Analyzing The Net Asset Value (NAV) For The Amundi DJIA UCITS ETF Distribution

Table of Contents

2.1 What is Net Asset Value (NAV) and How is it Calculated?

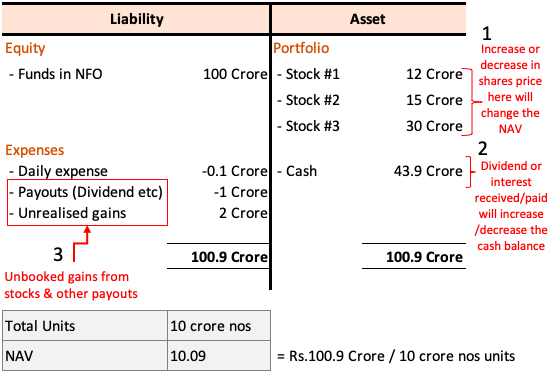

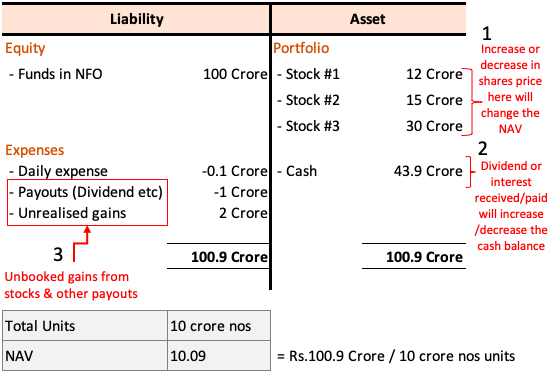

Net Asset Value (NAV) represents the underlying value of an ETF's assets per share. Simply put, it's the total value of all the assets held by the ETF, minus its liabilities, divided by the number of outstanding shares. For the Amundi DJIA UCITS ETF, understanding its NAV is key to gauging its performance relative to the DJIA.

The calculation involves these key components:

- Market Value of Underlying Assets: This is the total value of all the stocks that make up the DJIA within the ETF's portfolio, valued at their current market prices. Because this ETF tracks the DJIA, its asset value directly reflects the performance of the index's 30 constituent companies.

- Liabilities: This includes expenses such as management fees, administrative costs, and any other outstanding debts associated with the ETF's operation.

- Number of Outstanding Shares: This is the total number of Amundi DJIA UCITS ETF shares currently held by investors.

The formula is straightforward: NAV = (Total Asset Value - Liabilities) / Number of Outstanding Shares. The NAV fluctuates daily, mirroring the market performance of the DJIA components. A rising DJIA generally leads to a higher Amundi DJIA UCITS ETF NAV, and vice-versa. This daily ETF NAV calculation provides a clear picture of the fund's intrinsic worth.

2.2 Factors Affecting the NAV of the Amundi DJIA UCITS ETF

Several factors influence the NAV of the Amundi DJIA UCITS ETF:

- Performance of the Dow Jones Industrial Average (DJIA) Index: The most significant factor is the performance of the DJIA itself. Positive market movements in the DJIA's constituent companies directly increase the ETF's NAV. Conversely, negative market trends lead to a decrease.

- Currency Fluctuations: If the ETF invests in companies with exposure to multiple currencies, fluctuations in exchange rates can impact the NAV. For instance, a strengthening US dollar against the Euro could affect the NAV if the ETF holds Euro-denominated assets.

- Dividend Distributions: When the underlying companies in the DJIA pay dividends, the ETF receives these dividends, which generally increase the NAV. However, the actual impact on NAV depends on the dividend amount and the number of outstanding shares.

- Management Fees and Other Expenses: These fees are deducted from the ETF's assets, impacting the NAV. Higher expenses reduce the overall NAV available for distribution among shareholders.

Understanding these Amundi DJIA UCITS ETF factors is vital for interpreting NAV changes and making informed investment decisions.

2.3 Analyzing NAV Trends and Identifying Investment Opportunities

Analyzing historical Amundi DJIA UCITS ETF NAV data reveals valuable trends and patterns. Visualizing this data using charts and graphs simplifies the identification of upward or downward trends. Comparing the NAV to the ETF's market price helps determine whether it's trading at a premium or discount.

- Trend Analysis: Examine long-term and short-term NAV trends to identify periods of growth or decline.

- Price Comparison: Compare the NAV with the ETF's market price. A premium indicates the market price is higher than the NAV, while a discount signifies the opposite.

- Investment Strategies: Use this analysis to inform your investment strategy. A "buy low, sell high" approach involves purchasing the ETF when its market price is below the NAV (a discount) and selling when it trades at a premium.

Effective NAV analysis enhances your ability to capitalize on market fluctuations.

2.4 Accessing and Interpreting Amundi DJIA UCITS ETF NAV Data

Accessing real-time and historical Amundi DJIA UCITS ETF NAV data is straightforward:

- Amundi's Official Website: The official Amundi website is a primary source for accurate and up-to-date NAV information.

- Financial Data Providers: Reputable financial data providers such as Bloomberg, Yahoo Finance, and Google Finance also offer real-time NAV and historical NAV data for the Amundi DJIA UCITS ETF.

Interpreting this data involves understanding the time stamps and any accompanying information provided, including dividend payouts, expense ratios, and currency conversions. Consistent monitoring of this data helps you make well-informed investment decisions.

3. Conclusion: Mastering NAV Analysis for the Amundi DJIA UCITS ETF

Regular analysis of the Amundi DJIA UCITS ETF NAV is critical for successful investing. By understanding the calculation of NAV, the factors affecting it, and how to interpret historical data, you can make more informed decisions about buying, selling, or holding this ETF. Mastering NAV analysis allows you to better understand the fund's performance relative to the market and potentially capitalize on market inefficiencies. Continue to monitor the Amundi DJIA UCITS ETF NAV, use the strategies outlined above, and consider supplementing your research with other resources to refine your Amundi DJIA UCITS ETF investment strategy. Understanding NAV is key to successful ETF investment – start analyzing today!

Featured Posts

-

Analysis Demna Gvasalias Impact On Guccis Design

May 24, 2025

Analysis Demna Gvasalias Impact On Guccis Design

May 24, 2025 -

She Still Waiting By The Phone A Personal Account

May 24, 2025

She Still Waiting By The Phone A Personal Account

May 24, 2025 -

Ferrarin Uusi Kyky 13 Vuotias Kuljettaja Liittyy Tiimiin

May 24, 2025

Ferrarin Uusi Kyky 13 Vuotias Kuljettaja Liittyy Tiimiin

May 24, 2025 -

Top 10 Fastest Standard Production Ferraris On Their Home Track

May 24, 2025

Top 10 Fastest Standard Production Ferraris On Their Home Track

May 24, 2025 -

8 Stock Market Rally On Euronext Amsterdam Impact Of Trumps Tariff Pause

May 24, 2025

8 Stock Market Rally On Euronext Amsterdam Impact Of Trumps Tariff Pause

May 24, 2025

Latest Posts

-

Buffetts Apple Holdings A Post Trump Tariff Analysis

May 24, 2025

Buffetts Apple Holdings A Post Trump Tariff Analysis

May 24, 2025 -

Apples Resilience Withstanding The Impact Of Tariffs

May 24, 2025

Apples Resilience Withstanding The Impact Of Tariffs

May 24, 2025 -

Analyzing Apples Performance Under Trumps Tariffs

May 24, 2025

Analyzing Apples Performance Under Trumps Tariffs

May 24, 2025 -

The Future Of Apple Navigating Trump Tariff Impacts

May 24, 2025

The Future Of Apple Navigating Trump Tariff Impacts

May 24, 2025 -

Is Apple Stock Headed To 254 Analyst Prediction And Buying Opportunities

May 24, 2025

Is Apple Stock Headed To 254 Analyst Prediction And Buying Opportunities

May 24, 2025