Euronext Amsterdam Stocks Jump 8% Following Trump Tariff Decision

Table of Contents

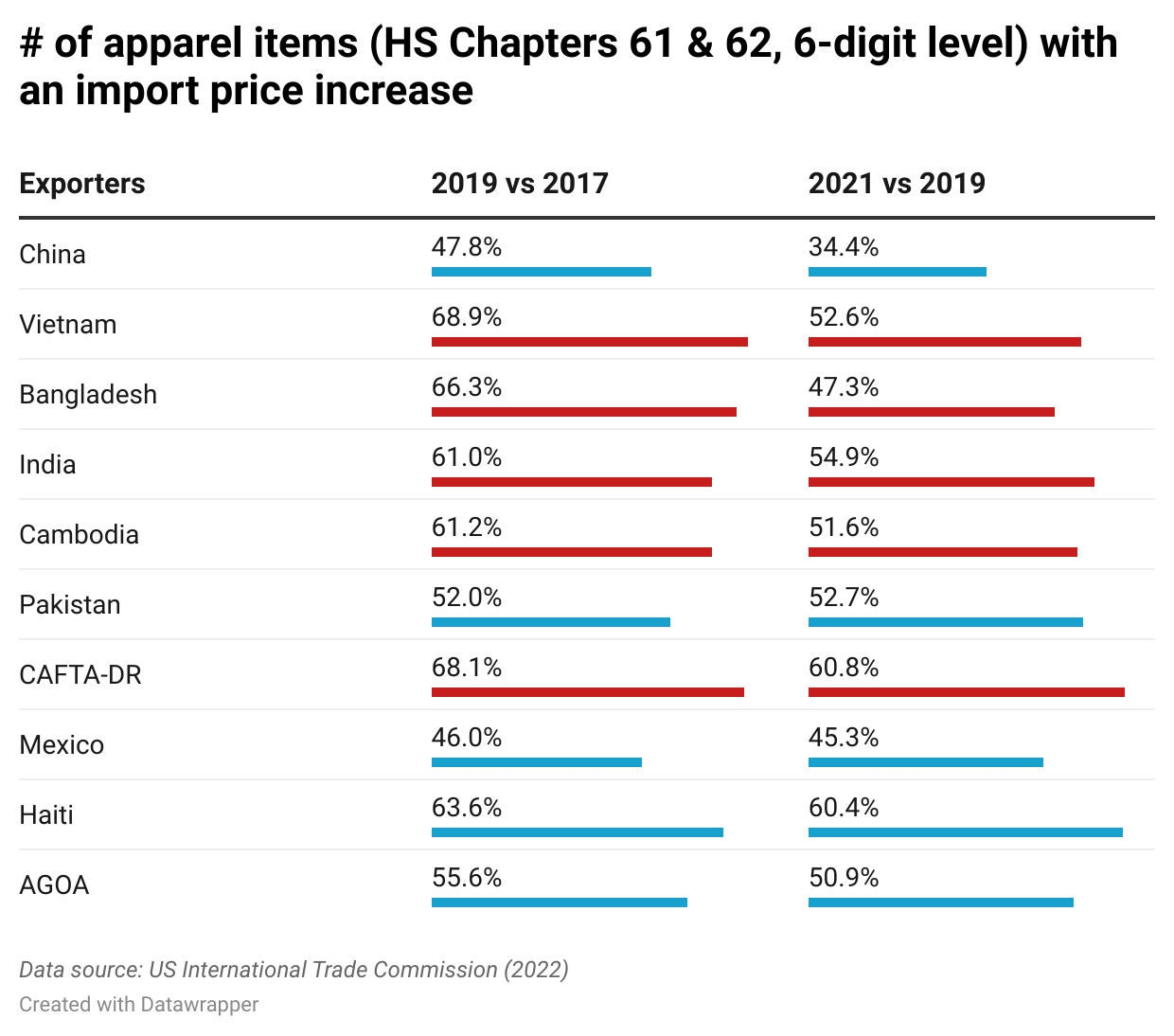

Understanding the Trump Tariff Decision and its Global Impact

The Trump administration's latest tariff decision, while specific details remain somewhat opaque to the public, involved adjustments to import duties on certain goods. This decision, however, is not an isolated event but rather part of a broader pattern of escalating trade tensions between the US and several key economic partners. These ongoing trade disputes create uncertainty in global markets, influencing investor sentiment and impacting international trade flows. The ripple effects of such decisions are far-reaching, affecting supply chains, commodity prices, and the overall economic outlook for many countries, making global market analysis ever more crucial. Keywords: Trump tariffs, trade war, global markets, economic impact, international trade.

Immediate Market Reaction: The 8% Surge on Euronext Amsterdam

The Euronext Amsterdam market experienced an immediate and sharp 8% increase in stock prices within hours of the tariff announcement. This surge peaked around midday, with trading volume significantly exceeding the average daily volume for the past month. While the entire market benefited, specific sectors, including technology and consumer goods, saw even more pronounced gains, with some companies reporting double-digit percentage increases in their market capitalization. This rapid market volatility highlights the sensitivity of Euronext Amsterdam to global trade developments. Keywords: market volatility, stock prices, trading volume, market capitalization.

Analyzing the Reasons Behind the Euronext Amsterdam Stock Jump

Several factors likely contributed to the positive market reaction on Euronext Amsterdam. While the exact proportions are difficult to definitively quantify, a combination of the following likely played a crucial role:

-

Relief from Anticipated More Severe Tariffs: The market's reaction might reflect a sense of relief that the actual tariffs were less stringent than initially feared by many analysts. This reduced uncertainty and improved investor confidence.

-

Positive Investor Sentiment Towards Specific Sectors: Certain sectors on Euronext Amsterdam might have been perceived as benefiting indirectly from the tariff adjustments, leading to increased investment in those specific areas.

-

Short-Covering by Investors: Investors who had bet against (shorted) specific stocks may have been forced to buy them back to limit potential losses, thereby driving up prices.

-

Speculation About Future Economic Growth: The market may have incorporated speculative expectations of positive future economic growth, potentially fueled by the belief that the tariff changes would ultimately stimulate specific sectors of the Dutch economy. Keywords: investor sentiment, market speculation, economic outlook, stock market analysis.

Long-Term Implications for Euronext Amsterdam and its Listed Companies

The long-term effects of this tariff decision on Euronext Amsterdam remain uncertain and require continued market monitoring. While the immediate reaction was positive, the long-term outlook hinges on several unpredictable factors. A prolonged trade war could negatively impact European businesses reliant on US trade, leading to decreased profitability and potentially lower stock valuations. Conversely, if the tariff adjustments prove beneficial to specific sectors, sustained growth could be observed. Careful market analysis and long-term economic forecasting will be necessary to understand and interpret future market trends. Keywords: long-term investment, market trends, future outlook, economic forecasts.

Conclusion: Navigating the Euronext Amsterdam Market After the Tariff Decision

The Trump tariff decision had a significant and immediate impact on Euronext Amsterdam stocks, resulting in an impressive 8% jump. This surge was likely driven by a combination of relief from anticipated worse outcomes, positive investor sentiment towards certain sectors, short-covering, and speculation about future growth. However, investors should approach the Euronext Amsterdam market with a balanced perspective, recognizing both the opportunities and potential risks inherent in this volatile global landscape. Monitor Euronext Amsterdam stocks closely, stay updated on the latest developments in the Euronext Amsterdam market, and learn more about investing in Euronext Amsterdam stocks to make informed decisions. Careful risk management and a comprehensive understanding of market dynamics are crucial for navigating the complexities of the Euronext Amsterdam market in the coming months. Keywords: Euronext Amsterdam, stock market, investment opportunities, market analysis, risk management.

Featured Posts

-

Dutch Stocks Slump Amidst Escalating Us Trade War

May 25, 2025

Dutch Stocks Slump Amidst Escalating Us Trade War

May 25, 2025 -

Euronext Amsterdam Sees 8 Stock Increase Impact Of Trumps Tariff Action

May 25, 2025

Euronext Amsterdam Sees 8 Stock Increase Impact Of Trumps Tariff Action

May 25, 2025 -

Exploring Growth Opportunities Bangladesh And Europes Enhanced Partnership

May 25, 2025

Exploring Growth Opportunities Bangladesh And Europes Enhanced Partnership

May 25, 2025 -

Nashemu Pokoleniyu Chto To Udalos Dostizheniya I Vyzovy Vremeni

May 25, 2025

Nashemu Pokoleniyu Chto To Udalos Dostizheniya I Vyzovy Vremeni

May 25, 2025 -

Escape To The Country Weighing The Pros And Cons Of Rural Life

May 25, 2025

Escape To The Country Weighing The Pros And Cons Of Rural Life

May 25, 2025

Latest Posts

-

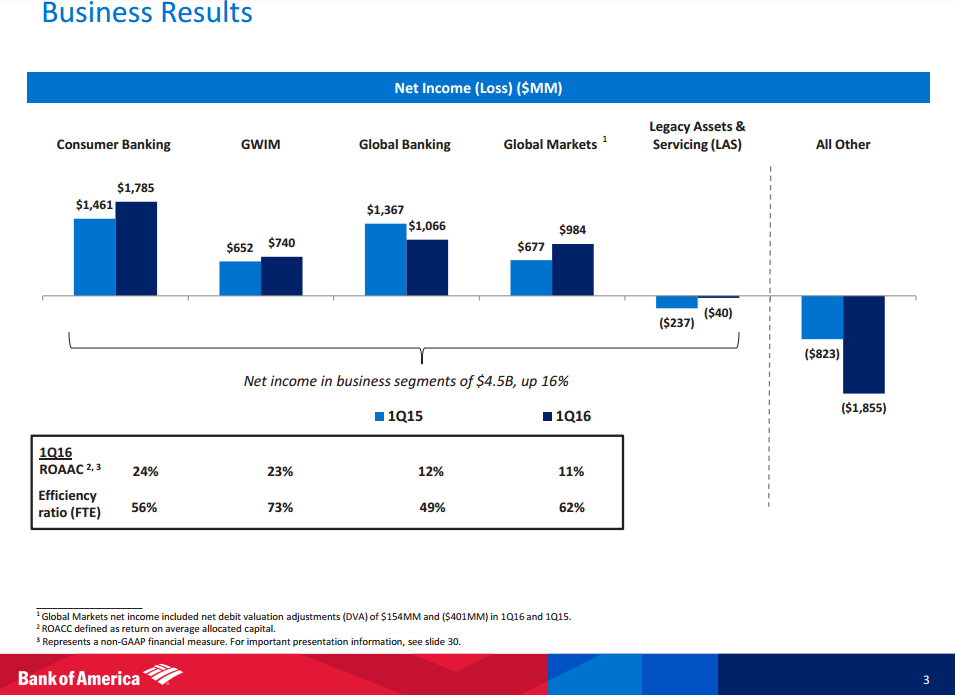

Stock Market Valuation Concerns Bof A Offers A Reassuring Perspective

May 25, 2025

Stock Market Valuation Concerns Bof A Offers A Reassuring Perspective

May 25, 2025 -

Public Reaction To Thames Waters Executive Bonus Payments

May 25, 2025

Public Reaction To Thames Waters Executive Bonus Payments

May 25, 2025 -

Thames Waters Executive Bonuses A Case Study In Corporate Governance

May 25, 2025

Thames Waters Executive Bonuses A Case Study In Corporate Governance

May 25, 2025 -

High Stock Valuations Bof As Reason For Investor Calm

May 25, 2025

High Stock Valuations Bof As Reason For Investor Calm

May 25, 2025 -

Malaysias Najib Razak Faces New Accusations In French Submarine Bribery Case

May 25, 2025

Malaysias Najib Razak Faces New Accusations In French Submarine Bribery Case

May 25, 2025