Ethereum Price Rebound: Weekly Chart Indicator Suggests Buy

Table of Contents

Technical Analysis: Identifying the Rebound Signal

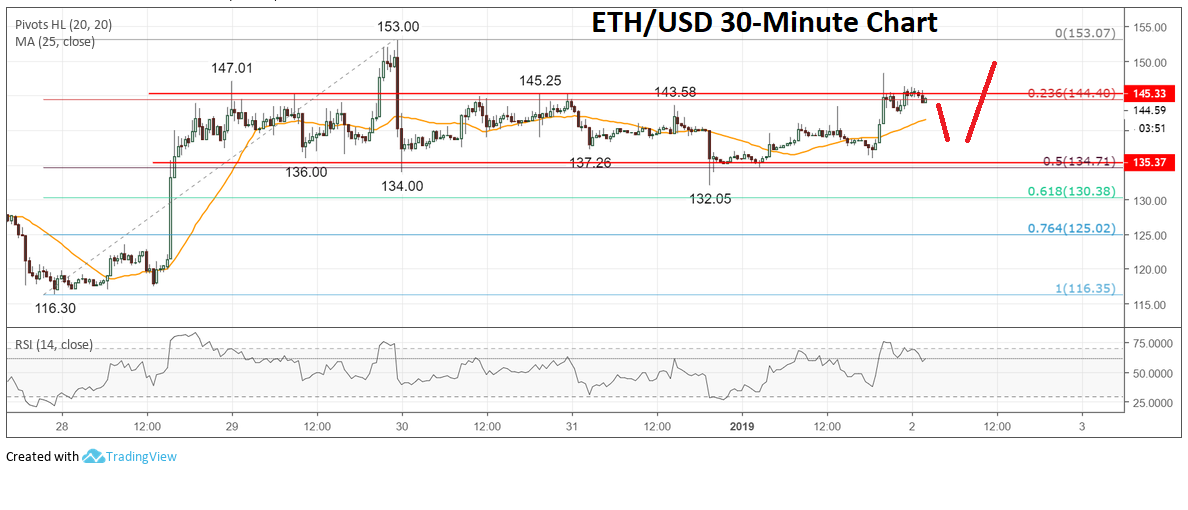

Technical analysis of the Ethereum price provides valuable insights into potential price movements. Examining specific chart patterns and key support/resistance levels helps predict future trends and identify potential buy signals for Ethereum.

Weekly Chart Patterns: Spotting the Bullish Signals

The Ethereum weekly chart exhibits several patterns suggesting a potential price rebound. One prominent pattern is a bullish engulfing candle, observed around [Insert Date], where a large green candle completely enveloped the previous red candle. This pattern often signals a shift in momentum from bearish to bullish. Additionally, a potential head and shoulders reversal pattern is forming, with the right shoulder currently developing. Confirmation of this pattern would strongly suggest a significant price increase.

- Specific Price Levels and Dates: The bullish engulfing candle appeared around [Insert Date] at a price of approximately $[Insert Price]. The potential head and shoulders pattern's neckline sits around $[Insert Price].

- RSI and MACD Confirmation: Supporting this bullish sentiment, the Relative Strength Index (RSI) is showing signs of moving above oversold territory (below 30), and the Moving Average Convergence Divergence (MACD) is exhibiting a bullish crossover. [Insert Chart showing RSI and MACD].

- Volume Confirmation: Increased trading volume during the formation of these patterns further strengthens the bullish signal, indicating strong buying pressure. [Insert chart showing volume].

Support and Resistance Levels: Breaking Through Barriers

Ethereum has historically found support around $[Insert Price] and resistance around $[Insert Price]. The recent price action demonstrates a bounce off the support level, indicating strong buyer interest. A decisive break above the resistance level could trigger a significant price surge, potentially reaching $[Insert Potential Price Target].

- Psychological Importance: The $[Insert Price] resistance level holds psychological significance as it represents a previous high. Breaking through this level could unlock further upward momentum. [Insert chart showing support and resistance levels].

- Breaching Resistance: A successful breach above the resistance level would confirm a bullish breakout, potentially leading to a sustained price increase in ETH.

Fundamental Factors Supporting a Potential Ethereum Price Rebound

Beyond technical analysis, several fundamental factors underpin the possibility of an Ethereum price rebound. These factors point towards increased demand and long-term growth potential for the ETH cryptocurrency.

Ethereum 2.0 Development: Paving the Way for Scalability

The ongoing development of Ethereum 2.0 is a significant catalyst for future price growth. The transition to a proof-of-stake (PoS) consensus mechanism significantly enhances Ethereum's scalability, security, and efficiency.

- Key Milestones: The successful launch of the Beacon Chain and ongoing shard chain development are key milestones demonstrating the progress of Ethereum 2.0.

- Enhanced Utility: The improved scalability provided by Ethereum 2.0 will allow for increased transaction throughput and lower transaction fees, boosting its utility and attractiveness for developers and users.

Growing DeFi Ecosystem: Fueling Demand for ETH

The explosive growth of the Decentralized Finance (DeFi) ecosystem built on Ethereum continues to fuel demand for ETH. Many DeFi protocols require ETH for transaction fees (gas fees) and staking, creating a significant demand driver.

- TVL Statistics: The total value locked (TVL) in DeFi protocols on Ethereum has reached $[Insert TVL amount], showcasing the immense growth of this sector.

- Increased Activity: Increased DeFi activity translates to higher demand for ETH, contributing to its price appreciation.

Institutional Adoption: The Rise of Institutional Investors

The growing interest from institutional investors in Ethereum is a powerful indicator of its long-term potential. Major institutional players are increasingly recognizing the value proposition of Ethereum.

- Examples of Institutional Adoption: [Insert examples of institutional investors showing interest in Ethereum].

- Long-Term Implications: This increasing institutional adoption adds legitimacy and stability to the Ethereum ecosystem, which can drive price growth.

Risks and Considerations Before Buying Ethereum

Despite the positive signals, it's crucial to acknowledge the inherent risks involved in investing in cryptocurrencies before buying Ethereum. Thorough risk assessment is crucial for responsible investing.

Market Volatility: Navigating the Ups and Downs

The cryptocurrency market is inherently volatile, subject to sudden price swings driven by various factors. Unexpected market corrections or regulatory uncertainty could trigger price declines.

- Factors Influencing Price Decline: Regulatory changes, market-wide sell-offs, and security concerns can negatively impact the price.

- Risk Management Strategies: Diversification, stop-loss orders, and position sizing are essential risk management strategies.

Diversification: Spreading Your Investment Risk

Diversification is a cornerstone of sound investment strategy. Avoid putting all your eggs in one basket by diversifying your investment portfolio across different cryptocurrencies and asset classes.

- Diversification Strategies: Consider allocating investments across a basket of cryptocurrencies, stocks, and bonds.

Due Diligence: Research is Key

Before investing in Ethereum or any cryptocurrency, conduct thorough research to fully understand the risks and potential rewards.

Conclusion: Should You Buy Ethereum Now?

Our analysis of the Ethereum weekly chart reveals potential bullish signals, supported by both technical indicators (chart patterns, support/resistance levels) and fundamental factors (Ethereum 2.0, DeFi growth, institutional adoption). However, the cryptocurrency market remains volatile, emphasizing the importance of risk management and diversification. While this analysis suggests a potential Ethereum price rebound and a potential opportunity to buy Ethereum, it's crucial to conduct your own research before investing. Consider the presented factors and make an informed decision based on your individual risk tolerance. Is now the right time to buy Ethereum? The data suggests a strong possibility, but the ultimate decision rests with you. Remember to conduct your due diligence before investing in Ethereum or any cryptocurrency.

Featured Posts

-

Ethereum Price Analysis Resilience And Potential For Growth

May 08, 2025

Ethereum Price Analysis Resilience And Potential For Growth

May 08, 2025 -

Counting Crows To Play Las Vegas Strip

May 08, 2025

Counting Crows To Play Las Vegas Strip

May 08, 2025 -

Understanding Bitcoins Golden Cross Market Predictions And Analysis

May 08, 2025

Understanding Bitcoins Golden Cross Market Predictions And Analysis

May 08, 2025 -

Stephen Kings The Long Walk A Surprisingly Faithful Film Adaptation

May 08, 2025

Stephen Kings The Long Walk A Surprisingly Faithful Film Adaptation

May 08, 2025 -

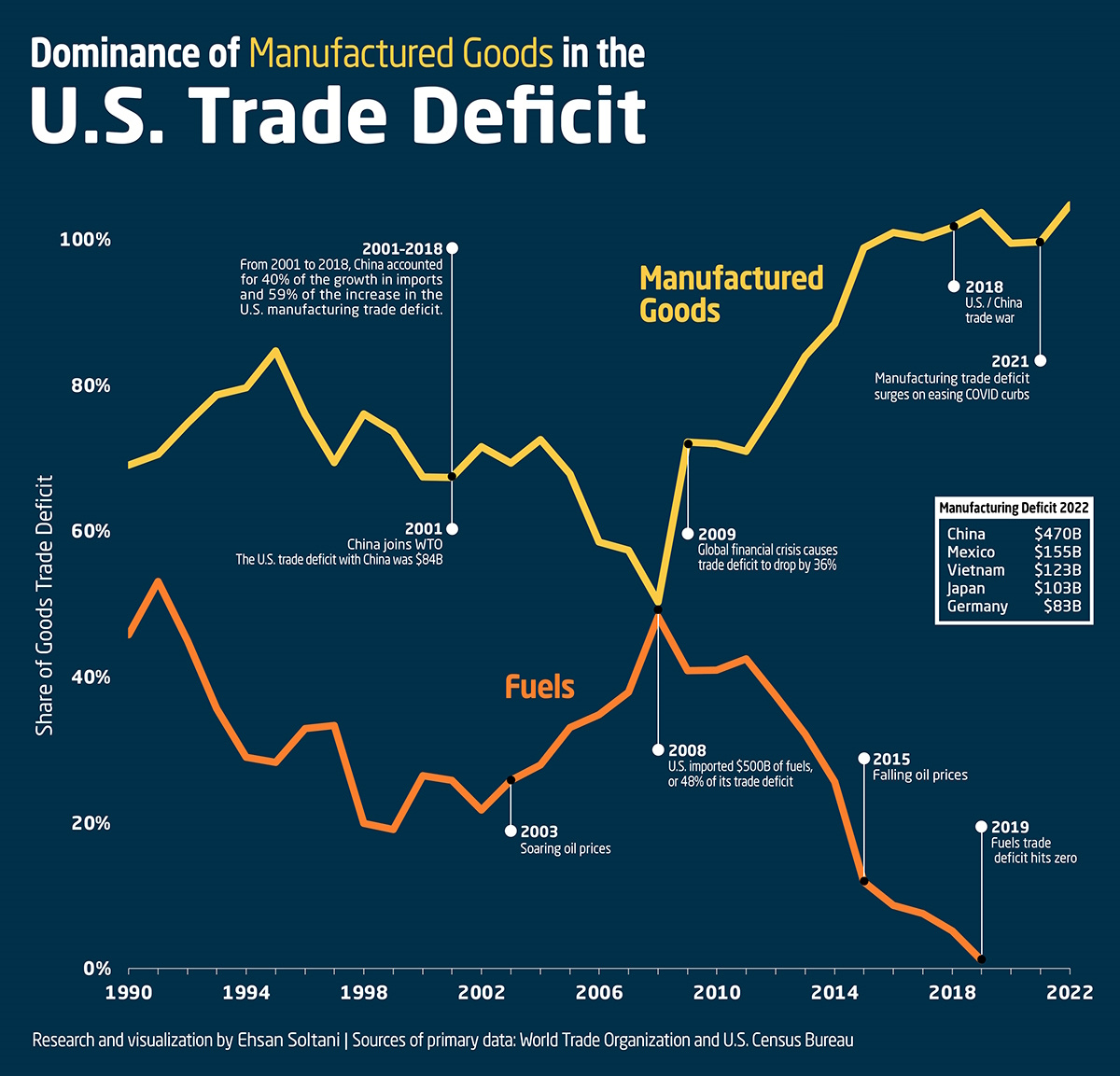

Analysis Of Canadas 506 Million Trade Deficit Tariff Effects

May 08, 2025

Analysis Of Canadas 506 Million Trade Deficit Tariff Effects

May 08, 2025

Latest Posts

-

Ripple Xrp Price Surge Brazil Etf Approval And Trumps Social Media Post

May 08, 2025

Ripple Xrp Price Surge Brazil Etf Approval And Trumps Social Media Post

May 08, 2025 -

Lottozahlen 6aus49 Vom 19 April 2025 Ziehungsergebnis Und Quoten

May 08, 2025

Lottozahlen 6aus49 Vom 19 April 2025 Ziehungsergebnis Und Quoten

May 08, 2025 -

Xrp On The Brink Examining The Etf Push Sec Case Resolution And Ripples Next Steps

May 08, 2025

Xrp On The Brink Examining The Etf Push Sec Case Resolution And Ripples Next Steps

May 08, 2025 -

Lotto 6aus49 Ergebnisse Mittwoch 9 April 2025 Gewinnzahlen Ueberpruefen

May 08, 2025

Lotto 6aus49 Ergebnisse Mittwoch 9 April 2025 Gewinnzahlen Ueberpruefen

May 08, 2025 -

Is This Xrps Big Moment Etf Approvals Sec Action And Market Impact

May 08, 2025

Is This Xrps Big Moment Etf Approvals Sec Action And Market Impact

May 08, 2025