China's Energy Strategy: Reducing Reliance On US LPG Through Middle Eastern Imports

Table of Contents

The Rising Demand for LPG in China

China's LPG consumption has skyrocketed over the past decade, driven by a confluence of factors. Rapid industrial growth, particularly in sectors like petrochemicals and manufacturing, is a major contributor. Furthermore, rising living standards have increased household demand for LPG for cooking and heating, especially in rural areas. The burgeoning transportation sector also plays a role, with LPG increasingly used as an automotive fuel.

- Industrial Growth: The manufacturing sector's reliance on LPG as a feedstock and fuel source continues to expand.

- Household Consumption: LPG is a vital fuel for cooking and heating in many Chinese households, driving domestic demand.

- Transportation Fuel: LPG's cleaner-burning properties are leading to its adoption as an alternative fuel for vehicles.

Statistics reveal a dramatic increase in China's LPG consumption. While precise figures vary depending on the source and year, reports consistently indicate double-digit percentage growth over the last ten years. This surging demand outpaces domestic LPG production capabilities, highlighting the critical need for substantial imports to meet the nation's energy requirements. Keywords: China LPG consumption, LPG demand, domestic LPG production, energy consumption.

The Geopolitical Significance of Reducing US LPG Dependence

The complex relationship between the US and China significantly influences their energy trade. Recent trade disputes and political tensions have underscored the vulnerability of relying on a single major supplier for crucial energy resources. Diversifying LPG sources is, therefore, a strategic imperative for China, enhancing its energy independence and mitigating risks associated with potential US sanctions or trade disruptions.

- Reduced Vulnerability to Sanctions: A diversified supply chain reduces China's susceptibility to economic pressure through trade restrictions.

- Enhanced Bargaining Power: A less reliant China enjoys greater negotiating leverage in international energy markets.

- Strengthened Energy Security: Reducing dependence on a single source minimizes disruptions to energy supply.

By shifting towards Middle Eastern LPG, China seeks to de-risk its energy supply chain and solidify its position in global energy markets. Keywords: US-China relations, energy trade, trade disputes, energy independence, geopolitical risks.

Middle Eastern LPG: A Viable Alternative for China

The Middle East boasts several major LPG producers, including Saudi Arabia, Qatar, and Iran, offering China a geographically proximate and potentially cost-effective alternative to US LPG. Existing and developing pipeline infrastructure and maritime shipping routes facilitate the transportation of LPG from the Middle East to China. Furthermore, established trade relationships and potential new agreements further strengthen this energy partnership.

- Saudi Arabia: A significant LPG producer with established export capacity and potential for increased trade with China.

- Qatar: Known for its substantial LNG production and export capabilities, with potential to expand LPG exports.

- Iran: Possesses substantial LPG reserves but faces geopolitical constraints affecting its export potential.

The proximity of Middle Eastern LPG sources significantly reduces transportation costs and transit time compared to US imports. This, coupled with potentially competitive pricing, makes the Middle East an increasingly attractive option for China. Keywords: Middle East LPG producers, LPG trade routes, Saudi Arabia LPG, Qatar LPG, Iran LPG, energy infrastructure.

Economic and Environmental Implications of the Shift

The shift to Middle Eastern LPG imports has significant economic implications for both China and the Middle Eastern nations involved. Increased demand from China could boost LPG prices globally, benefiting exporting countries while potentially impacting consuming nations. However, this price fluctuation is a double-edged sword; a global LPG price increase could disadvantage nations reliant on LPG imports and increase costs for industries and consumers.

- Economic Growth in Middle Eastern Countries: Increased LPG exports generate revenue and stimulate economic growth in the Middle East.

- Price Volatility in the Global LPG Market: A shift in supply chains can impact LPG prices worldwide.

- Environmental Concerns: Increased LPG usage contributes to carbon emissions, necessitating a focus on cleaner energy solutions.

China's long-term energy strategy recognizes the need to balance energy security with environmental sustainability. The increased reliance on LPG, although offering a short-term solution, highlights the ongoing need for investment in and transition to renewable energy sources. Keywords: LPG price, global LPG market, carbon emissions, renewable energy, clean energy transition.

Conclusion: China's Energy Future and the Decline of US LPG Dominance

China's strategic shift towards Middle Eastern LPG imports represents a significant turning point in its energy strategy. Driven by a combination of soaring energy demands, geopolitical considerations, and a quest for enhanced energy security, this move reduces reliance on US LPG and reshapes global energy dynamics. The implications for US-China relations are substantial, impacting trade relations and geopolitical influence. The future will likely see continued diversification in China's energy portfolio, with increased emphasis on renewable energy sources alongside LPG imports from diverse regions. Stay informed about China's evolving energy strategy and its impact on the global LPG market and US-China relations. Further research on China's energy security is crucial for understanding future global energy dynamics.

Featured Posts

-

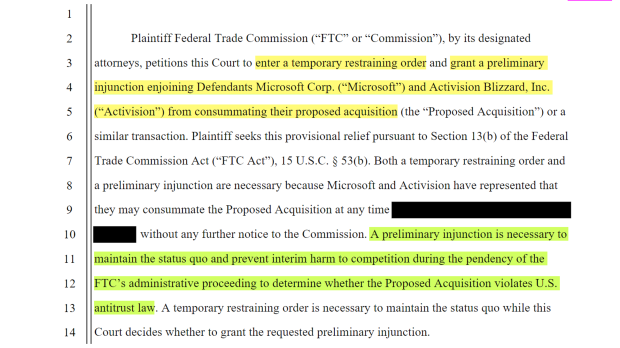

Ftc Challenges Court Ruling On Microsoft Activision Merger

Apr 24, 2025

Ftc Challenges Court Ruling On Microsoft Activision Merger

Apr 24, 2025 -

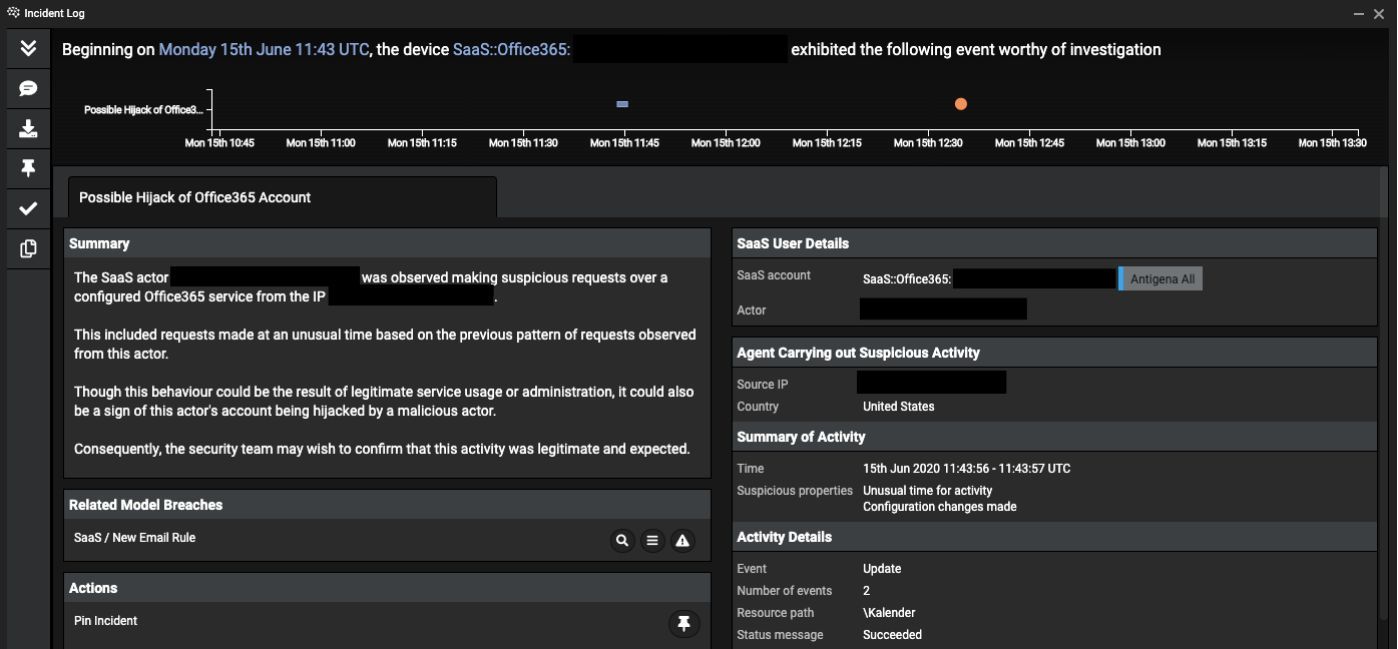

Cybercriminal Accused Of Millions In Office365 Account Compromises

Apr 24, 2025

Cybercriminal Accused Of Millions In Office365 Account Compromises

Apr 24, 2025 -

Bof As View Are High Stock Market Valuations A Cause For Concern

Apr 24, 2025

Bof As View Are High Stock Market Valuations A Cause For Concern

Apr 24, 2025 -

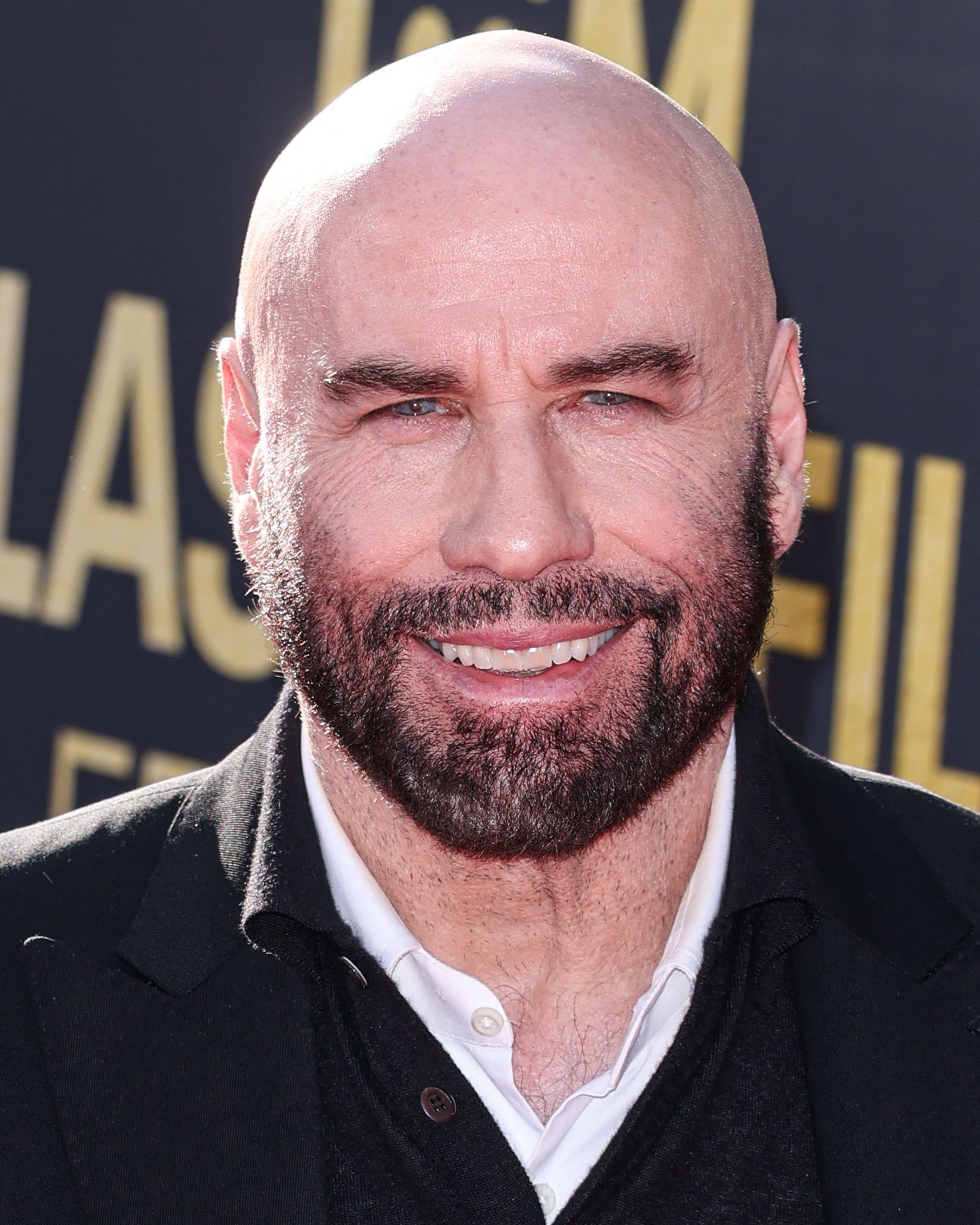

John Travoltas New Action Movie Exclusive High Rollers Poster And Photo Preview

Apr 24, 2025

John Travoltas New Action Movie Exclusive High Rollers Poster And Photo Preview

Apr 24, 2025 -

Five Point Plan From Canadian Auto Dealers To Counter Us Trade Threats

Apr 24, 2025

Five Point Plan From Canadian Auto Dealers To Counter Us Trade Threats

Apr 24, 2025

Latest Posts

-

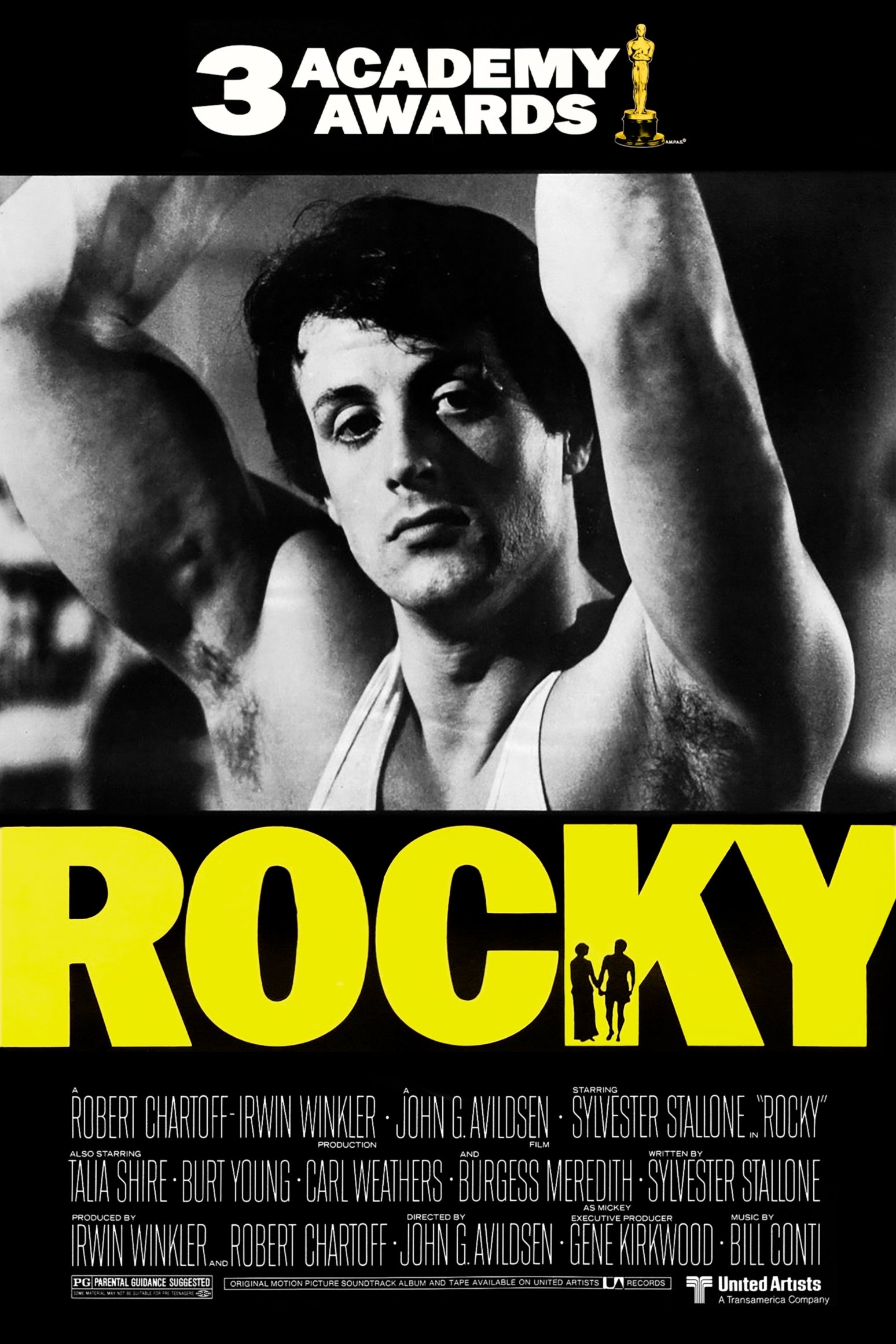

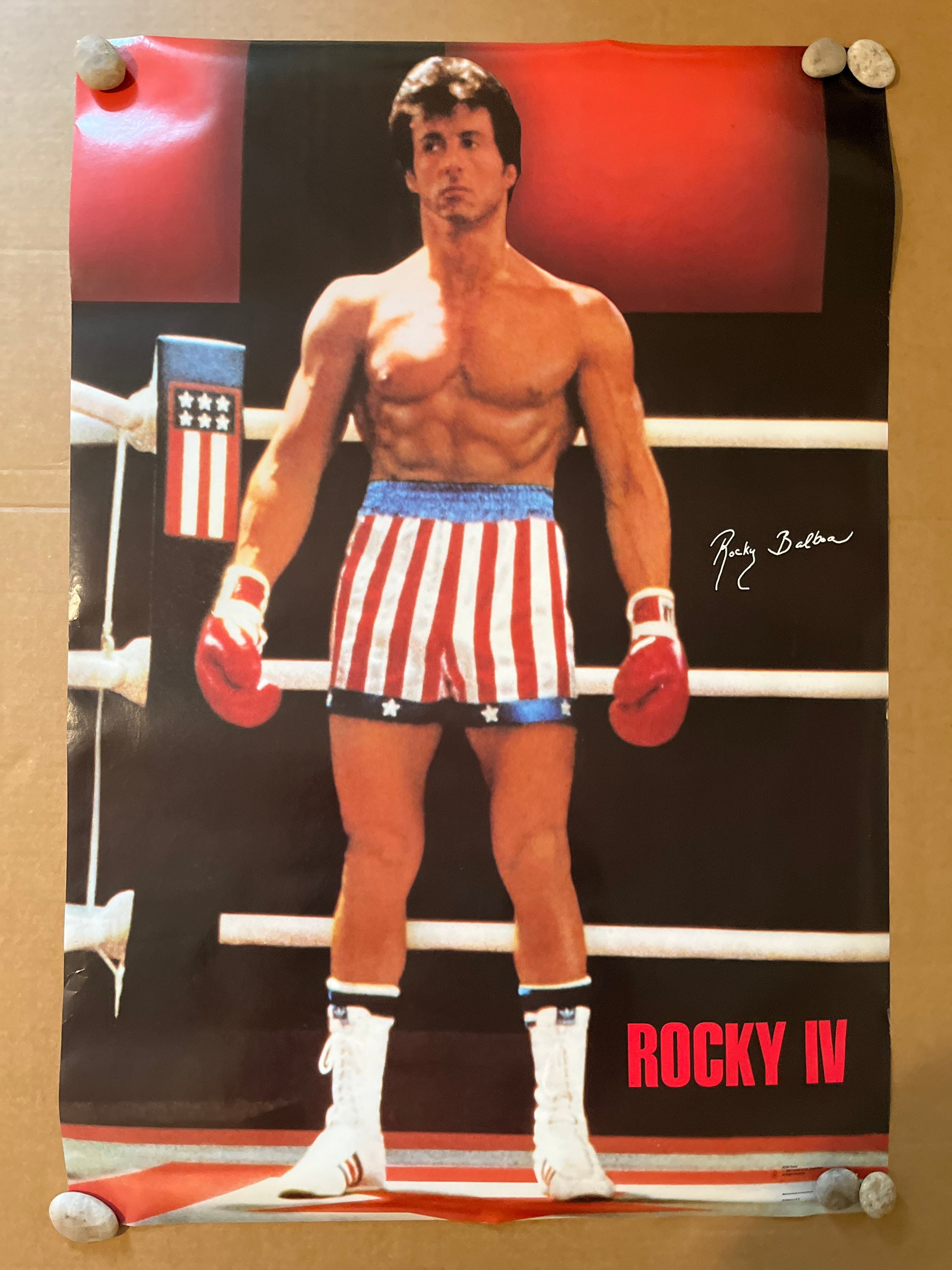

The Most Emotional Rocky Movie Stallones Personal Choice

May 12, 2025

The Most Emotional Rocky Movie Stallones Personal Choice

May 12, 2025 -

Rockys Emotional Core Stallone Reveals His Favorite Film

May 12, 2025

Rockys Emotional Core Stallone Reveals His Favorite Film

May 12, 2025 -

Sylvester Stallones Directing Career A Focus On His One Unstarred Film

May 12, 2025

Sylvester Stallones Directing Career A Focus On His One Unstarred Film

May 12, 2025 -

Stallone On Rocky Which Film Touches Him Most

May 12, 2025

Stallone On Rocky Which Film Touches Him Most

May 12, 2025 -

The One Movie Sylvester Stallone Directed But Didnt Star In A Critical Analysis

May 12, 2025

The One Movie Sylvester Stallone Directed But Didnt Star In A Critical Analysis

May 12, 2025