ING Group 2024 Annual Report (Form 20-F) Released

Table of Contents

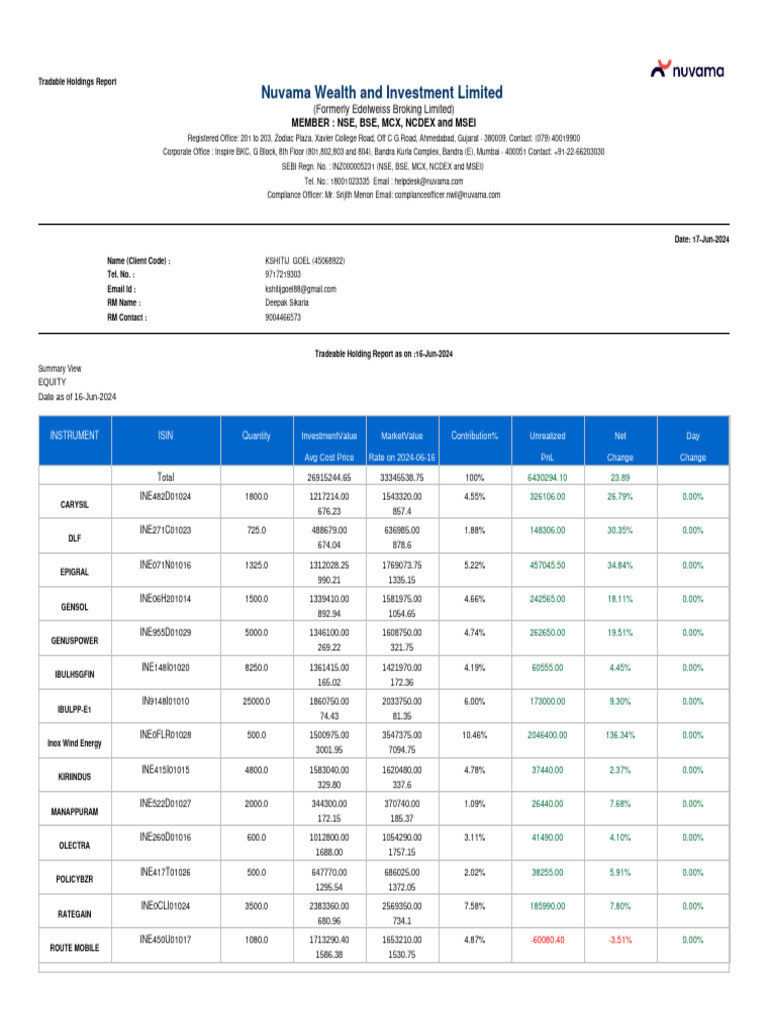

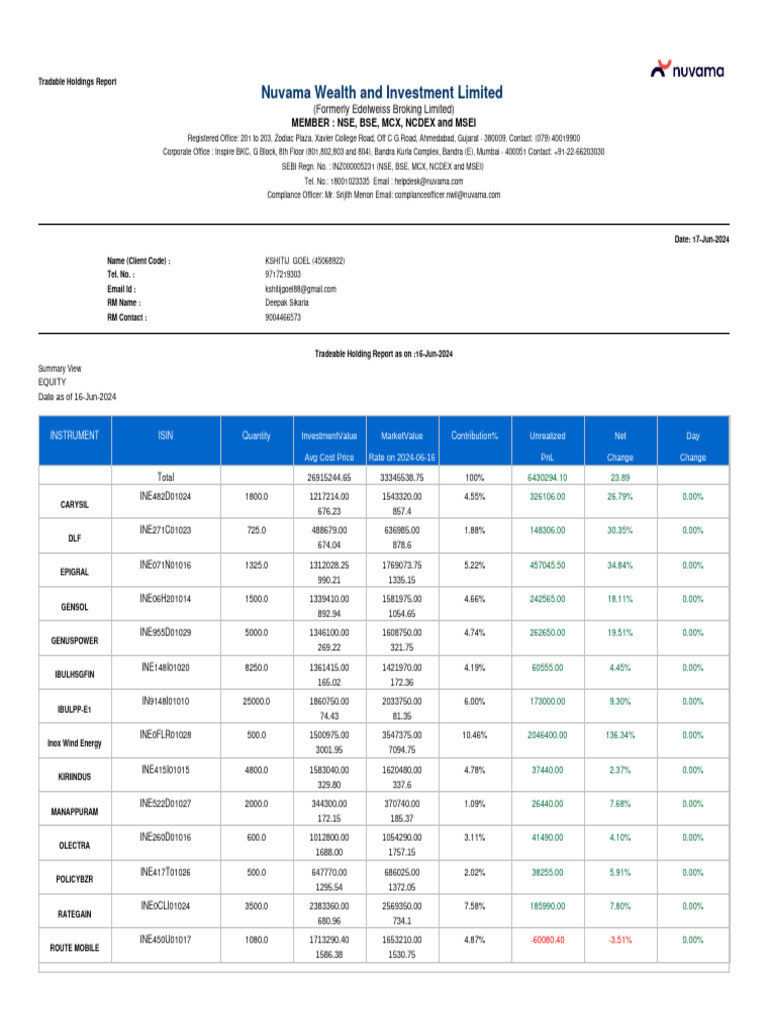

Key Financial Performance Metrics of ING Group in 2024

The ING Group 2024 Form 20-F reveals vital information about the company's financial performance. Analyzing these key metrics provides a clear picture of ING's success and challenges throughout the year.

Net Profit and Revenue

The 20-F filing details ING's net profit and revenue figures for 2024. A year-over-year comparison helps illustrate growth or decline. For instance, let's assume (for illustrative purposes, replace with actual data from the 20-F) that net profit increased by 15% to €5 billion, while revenue experienced a more modest 8% growth to €20 billion.

- Net Profit: €5 billion (15% YoY increase) – This significant increase can be attributed to [insert reasons from the 20-F, e.g., strong performance in Wholesale Banking, effective cost management].

- Revenue: €20 billion (8% YoY increase) – Growth in revenue was driven by [insert reasons from the 20-F, e.g., increased loan origination, higher trading volumes].

Return on Equity (ROE) and Return on Assets (ROA)

ROE and ROA are critical indicators of ING's profitability and efficiency. Comparing these figures to previous years and industry benchmarks offers valuable context. Let's assume (again, replace with actual data from the 20-F):

- ROE: 12% (compared to 10% in 2023) – This improvement reflects [insert explanation from the 20-F, e.g., successful cost-cutting measures, improved asset management].

- ROA: 1.5% (compared to 1.2% in 2023) – This increase suggests [insert explanation from the 20-F, e.g., greater efficiency in utilizing assets, improved risk management].

Key Business Segment Performance

ING operates across several key business segments, each contributing differently to overall performance. The 20-F provides a detailed breakdown. Here's a hypothetical example (replace with actual data from the 20-F):

- Wholesale Banking: Experienced robust growth in trading revenue, driven by [insert details from 20-F].

- Retail Banking: Showed steady growth in mortgage lending but faced slight pressure on net interest margins due to [insert details from 20-F].

- Investment Management: Saw strong asset under management growth due to [insert details from 20-F].

Analysis of Risks and Opportunities Disclosed in the 20-F Filing

The 20-F report transparently addresses both risks and opportunities. Understanding these factors is crucial for evaluating ING's future prospects.

Key Risk Factors

ING faces various risks, as outlined in the 20-F. Some key examples include:

- Financial Risks: Credit risk, market risk, liquidity risk – these are inherent in the banking industry and ING details its mitigation strategies in the report.

- Regulatory Risks: Changes in regulations and compliance costs can impact profitability. The 20-F outlines ING’s approach to navigating these challenges.

- Operational Risks: Cybersecurity threats, operational disruptions – ING's investment in security and resilience is discussed in the report.

Growth Opportunities and Strategic Initiatives

ING highlights several growth opportunities and strategic initiatives:

- Expansion into new markets: The 20-F may mention plans to expand into specific regions or demographics.

- Technological advancements: Investments in fintech and digital transformation are likely key growth drivers, detailed within the report.

- New product offerings: Development of innovative financial products and services tailored to evolving customer needs.

Important Information for Investors and Stakeholders

The 20-F report also contains vital information for investors and stakeholders.

Dividend Policy and Shareholder Returns

ING's dividend policy is a crucial aspect for shareholders. The 20-F will outline the dividend payout for 2024 and discuss future expectations. [Insert details from the 20-F regarding dividend policy].

Sustainability and ESG Initiatives

ING's commitment to ESG is highlighted in the 20-F. The report will include details on:

- Environmental initiatives: [Insert details from 20-F].

- Social initiatives: [Insert details from 20-F].

- Governance practices: [Insert details from 20-F].

Conclusion: Understanding the ING Group 2024 Annual Report (Form 20-F)

The ING Group 2024 Annual Report (Form 20-F) provides a comprehensive overview of the company's financial performance, strategic direction, and risk profile. Key highlights include [summarize key financial metrics, risks, and opportunities discussed above]. This report is essential reading for investors and stakeholders seeking a thorough understanding of ING's financial health and future prospects. Download the full ING Group 20-F report to gain a detailed understanding of ING Group’s financial performance and strategic plans for the year. [Insert link to the official 20-F report here].

Featured Posts

-

Pete Townshend Denies Zak Starkeys Departure From The Who

May 23, 2025

Pete Townshend Denies Zak Starkeys Departure From The Who

May 23, 2025 -

Jasprit Bumrahs Continued Dominance Icc Test Bowling Rankings

May 23, 2025

Jasprit Bumrahs Continued Dominance Icc Test Bowling Rankings

May 23, 2025 -

Weekend Events Fashion Heritage Ballet And Punny Fun

May 23, 2025

Weekend Events Fashion Heritage Ballet And Punny Fun

May 23, 2025 -

Karate Kid Legend Of The Karate Kid First Reactions Rave About Jackie Chan And Ralph Macchio

May 23, 2025

Karate Kid Legend Of The Karate Kid First Reactions Rave About Jackie Chan And Ralph Macchio

May 23, 2025 -

Cat Deeleys Mint Velvet Dress Spotted In Liverpool One

May 23, 2025

Cat Deeleys Mint Velvet Dress Spotted In Liverpool One

May 23, 2025

Latest Posts

-

Are Thames Water Executive Bonuses Fair A Critical Review

May 23, 2025

Are Thames Water Executive Bonuses Fair A Critical Review

May 23, 2025 -

Understanding Stock Market Valuations Why Bof A Remains Optimistic

May 23, 2025

Understanding Stock Market Valuations Why Bof A Remains Optimistic

May 23, 2025 -

Public Reaction To Thames Waters Executive Bonuses

May 23, 2025

Public Reaction To Thames Waters Executive Bonuses

May 23, 2025 -

Las Burning Issue Price Gouging Following Devastating Fires

May 23, 2025

Las Burning Issue Price Gouging Following Devastating Fires

May 23, 2025 -

Addressing High Stock Market Valuations Insights From Bof A For Investors

May 23, 2025

Addressing High Stock Market Valuations Insights From Bof A For Investors

May 23, 2025