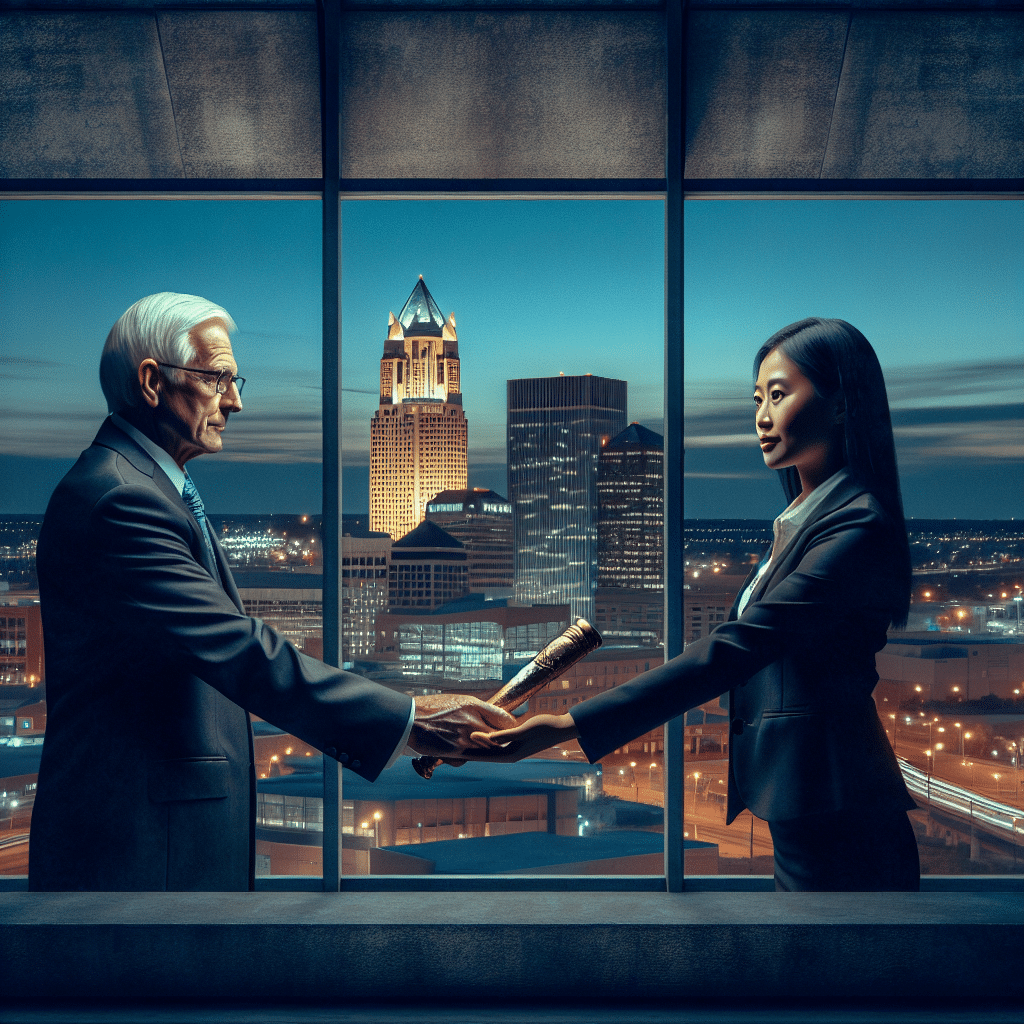

Greg Abel: Warren Buffett's Successor And The Future Of Berkshire Hathaway

Table of Contents

Greg Abel's Background and Career at Berkshire Hathaway

Greg Abel's extensive career within Berkshire Hathaway has uniquely prepared him for the top job. His Berkshire Hathaway career spans decades, showcasing a deep understanding of the company's diverse holdings and operational complexities. His Greg Abel biography reveals a steady climb through the ranks, marked by significant contributions across various sectors.

- Energy Expertise: Abel has long overseen Berkshire Hathaway Energy, demonstrating exceptional leadership in the energy sector, a key component of Berkshire's portfolio. He successfully navigated complex regulatory environments and oversaw substantial growth.

- Insurance Prowess: His experience within Berkshire's insurance operations provides critical insight into risk management and underwriting, crucial for the company's long-term stability.

- Proven Track Record: Abel's operational experience and management skills are evident in his successful track record of leading large, complex businesses within the Berkshire Hathaway umbrella. His ability to improve efficiency and profitability has been consistently demonstrated.

- Executive Leadership: Abel's promotion to CEO is a testament to his exemplary executive leadership capabilities, honed through years of experience and successful strategic decision-making.

Abel's Leadership Style and Management Approach

While Warren Buffett's value investing approach is legendary, Greg Abel's leadership style and management approach remain to be fully unveiled in his new role. While specifics are still emerging, early indications suggest a more collaborative style, leveraging the expertise of Berkshire's diverse leadership team.

- Collaborative Decision-Making: Unlike Buffett's sometimes more solitary decision-making process, Abel's approach is expected to incorporate more collaborative input from various sectors within Berkshire Hathaway.

- Data-Driven Approach: Abel's background suggests a preference for data-driven decision-making, allowing for a more analytical assessment of opportunities and risks within the diverse Berkshire Hathaway management structure.

- Adaptability and Innovation: While respecting Buffett's legacy, Abel's leadership likely involves embracing innovation and adapting to the evolving economic landscape. This includes exploring new investment avenues and leveraging technological advancements.

- Corporate Governance: Abel's commitment to strong corporate governance is crucial for maintaining investor confidence and ensuring the long-term success of Berkshire Hathaway.

Challenges Facing Greg Abel as CEO

The path ahead for Greg Abel is not without its challenges. He inherits a company navigating a complex global economic environment.

- Economic Uncertainty: Global economic uncertainties, including inflation, interest rate hikes, and geopolitical instability, present significant headwinds. Effective investment strategy will be critical in navigating this volatility.

- Market Volatility: Maintaining strong investment performance amid market volatility demands a keen understanding of market dynamics and a strategic approach to risk management.

- Managing a Vast Conglomerate: Overseeing Berkshire Hathaway's incredibly diverse portfolio of companies requires exceptional organizational and leadership skills. Ensuring the continued success of each subsidiary is a significant undertaking.

- Maintaining Shareholder Value: Meeting or exceeding the expectations of Berkshire Hathaway's shareholders, given Buffett's incredible track record, presents a substantial challenge. Succession challenges always include the pressure to maintain or exceed previous achievements.

The Future of Berkshire Hathaway Under Greg Abel

What does the future of Berkshire Hathaway look like under Greg Abel? While maintaining a core commitment to value investing, it's likely that we'll see some shifts.

- Strategic Diversification: Abel might pursue opportunities for further diversification beyond Berkshire's traditional holdings, expanding into new sectors to mitigate risk.

- Technological Investments: Expect increased focus on technology-related investments, reflecting the growing importance of technology across various industries.

- Sustainability Initiatives: Abel may place a stronger emphasis on environmental, social, and governance (ESG) factors in investment decisions.

- Long-Term Growth: The long-term growth of Berkshire Hathaway will continue to be a paramount objective under Abel's leadership, leveraging its strong financial foundation and diversified portfolio.

Comparing Greg Abel to Warren Buffett's Legacy

Comparing Greg Abel to Warren Buffett is inevitable, though unfair in some ways. Buffett's legacy is unique and unparalleled. However, some comparisons can be drawn.

- Value Investing Principles: Abel is expected to uphold Buffett's commitment to value investing, though potentially with a slightly different approach and emphasis.

- Long-Term Vision: Both share a dedication to long-term investment strategies, prioritizing sustainable growth over short-term gains.

- Succession Transition: The succession transition itself will be a key factor in shaping the company's future. The smoothness and efficiency of this transition will significantly impact investor confidence and market perception.

Conclusion: The Future is in Abel's Hands: Greg Abel and Berkshire Hathaway

Greg Abel's appointment as CEO of Berkshire Hathaway marks a significant moment. His extensive experience, leadership capabilities, and deep understanding of the company position him well to navigate the challenges ahead. While he faces considerable hurdles, his potential to build upon Buffett's legacy and shape the future of Berkshire Hathaway is considerable. The success of this succession planning process will be measured over time, but the early indicators are promising. Stay informed about Greg Abel's leadership of Berkshire Hathaway, research Berkshire Hathaway's investments, and continue to learn more about the future of Berkshire Hathaway under Greg Abel. This is a crucial time for one of the world's most influential companies.

Featured Posts

-

Investor Concerns About Stock Market Valuations Bof As Analysis

May 06, 2025

Investor Concerns About Stock Market Valuations Bof As Analysis

May 06, 2025 -

A Worthy Sequel Does It Live Up To The Originals Legacy

May 06, 2025

A Worthy Sequel Does It Live Up To The Originals Legacy

May 06, 2025 -

The Chris Pratt Patrick Schwarzenegger White Lotus Nude Scene Controversy

May 06, 2025

The Chris Pratt Patrick Schwarzenegger White Lotus Nude Scene Controversy

May 06, 2025 -

Gold Market Update Back To Back Weekly Declines For 2025

May 06, 2025

Gold Market Update Back To Back Weekly Declines For 2025

May 06, 2025 -

Princess Dianas Bold Met Gala Look A Risky Choice And A Secret Redesign

May 06, 2025

Princess Dianas Bold Met Gala Look A Risky Choice And A Secret Redesign

May 06, 2025

Latest Posts

-

Nba Playoffs 2024 Knicks Vs Celtics Game 1 Predictions And Picks

May 06, 2025

Nba Playoffs 2024 Knicks Vs Celtics Game 1 Predictions And Picks

May 06, 2025 -

Celtics Vs Suns April 4th Game Time Tv Schedule And Live Streaming Info

May 06, 2025

Celtics Vs Suns April 4th Game Time Tv Schedule And Live Streaming Info

May 06, 2025 -

Knicks Vs Celtics Game 1 Expert Predictions Best Bets And Analysis

May 06, 2025

Knicks Vs Celtics Game 1 Expert Predictions Best Bets And Analysis

May 06, 2025 -

Nba Playoffs Knicks Vs Celtics Game 1 Predictions And Betting Picks

May 06, 2025

Nba Playoffs Knicks Vs Celtics Game 1 Predictions And Betting Picks

May 06, 2025 -

Where To Watch The Celtics Vs Heat Game On February 10th Time And Channels

May 06, 2025

Where To Watch The Celtics Vs Heat Game On February 10th Time And Channels

May 06, 2025