Case Study: Financing A 270MWh BESS Project In Belgium's Merchant Market

Table of Contents

Securing funding for large-scale Battery Energy Storage Systems (BESS) projects is crucial for their successful deployment. This case study examines the complex financing landscape for a 270MWh BESS project within Belgium's competitive merchant market, highlighting the key challenges and strategies employed to secure the necessary capital. We delve into the financial models, risk mitigation techniques, and regulatory considerations that were pivotal to the project's success, offering valuable insights for future BESS development in Belgium and beyond. This analysis will be particularly useful for those seeking to understand the intricacies of BESS financing in Belgium.

Project Overview and Market Conditions

This 270MWh BESS project is located in [Specific Location in Belgium, e.g., Flanders], utilizing [Specific Technology, e.g., Lithium-ion battery technology]. The project aims to provide grid stabilization services and participate in the merchant energy market, capitalizing on price arbitrage opportunities.

The Belgian energy market presents both opportunities and challenges for BESS investment. Belgium has a high penetration of renewable energy sources, primarily wind and solar, leading to significant fluctuations in electricity supply and price. This volatility creates a strong demand for grid-scale energy storage solutions like BESS to balance intermittent renewable generation and ensure grid stability. The regulatory framework, while supportive of renewable energy integration, is constantly evolving, impacting investment decisions. Furthermore, participation in capacity markets and the availability of ancillary services revenue streams are key considerations for project financing.

Key market characteristics impacting BESS financing in Belgium include:

- High renewable energy penetration: Creating opportunities for arbitrage and frequency regulation services.

- Fluctuations in electricity prices: Introducing price risk that needs careful management through hedging strategies.

- Demand for grid stabilization services: Offering a stable revenue stream for BESS projects.

- Government policies supporting renewable energy integration: Providing potential incentives and subsidies for BESS deployment. This includes [mention specific Belgian government initiatives or subsidies relevant to BESS].

Financing Structure and Sources of Capital

The financing structure for this 270MWh BESS project involved a blend of debt and equity financing. Approximately [Percentage]% was secured through debt financing from [Name of Banks or Financial Institutions involved], while the remaining [Percentage]% was provided by equity investors, including [Name of Equity Investors or Investment Funds, if possible. If not possible, describe the investor type, e.g., a consortium of private equity firms].

The financial model relies on multiple revenue streams:

- Arbitrage: Buying energy at low prices and selling it at higher prices.

- Frequency regulation: Providing ancillary services to maintain grid stability.

- Capacity market participation: Selling capacity to ensure grid reliability.

Specific financing sources included:

- Debt Financing: [Percentage]% of total project cost, secured at an interest rate of [Interest Rate]% over a term of [Loan Term] years. The loan agreement included specific covenants related to project performance and financial metrics.

- Equity Financing: [Percentage]% of total project cost, sourced from [Investor type(s), e.g., private equity funds specializing in renewable energy].

- Potential Government Subsidies/Tax Breaks: [Mention any applicable subsidies or tax benefits received by the project, quantifying their impact if possible].

Risk Mitigation and Due Diligence

Several key risks were identified and mitigated throughout the project development and financing phases:

- Technology Risk: Mitigated through the selection of proven battery technology and robust performance guarantees from the EPC contractor.

- Regulatory Risk: Addressed through thorough due diligence on regulatory requirements and proactive engagement with relevant authorities.

- Market Risk: Managed through sophisticated hedging strategies to mitigate price volatility in the electricity market.

Risk mitigation strategies included:

- Insurance policies: Comprehensive insurance coverage for equipment failure, operational disruptions, and other potential risks.

- Hedging strategies: Utilizing financial instruments to protect against adverse price movements in the electricity market.

- Independent engineering, procurement, and construction (EPC) assessments: Ensuring the technical feasibility and quality of the project.

- Detailed financial modeling and sensitivity analysis: Assessing project viability under various scenarios.

Regulatory Compliance and Permitting

Obtaining the necessary permits and approvals for the BESS project in Belgium involved navigating several regulatory hurdles, including:

- Grid connection permits: Securing approval from the Elia, the Belgian transmission system operator, for grid connection.

- Safety standards compliance: Meeting strict safety standards and regulations for battery storage systems.

- Environmental permits: Obtaining environmental permits to ensure compliance with environmental regulations.

The successful navigation of these regulatory requirements played a crucial role in securing financing for the project, demonstrating to investors the project's feasibility and adherence to legal frameworks.

Conclusion

This case study demonstrates the feasibility of financing substantial BESS projects like this 270MWh system in Belgium's merchant market. By carefully considering market conditions, structuring a robust financing model, and implementing effective risk mitigation strategies, developers can successfully attract capital for large-scale energy storage deployments. The successful completion of this project highlights the growing importance of BESS in supporting renewable energy integration and grid stability. Understanding these financing mechanisms is crucial for future BESS projects. For more information on securing financing for your own BESS project in Belgium, contact [Contact Information/Link to relevant services]. Explore the possibilities of efficient and sustainable BESS financing in the Belgian market today.

Featured Posts

-

Canadian Dollar Strengthens Following Trump Carney Deal Hints

May 03, 2025

Canadian Dollar Strengthens Following Trump Carney Deal Hints

May 03, 2025 -

Declaration De Macron Sur Gaza Le Danger D Une Aide Humanitaire Militarisee Par Israel

May 03, 2025

Declaration De Macron Sur Gaza Le Danger D Une Aide Humanitaire Militarisee Par Israel

May 03, 2025 -

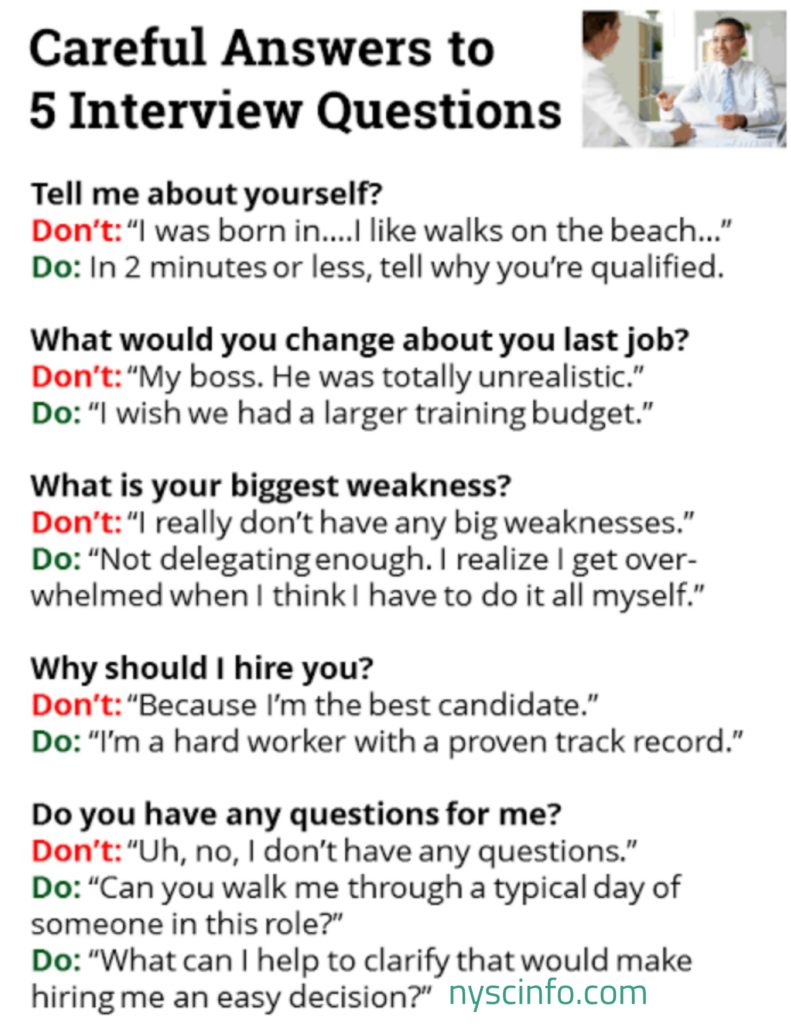

Ace Your Private Credit Job Interview 5 Dos And Don Ts To Follow

May 03, 2025

Ace Your Private Credit Job Interview 5 Dos And Don Ts To Follow

May 03, 2025 -

Signing And Exchange Of Notes Grant Assistance To Mauritius

May 03, 2025

Signing And Exchange Of Notes Grant Assistance To Mauritius

May 03, 2025 -

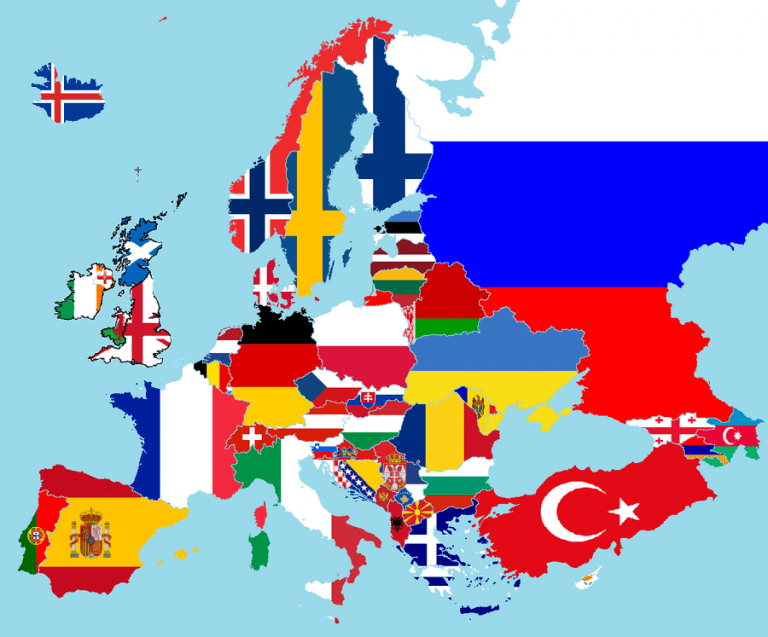

Avrupa Ile Is Birliginin Gelecegi

May 03, 2025

Avrupa Ile Is Birliginin Gelecegi

May 03, 2025

Latest Posts

-

Stratejik Avrupa Is Birligi Oenemli Adimlar

May 03, 2025

Stratejik Avrupa Is Birligi Oenemli Adimlar

May 03, 2025 -

Avrupa Ile Is Birliginin Gelecegi

May 03, 2025

Avrupa Ile Is Birliginin Gelecegi

May 03, 2025 -

Sulm Me Thike Ne Qender Tregtare Te Cekise Detajet E Ngjarjes

May 03, 2025

Sulm Me Thike Ne Qender Tregtare Te Cekise Detajet E Ngjarjes

May 03, 2025 -

10 Year Old Girl Too Good For This World Dies On Rugby Pitch A Communitys Grief

May 03, 2025

10 Year Old Girl Too Good For This World Dies On Rugby Pitch A Communitys Grief

May 03, 2025 -

Gueclendirilen Avrupa Is Birligi Son Gelismeler Ve Analizler

May 03, 2025

Gueclendirilen Avrupa Is Birligi Son Gelismeler Ve Analizler

May 03, 2025