BYD Capitalizes On Ford's Retreat: Growth Of Electric Vehicles In Brazil

Table of Contents

Ford's Departure Creates a Vacuum in the Brazilian EV Market

Ford's decision to cease its automotive operations in Brazil in 2021 (adjust year if necessary) significantly impacted the country's automotive landscape. This strategic retreat, driven by factors including declining market share and high manufacturing costs, left a considerable gap in the market, particularly within the still-developing EV segment. Before its departure, Ford held approximately X% market share (replace X with actual data if available), with some models like the Focus Electric (or other relevant models if applicable) representing a minor, yet still significant presence in the nascent Brazilian EV market. The absence of Ford created opportunities for competitors, especially those focusing on electric vehicles in Brazil.

- Ford's Market Share: Before leaving Brazil, Ford held approximately X% of the overall market share (insert accurate data). Within the EV segment, its share was considerably smaller but still represented a tangible presence.

- Ford's EV Models: Ford offered a limited range of EVs in Brazil, predominantly focusing on [mention specific models if any].

- Consumer Impact: Ford's departure left a gap in consumer choice, especially for those seeking specific vehicle types previously offered by the brand. This created an opportunity for other manufacturers to capture this segment of the market.

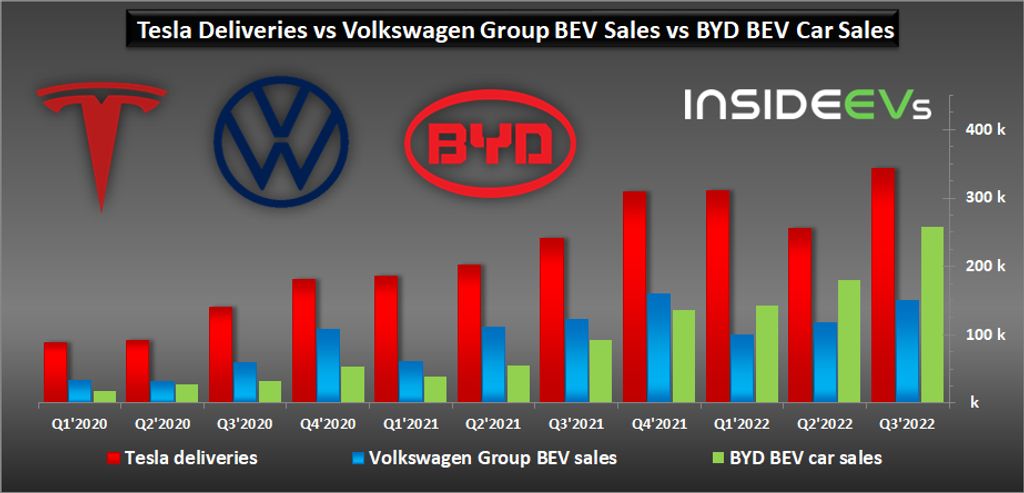

BYD's Strategic Entry and Aggressive Expansion in Brazil

BYD, a global leader in electric vehicle manufacturing, has seized the opportunity created by Ford's exit, demonstrating a strategic and aggressive expansion into the Brazilian market. BYD’s competitive advantages include its vertically integrated manufacturing process, allowing for cost control and efficient production, coupled with a diverse range of technologically advanced electric vehicles. Its strategy focuses on providing competitive pricing, technologically advanced features, and establishing a robust sales and service network across the country.

- BYD Models in Brazil: BYD offers a variety of EV models in Brazil, including the [list specific models with brief descriptions and pricing information].

- Key Features: Brazilian consumers are attracted to BYD's EVs due to features such as competitive pricing, long driving ranges (specific range details would be valuable here), advanced safety technology (e.g., autonomous driving features, if applicable), and stylish designs.

- Sales and Market Penetration: BYD has seen significant growth in its sales figures since entering the Brazilian market, achieving a market share of Y% in [specify time period, e.g., Q1 2024] (insert accurate data if available).

Government Incentives and Infrastructure Development for EVs in Brazil

The Brazilian government is actively promoting the adoption of electric vehicles through various initiatives. These incentives are crucial in driving the growth of the EV market and supporting companies like BYD. Government policies include tax breaks, subsidies, and investments in charging infrastructure.

- Government Incentives: Specific incentives include [mention specific tax breaks, subsidies, or other incentives offered by the Brazilian government].

- Charging Infrastructure: The number of public charging stations in Brazil is increasing, although still limited in comparison to more developed EV markets. Future plans include [mention specific government plans to expand charging infrastructure].

- Policy Effectiveness: The government's policies have positively influenced EV adoption, though challenges remain in terms of accessibility and coverage across the country. Further expansion of charging infrastructure and incentives is crucial for sustained market growth.

Challenges and Opportunities for BYD in the Brazilian EV Market

Despite its success, BYD faces challenges in the Brazilian EV market. Competition from other established automakers and emerging EV brands is intensifying, alongside infrastructure limitations and potential consumer concerns regarding range anxiety.

- Key Competitors: BYD faces competition from both established automakers offering EVs and other new entrants in the Brazilian market. [mention key competitors and their market strategies].

- Infrastructure Limitations: The lack of widespread charging infrastructure presents a challenge, potentially limiting the adoption of EVs, especially in more remote areas. Range anxiety remains a significant concern for many potential buyers.

- Growth Opportunities: The commercial vehicle segment presents a significant opportunity for BYD, as the demand for electric buses and delivery trucks is growing rapidly. Expansion into this segment could be a major driver of growth.

BYD's Rise and the Future of Electric Vehicles in Brazil

BYD's remarkable success in Brazil, fueled by Ford's exit and government support, showcases the potential for rapid growth in the electric vehicle market. BYD's strategic entry, combined with government incentives and the rising consumer demand for sustainable transportation, points toward a bright future for electric vehicles in Brazil. The expansion of charging infrastructure and continued policy support will be vital for continued growth and broader adoption. The future looks bright for electric vehicles in Brazil, and BYD is poised to play a leading role in this transformation.

Learn more about the exciting developments in the Brazilian electric vehicle market and BYD's leading role by visiting [link to BYD Brazil website or a relevant news source].

Featured Posts

-

Comprehensive Senior Activities Calendar Trips And Events

May 13, 2025

Comprehensive Senior Activities Calendar Trips And Events

May 13, 2025 -

Prozhivannya Romiv V Ukrayini Geografichni Osoblivosti Ta Demografichni Dani

May 13, 2025

Prozhivannya Romiv V Ukrayini Geografichni Osoblivosti Ta Demografichni Dani

May 13, 2025 -

Electric Vehicle Market Byds Global Expansion And Fords Brazilian Challenges

May 13, 2025

Electric Vehicle Market Byds Global Expansion And Fords Brazilian Challenges

May 13, 2025 -

Cooper Flagg Hype Top Contenders For The 1 Nba Draft Pick

May 13, 2025

Cooper Flagg Hype Top Contenders For The 1 Nba Draft Pick

May 13, 2025 -

Zvanican Spisak Glumaca Za Avengers Doomsday

May 13, 2025

Zvanican Spisak Glumaca Za Avengers Doomsday

May 13, 2025

Latest Posts

-

Key Provisions Of The House Republicans Trump Tax Cut Plan

May 13, 2025

Key Provisions Of The House Republicans Trump Tax Cut Plan

May 13, 2025 -

The Semiconductor Markets Recent Surge Was It Predicted By Etf Investor Behavior

May 13, 2025

The Semiconductor Markets Recent Surge Was It Predicted By Etf Investor Behavior

May 13, 2025 -

Crack The Code 5 Essential Dos And Don Ts For Private Credit Jobs

May 13, 2025

Crack The Code 5 Essential Dos And Don Ts For Private Credit Jobs

May 13, 2025 -

The Impact Of Walleye Credit Cuts On Core Group Performance In Commodities

May 13, 2025

The Impact Of Walleye Credit Cuts On Core Group Performance In Commodities

May 13, 2025 -

Growth Markets In Focus A National Map Of Emerging Business Hotspots

May 13, 2025

Growth Markets In Focus A National Map Of Emerging Business Hotspots

May 13, 2025