Ethereum Price Analysis: Support Holds, But Is A Fall To $1500 Likely?

Table of Contents

Current Market Conditions and Technical Indicators

The overall cryptocurrency market sentiment is currently [Describe Market Sentiment - bullish, bearish, or sideways, providing reasoning]. This overarching sentiment significantly impacts Ethereum's price, as it often moves in correlation with the broader crypto market. Let's examine key technical indicators for a more granular understanding:

- Moving Averages (MA): The 50-day MA is currently at [Insert Value], while the 200-day MA sits at [Insert Value]. [Analyze whether these MAs are providing support or resistance, and what that suggests about the short-term and long-term trends. Include a chart visualizing these MAs].

- Relative Strength Index (RSI): The RSI is currently at [Insert Value]. [Analyze whether the RSI is overbought or oversold, and what this indicates about the buying and selling pressure. Is it suggesting a potential reversal?].

- MACD: The MACD is [Describe the MACD’s current state - e.g., showing a bullish crossover, bearish divergence, etc.]. [Explain what this signifies about the momentum of the Ethereum price]. [Include a chart illustrating the MACD].

- Bollinger Bands: The Ethereum price is currently [situated within, above, or below] the Bollinger Bands. [Explain the significance – is it bouncing off the lower band (support) or breaking out (indicating a strong trend)? Include a chart].

Support and Resistance Levels

Identifying key support and resistance levels is crucial for predicting potential price movements. Currently, Ethereum finds support around [Insert Key Support Levels], with a significant level of concern around $1500. A break below this level could trigger further selling pressure.

- Key Support Levels: $1500, [Insert Other Support Levels]. The strength of these support levels depends on factors like trading volume and market sentiment. [Explain the historical significance of these levels, if any].

- Resistance Levels: Ethereum faces resistance at [Insert Key Resistance Levels]. Breaking through these levels would suggest a stronger bullish trend. [Discuss the factors that could contribute to breaking through resistance].

- Significance: The interplay between support and resistance levels dictates the potential for a price drop to $1500. If support levels hold, a rebound is more likely. However, a significant breach of support could accelerate a downward trend.

Fundamental Factors Influencing Ethereum Price

Beyond technical analysis, fundamental factors play a crucial role in shaping Ethereum's price.

- Ethereum Upgrades: Upcoming upgrades like [Mention Specific Upgrades e.g., sharding, layer-2 scaling solutions] promise improved scalability and efficiency. Successful implementation could positively impact the price.

- Regulatory Changes: Regulatory clarity (or lack thereof) concerning cryptocurrencies significantly influences market sentiment and investment decisions. [Discuss the potential impact of current or anticipated regulations on Ethereum’s price].

- Adoption and Usage: Increasing adoption of Ethereum for DeFi applications, NFTs, and other use cases fuels demand and price appreciation. [Discuss current adoption trends and their likely effect on the price].

- Institutional Investment: The involvement of large institutional investors can significantly influence price movements. Increased institutional buying generally provides support, while selling can lead to price drops.

The Likelihood of a Fall to $1500

Based on the above analysis, a drop to $1500 is [Describe Likelihood - likely, unlikely, possible, etc.].

- Arguments For: A breakdown of key support levels, coupled with a bearish market sentiment and negative regulatory news, could trigger a substantial drop to $1500.

- Arguments Against: Strong support levels, positive developments in the Ethereum ecosystem, and increased institutional interest could prevent a fall to $1500.

- Potential Catalysts: A major market downturn, negative regulatory news, or a significant security breach within the Ethereum network could act as catalysts for a drop.

Conclusion

This Ethereum price analysis suggests that while a drop to $1500 is possible, it's not inevitable. The current support levels, combined with positive fundamental developments, offer a counterbalance. However, the volatile nature of the cryptocurrency market necessitates constant vigilance. The interplay of technical indicators and fundamental factors will ultimately dictate Ethereum's price trajectory. Remember to conduct thorough research and consider your risk tolerance before making any investment decisions. Continuous monitoring of Ethereum price analysis is crucial for informed decision-making in this dynamic market. Follow us for updates on the volatile Ethereum market and stay informed. The ongoing evolution of Ethereum's price demands continuous and comprehensive analysis.

Featured Posts

-

Andor Season 2 How It Redefines Star Wars Canon According To A Rogue One Actor

May 08, 2025

Andor Season 2 How It Redefines Star Wars Canon According To A Rogue One Actor

May 08, 2025 -

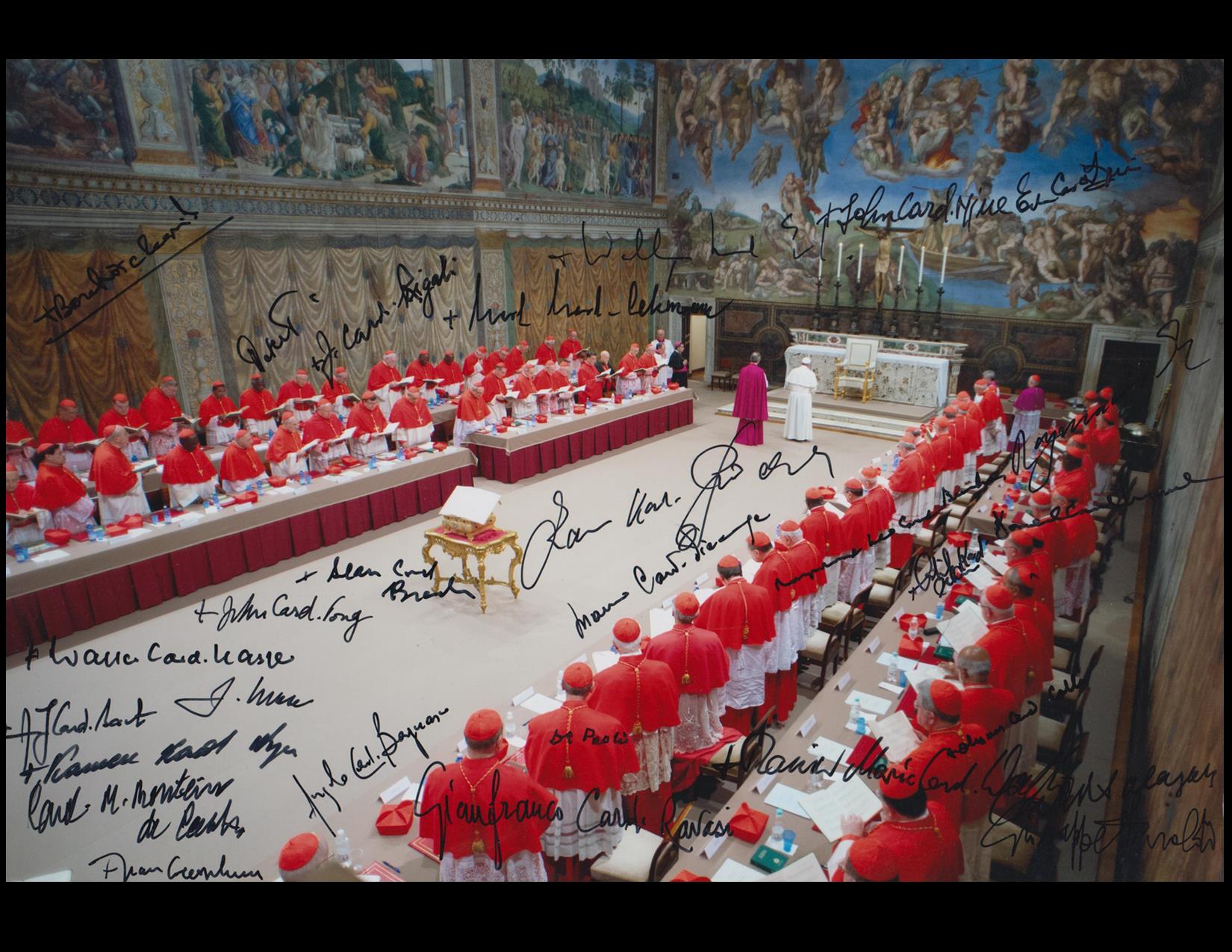

Understanding The Papal Conclave Choosing The Next Pope

May 08, 2025

Understanding The Papal Conclave Choosing The Next Pope

May 08, 2025 -

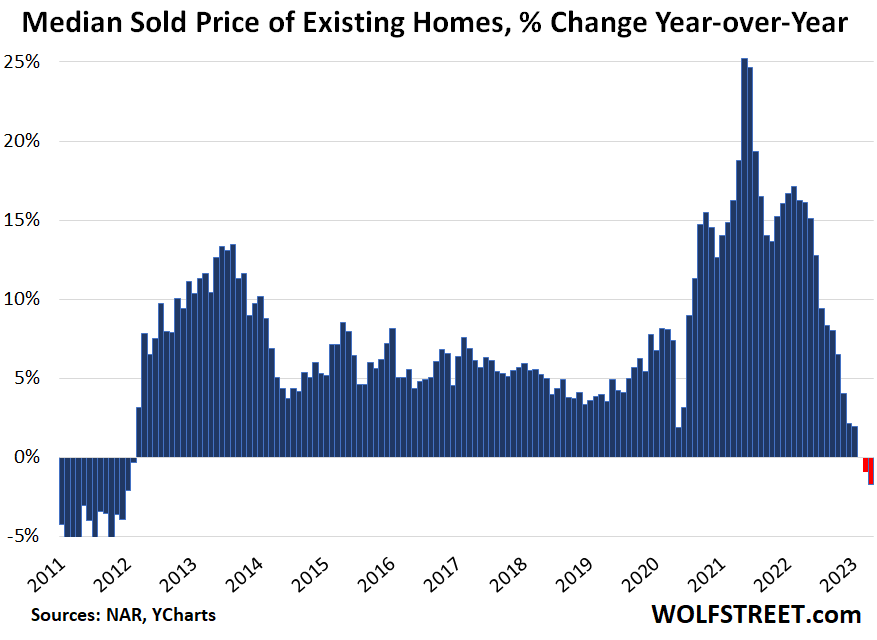

Toronto Home Sales Plunge 23 Drop Year Over Year Prices Down 4

May 08, 2025

Toronto Home Sales Plunge 23 Drop Year Over Year Prices Down 4

May 08, 2025 -

Chinas Economic Stimulus Rate Cuts And Enhanced Bank Lending Accessibility

May 08, 2025

Chinas Economic Stimulus Rate Cuts And Enhanced Bank Lending Accessibility

May 08, 2025 -

Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results Here

May 08, 2025

Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results Here

May 08, 2025