Investing In Amundi MSCI World II UCITS ETF USD Hedged Dist: A NAV Perspective

Table of Contents

What is Net Asset Value (NAV) and Why is it Important for ETF Investors?

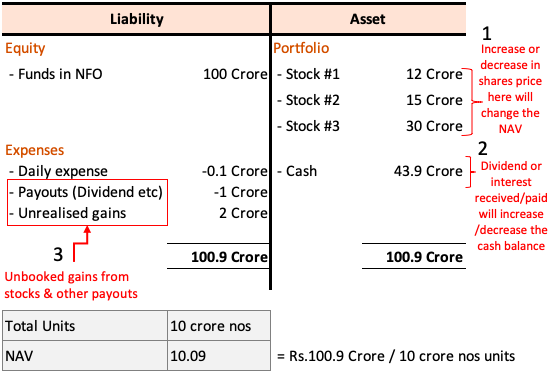

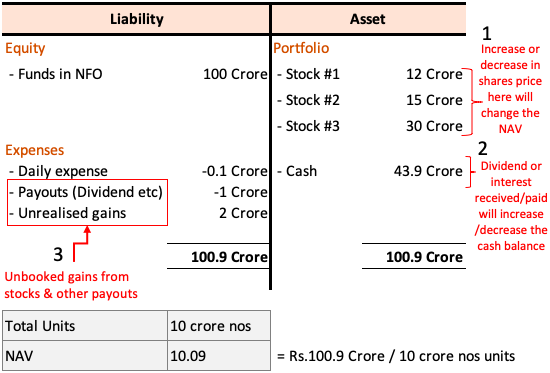

Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, the NAV is calculated daily by taking the total market value of all the securities held in the ETF's portfolio, adding any cash reserves, subtracting liabilities (including expenses), and then dividing by the total number of outstanding shares.

NAV is a critical metric for several reasons:

- Daily Fluctuations and NAV: Daily changes in the market value of the underlying assets directly impact the ETF's NAV. Monitoring these fluctuations provides insights into the ETF's short-term performance.

- Arbitrage Opportunities: Comparing the ETF's market price to its NAV can reveal potential arbitrage opportunities. If the market price deviates significantly from the NAV, savvy investors can profit from these discrepancies.

- Long-Term Growth Tracking: Tracking the NAV over time allows investors to assess the long-term growth of their investment and compare it against benchmarks like the MSCI World Index.

- Dividend Distributions: The NAV reflects the impact of dividend distributions from the underlying securities. Understanding NAV helps investors track the cumulative effect of these payouts on their investment.

Analyzing the Amundi MSCI World II UCITS ETF USD Hedged Dist's NAV Performance

Analyzing the historical NAV performance of the Amundi MSCI World II UCITS ETF USD Hedged Dist is crucial for understanding its investment potential. (Insert a graph or chart here showing NAV trends over a period of time, e.g., 1-year, 5-year. Clearly label the axes and include a title like "Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Performance.")

This visual representation allows us to identify periods of growth and decline. For example, [mention a specific period of strong performance and its possible causes – e.g., strong global economic growth] and [mention a period of weaker performance and its likely reasons – e.g., global market correction due to rising interest rates]. Comparing this performance to the MSCI World Index helps gauge the effectiveness of the ETF's strategy and the impact of the USD hedge.

The USD hedge is a significant feature. Currency fluctuations between the Euro (the ETF's base currency) and the US dollar directly influence the NAV, expressed in USD. A strong dollar can negatively impact the NAV for USD-based investors, while a weak dollar can have the opposite effect. The advantage of a USD hedge is mitigating this currency risk for investors whose primary currency is the US dollar. However, a poorly performing USD hedge can also negatively impact returns compared to an unhedged version of the same ETF.

Factors Influencing the Amundi MSCI World II UCITS ETF USD Hedged Dist's NAV

Several factors influence the Amundi MSCI World II UCITS ETF USD Hedged Dist's NAV:

- Macroeconomic Factors: Global economic growth, interest rate changes, and geopolitical events significantly affect the performance of the underlying assets and, therefore, the NAV. For instance, a global recession would likely negatively impact the NAV.

- MSCI World Index Sector Weights: The ETF tracks the MSCI World Index, which comprises various sectors (Technology, Financials, Healthcare, etc.). The relative performance of these sectors influences the overall NAV. A strong performance in the Technology sector, for example, would likely boost the NAV.

- Expense Ratios: The ETF's expense ratio, which covers management and operational costs, gradually impacts the NAV growth. Higher expense ratios result in lower NAV growth over time, all else being equal.

Comparing the Amundi MSCI World II UCITS ETF USD Hedged Dist to Alternatives

To make informed investment decisions, comparing the Amundi MSCI World II UCITS ETF USD Hedged Dist to similar ETFs is essential. This includes comparing ETFs that track the MSCI World Index, both with and without USD hedging. Key factors to consider during the comparison include:

- NAV Performance: Analyze the historical NAV performance of comparable ETFs.

- Expense Ratios: Compare the expense ratios to identify cost-effective options.

- Investment Strategies: Understand the nuances of different investment strategies and their impact on NAV.

Conclusion: Making Informed Decisions with Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Data

Understanding the Net Asset Value (NAV) is paramount for making informed investment decisions regarding the Amundi MSCI World II UCITS ETF USD Hedged Dist. By analyzing its historical NAV performance, understanding the factors influencing its NAV, and comparing it to alternatives, investors can better assess the ETF's risk and return profile. Remember, consistent monitoring of the NAV, coupled with an understanding of market trends and economic factors, is crucial for long-term success in ETF investing. Before investing in the Amundi MSCI World II UCITS ETF USD Hedged Dist, conduct your own thorough NAV analysis to evaluate its long-term growth potential.

Featured Posts

-

Revealed Kyle Walkers Milan Party With Models Following Wifes Return To Uk

May 24, 2025

Revealed Kyle Walkers Milan Party With Models Following Wifes Return To Uk

May 24, 2025 -

The Ultimate Escape To The Country Homes Land And Lifestyle

May 24, 2025

The Ultimate Escape To The Country Homes Land And Lifestyle

May 24, 2025 -

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025 -

Frankfurt Stock Market Update Dax Climbs Nears Record High

May 24, 2025

Frankfurt Stock Market Update Dax Climbs Nears Record High

May 24, 2025 -

Tracking The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Tracking The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Latest Posts

-

How To Monitor The Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Distribution

May 24, 2025

How To Monitor The Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Distribution

May 24, 2025 -

Understanding And Interpreting The Net Asset Value Nav For Amundis Dow Jones Industrial Average Ucits Etf

May 24, 2025

Understanding And Interpreting The Net Asset Value Nav For Amundis Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

The Long Wait By The Phone

May 24, 2025

The Long Wait By The Phone

May 24, 2025 -

Amundi Djia Ucits Etf Daily Nav Updates And Analysis

May 24, 2025

Amundi Djia Ucits Etf Daily Nav Updates And Analysis

May 24, 2025 -

Analyzing The Net Asset Value Nav For The Amundi Djia Ucits Etf Distribution

May 24, 2025

Analyzing The Net Asset Value Nav For The Amundi Djia Ucits Etf Distribution

May 24, 2025