Ethereum Transaction Volume Spikes: Analysis Of Recent Network Activity

Table of Contents

Factors Contributing to Increased Ethereum Transaction Volume

Several key factors have converged to fuel the recent surge in Ethereum transaction volume. Understanding these drivers is crucial for predicting future network activity and its consequences.

DeFi Activity and its Impact

Decentralized Finance (DeFi) applications have played a pivotal role in driving the increased Ethereum transaction volume. The explosive growth of DeFi protocols has led to a massive increase in on-chain activity.

- Yield Farming: Users constantly stake, swap, and reinvest their assets across various DeFi platforms, generating a high volume of transactions.

- Lending and Borrowing: The popularity of lending and borrowing protocols like Aave and Compound results in numerous transactions related to depositing, withdrawing, and managing collateral.

- Token Swaps: Decentralized exchanges (DEXs) like Uniswap, Curve, and SushiSwap facilitate countless token swaps, each contributing to the overall transaction volume.

For instance, Uniswap alone processes millions of transactions daily, significantly impacting Ethereum's overall network activity. The constant interaction with these DeFi platforms creates a consistently high demand for Ethereum transactions.

NFT Market Influence

The booming Non-Fungible Token (NFT) market has also significantly contributed to the recent Ethereum transaction volume spikes. The trading and minting of NFTs on marketplaces like OpenSea and Rarible have generated millions of transactions.

- Digital Art: The sale of unique digital artworks has driven massive transaction volume.

- Collectibles: Trading cards, virtual land, and other digital collectibles also contribute significantly.

- Gaming Items: In-game assets and virtual items are increasingly traded as NFTs, adding to the transaction volume.

The high-value sales of NFTs, coupled with a growing number of users participating in this market, create substantial demand on the Ethereum network.

Ethereum 2.0 and its Gradual Effect

The ongoing transition to Ethereum 2.0, while aiming to improve scalability, might also be contributing to temporary fluctuations in transaction volume.

- Staking Rewards: The staking mechanism in Ethereum 2.0 involves many transactions related to staking and unstaking ETH.

- Sharding (Future Impact): While not fully implemented, the anticipated benefits of sharding—which will increase transaction throughput—are expected to mitigate future volume spikes.

- Transitional Challenges: The migration process itself might temporarily increase transaction volume due to network upgrades and adjustments.

The gradual rollout of Ethereum 2.0 creates a complex interplay of factors influencing current transaction volume.

Consequences of Increased Ethereum Transaction Volume

The substantial increase in Ethereum transaction volume has several notable consequences, primarily affecting gas fees and network performance.

Gas Fee Volatility

The relationship between transaction volume and gas fees is directly proportional: higher volume leads to higher gas prices. This results in increased costs for users, especially for smaller transactions.

- Increased Congestion: Higher transaction volume leads to congestion, making it more expensive to execute transactions.

- Accessibility Concerns: High gas fees can make it difficult or prohibitively expensive for smaller users to participate in the network.

- Price Fluctuations: Gas fees are highly volatile, often spiking significantly during periods of peak network activity.

Recent gas fee spikes have lasted for days, significantly impacting the user experience and accessibility.

Network Congestion and Transaction Times

Increased Ethereum transaction volume directly translates to network congestion, leading to slower transaction processing times.

- Increased Latency: Transactions take longer to be confirmed and finalized.

- User Experience Impact: Users face delays and uncertainties regarding the completion of their transactions.

- Transaction Prioritization: Users may opt to pay higher gas fees to prioritize their transactions, further exacerbating the issue for those with limited budgets.

These delays and uncertainties affect the overall usability of the Ethereum network.

Future Predictions and Trends

Predicting the future of Ethereum transaction volume requires considering several factors and their potential interactions.

Sustained Growth or Temporary Spike?

Whether the recent spikes represent sustained growth or a temporary phenomenon remains to be seen.

- Continued DeFi Growth: The continued expansion of the DeFi ecosystem suggests a high likelihood of sustained high transaction volume.

- NFT Market Maturation: The NFT market's future trajectory will impact Ethereum's transaction volume.

- Ethereum 2.0 Rollout: The complete implementation of Ethereum 2.0 is expected to significantly improve scalability and reduce congestion.

Careful observation of these factors will help determine whether this is a new normal or a temporary peak.

Scaling Solutions and Their Impact

Various scaling solutions are being developed to address the challenges posed by increasing Ethereum transaction volume.

- Layer-2 Solutions: These solutions, such as rollups and state channels, aim to process transactions off-chain, reducing the load on the main Ethereum network.

- Sharding (Ethereum 2.0): Sharding will enable parallel processing of transactions, drastically increasing the network's capacity.

These solutions hold the potential to significantly enhance the scalability and efficiency of the Ethereum network, handling future transaction volume surges more effectively. The successful implementation and adoption of these solutions will be crucial in shaping the future of Ethereum.

Conclusion

The recent spikes in Ethereum transaction volume are primarily driven by the burgeoning DeFi and NFT markets, coupled with the ongoing transition to Ethereum 2.0. These increases have resulted in significant gas fee volatility and network congestion. While the future trajectory of Ethereum transaction volume remains uncertain, the development and implementation of scaling solutions offer a promising path towards enhanced scalability and efficiency. Keep monitoring the Ethereum transaction volume to stay ahead of the curve in this dynamic blockchain ecosystem. Further research into Ethereum network activity and the impact of scaling solutions is recommended to gain a comprehensive understanding of the future trends in Ethereum transaction volume.

Featured Posts

-

Xrp Etf Launch Pro Shares Enters The Crypto Market

May 08, 2025

Xrp Etf Launch Pro Shares Enters The Crypto Market

May 08, 2025 -

Bitcoin Chart Analysis May 6 Signals Suggest Imminent Rally

May 08, 2025

Bitcoin Chart Analysis May 6 Signals Suggest Imminent Rally

May 08, 2025 -

De Andre Jordans Milestone A Historic Game For The Nuggets

May 08, 2025

De Andre Jordans Milestone A Historic Game For The Nuggets

May 08, 2025 -

Inter Milans Stunning Champions League Victory Over Bayern Munich

May 08, 2025

Inter Milans Stunning Champions League Victory Over Bayern Munich

May 08, 2025 -

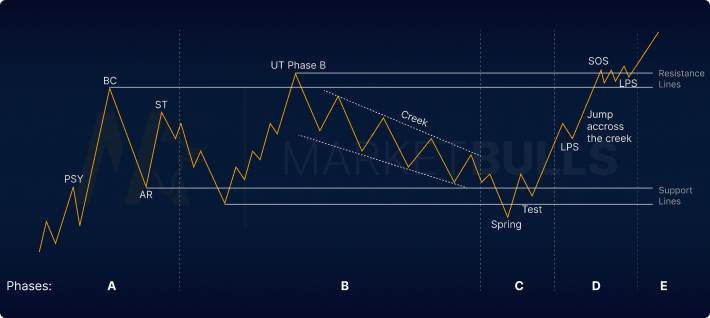

Analyzing Ethereums Price Action Could 2 700 Be Next Wyckoff Accumulation

May 08, 2025

Analyzing Ethereums Price Action Could 2 700 Be Next Wyckoff Accumulation

May 08, 2025