GOP Tax Plan: Does It Really Cut The Deficit? A Mathematical Look

Table of Contents

The GOP Tax Plan's Core Provisions and Their Projected Impact

The GOP tax plan, enacted in 2017, significantly altered the US tax code. Understanding its impact on deficit reduction requires careful examination of its core components.

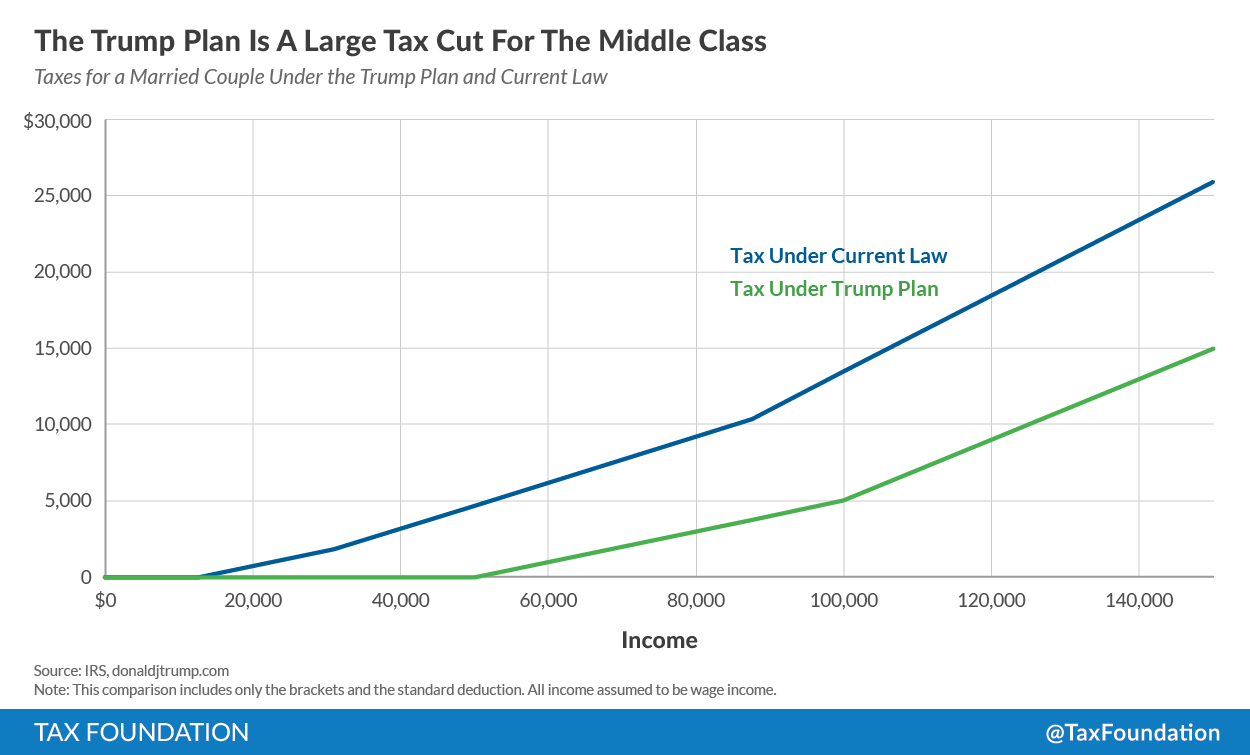

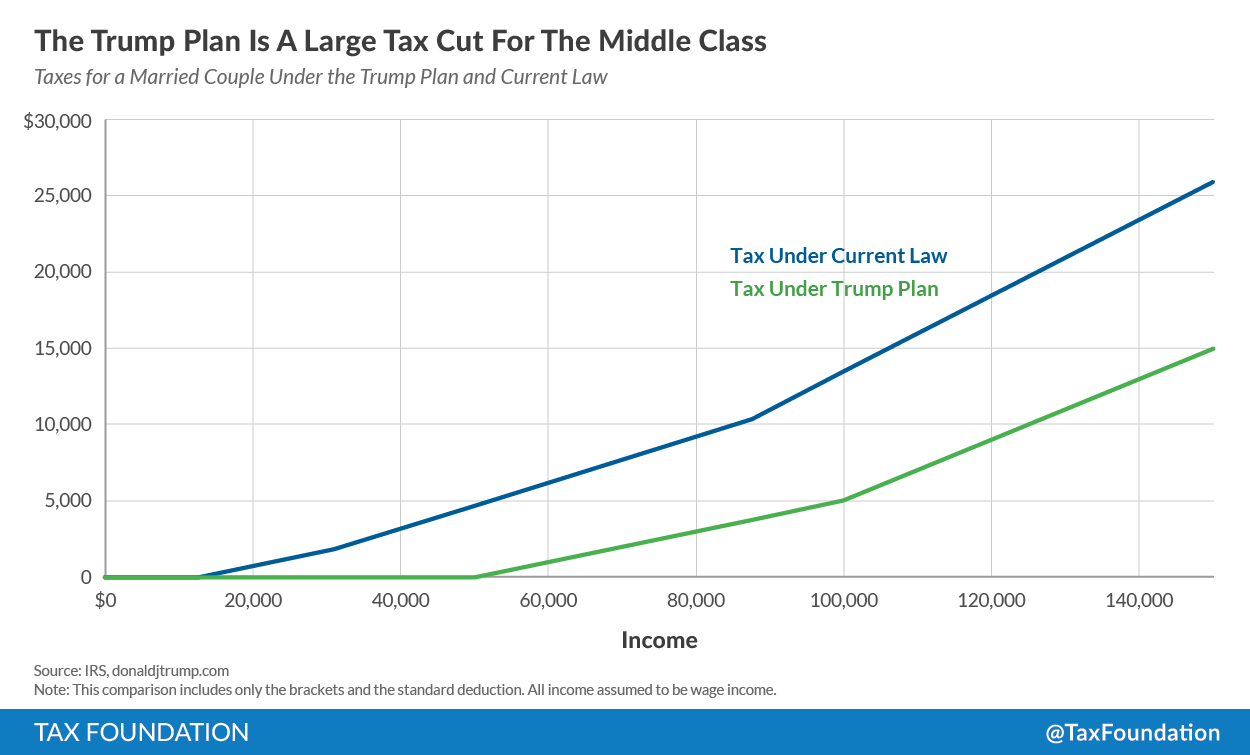

Tax Rate Changes

The plan implemented substantial cuts to both corporate and individual income tax rates. For instance, the top individual income tax rate was reduced from 39.6% to 37%, while the corporate tax rate was slashed from 35% to 21%.

- Individual Income Tax Rates: Reductions across multiple brackets, with varying percentage decreases depending on income level.

- Corporate Income Tax Rate: A significant reduction from 35% to 21%, aiming to boost business investment and economic growth.

- Projected Revenue Impact: Initial projections by the Trump administration suggested these tax cuts would stimulate economic growth, offsetting the revenue losses. However, the Congressional Budget Office (CBO) projected significant increases in the national debt over the following decade. These projections varied depending on the assumed economic growth rate.

Impact on Tax Revenue

Analyzing the tax plan's impact requires understanding two crucial methodologies: static and dynamic scoring.

- Static Scoring: This method assumes that tax revenues will decrease proportionately to the tax rate cuts, without considering any changes in economic behavior. This is a conservative approach.

- Dynamic Scoring: This more complex method considers the potential effects of the tax cuts on economic activity. It attempts to estimate how changes in tax rates might influence factors like investment, employment, and overall economic growth, which in turn affect tax revenue. Dynamic scoring often suggests a smaller revenue loss than static scoring, or even potential revenue gains in the long run, due to stimulated economic growth.

The CBO primarily uses static scoring, leading to projections of significant revenue loss and increased deficits. However, the accuracy of dynamic scoring remains a subject of debate among economists, with significant uncertainty surrounding the magnitude of any potential stimulative effect on economic growth.

Changes to Deductions and Credits

The 2017 GOP tax plan also modified several deductions and credits.

- Standard Deduction: Increased significantly, benefiting lower- and middle-income taxpayers.

- State and Local Tax (SALT) Deduction: Limited to $10,000, disproportionately impacting high-tax states.

- Individual Mandate Penalty: Eliminated, impacting the Affordable Care Act's (ACA) insurance coverage.

- Impact on Income Brackets: While some lower- and middle-income households benefited from the increased standard deduction, higher-income households experienced greater tax savings due to lower marginal tax rates. The elimination of certain deductions disproportionately affected specific demographics.

Economic Modeling and Forecasting Techniques

Predicting the impact of the GOP tax plan on the deficit relies heavily on economic modeling. However, these models are subject to inherent limitations and assumptions.

Underlying Assumptions of Economic Models

Economic models used to forecast the plan's impact rely on various assumptions, including:

- Economic Growth Rates: Different models use different assumptions about future economic growth, significantly influencing their projections of tax revenue.

- Inflation Rates: Inflation's impact on the real value of tax revenues and government spending is a key factor influencing deficit projections.

- Interest Rates: Changes in interest rates directly impact the cost of servicing the national debt.

- Potential Biases: The choice of economic model and the assumptions made can introduce bias into the results, leading to different conclusions.

Comparing Different Economic Models

Various economic models produced diverging projections of the GOP tax plan's impact.

- Congressional Budget Office (CBO) Model: The CBO model, often cited for its non-partisan approach, projected significant increases in the national debt.

- Treasury Department Model: The Treasury Department, using dynamic scoring, presented more optimistic projections.

- Independent Economic Models: Various independent research groups and economists have produced their own models, leading to a range of differing projections.

Discrepancies often stem from differing assumptions about economic growth, inflation, and the responsiveness of the economy to tax cuts.

The Role of Economic Growth in Deficit Reduction

Supply-side economics argues that tax cuts stimulate economic growth, leading to higher tax revenues that offset the initial revenue loss. However, empirical evidence supporting this theory is mixed.

- Evidence for Supply-Side Economics: Proponents point to historical examples where tax cuts were followed by periods of economic expansion.

- Evidence Against Supply-Side Economics: Critics argue that the link between tax cuts and economic growth is tenuous and that other factors often play a more significant role. The impact of the 2017 tax cuts on economic growth has been a subject of ongoing debate among economists.

Long-Term vs. Short-Term Effects

The GOP tax plan's impact on the deficit needs to be analyzed across different time horizons.

Immediate Impact on the Deficit

In the short term, the tax cuts led to a substantial decrease in federal revenue. This, coupled with increased government spending, resulted in a widening of the federal budget deficit.

- Short-Term Deficit Projections: Initial years showed significant increases in the deficit, primarily driven by revenue losses from the tax cuts.

Long-Term Sustainability

The long-term sustainability of the plan remains questionable, given the projected increase in the national debt and its associated costs.

- Long-Term Debt Projections: The CBO projected substantial increases in the national debt over the long term due to the plan. This increased debt leads to higher interest payments, further straining the budget.

- Potential Risks: The increasing national debt poses risks to economic stability, potentially leading to higher interest rates, reduced investment, and slower economic growth.

Conclusion

Analyzing the GOP Tax Plan Deficit Reduction reveals a complex interplay between tax policy, economic modeling, and long-term fiscal sustainability. While proponents argued that the plan would stimulate economic growth and ultimately reduce the deficit, the evidence suggests otherwise. The CBO and other independent analyses project significant increases in the national debt over the long term, casting doubt on the plan's ability to achieve its stated goal. Different economic models produce diverging results largely due to varying assumptions regarding economic growth and the effectiveness of supply-side economics. The short-term impact shows increased deficits, and the long-term outlook remains precarious due to the rising national debt and associated interest payments. Understanding the GOP Tax Plan Deficit Reduction requires a critical examination of these various perspectives and an awareness of the inherent uncertainties in economic forecasting. Continue your research into the GOP tax plan's effect on the deficit and form your own informed opinion based on reliable data from sources like the CBO and independent economic studies.

Featured Posts

-

Jennifer Lawrence Moeder Voor De Tweede Keer

May 20, 2025

Jennifer Lawrence Moeder Voor De Tweede Keer

May 20, 2025 -

The Buy Canadian Movement Navigating Tariffs In The Beauty Sector

May 20, 2025

The Buy Canadian Movement Navigating Tariffs In The Beauty Sector

May 20, 2025 -

Deconstructing The Meaning Behind Suki Waterhouses On This Love

May 20, 2025

Deconstructing The Meaning Behind Suki Waterhouses On This Love

May 20, 2025 -

Urgent Hmrc Child Benefit Message What You Need To Know

May 20, 2025

Urgent Hmrc Child Benefit Message What You Need To Know

May 20, 2025 -

Nj Transit Engineers End Strike After Reaching Deal

May 20, 2025

Nj Transit Engineers End Strike After Reaching Deal

May 20, 2025

Latest Posts

-

Mondays Market Sell Off Analyzing The Impact On D Wave Quantum Qbts

May 20, 2025

Mondays Market Sell Off Analyzing The Impact On D Wave Quantum Qbts

May 20, 2025 -

Understanding D Wave Quantum Qbts Stocks Significant Monday Dip

May 20, 2025

Understanding D Wave Quantum Qbts Stocks Significant Monday Dip

May 20, 2025 -

D Wave Quantum Qbts Stock Drop Unpacking Mondays Sharp Decline

May 20, 2025

D Wave Quantum Qbts Stock Drop Unpacking Mondays Sharp Decline

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Plunge Mondays Market Crash Explained

May 20, 2025

D Wave Quantum Inc Qbts Stock Plunge Mondays Market Crash Explained

May 20, 2025 -

Gretzkys Allegiance To Trump Analyzing The Fallout And Its Long Term Effects

May 20, 2025

Gretzkys Allegiance To Trump Analyzing The Fallout And Its Long Term Effects

May 20, 2025