BofA's Reassuring View: Why High Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Strong Earnings Growth Outweighs High P/E Ratios

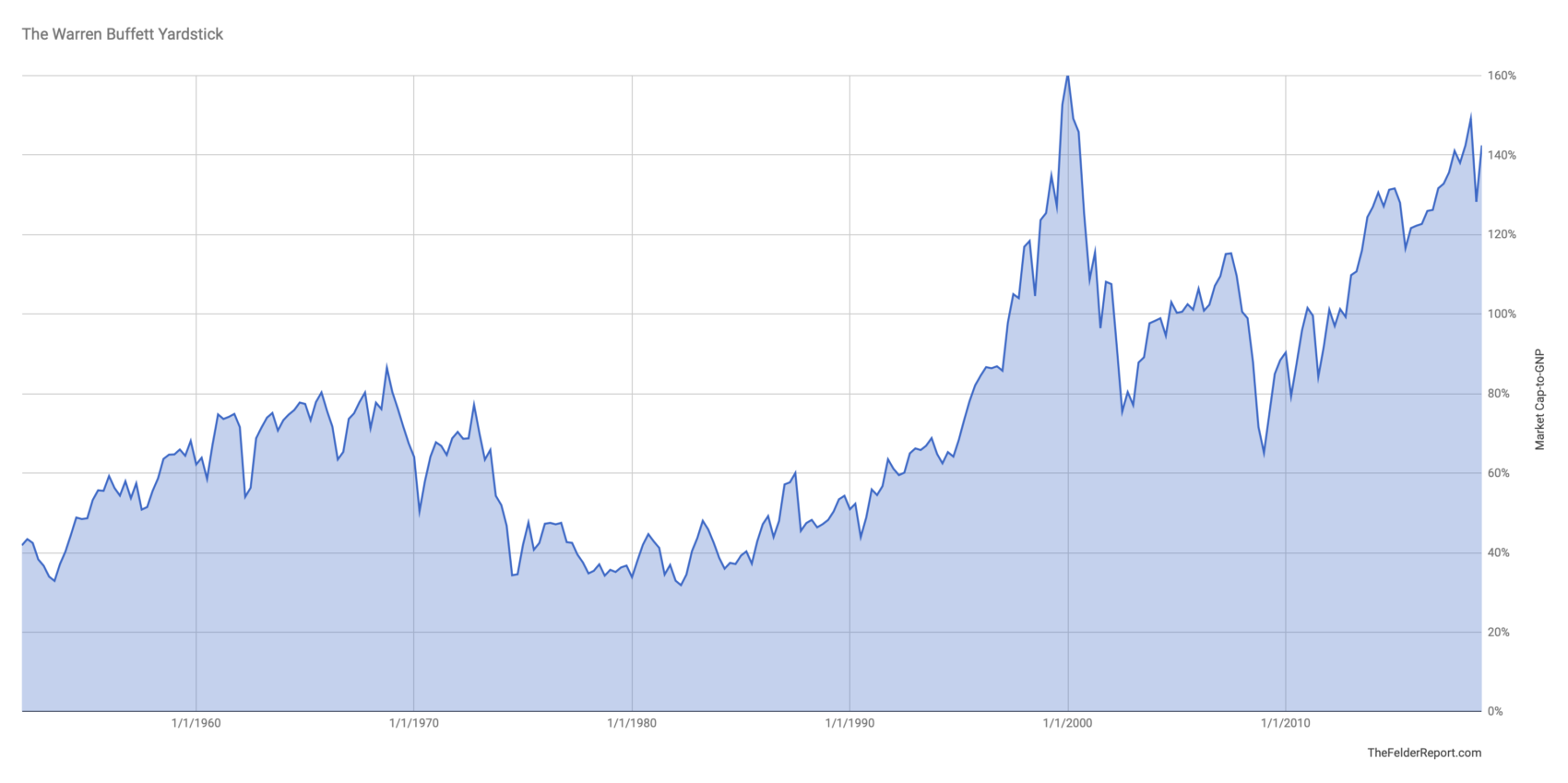

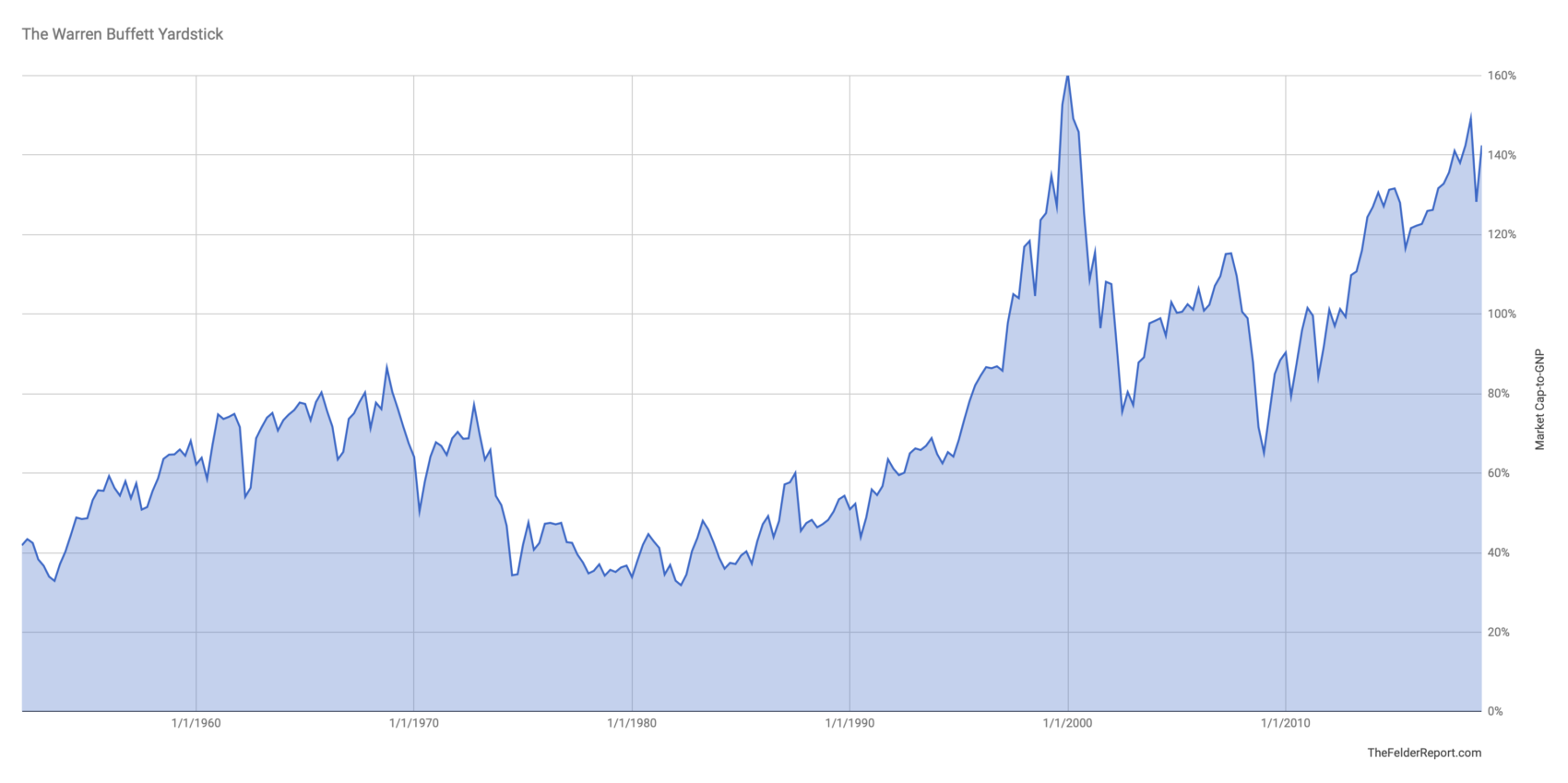

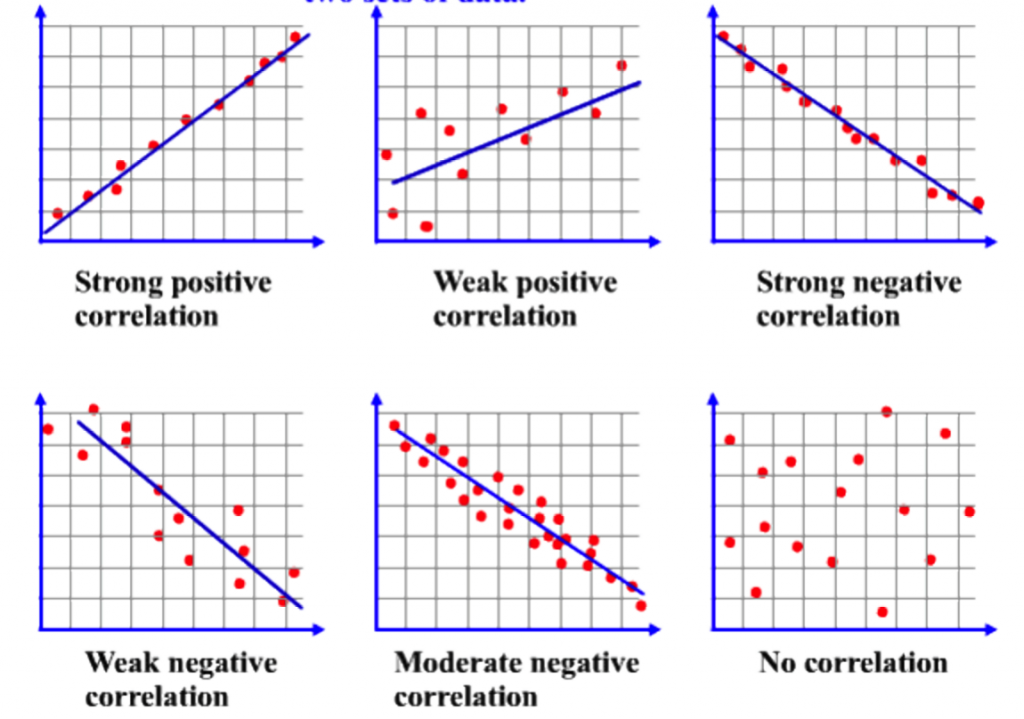

BofA's core argument rests on the premise that robust corporate earnings growth justifies the current elevated Price-to-Earnings (P/E) ratios. Their research indicates that strong earnings are outpacing the rise in valuations, suggesting a sustainable, rather than precarious, market environment.

- Supporting Data: BofA's analysts point to [insert specific data points from BofA's research here, e.g., projected EPS growth for the S&P 500 for the next 2 years, specific sector performance]. This data suggests that companies are generating significant profits, supporting the higher valuations.

- Sectoral Growth: While some sectors might show higher P/E ratios than others, BofA's analysis likely highlights strong growth projections across various sectors, mitigating concerns about overvaluation in specific areas. [Insert examples of sectors with strong projected growth according to BofA's research].

- BofA's Stock Market Analysis: Their analysis emphasizes the importance of looking beyond just the P/E ratio and considering factors like revenue growth, profit margins, and future earnings potential for a comprehensive picture of company valuations and overall market health.

The Role of Low Interest Rates and Monetary Policy

Low interest rates play a significant role in supporting higher stock valuations. When interest rates are low, the cost of borrowing is reduced, encouraging companies to invest and expand. This, in turn, fuels earnings growth.

- Impact on Investor Behavior: Low interest rates make bonds less attractive, pushing investors towards higher-yielding assets like stocks. This increased demand drives up stock prices and contributes to higher valuations.

- Quantitative Easing (QE) Influence: Central bank policies, particularly QE programs, inject liquidity into the market, further supporting asset prices. BofA's analysis likely considers the impact of past and potential future QE measures on market sentiment and stock valuations.

- Market Sentiment and Stock Prices: The combination of low interest rates and supportive monetary policy creates a positive feedback loop, boosting investor confidence and fueling higher stock prices, even with seemingly high P/E ratios.

Long-Term Growth Prospects and Technological Innovation

BofA's optimistic outlook extends beyond short-term earnings; they emphasize the long-term growth potential fueled by technological innovation.

- Economic Growth and Stock Valuations: BofA's research likely projects sustained economic growth, driven by technological advancements and increased productivity. This long-term growth narrative supports higher valuations as investors anticipate future earnings growth.

- Technological Innovation and Corporate Profitability: Technological breakthroughs are constantly reshaping industries, creating new opportunities for corporate profitability. BofA likely highlights specific technologies and their potential impact on corporate earnings and long-term growth.

- Market Potential: The combination of economic expansion and technological disruption paints a picture of significant market potential, justifying higher valuations in the eyes of BofA's analysts.

Addressing Investor Concerns: Managing Risk in a High-Valuation Market

While BofA presents a bullish case, they also acknowledge the concerns of investors wary of high valuations and the potential for market corrections.

- Market Correction Concerns: BofA likely addresses the possibility of market downturns and emphasizes the importance of prudent risk management strategies.

- BofA's Risk Management Advice: They likely recommend diversification across asset classes, a long-term investment horizon, and avoiding emotional decision-making based on short-term market fluctuations.

- Building a Balanced Portfolio: The importance of a well-diversified portfolio that aligns with individual risk tolerance is a key element of BofA's approach to navigating a high-valuation market.

Conclusion: BofA's Reassuring View and a Call to Action

BofA's analysis suggests that while stock market valuations appear high, robust earnings growth, low interest rates, and long-term growth prospects offer a reassuring perspective. By considering long-term growth, focusing on fundamental analysis, and employing effective risk management strategies, investors can navigate this market environment effectively. Don't let high valuations alone dictate your investment decisions. Adopt a balanced, informed approach. Learn more about BofA's market outlook and strategic investment advice for navigating high stock market valuations by visiting [insert link to relevant BofA resources here]. Invest wisely, and consider a long-term investment strategy that accounts for both potential risks and rewards.

Featured Posts

-

What To Do On February 20 2025 A Happy Day Guide

Apr 27, 2025

What To Do On February 20 2025 A Happy Day Guide

Apr 27, 2025 -

The Dax And The Bundestag Understanding The Correlation Between Politics And Markets

Apr 27, 2025

The Dax And The Bundestag Understanding The Correlation Between Politics And Markets

Apr 27, 2025 -

Monte Carlo Masters 2025 Djokovics Unexpected Loss To Tabilo

Apr 27, 2025

Monte Carlo Masters 2025 Djokovics Unexpected Loss To Tabilo

Apr 27, 2025 -

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Ackmans Trade War Prediction Us Vs China

Apr 27, 2025

Ackmans Trade War Prediction Us Vs China

Apr 27, 2025

Latest Posts

-

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025 -

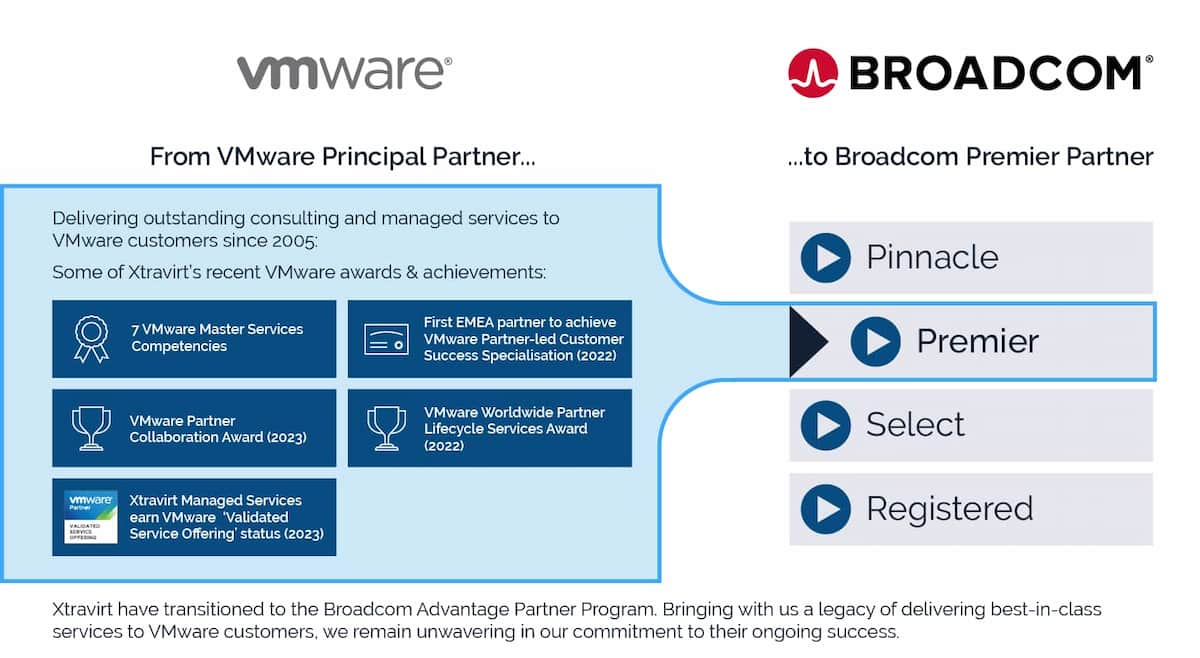

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025 -

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025 -

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025