How To Interpret The Net Asset Value Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the underlying value of an ETF's assets per share. It's a crucial metric for understanding the intrinsic worth of your investment. Unlike the market price, which fluctuates throughout the trading day based on supply and demand, the NAV reflects the actual value of the ETF's holdings. Think of it as the net asset value per share. This is different from the market price you see quoted, which can be higher or lower depending on market forces.

- NAV is calculated daily, usually at the end of the trading day, providing a snapshot of the ETF's value at that point in time.

- It reflects the total value of the ETF's holdings (in this case, the stocks that make up the Dow Jones Industrial Average) minus any liabilities (like management fees), divided by the number of outstanding shares.

- NAV provides a measure of the intrinsic value of the ETF, offering a more stable benchmark than the fluctuating market price. This is particularly important for asset-backed investments such as ETFs.

How is the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Calculated?

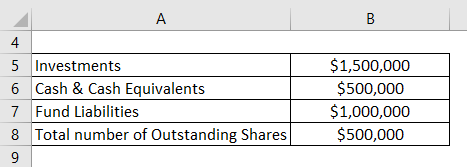

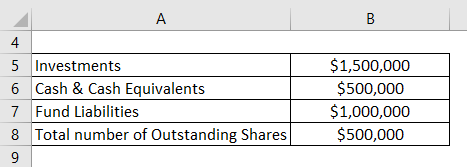

The Amundi Dow Jones Industrial Average UCITS ETF's NAV calculation is straightforward. Since it's designed to track the Dow Jones Industrial Average, its NAV closely mirrors the index's performance. The calculation process involves valuing the ETF’s underlying assets.

- The ETF mirrors the composition of the Dow Jones Industrial Average, meaning it holds a proportionate share of each of the 30 constituent companies.

- The daily closing prices of these 30 constituent stocks are used in the calculation. Each stock's market capitalization within the index is considered.

- Any expenses or liabilities, such as management fees and other operational costs, are deducted from the total asset value before calculating the NAV.

- The resulting figure (total asset value minus liabilities) is then divided by the total number of outstanding ETF shares to arrive at the NAV per share. This fund value is then used to quote the ETF's NAV per share.

Interpreting the NAV and its Relationship to Market Price.

While the NAV provides a measure of the ETF's intrinsic value, the market price reflects the price at which the ETF is currently trading. These two values are often close, but discrepancies can occur.

- The market price can fluctuate throughout the trading day due to supply and demand, while the NAV is calculated once daily, usually at the close of the market.

- Small discrepancies between NAV and market price are common and generally reflect the bid-ask spread (the difference between the highest buying price and the lowest selling price).

- Significant deviations might indicate market inefficiencies or investor sentiment, potentially representing an opportunity or a risk depending on the direction of the deviation (premium or discount).

- Understanding this relationship is vital for making informed trading decisions. For example, buying when the market price trades at a discount to the NAV might offer a potentially better entry point.

Using NAV to Track ETF Performance

Tracking the NAV of the Amundi Dow Jones Industrial Average UCITS ETF over time allows you to monitor its performance effectively.

- Track NAV changes over time to assess the growth of your investment and compare it to your expectations.

- Compare NAV performance to the performance of the underlying Dow Jones Industrial Average. This helps determine how effectively the ETF is tracking its benchmark index. A high tracking error indicates potential underperformance.

- Use the information to evaluate the ETF manager's performance in terms of minimizing tracking error. A well-managed ETF will show NAV closely aligned with the index's movement.

- This data informs long-term investment decisions, enabling you to evaluate the efficacy of your investment strategy and make adjustments as needed.

Conclusion:

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is essential for making informed investment decisions. By understanding how the NAV is calculated and its relationship to the market price, investors can effectively track the ETF's performance, assess the fund manager's effectiveness, and make strategic buy and sell decisions. Mastering the interpretation of the Net Asset Value is crucial for successful investment in the Amundi Dow Jones Industrial Average UCITS ETF. Stay informed and make the most of your investment strategy!

Featured Posts

-

Apple Stock Slumps On 900 Million Tariff Projection

May 24, 2025

Apple Stock Slumps On 900 Million Tariff Projection

May 24, 2025 -

Net Asset Value Nav Changes In Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025

Net Asset Value Nav Changes In Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025 -

Borsa Europa Attenzione Fed Piazza Affari In Attesa

May 24, 2025

Borsa Europa Attenzione Fed Piazza Affari In Attesa

May 24, 2025 -

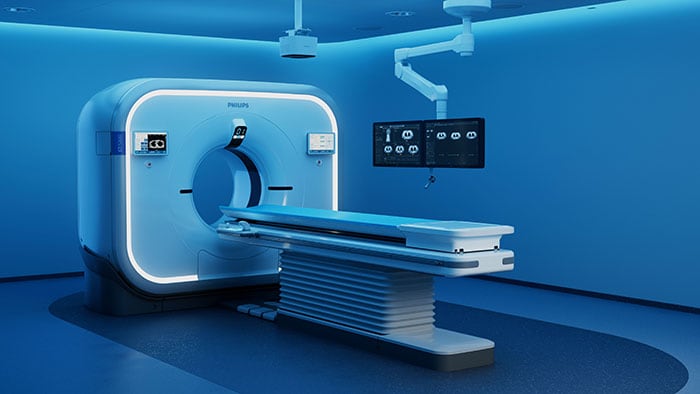

Ai In Healthcare Key Findings From The Philips Future Health Index 2025

May 24, 2025

Ai In Healthcare Key Findings From The Philips Future Health Index 2025

May 24, 2025 -

M62 Resurfacing Westbound Closure Between Manchester And Warrington

May 24, 2025

M62 Resurfacing Westbound Closure Between Manchester And Warrington

May 24, 2025

Latest Posts

-

Past Florida Film Festival Guests Mia Farrow Christina Ricci And Other Notable Stars

May 24, 2025

Past Florida Film Festival Guests Mia Farrow Christina Ricci And Other Notable Stars

May 24, 2025 -

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025 -

Florida Film Festival Celebrity Sightings Mia Farrow Christina Ricci And More

May 24, 2025

Florida Film Festival Celebrity Sightings Mia Farrow Christina Ricci And More

May 24, 2025 -

Sadie Sink And Mia Farrow A Broadway Encounter Image 5162787

May 24, 2025

Sadie Sink And Mia Farrow A Broadway Encounter Image 5162787

May 24, 2025 -

Mia Farrow And Christina Ricci At The Florida Film Festival

May 24, 2025

Mia Farrow And Christina Ricci At The Florida Film Festival

May 24, 2025