Federal Student Loan Refinancing: Pros, Cons, And Considerations

Table of Contents

The weight of student loan debt in the US is staggering, impacting millions of borrowers and their financial futures. Many are exploring options to manage their debt, and one frequently considered strategy is Federal Student Loan Refinancing. This process involves replacing your existing federal student loans with a new private loan, often at a lower interest rate. This article will delve into the advantages and disadvantages of federal student loan refinancing, providing you with the essential information to make an informed decision. We'll cover the potential pros, the significant cons, and crucial factors to consider before taking the leap.

H2: Pros of Federal Student Loan Refinancing

Refinancing your federal student loans can offer several compelling benefits, but it's crucial to weigh them against the potential drawbacks.

H3: Lower Monthly Payments:

One of the most attractive advantages is the potential for significantly lower monthly payments. This is achieved through either a lower interest rate or an extended loan term.

- Example: A borrower with $50,000 in federal loans at 6% interest might see their monthly payment reduced by $100-$200 by refinancing to a 4% interest rate. This translates to thousands of dollars in savings over the life of the loan.

- Shorter Loan Term: While extending the loan term lowers monthly payments, you could also choose a shorter term to pay off your debt faster, though this will increase your monthly payment. This approach will save you money on interest over time.

H3: Simplified Repayment:

Managing multiple federal student loans can be a logistical nightmare. Refinancing consolidates these loans into a single, manageable payment.

- Easier Tracking: Instead of juggling multiple due dates and logins, you'll have one simple monthly payment.

- Reduced Administrative Burden: This simplifies your budgeting and reduces the risk of missed payments.

H3: Access to Better Loan Terms:

Refinancing can open doors to better interest rates and more flexible repayment options than your original federal loans offered.

- Fixed vs. Variable Rates: You can choose between fixed and variable interest rates to suit your risk tolerance and financial goals.

- Repayment Plans: Private lenders often offer a wider range of repayment plans, potentially including options unavailable through federal programs.

- Cashback Offers: Some lenders might offer cashback incentives for refinancing, providing an additional financial benefit.

H2: Cons of Federal Student Loan Refinancing

While refinancing sounds appealing, it's essential to acknowledge the potential drawbacks.

H3: Loss of Federal Protections:

This is perhaps the most significant disadvantage. Refinancing your federal student loans means losing access to crucial federal protections:

- Income-Driven Repayment (IDR) Plans: These plans tie your monthly payments to your income, offering relief during periods of financial hardship. Losing this protection can be devastating if your income decreases.

- Deferment and Forbearance: These options temporarily suspend or reduce your payments during times of unemployment, illness, or other extenuating circumstances. Refinancing eliminates this safety net.

- Default and Credit Score Impact: Defaulting on a private student loan can severely damage your credit score and lead to wage garnishment or legal action, much more aggressively than defaulting on federal loans.

H3: Higher Interest Rates (Potential):

While refinancing often leads to lower rates, it's not guaranteed. Borrowers with less-than-perfect credit scores may end up with a higher interest rate than their original federal loans.

- Credit Score Influence: Your credit score is a major factor determining the interest rate you'll receive.

- Rate Shopping: It's crucial to compare offers from multiple lenders to secure the best possible rate.

H3: Prepayment Penalties (Potential):

Some private lenders impose prepayment penalties, charging a fee if you pay off the loan early.

- Penalty Comparison: Always check the loan agreement for prepayment penalties before signing.

- Hidden Costs: These penalties can negate the savings you might achieve by paying off your loan early.

H2: Key Considerations Before Refinancing Federal Student Loans

Before you jump into refinancing, carefully consider these crucial aspects:

H3: Credit Score and History:

A strong credit score is essential for obtaining favorable refinancing terms.

- Rate Impact: A higher credit score typically translates to a lower interest rate.

- Score Improvement: Work on improving your credit score before applying to maximize your chances of securing a good rate.

H3: Shopping Around for the Best Rates:

Don't settle for the first offer you receive. Compare rates and terms from multiple lenders.

- Comparative Analysis: Use online comparison tools or contact lenders directly to get quotes.

- Beyond Interest Rate: Consider factors like fees, repayment options, and customer service.

H3: Understanding the Terms and Conditions:

Meticulously review the loan agreement before signing.

- Key Clauses: Pay close attention to interest rates, fees, repayment terms, and prepayment penalties.

- Professional Advice: Consider consulting a financial advisor for guidance.

H3: Assessing Your Financial Situation:

Honestly evaluate your current financial health before refinancing.

- Income and Expenses: Assess your income, expenses, and debt levels to ensure you can comfortably manage the new payments.

- Financial Goals: Determine if refinancing aligns with your long-term financial goals.

3. Conclusion:

Federal student loan refinancing offers the potential for lower monthly payments and simplified repayment. However, it's crucial to be aware of the risks involved, including the loss of federal protections and the possibility of higher interest rates. Before making a decision, carefully weigh the pros and cons, compare offers from multiple lenders, and assess your financial situation. Make an informed decision about Federal Student Loan Refinancing by thoroughly researching and comparing different lenders to find the best option for your unique circumstances. Consider consulting a financial advisor for personalized guidance.

Featured Posts

-

North Dakotas Richest Person Awarded Msum Honorary Degree

May 17, 2025

North Dakotas Richest Person Awarded Msum Honorary Degree

May 17, 2025 -

13 Analysts Weigh In A Comprehensive Look At Principal Financial Group Pfg

May 17, 2025

13 Analysts Weigh In A Comprehensive Look At Principal Financial Group Pfg

May 17, 2025 -

Crude Oil Market Report News And Insights For May 16

May 17, 2025

Crude Oil Market Report News And Insights For May 16

May 17, 2025 -

Seattle Mariners Vs Chicago Cubs Spring Training Free Live Stream Options

May 17, 2025

Seattle Mariners Vs Chicago Cubs Spring Training Free Live Stream Options

May 17, 2025 -

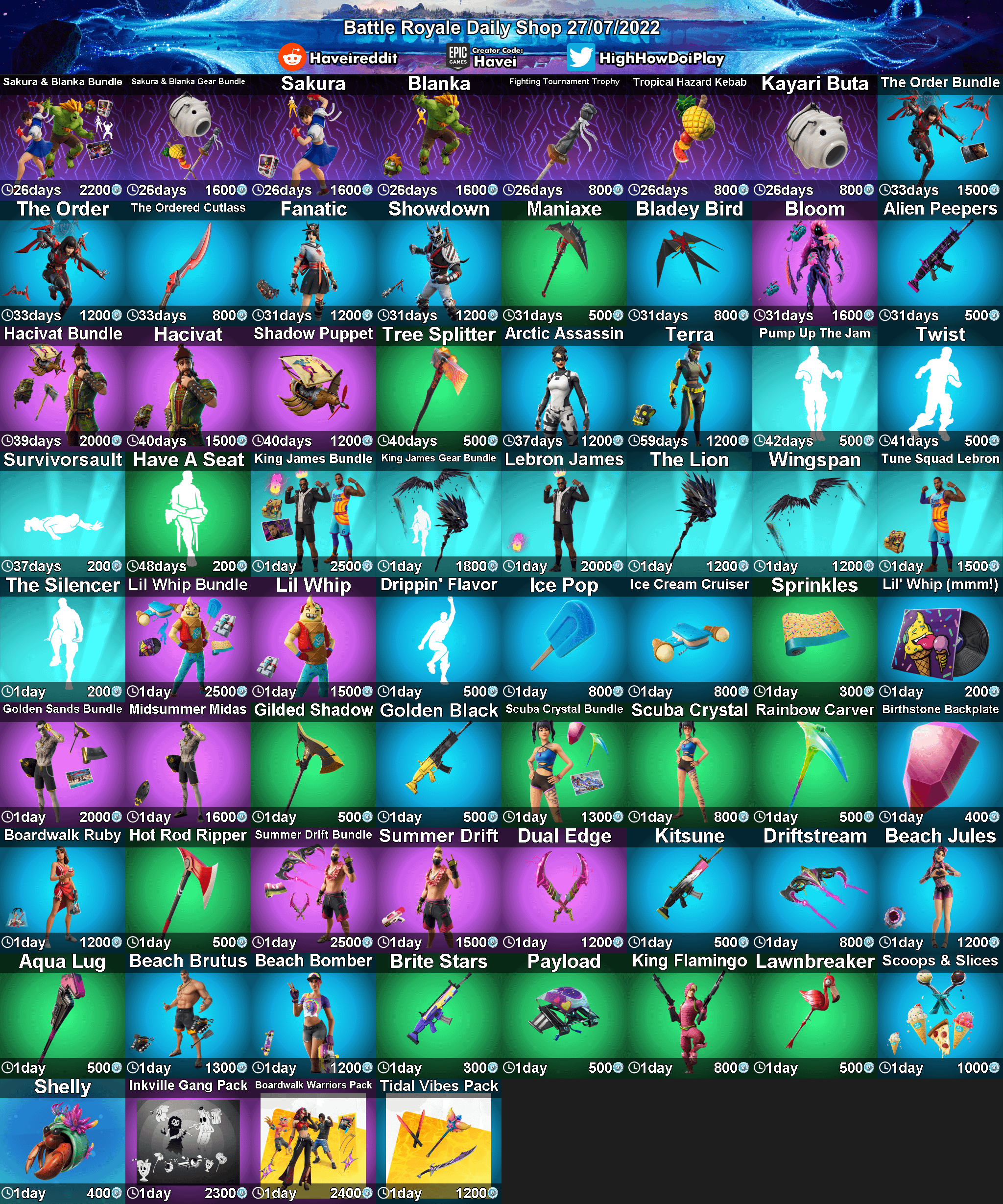

Fortnite A New Icon Skin Joins The Battle Royale

May 17, 2025

Fortnite A New Icon Skin Joins The Battle Royale

May 17, 2025

Latest Posts

-

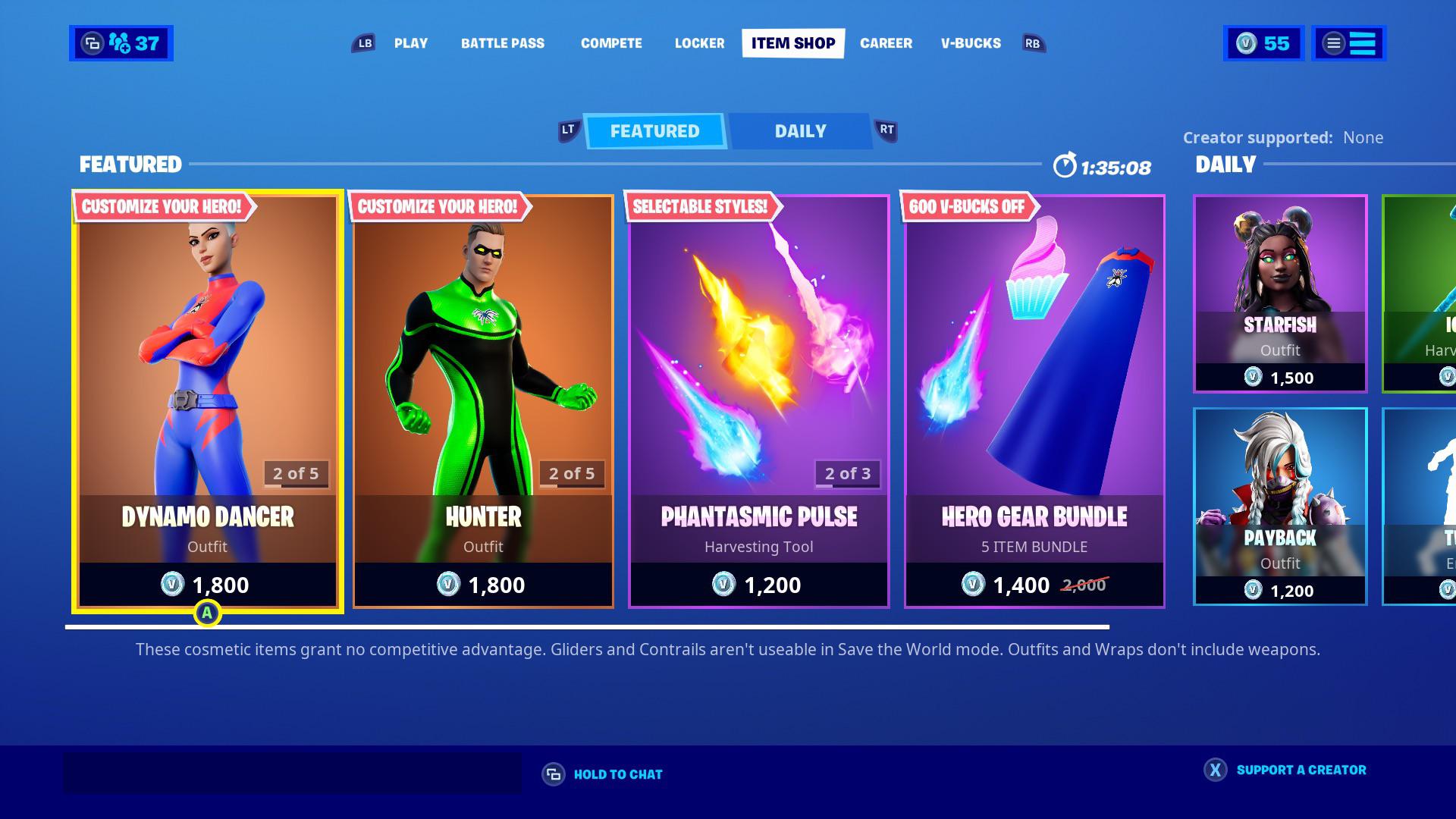

Helpful New Feature Added To The Fortnite Item Shop

May 17, 2025

Helpful New Feature Added To The Fortnite Item Shop

May 17, 2025 -

Fortnite Item Shop Enhanced Functionality For Players

May 17, 2025

Fortnite Item Shop Enhanced Functionality For Players

May 17, 2025 -

Improved Fortnite Item Shop Navigation With New Feature

May 17, 2025

Improved Fortnite Item Shop Navigation With New Feature

May 17, 2025 -

New Fortnite Item Shop Feature Makes Purchasing Easier

May 17, 2025

New Fortnite Item Shop Feature Makes Purchasing Easier

May 17, 2025 -

Fortnites Item Shop Gets A Useful New Feature

May 17, 2025

Fortnites Item Shop Gets A Useful New Feature

May 17, 2025