Court-Appointed Monitor Recommends Liquidation For Lion Electric

Table of Contents

H2: The Court-Appointed Monitor's Recommendation and Rationale

The court-appointed monitor, tasked with overseeing Lion Electric's financial situation, has concluded that liquidation represents the most viable path forward. Their role involves investigating the company's financial health, exploring potential restructuring options, and ultimately recommending a course of action to the court. The monitor's recommendation for Lion Electric liquidation stems from a thorough assessment of the company's precarious financial position.

The key reasons cited for recommending liquidation include:

-

Unsustainable Debt: Lion Electric is burdened with significant debt obligations that it cannot currently service, leading to financial distress.

-

Dwindling Cash Reserves: The company's cash reserves have reportedly diminished significantly, hindering its ability to meet operational expenses and future obligations.

-

Lack of Viable Restructuring Options: Despite exploring various restructuring options, the monitor determined that no feasible plan could restore the company's financial stability.

-

Specific financial difficulties:

- Repeated missed earnings targets and revenue shortfalls.

- Inability to secure additional financing or investment.

- Significant operating losses over several consecutive quarters.

H2: Impact on Lion Electric Investors and Stockholders

The court's recommendation for Lion Electric liquidation has immediately impacted the company's stock price, leading to substantial losses for investors. Shareholders now face the potential loss of a significant portion, or potentially all, of their investment.

The legal process that shareholders can expect includes:

-

Notification of the bankruptcy proceedings: Official notification and details regarding the liquidation process.

-

Claim filing: Shareholders will have to file claims to potentially recover some assets.

-

Asset distribution: Assets remaining after the satisfaction of secured creditors will be distributed among other claimants according to the priority determined by bankruptcy laws.

-

Potential outcomes for different classes of investors:

- Secured creditors are likely to have priority in the recovery of assets.

- Unsecured creditors will likely face significant losses.

- Shareholders will likely receive minimal or no return on their investment.

H2: Implications for the Electric Vehicle Industry

Lion Electric's potential liquidation carries substantial implications for the broader EV industry. This event could shake investor confidence, particularly in companies with similar financial challenges or business models. The competitive landscape will undoubtedly shift, with other EV manufacturers potentially vying for market share previously held by Lion Electric. The situation raises concerns about the long-term sustainability of certain business models within the rapidly evolving EV sector.

-

Impact on investor confidence: The liquidation could lead to heightened scrutiny of other EV companies with similar financial vulnerabilities.

-

Shifting competitive landscape: Competitors are likely to benefit from Lion Electric’s absence, especially those already well-positioned in the electric bus and truck segments.

-

Potential precedent: The case might serve as a cautionary tale for other EV companies struggling with debt and cash flow issues.

-

Comparison to other EV companies: While Lion Electric's situation is unique, it highlights broader challenges faced by some EV manufacturers including securing sufficient funding, managing high production costs, and achieving profitability.

H3: Potential Future Scenarios for Lion Electric's Assets

The liquidation process will involve the sale of Lion Electric's assets, including its factories, technology, intellectual property, and other valuable resources. These assets could be sold individually or as a package in a bankruptcy auction. Potential buyers could include established EV manufacturers looking to expand their operations or companies interested in acquiring specific technologies or intellectual property. The outcome will significantly impact the employees of Lion Electric, potentially resulting in job losses.

- Different scenarios for asset sales:

- Sale of assets in a piecemeal fashion to various buyers.

- Sale of the entire company to a strategic investor.

- Liquidation of assets to satisfy creditors.

Conclusion:

The court-appointed monitor's recommendation to liquidate Lion Electric represents a significant development with far-reaching consequences. The liquidation will impact investors significantly, potentially causing substantial losses. Furthermore, the event casts a shadow on the wider EV industry, raising concerns about financial stability and prompting closer examination of business models. The uncertainty surrounding the future of Lion Electric’s assets and the potential impact on employment are serious concerns.

Stay updated on the Lion Electric liquidation process and its ramifications for the EV industry. Learn more about the financial challenges facing the electric vehicle sector by following the Lion Electric liquidation case closely.

Featured Posts

-

Keanu Reeves On John Wick 5 The Latest Updates And Fan Reactions

May 07, 2025

Keanu Reeves On John Wick 5 The Latest Updates And Fan Reactions

May 07, 2025 -

Ensuring Smooth Ldc Graduation A Commerce Advisor Perspective

May 07, 2025

Ensuring Smooth Ldc Graduation A Commerce Advisor Perspective

May 07, 2025 -

Fast Paced Warriors Face Defensive Test From The Rockets

May 07, 2025

Fast Paced Warriors Face Defensive Test From The Rockets

May 07, 2025 -

Royal Air Maroc Flight Cancellations Brussels Strikes Impact

May 07, 2025

Royal Air Maroc Flight Cancellations Brussels Strikes Impact

May 07, 2025 -

Unleash Your Inner Baba Yaga A John Wick Themed Las Vegas Adventure

May 07, 2025

Unleash Your Inner Baba Yaga A John Wick Themed Las Vegas Adventure

May 07, 2025

Latest Posts

-

The Strategic Importance Of Middle Management In Modern Organizations

May 08, 2025

The Strategic Importance Of Middle Management In Modern Organizations

May 08, 2025 -

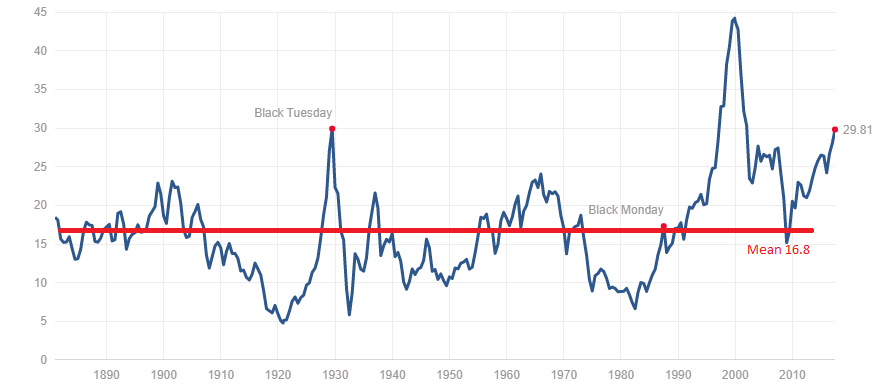

Bof As Take On High Stock Market Valuations A Reason For Investor Optimism

May 08, 2025

Bof As Take On High Stock Market Valuations A Reason For Investor Optimism

May 08, 2025 -

Exploring The Value Of Middle Management Benefits For Companies And Their Workforces

May 08, 2025

Exploring The Value Of Middle Management Benefits For Companies And Their Workforces

May 08, 2025 -

Why Middle Managers Matter A Critical Analysis Of Their Impact On Companies And Employees

May 08, 2025

Why Middle Managers Matter A Critical Analysis Of Their Impact On Companies And Employees

May 08, 2025 -

Why Stretched Stock Market Valuations Shouldnt Deter Investors A Bof A Analysis

May 08, 2025

Why Stretched Stock Market Valuations Shouldnt Deter Investors A Bof A Analysis

May 08, 2025