Crack The Code: 5 Do's And Don'ts To Secure A Private Credit Role

Table of Contents

Do's to Secure a Private Credit Role

1. Master the Fundamentals of Private Credit

Demonstrate a thorough understanding of private credit strategies, including direct lending, mezzanine financing, and distressed debt investing. This isn't just about knowing the definitions; it's about showcasing your ability to apply this knowledge to real-world scenarios. Understanding the nuances of each strategy, including their associated risks and returns, is critical.

- Showcase knowledge of different credit structures, covenants, and risk assessment methodologies. Be prepared to discuss the intricacies of various loan structures, such as unitranche loans or second-lien debt, and how covenants protect lenders. Familiarity with credit scoring models and risk analysis techniques is also essential.

- Stay updated on current market trends and regulations affecting the private credit space. Read industry publications like Private Debt Investor and PEI Media to stay informed about market dynamics, regulatory changes, and emerging investment opportunities. Understanding the current economic climate and its impact on the private credit market is also crucial.

- Highlight specific private credit courses or certifications in your resume and interviews. Demonstrating a commitment to professional development through relevant certifications, like the CFA charter or CAIA designation, can significantly enhance your candidacy.

- Develop case studies demonstrating your understanding of complex private credit transactions. Illustrate your abilities by preparing case studies analyzing specific deals, highlighting your analytical skills and decision-making process.

2. Network Strategically Within the Private Credit Community

Networking is paramount in the private credit industry. Building relationships with professionals in the field opens doors to unadvertised opportunities and provides invaluable insights.

- Attend industry conferences and events to expand your network. Conferences like SuperReturn and others provide opportunities to meet key players and learn about the latest industry trends.

- Leverage LinkedIn to connect with professionals in private credit. Actively engage with their posts, participate in relevant discussions, and personalize your connection requests.

- Actively participate in relevant online forums and discussions. Online communities offer a platform to share insights, ask questions, and engage with industry experts.

- Informational interviews are invaluable – reach out to professionals working in your target roles. These conversations provide valuable insights into specific roles, company culture, and career paths.

- Join relevant professional organizations focused on private credit and alternative investments. Membership in organizations like the CFA Institute or similar groups can connect you with a broader network of professionals.

3. Craft a Compelling Resume and Cover Letter Tailored to Private Credit

Your resume and cover letter are your first impression; make it count. Highlight your relevant skills and experience using keywords and quantifiable results.

- Quantify your achievements using metrics and results wherever possible. Instead of simply stating "increased sales," quantify your success with specific numbers, e.g., "increased sales by 15% in Q3 2023."

- Highlight experiences demonstrating financial modeling, underwriting, and due diligence skills. Showcase your proficiency in these areas using concrete examples from past projects or roles.

- Use keywords relevant to private credit, such as "leveraged buyouts," "senior debt," "mezzanine financing," and "distressed debt." Incorporate these terms naturally within your application materials.

- Customize your resume and cover letter for each specific private credit role you apply for. Generic applications rarely impress; tailor your materials to reflect the specific requirements of each position.

- Get feedback from experienced professionals to refine your application materials. Seek feedback from mentors or career advisors to ensure your application is polished and impactful.

4. Ace the Interview with Private Credit-Specific Knowledge

Interview preparation is crucial. Thoroughly research the firm and practice your responses to common interview questions.

- Prepare for in-depth questions about your private credit experience and knowledge. Expect questions on your understanding of various investment strategies, risk assessment, and financial modeling techniques.

- Practice your responses to common behavioral interview questions. Prepare examples demonstrating your teamwork, problem-solving, and communication skills.

- Demonstrate your understanding of financial statement analysis, valuation, and risk management. Be prepared to walk interviewers through your analytical process and justify your conclusions.

- Research the firm thoroughly and prepare intelligent questions to ask the interviewer. This demonstrates your genuine interest and initiative.

- Showcase your analytical abilities by providing detailed examples and solutions to hypothetical scenarios. Prepare for case studies or problem-solving exercises that test your analytical skills.

5. Develop Strong Financial Modeling and Analytical Skills

Proficiency in financial modeling is non-negotiable. Mastering these skills will significantly enhance your chances of securing a private credit role.

- Master financial modeling techniques crucial for private credit analysis. Develop strong skills in discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and other relevant techniques.

- Demonstrate proficiency in using relevant software like Excel and Bloomberg Terminal. These tools are essential for financial analysis in the private credit industry.

- Develop your ability to interpret financial statements and identify key credit risks. Understanding financial statements is fundamental to assessing the creditworthiness of borrowers.

- Complete relevant coursework or pursue certifications to enhance your financial modeling capabilities. Consider specialized courses or certifications to strengthen your skillset.

- Include projects or portfolio examples demonstrating your analytical skills. Highlight your accomplishments by showcasing your work on past projects, preferably ones involving financial modeling or analysis.

Don'ts to Avoid When Pursuing a Private Credit Role

- Don't Neglect the Importance of Networking: Underestimating the power of networking in the private credit industry is a major mistake. Building relationships is crucial for uncovering opportunities and gaining valuable insights.

- Don't Submit Generic Resumes and Cover Letters: Failing to tailor your application materials to each specific role will hurt your chances. Take the time to personalize each application to reflect the specific requirements of each position.

- Don't Underestimate the Importance of Financial Modeling Skills: Private credit requires strong analytical and modeling skills – lacking these will disqualify you. Develop your skills to a high level of proficiency.

- Don't Go Unprepared for Interviews: Lack of preparation will show during interviews and severely impact your chances of success. Practice your responses and research the firm thoroughly.

- Don't Ignore Industry News and Trends: Staying abreast of the latest developments in private credit is essential for success. Follow industry publications and news sources to stay updated.

Conclusion

Securing a private credit role requires diligent effort and strategic planning. By following these do's and don'ts, you'll significantly improve your chances of cracking the code and landing your dream job. Remember to master the fundamentals, network effectively, craft a compelling application, ace the interview, and develop strong analytical skills. Don't delay – start implementing these strategies today and embark on your journey to a successful career in private credit!

Featured Posts

-

Usd Strengthens Against Major Currencies As Trump Tones Down Fed Criticism

Apr 24, 2025

Usd Strengthens Against Major Currencies As Trump Tones Down Fed Criticism

Apr 24, 2025 -

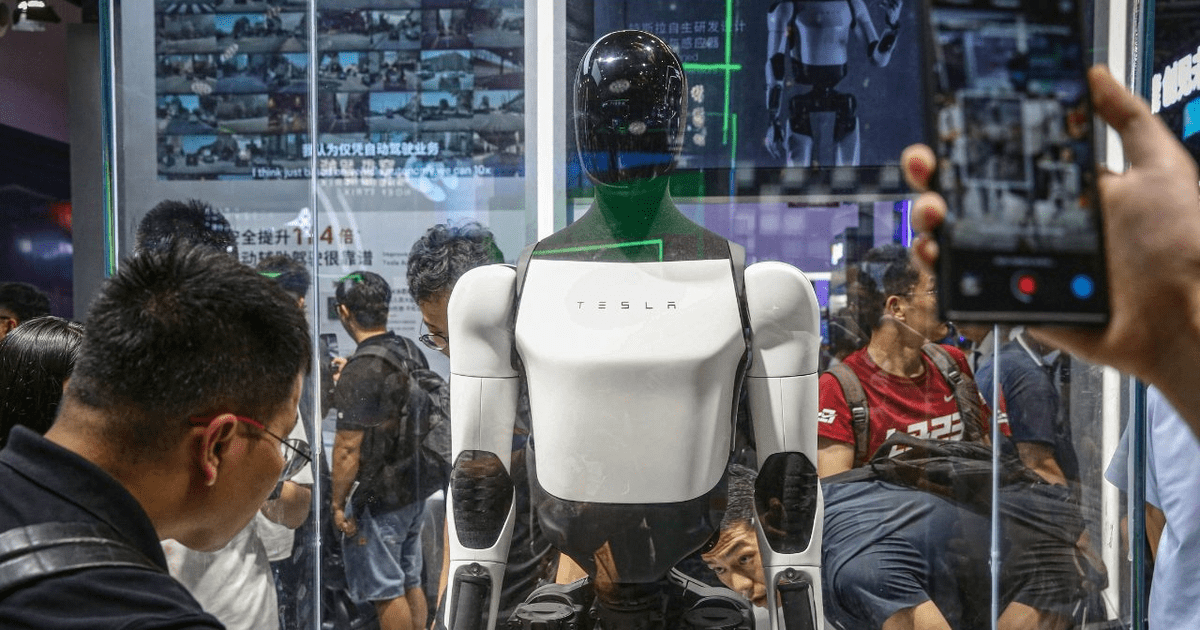

Teslas Optimus Humanoid Robot Project Faces Setbacks Due To Rare Earth Supply Issues

Apr 24, 2025

Teslas Optimus Humanoid Robot Project Faces Setbacks Due To Rare Earth Supply Issues

Apr 24, 2025 -

Tesla Q1 Profits Plunge Amidst Musks Controversial Role

Apr 24, 2025

Tesla Q1 Profits Plunge Amidst Musks Controversial Role

Apr 24, 2025 -

Kci Johna Travolte Nevjerojatna Transformacija

Apr 24, 2025

Kci Johna Travolte Nevjerojatna Transformacija

Apr 24, 2025 -

Understanding The Liberal Platform A Voters Guide

Apr 24, 2025

Understanding The Liberal Platform A Voters Guide

Apr 24, 2025

Latest Posts

-

The Most Emotional Rocky Film According To Sylvester Stallone

May 11, 2025

The Most Emotional Rocky Film According To Sylvester Stallone

May 11, 2025 -

Which Rocky Movie Touches Sylvester Stallone The Most

May 11, 2025

Which Rocky Movie Touches Sylvester Stallone The Most

May 11, 2025 -

Sylvester Stallone Picks His Most Emotional Rocky Film

May 11, 2025

Sylvester Stallone Picks His Most Emotional Rocky Film

May 11, 2025 -

Sylvester Stallones Favorite Rocky Movie A Deep Dive Into The Franchises Most Emotional Entry

May 11, 2025

Sylvester Stallones Favorite Rocky Movie A Deep Dive Into The Franchises Most Emotional Entry

May 11, 2025 -

Sylvester Stallones Underrated Directing Career Focusing On His One Non Acting Project

May 11, 2025

Sylvester Stallones Underrated Directing Career Focusing On His One Non Acting Project

May 11, 2025