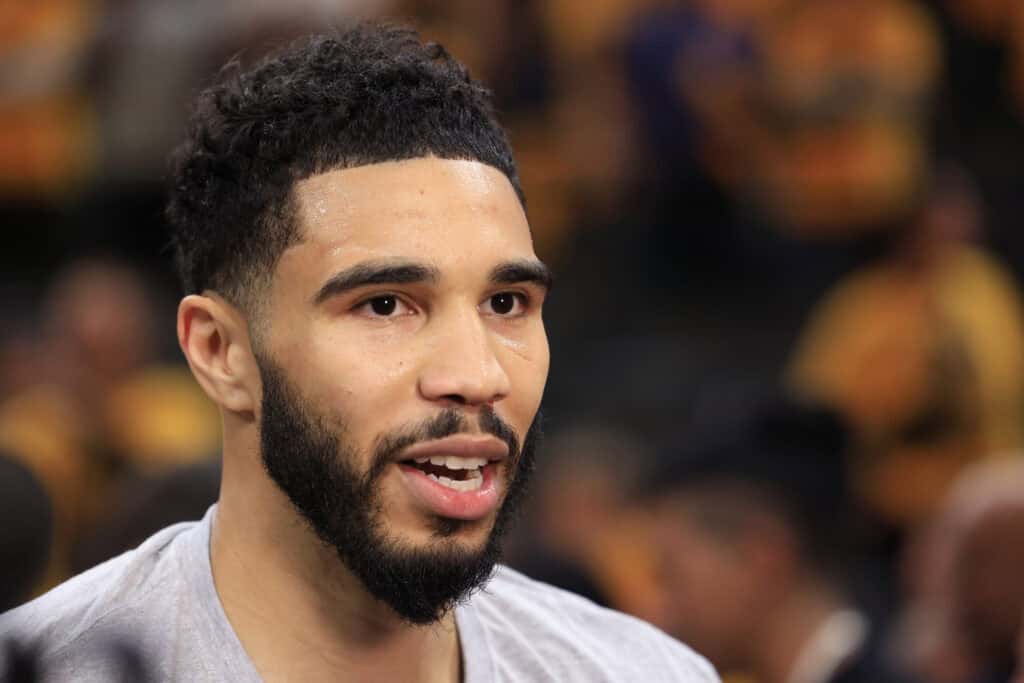

Jayson Tatum Opens Up Grooming Confidence And A Full Circle Coaching Moment

May 08, 2025

Jayson Tatum Opens Up Grooming Confidence And A Full Circle Coaching Moment

May 08, 2025 -

Microsoft Surface Pro 12 Inch A Comprehensive Guide

May 08, 2025

Microsoft Surface Pro 12 Inch A Comprehensive Guide

May 08, 2025