Falling Retail Sales: Pressure Mounts On Bank Of Canada To Cut Rates

Table of Contents

The connection between falling retail sales and potential interest rate cuts is direct. Declining sales reflect weakening consumer spending, a key driver of economic growth. When consumers reduce spending, businesses see lower revenues, leading to potential job losses and further dampening economic activity. This slowdown could force the Bank of Canada's hand, prompting them to lower interest rates to stimulate borrowing and spending, thereby boosting economic activity.

The Severity of Falling Retail Sales

The decline in retail sales is not insignificant. Recent statistics paint a concerning picture. For example, September's retail sales figures showed a [insert percentage]% drop compared to August, and a [insert percentage]% decrease year-over-year. This represents the [insert description – e.g., steepest decline] in [insert timeframe – e.g., five years]. The impact is widespread, but certain sectors are feeling the pinch more acutely.

- Hardest Hit Sectors: The automotive sector has experienced a particularly sharp downturn, mirroring a global trend. Sales of durable goods, such as appliances and furniture, have also declined significantly.

- Retailer Examples: Major retailers like [insert example retailer 1] and [insert example retailer 2] have reported substantial drops in sales, indicating the widespread nature of the problem.

- Geographical Spread: The decline in retail sales is not limited to specific regions; it's affecting various provinces across the country, suggesting a broader economic slowdown.

- Expert Forecasts: Leading economists predict [insert expert predictions and sources – e.g., a continued contraction in retail sales for the next quarter].

Reasons Behind the Decline in Retail Sales

Several factors contribute to the current slump in retail sales. The primary culprits are high inflation and the Bank of Canada's previous interest rate hikes.

- Inflation's Impact: Soaring inflation has significantly eroded consumer purchasing power. The rising cost of essential goods like groceries and energy leaves less disposable income for discretionary spending. A detailed breakdown shows [insert data – e.g., food prices increasing by X%, energy prices by Y%].

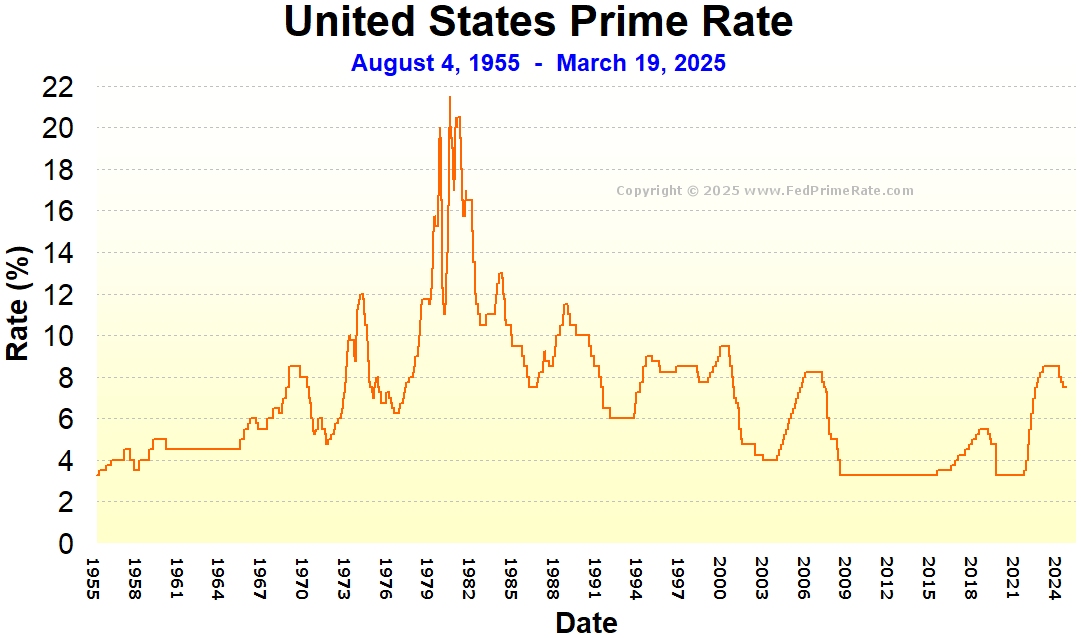

- Higher Interest Rates: The Bank of Canada's previous interest rate increases, aimed at curbing inflation, have made borrowing more expensive. This discourages consumers from taking out loans for large purchases like homes or cars, further dampening retail sales. The impact on mortgages and other consumer loans has been substantial.

- Supply Chain Disruptions: Lingering supply chain issues continue to contribute to higher prices and reduced availability of certain goods, impacting consumer choices and spending.

The Bank of Canada's Response and Potential Rate Cuts

The Bank of Canada is closely monitoring the situation. Its current monetary policy stance remains [insert current stance – e.g., cautiously watchful], but the pressure to cut interest rates is mounting given the severity of falling retail sales.

- Recent Announcements: The Bank's recent statements acknowledge the weakening economy but have stopped short of committing to immediate rate cuts. [Insert details of recent statements].

- Potential Rate Cut Scenarios: Economists are divided on the timing and magnitude of potential rate cuts. Some predict a cut as early as [insert timeframe], while others suggest waiting to see further economic data.

- Economic Consequences: Cutting rates could stimulate the economy but might also fuel inflation. Maintaining rates could prevent further inflation but risks prolonging the economic slowdown.

Alternative Economic Indicators and Their Influence

While falling retail sales are a significant concern, the Bank of Canada considers other indicators to inform its monetary policy decisions.

- Employment Data: Recent employment figures show [insert details – e.g., a slight increase/decrease in employment]. This data provides a nuanced view of the economy's health, offering insights beyond retail sales alone.

- Consumer Confidence Index: The consumer confidence index reflects consumer sentiment regarding the economy. A low index suggests pessimism, which could further impact spending. [Insert relevant data].

- Interrelationship of Indicators: Analyzing these indicators in conjunction with retail sales data provides a more comprehensive picture of the economic climate, helping the Bank of Canada make informed decisions. Discrepancies between the indicators can highlight economic complexities and uncertainties.

Conclusion: Falling Retail Sales and the Urgency for a Bank of Canada Response

The severity of falling retail sales in Canada is undeniable, signaling a significant economic slowdown. This decline, fueled by inflation and previous interest rate hikes, is putting substantial pressure on the Bank of Canada to respond. The interconnectedness of retail sales, consumer spending, and overall economic health necessitates careful consideration of potential interest rate cuts. While such cuts could stimulate the economy and boost consumer confidence, they also carry the risk of increased inflation. The Bank of Canada’s decision will significantly impact the Canadian economy in the coming months. Stay informed about developments concerning declining retail sales and the Bank of Canada's response by subscribing to our newsletter or following us on social media. Understanding the trends in weakening retail sales is crucial for navigating the current economic climate.

Featured Posts

-

The Magnificent Sevens 2024 Losses A 2 5 Trillion Market Cap Drop

Apr 29, 2025

The Magnificent Sevens 2024 Losses A 2 5 Trillion Market Cap Drop

Apr 29, 2025 -

Georgia Deputies Shot During Traffic Stop One Killed Another Injured

Apr 29, 2025

Georgia Deputies Shot During Traffic Stop One Killed Another Injured

Apr 29, 2025 -

Jejak Sejarah Porsche 356 Pabrik Zuffenhausen Dan Warisannya

Apr 29, 2025

Jejak Sejarah Porsche 356 Pabrik Zuffenhausen Dan Warisannya

Apr 29, 2025 -

Cost Cutting Measures Surge As U S Companies Face Tariff Challenges

Apr 29, 2025

Cost Cutting Measures Surge As U S Companies Face Tariff Challenges

Apr 29, 2025 -

Rosenberg Slams Bank Of Canadas Monetary Policy As Too Timid

Apr 29, 2025

Rosenberg Slams Bank Of Canadas Monetary Policy As Too Timid

Apr 29, 2025

Latest Posts

-

Understanding The Increase In Young Adult Adhd Cases At Aiims

Apr 29, 2025

Understanding The Increase In Young Adult Adhd Cases At Aiims

Apr 29, 2025 -

The Rise Of Adhd Among Young Adults A Case Study From Aiims Opd

Apr 29, 2025

The Rise Of Adhd Among Young Adults A Case Study From Aiims Opd

Apr 29, 2025 -

Adhd

Apr 29, 2025

Adhd

Apr 29, 2025 -

Adult Adhd Understanding Your Diagnosis And Next Steps

Apr 29, 2025

Adult Adhd Understanding Your Diagnosis And Next Steps

Apr 29, 2025 -

Diagnosed With Adult Adhd Your Action Plan Starts Here

Apr 29, 2025

Diagnosed With Adult Adhd Your Action Plan Starts Here

Apr 29, 2025