Crude Oil Prices: April 23 Market Analysis And News

Table of Contents

Global Supply and Demand Dynamics

The global crude oil market is a delicate balance between supply and demand. Fluctuations in either can significantly impact the oil price.

OPEC+ Production Decisions

OPEC+ (the Organization of the Petroleum Exporting Countries and its allies) plays a crucial role in regulating global oil supply. Recent meetings have seen discussions around production quotas and adherence to agreed-upon levels.

- Adherence to Quotas: Monitoring the extent to which OPEC+ members stick to their production targets is key to understanding market dynamics. Any deviation can significantly affect the oil price.

- Future Production Adjustments: The potential for future adjustments to production quotas remains a significant factor influencing oil price predictions. Market participants closely watch announcements for any hints of changes.

- Impact of Individual Member Decisions: Decisions by individual member countries, particularly Saudi Arabia and Russia, significantly impact overall production levels and the oil market. Any shifts in their strategies directly influence the global crude oil price. Recent news suggests [Insert specific recent news about OPEC+ decisions and their implications for oil supply].

Demand Outlook

Global demand for crude oil is influenced by a multitude of factors, most notably economic growth and seasonal changes.

- Economic Growth and Fuel Consumption: Strong economic growth in major economies like the US, China, and Europe typically leads to increased fuel consumption and higher demand for crude oil. Conversely, economic slowdowns can suppress demand.

- Travel Patterns and Industrial Activity: Seasonal variations and shifts in travel patterns (e.g., increased driving during summer months) impact oil demand. Similarly, industrial activity levels significantly affect the demand for oil used in manufacturing and transportation.

- Forecasts and Predictions: Reports from reputable organizations like the International Energy Agency (IEA) and the OPEC provide valuable insights into the future demand outlook. [Insert relevant data or forecasts from these organizations].

Geopolitical Factors and Market Volatility

Geopolitical events can dramatically impact crude oil prices, creating significant market volatility.

Geopolitical Risks

Instability in various regions can disrupt oil supply chains and fuel uncertainty in the market.

- Ukraine Conflict: The ongoing conflict in Ukraine continues to cast a shadow over the global energy market. Disruptions to Russian oil and gas exports have resulted in significant price volatility.

- Middle East Tensions: Political instability or conflicts in the Middle East, a major oil-producing region, can lead to supply disruptions and price spikes. [Mention any current tensions or conflicts impacting oil supply].

- Impact on Market Sentiment: Geopolitical events often impact market sentiment, leading to increased uncertainty and potential price swings. Investors tend to react to such news by adjusting their positions.

US-China Relations

The relationship between the US and China plays a significant role in shaping global oil markets.

- Trade Disputes and Sanctions: Trade tensions or sanctions between the two economic giants can directly impact oil trade flows and prices.

- Impact on Oil Imports and Exports: Any changes in the US-China relationship can significantly influence the demand and supply dynamics within the oil market, leading to either price increases or decreases.

Economic Indicators and Market Sentiment

Macroeconomic indicators like inflation and interest rates strongly correlate with crude oil prices.

Inflation and Interest Rates

- Rising Interest Rates and Economic Activity: Rising interest rates can slow down economic activity, potentially reducing demand for oil and impacting prices.

- Inflation and Energy Prices: High inflation generally increases energy prices, including crude oil, as consumers and businesses pay more for goods and services.

US Dollar Strength

The US dollar's strength relative to other currencies plays a significant role in oil pricing.

- Dollar Strength and Oil Prices: A stronger US dollar makes oil more expensive for buyers using other currencies, potentially reducing demand and influencing prices. [Mention any recent changes in the USD exchange rate].

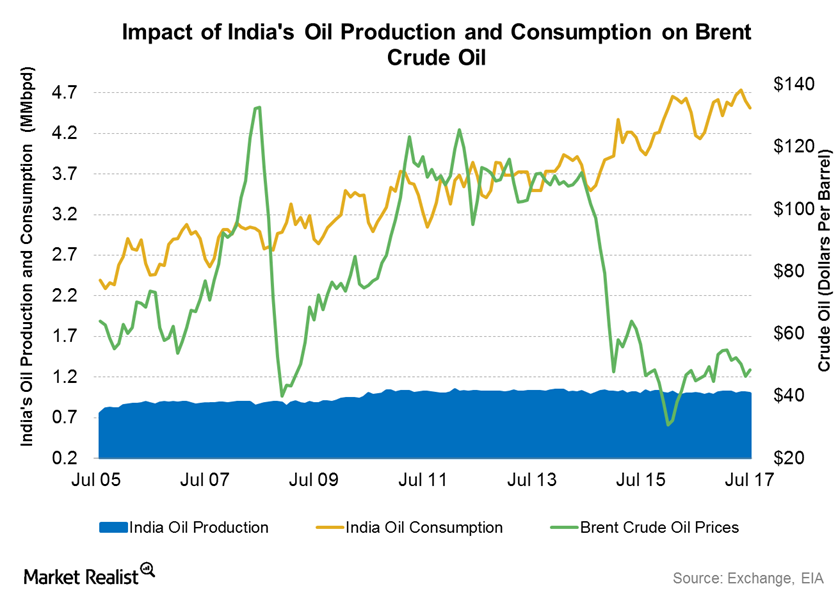

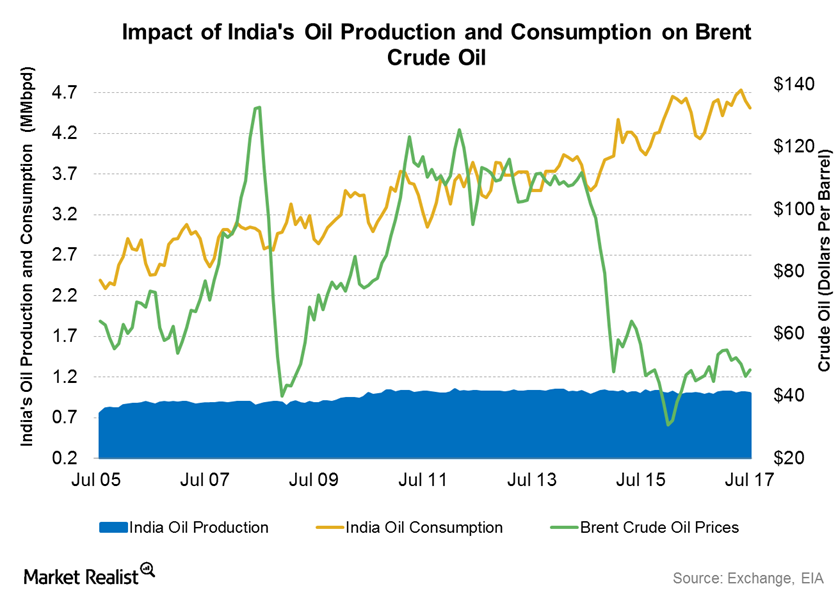

WTI vs. Brent Crude: Price Differences and Analysis

West Texas Intermediate (WTI) and Brent Crude are the two main global crude oil benchmarks.

Price Comparison

- Current Prices: [Insert current WTI and Brent Crude prices]. The price difference between the two benchmarks is often due to various factors.

- Factors Contributing to the Price Spread: The difference between WTI and Brent Crude prices frequently reflects differences in supply, regional demand, and transportation costs.

Future Outlook

The outlook for both WTI and Brent Crude depends on the interplay of factors discussed above. [Insert any available expert predictions or market forecasts for both benchmarks].

Conclusion

Crude oil prices on April 23rd are influenced by a complex interplay of supply and demand dynamics, geopolitical events, and key economic indicators. OPEC+ decisions, geopolitical risks, the strength of the US dollar, and the overall economic climate all contribute to the price fluctuations we observe in benchmarks like WTI and Brent Crude. Understanding these factors is crucial for navigating the oil market.

Stay informed about the ever-changing landscape of crude oil prices by regularly checking back for our latest market analysis and news. Understanding crude oil price trends is crucial for investors and consumers alike. Continue to monitor crude oil price fluctuations for informed decision-making.

Featured Posts

-

Herros Hot Shooting 3 Point Contest Victory And Cavs Skills Challenge Win

Apr 24, 2025

Herros Hot Shooting 3 Point Contest Victory And Cavs Skills Challenge Win

Apr 24, 2025 -

Signal App Controversy Hegseths Loyalty To Trumps Platform

Apr 24, 2025

Signal App Controversy Hegseths Loyalty To Trumps Platform

Apr 24, 2025 -

Open Ais 2024 Developer Event Easier Voice Assistant Creation

Apr 24, 2025

Open Ais 2024 Developer Event Easier Voice Assistant Creation

Apr 24, 2025 -

Liberal Spending Is Canadas Fiscal Health At Risk

Apr 24, 2025

Liberal Spending Is Canadas Fiscal Health At Risk

Apr 24, 2025 -

Crack The Code 5 Dos And Don Ts To Secure A Private Credit Role

Apr 24, 2025

Crack The Code 5 Dos And Don Ts To Secure A Private Credit Role

Apr 24, 2025

Latest Posts

-

Stream Over 100 Mtv Unplugged Performances Complete Episode Guide

May 12, 2025

Stream Over 100 Mtv Unplugged Performances Complete Episode Guide

May 12, 2025 -

Mtv Unplugged Full List Of 100 Episodes Available Now

May 12, 2025

Mtv Unplugged Full List Of 100 Episodes Available Now

May 12, 2025 -

Mtv Cancels 2025 Movie And Tv Awards Ceremony

May 12, 2025

Mtv Cancels 2025 Movie And Tv Awards Ceremony

May 12, 2025 -

Ru Pauls Drag Race S17 Episode 13 Preview Drag Baby Mamas

May 12, 2025

Ru Pauls Drag Race S17 Episode 13 Preview Drag Baby Mamas

May 12, 2025 -

Mtv Movie And Tv Awards No Show In 2025

May 12, 2025

Mtv Movie And Tv Awards No Show In 2025

May 12, 2025