How Climate Risk Impacts Your Mortgage Application

Table of Contents

Increased Flood Risk and Mortgage Applications

Many mortgage lenders now meticulously assess the flood risk associated with properties, significantly impacting your application. This evaluation often involves consulting flood maps and risk assessments to determine a property's vulnerability to flooding. Keywords: Flood risk, flood insurance, flood maps, FEMA, mortgage lenders, flood zones, property damage.

- Stricter Lending Criteria: Properties located in high-risk flood zones, as designated by the Federal Emergency Management Agency (FEMA), may face stricter lending criteria. This can translate to higher interest rates, larger down payments, or even outright rejection of your application.

- Flood Insurance is Crucial: Adequate flood insurance is no longer optional; it's often a mandatory requirement for mortgage approval in high-risk areas. The absence of flood insurance can be a deal-breaker, regardless of the property's apparent desirability.

- Understanding FEMA Flood Maps: FEMA flood maps provide crucial information about flood risk. Understanding your property's location within these zones is a critical first step in preparing your mortgage application. These maps are regularly updated, so it's essential to check the most recent version.

- Property Damage History: Lenders will often investigate a property's history of flood damage. Even past flood incidents, even if seemingly minor, could negatively impact your application.

Wildfire Risk and Its Influence on Mortgage Lending

The increasing frequency and intensity of wildfires present another significant climate risk impacting mortgage applications. Keywords: Wildfire risk, wildfire insurance, fire-prone areas, property protection, defensible space, home insurance rates.

- Increased Scrutiny in Fire-Prone Areas: Properties located in areas identified as high wildfire risk face heightened scrutiny during the mortgage application process. Lenders carefully evaluate factors such as proximity to wildlands, vegetation density, and local fire suppression capabilities.

- Wildfire-Specific Insurance: Similar to flood insurance, lenders may require wildfire-specific insurance policies as a condition of mortgage approval. These policies often come with higher premiums, impacting your overall affordability.

- Home Improvements for Fire Safety: Investing in fire-resistant building materials, creating defensible space around your property by removing flammable vegetation, and implementing other fire safety measures can significantly improve your application's chances of success. This proactive approach demonstrates your commitment to mitigating risk.

- Higher Home Insurance Rates: The cost of home insurance in fire-prone areas is considerably higher than in areas with lower wildfire risk, potentially influencing your ability to secure a mortgage.

Climate Change and the Long-Term Value of Your Property

Lenders are increasingly forward-looking, considering the long-term impact of climate change on property values. Keywords: Property value, climate change impact, sea-level rise, long-term investment, depreciation, sustainable home improvements.

- Sea-Level Rise and Coastal Properties: Properties vulnerable to sea-level rise face a significant risk of depreciation, impacting their long-term value and, consequently, your mortgage application. Lenders are incorporating sea-level rise projections into their risk assessments.

- Extreme Weather Events: The increased frequency and intensity of extreme weather events—hurricanes, droughts, heatwaves—pose significant threats to property value. Lenders are carefully evaluating a property's susceptibility to these events.

- Resource Scarcity: Factors like water scarcity and increased energy costs due to climate change are also considered. A property's reliance on vulnerable resources might negatively influence its perceived long-term value.

- Sustainable Home Improvements: Investing in sustainable home improvements, such as energy-efficient appliances or drought-resistant landscaping, can not only reduce your environmental footprint but also positively influence a lender's perception of your property's long-term value and resilience.

Understanding and Addressing Climate Risk in Your Application

Proactive engagement is key to navigating the challenges climate risk poses to your mortgage application. Keywords: Due diligence, risk mitigation, transparency, disclosure, proactive approach, environmental assessment.

- Due Diligence is Essential: Before applying for a mortgage, conduct thorough due diligence to assess your property's vulnerability to climate-related risks. Consult flood maps, wildfire risk assessments, and consider future climate projections.

- Transparency is Key: Disclose any known climate-related risks to your lender transparently. Open communication about potential challenges demonstrates responsibility and can build trust.

- Mitigation Strategies: Implement practical mitigation strategies where possible. This might involve upgrading your home's flood protection, creating defensible space around your property, or investing in energy-efficient upgrades.

- Professional Advice: Seek advice from qualified professionals—insurance brokers, environmental consultants—to accurately assess and address any climate-related concerns.

Conclusion

This article highlighted the significant impact of climate risk on your mortgage application. Understanding flood risk, wildfire risk, and the long-term implications of climate change on property value is crucial for successful mortgage approval. Lenders are increasingly incorporating climate risk assessments into their lending criteria. Don't let climate risk jeopardize your dream home. Proactively assess your property's climate vulnerability and take steps to mitigate potential risks before applying for a mortgage. Understanding how climate risk impacts your mortgage application will significantly improve your chances of approval.

Featured Posts

-

Mick Schumacher Nueva Vida Amorosa Tras Su Separacion

May 20, 2025

Mick Schumacher Nueva Vida Amorosa Tras Su Separacion

May 20, 2025 -

Settlement Reached Nj Transit Averts Further Service Disruptions

May 20, 2025

Settlement Reached Nj Transit Averts Further Service Disruptions

May 20, 2025 -

Diskalifikasyon Felaketi Ferrari Hamilton Ve Leclerc I Kaybediyor

May 20, 2025

Diskalifikasyon Felaketi Ferrari Hamilton Ve Leclerc I Kaybediyor

May 20, 2025 -

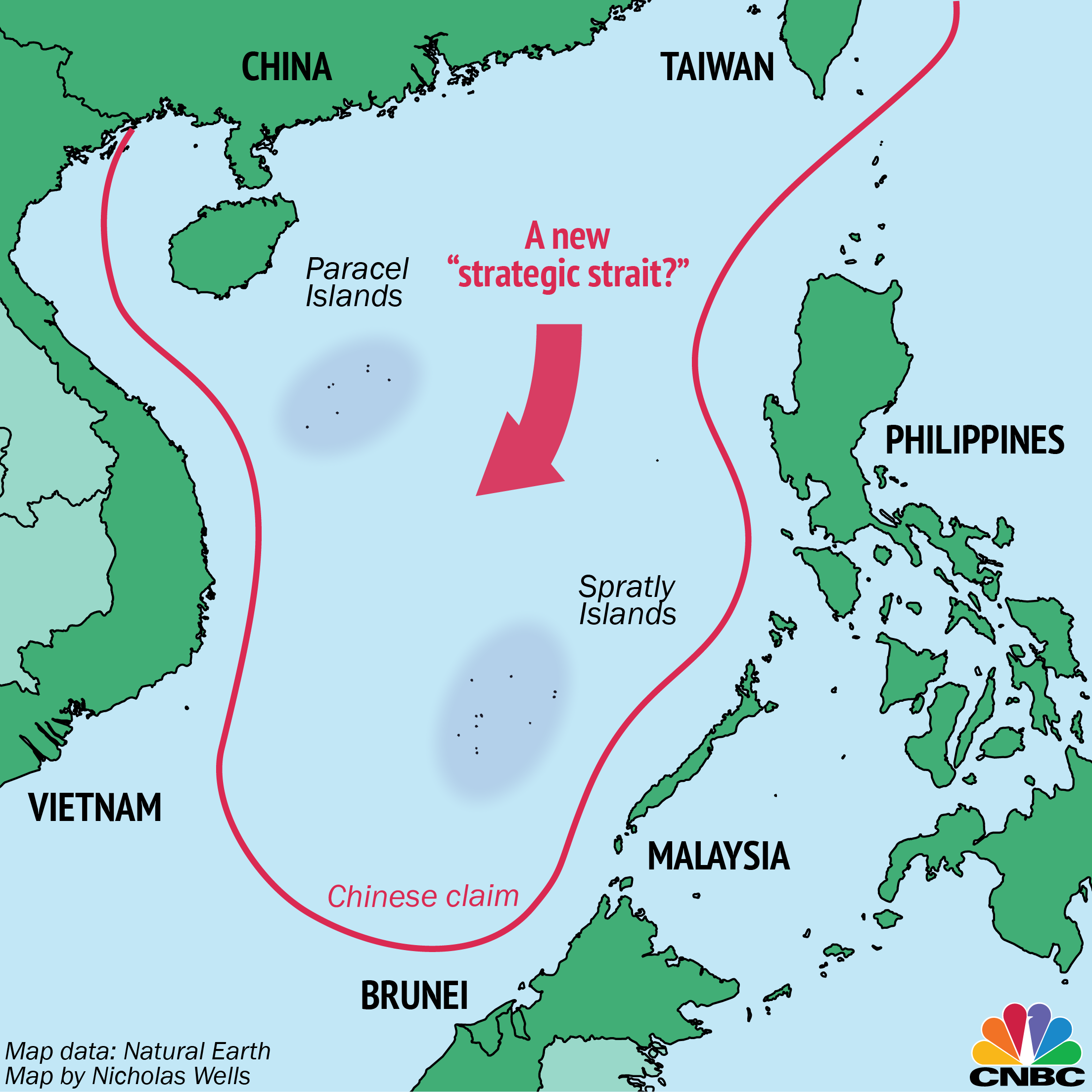

Chinas South China Sea Strategy Targeting Philippines Missile System

May 20, 2025

Chinas South China Sea Strategy Targeting Philippines Missile System

May 20, 2025 -

Jutarnji List Tko Je Sve Bio Na Premijeri Redatelji Glumci I Voditelji

May 20, 2025

Jutarnji List Tko Je Sve Bio Na Premijeri Redatelji Glumci I Voditelji

May 20, 2025

Latest Posts

-

Understanding The Recent D Wave Quantum Qbts Stock Price Jump

May 20, 2025

Understanding The Recent D Wave Quantum Qbts Stock Price Jump

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Surge Reasons Behind Todays Jump

May 20, 2025

D Wave Quantum Inc Qbts Stock Surge Reasons Behind Todays Jump

May 20, 2025 -

D Wave Quantum Qbts Stock Soars Analyzing The Weeks Price Increase

May 20, 2025

D Wave Quantum Qbts Stock Soars Analyzing The Weeks Price Increase

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Surge Reasons Behind The Recent Rise

May 20, 2025

D Wave Quantum Inc Qbts Stock Surge Reasons Behind The Recent Rise

May 20, 2025 -

Understanding The 2025 Market Downturn For D Wave Quantum Inc Qbts

May 20, 2025

Understanding The 2025 Market Downturn For D Wave Quantum Inc Qbts

May 20, 2025