AT&T Criticizes Broadcom's Extreme Price Hike On VMware Acquisition

Table of Contents

The Details of Broadcom's VMware Acquisition Offer

Broadcom's journey to acquire VMware has been marked by a dramatic price escalation. Initially offering a price [Insert Original Offer Price], Broadcom significantly upped its bid to [Insert Final Offer Price], representing a substantial [Insert Percentage]% increase. This represents a staggering [Insert Dollar Amount] increase in the total value of the deal. Key dates in this timeline include [Insert Key Dates and Brief Descriptions of Events, e.g., initial offer announcement, revised offer announcement, shareholder approval dates]. You can find further details in official press releases from Broadcom and VMware [Insert Links to Relevant Press Releases]. This unprecedented price hike is at the heart of AT&T's strong objections.

AT&T's Concerns Regarding the Acquisition and Increased Price

AT&T's criticism of the Broadcom-VMware deal isn't simply about the price tag; it's about the potential consequences. The company has voiced several significant concerns:

Anti-Competitive Concerns

AT&T fears that Broadcom's acquisition of VMware, a major player in virtualization and cloud computing, could stifle competition. This consolidation of power could lead to:

- Reduced innovation: Less competition could hinder the development of new technologies and services.

- Market dominance: Broadcom's increased market share could allow it to dictate prices and terms to its customers.

- Limited choices for businesses: AT&T, and other companies, may face fewer options for crucial infrastructure and software solutions.

Impact on Pricing and Services

The increased price of the acquisition could translate directly into higher costs for AT&T and other businesses relying on VMware's technology. This could mean:

- Increased infrastructure costs: Higher prices for VMware products could significantly impact AT&T's operational expenses.

- Potential for service price hikes: To offset increased costs, AT&T may be forced to raise prices for its own services to consumers and businesses.

- Reduced investment in innovation: Higher costs may divert funds away from AT&T's own research and development initiatives.

Regulatory Scrutiny

AT&T anticipates increased regulatory scrutiny and potential legal challenges to the acquisition. The company likely expects regulators to:

- Thoroughly investigate the potential anti-competitive effects of the deal.

- Assess the impact on consumer prices and market competition.

- Consider imposing conditions or blocking the acquisition altogether.

“[Insert a quote from an AT&T executive expressing their concerns about the acquisition and price hike]”

Market Reactions and Expert Opinions on the Broadcom-VMware Deal

The market's reaction to the increased offer has been mixed. While some analysts see the deal as a strategic move for Broadcom, others share AT&T's concerns about its potential anti-competitive implications. [Insert information about stock market reactions, if applicable]. Industry experts are divided, with some predicting a positive impact on the broader technology landscape and others warning of potential negative consequences. [Insert quotes and opinions from relevant industry analysts]. The possibility of counter-offers or alternative acquisition strategies remains open.

Potential Outcomes and Future Implications of the Broadcom VMware Acquisition

The success of the Broadcom-VMware acquisition remains uncertain. Several potential outcomes exist:

- Successful acquisition: If regulatory approvals are granted, Broadcom will integrate VMware into its operations, potentially leading to significant changes in the market.

- Acquisition blocked: Regulatory bodies could block the deal due to anti-competitive concerns.

- Negotiated settlement: A compromise might be reached, potentially involving divestments or other concessions from Broadcom.

The long-term implications for the technology and telecommunications sectors are substantial. The acquisition could reshape the competitive landscape, influencing pricing, innovation, and the overall availability of crucial technologies for businesses and consumers alike.

Conclusion: The Ongoing Debate Surrounding the Broadcom VMware Acquisition

AT&T's strong criticism of Broadcom's VMware acquisition, fueled by the extreme price hike, highlights the significant concerns surrounding this major deal. The potential for reduced competition, increased pricing, and regulatory challenges underscores the far-reaching implications of this merger. The magnitude of the price increase and its potential impact on the telecommunications and technology industries warrant close attention. Stay informed about the developments in the Broadcom VMware acquisition and the ongoing debate surrounding the price hike by following updates from reputable news sources and regulatory bodies. The future of this deal, and its effects on the market, remains to be seen.

Featured Posts

-

300 5 6 9

May 03, 2025

300 5 6 9

May 03, 2025 -

Swiss President Confirms Continued Support For Ukraine

May 03, 2025

Swiss President Confirms Continued Support For Ukraine

May 03, 2025 -

Watch Gaza Freedom Flotilla Attacked Malta Coast Incident

May 03, 2025

Watch Gaza Freedom Flotilla Attacked Malta Coast Incident

May 03, 2025 -

Mbadrat Aqtsadyt Jdydt Mn Amant Alastthmar Fy Aljbht Alwtnyt

May 03, 2025

Mbadrat Aqtsadyt Jdydt Mn Amant Alastthmar Fy Aljbht Alwtnyt

May 03, 2025 -

Investigimi I Sulmit Me Thike Ne Ceki Dy Te Vdekur Konfirmuar

May 03, 2025

Investigimi I Sulmit Me Thike Ne Ceki Dy Te Vdekur Konfirmuar

May 03, 2025

Latest Posts

-

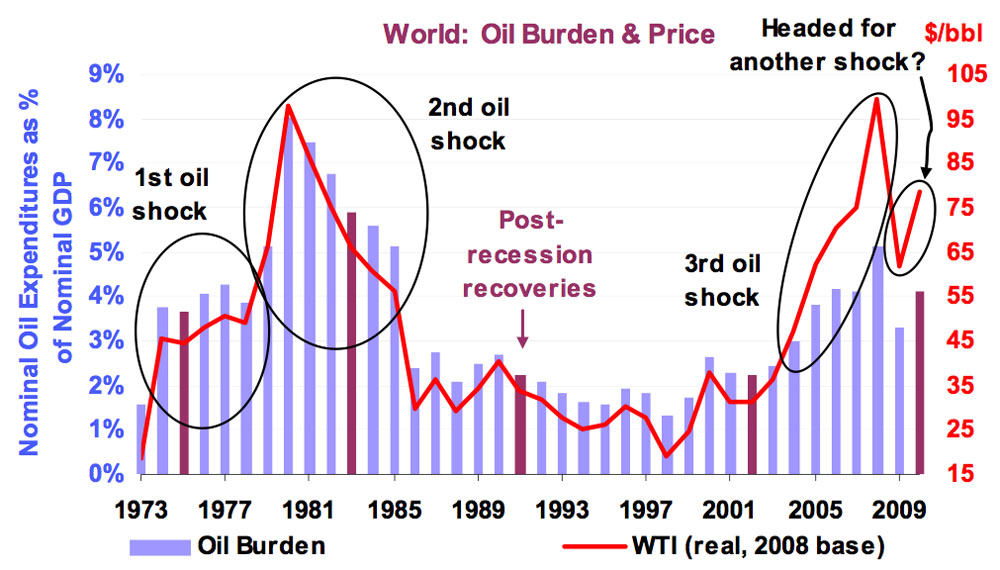

The Airline Industrys Vulnerability To Oil Supply Chain Instability

May 04, 2025

The Airline Industrys Vulnerability To Oil Supply Chain Instability

May 04, 2025 -

Oil Price Volatility And Its Effect On Airline Profitability

May 04, 2025

Oil Price Volatility And Its Effect On Airline Profitability

May 04, 2025 -

Soaring Fuel Costs The Airline Industrys Response To Oil Supply Shocks

May 04, 2025

Soaring Fuel Costs The Airline Industrys Response To Oil Supply Shocks

May 04, 2025 -

Tomatin Affordable Housing Strathdearn Community Project Marks Significant Progress

May 04, 2025

Tomatin Affordable Housing Strathdearn Community Project Marks Significant Progress

May 04, 2025 -

Pupils Celebrate Groundbreaking Of New Tomatin Affordable Housing In Strathdearn

May 04, 2025

Pupils Celebrate Groundbreaking Of New Tomatin Affordable Housing In Strathdearn

May 04, 2025