BMO Survey: Recession Concerns Halt Canadian Home Purchases

Table of Contents

Key Findings of the BMO Survey on Canadian Housing Market Sentiment

The BMO survey provides crucial insights into the current state of the Canadian housing market. Its findings underscore a significant shift in buyer sentiment, largely driven by macroeconomic factors.

Decreased Buyer Confidence

The BMO survey revealed a startling 25% drop in buyer confidence compared to the previous quarter. This significant decrease reflects a growing unease among potential homebuyers.

- Rising Interest Rates: The Bank of Canada's aggressive interest rate hikes have drastically reduced mortgage affordability, impacting buyer confidence.

- Inflationary Pressures: Soaring inflation has eroded purchasing power, making it more challenging for Canadians to save for a down payment and manage monthly mortgage payments.

- Job Security Concerns: Fears of potential job losses due to an economic slowdown are contributing to a more cautious approach towards major financial commitments like home purchases.

The survey data strongly suggests a direct correlation between these economic anxieties and the decline in buyer confidence within the Canadian housing market. The BMO survey results clearly indicate a shift in market sentiment.

Impact of Rising Interest Rates on Mortgage Affordability

Higher interest rates directly translate to significantly increased monthly mortgage payments. For example:

- A $500,000 mortgage at a 5% interest rate results in a monthly payment of approximately X.

- The same mortgage at a 7% interest rate increases the monthly payment to approximately Y (replace X and Y with actual figures based on the survey or mortgage calculator data).

This substantial increase in mortgage affordability significantly impacts the purchasing power of Canadian homebuyers, contributing to the slowdown in Canadian home purchases observed in the BMO survey. The increasing interest rates are a major factor affecting Canadian real estate.

Recessionary Fears and Their Influence on Purchasing Decisions

The BMO survey highlighted that recessionary fears are a major factor influencing Canadian home buying decisions. Many potential buyers are delaying purchases due to:

- Concerns about Job Security: Fear of job losses in a potential recession is leading many to postpone major financial commitments.

- Decreased Savings: Inflation and rising living costs have reduced savings, making it harder to accumulate the necessary funds for a down payment.

- Uncertainty about Future Income: The uncertainty surrounding future income prospects in a potential recession is making Canadians hesitant to take on significant debt.

These recession fears are significantly dampening the demand for Canadian home purchases, as highlighted in the BMO survey.

Regional Variations in Home Purchase Activity

While the BMO survey indicates a general slowdown in Canadian home purchases, the impact varies across different regions and property types.

Impact Across Different Provinces

The slowdown in home purchases is not uniform across all provinces. For instance:

- Ontario and British Columbia, traditionally strong markets, have experienced more significant drops in sales activity.

- Provinces like Manitoba and Saskatchewan have shown relative stability, though still experiencing some slowdown.

This regional variation reflects the diverse economic conditions and housing market dynamics across different parts of Canada. The regional housing market shows significant differences in the impact of the slowdown.

Type of Properties Affected

The slowdown is not affecting all property types equally.

- The condominium market has seen a more pronounced decline compared to the single-family home market.

- Higher-priced properties have experienced a steeper drop in demand due to their increased sensitivity to interest rate changes.

Analyzing these variations within housing market segments is crucial for a complete understanding of the current situation reported by the BMO survey.

Expert Opinions and Future Outlook for the Canadian Housing Market

Experts offer varied perspectives on the future trajectory of the Canadian housing market.

Analyst Predictions

Analysts' predictions range from a continued, albeit moderated, slowdown to a more significant correction.

- Some analysts predict a gradual stabilization of the market in the coming year, with prices potentially leveling off.

- Others foresee a more extended period of reduced activity, possibly leading to further price adjustments.

These differing perspectives underscore the uncertainty surrounding the future outlook for Canadian home sales. The housing market forecast remains a subject of debate among real estate experts.

Potential Policy Responses

The government may intervene to mitigate the impact of the slowdown. Potential policy responses include:

- Adjustments to mortgage rules, potentially making it easier for some buyers to qualify for mortgages.

- Stimulus packages aimed at boosting economic growth and consumer confidence.

Government policy will play a significant role in shaping the future of the Canadian housing market.

Conclusion: Navigating the Canadian Housing Market Amidst Recession Concerns

The BMO survey clearly indicates a significant slowdown in Canadian home purchases, driven by recession concerns and rising interest rates. The impact is uneven across provinces and property types. Understanding the findings of the BMO survey is crucial for navigating the complexities of the Canadian housing market during this period of uncertainty. Stay informed about future BMO surveys and consult with a real estate professional to make informed decisions about your Canadian home purchases. The future of your Canadian home purchase depends on staying informed about the latest market trends and understanding the implications of the BMO survey.

Featured Posts

-

Examining The Change How Julius Randle Impacted The Timberwolves Fanbase

May 07, 2025

Examining The Change How Julius Randle Impacted The Timberwolves Fanbase

May 07, 2025 -

A Conclave Explained From The Death Of A Pope To The Election Of His Successor

May 07, 2025

A Conclave Explained From The Death Of A Pope To The Election Of His Successor

May 07, 2025 -

Choosing Between Ps 5 And Xbox Series S A Comprehensive Guide

May 07, 2025

Choosing Between Ps 5 And Xbox Series S A Comprehensive Guide

May 07, 2025 -

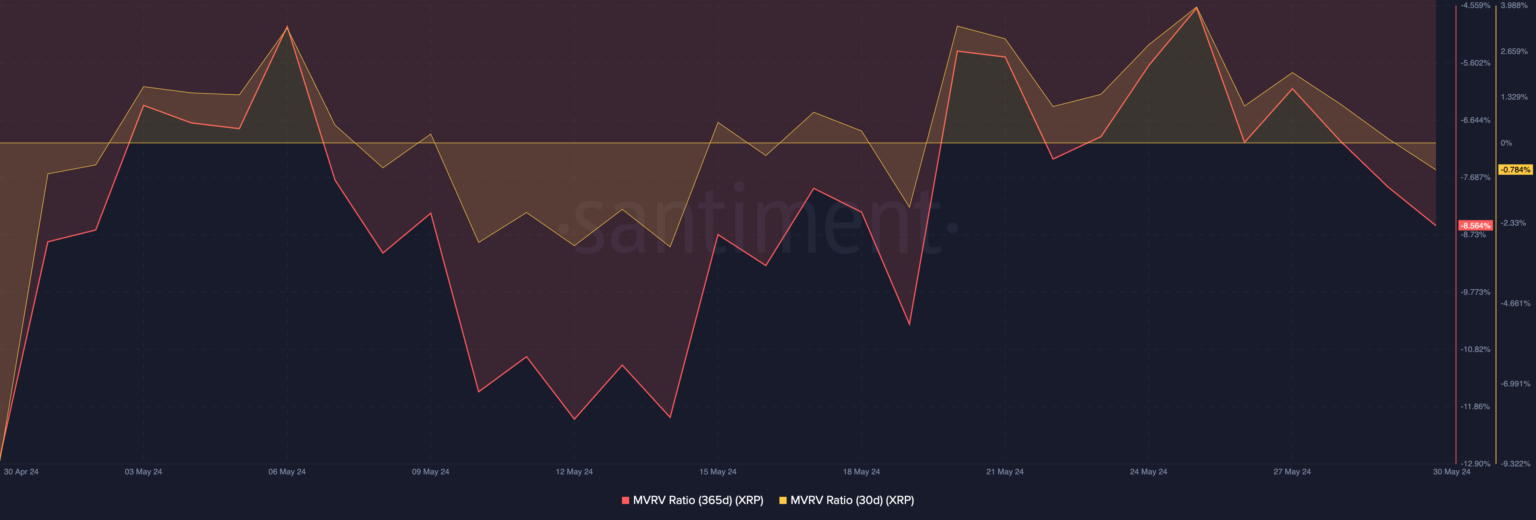

Xrp Etf Approval Analyzing The Potential For 800 Million In Initial Investment

May 07, 2025

Xrp Etf Approval Analyzing The Potential For 800 Million In Initial Investment

May 07, 2025 -

Zuckerberg And The Trump Era A New Phase For Meta

May 07, 2025

Zuckerberg And The Trump Era A New Phase For Meta

May 07, 2025

Latest Posts

-

Is An Xrp Etf Worth The Risk Assessing Supply Headwinds And Institutional Demand

May 08, 2025

Is An Xrp Etf Worth The Risk Assessing Supply Headwinds And Institutional Demand

May 08, 2025 -

The Impact Of High Xrp Supply On Etf Performance And Institutional Investment

May 08, 2025

The Impact Of High Xrp Supply On Etf Performance And Institutional Investment

May 08, 2025 -

Will Xrp Etfs Disappoint Investors Analyzing Supply And Demand

May 08, 2025

Will Xrp Etfs Disappoint Investors Analyzing Supply And Demand

May 08, 2025 -

Xrp Etf High Supply And Low Institutional Interest Raise Concerns

May 08, 2025

Xrp Etf High Supply And Low Institutional Interest Raise Concerns

May 08, 2025 -

Will Xrp Etfs Generate 800 Million In First Week Inflows

May 08, 2025

Will Xrp Etfs Generate 800 Million In First Week Inflows

May 08, 2025