Investing In Uber's Autonomous Future: A Guide To Relevant ETFs

Table of Contents

Understanding Uber's Autonomous Vehicle Strategy

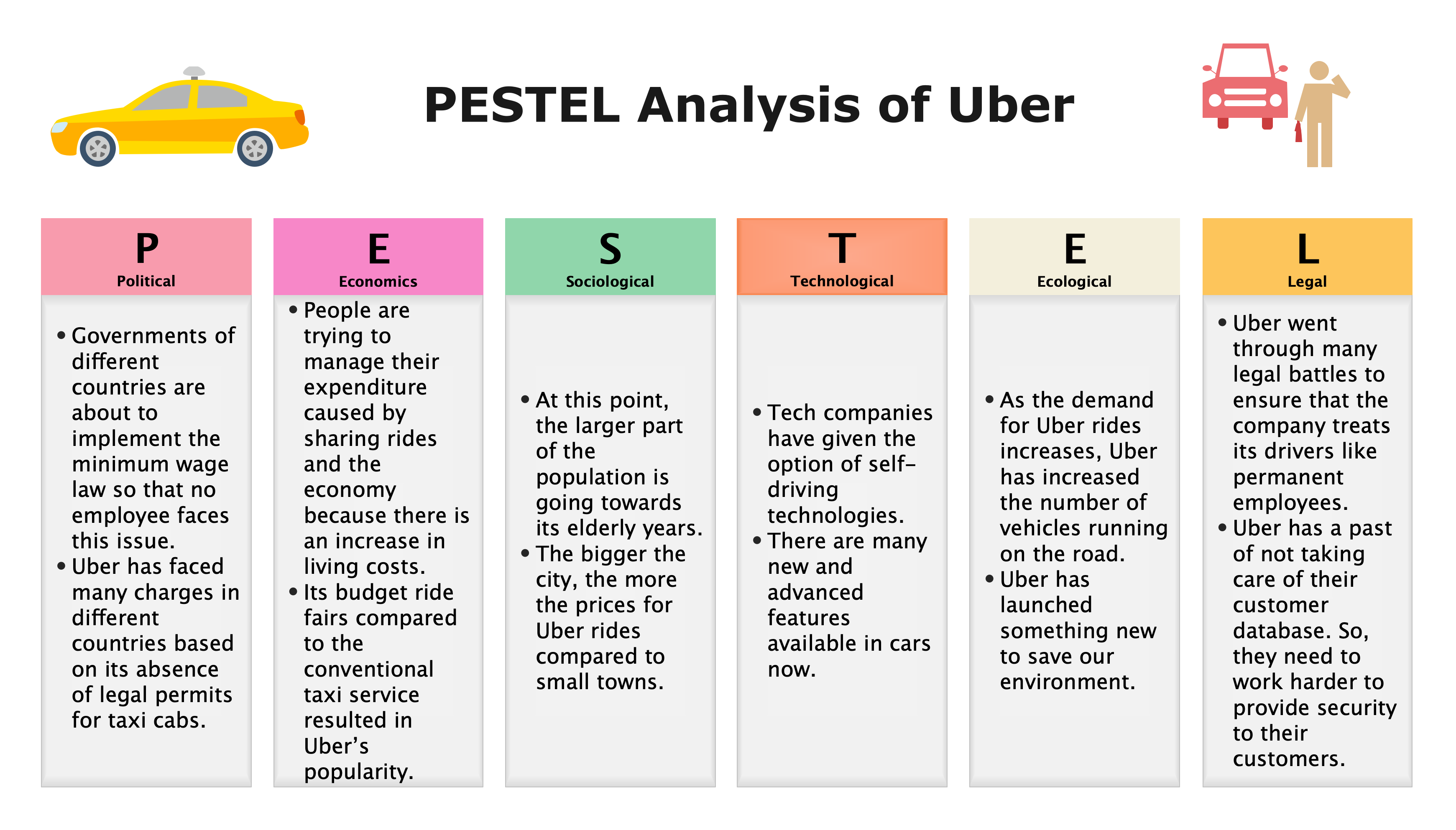

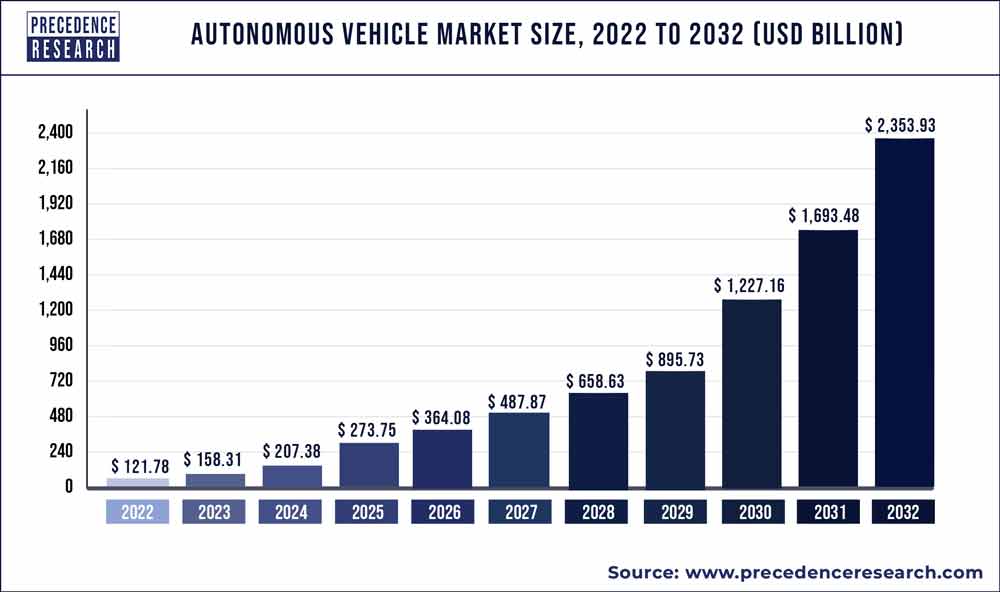

Uber's ambition in the autonomous vehicle (AV) market is substantial. They aim to revolutionize transportation through the deployment of self-driving vehicles, potentially impacting ride-sharing, delivery services, and logistics on a global scale. This strategy involves significant investment in research and development, strategic partnerships, and acquisitions of promising AV technology companies.

However, the path to autonomous driving dominance is fraught with challenges. Competition is fierce, with established automakers and tech giants vying for market share. Regulatory hurdles vary widely across different jurisdictions, creating uncertainty and potentially delaying deployment.

- Uber ATG (Advanced Technologies Group): Uber's dedicated division for developing self-driving technology, responsible for significant progress in areas like sensor technology, mapping, and AI-powered driving algorithms.

- Key Technological Milestones: Uber ATG has achieved significant milestones in autonomous driving, including millions of miles of autonomous test driving and continuous improvements in its self-driving system's safety and performance.

- Competition: Companies like Waymo, Cruise (GM), Tesla, and even Apple pose significant competition to Uber's autonomous vehicle ambitions.

- Regulatory Hurdles: The regulatory landscape for autonomous vehicles is still evolving, with varying regulations across different states and countries. This uncertainty presents both challenges and opportunities.

Identifying Relevant ETFs for Exposure to Autonomous Vehicle Technology

Exchange-Traded Funds (ETFs) offer a diversified and efficient way to gain exposure to the autonomous vehicle market. Unlike investing directly in a single company, ETFs provide a basket of stocks, reducing individual stock risk. Several ETF types can offer indirect exposure to Uber's autonomous vehicle efforts and the broader AV industry:

- Technology ETFs: These ETFs often hold shares of technology companies involved in developing the software, sensors, and computing power necessary for autonomous vehicles.

- Transportation ETFs: These funds may include companies involved in the manufacturing, logistics, and infrastructure related to autonomous vehicles.

- Robotics ETFs: Robotics is a crucial element of autonomous driving, and ETFs focused on this sector provide exposure to companies developing relevant technologies.

Let's consider some hypothetical examples (Note: Specific ETF holdings and performance data change constantly. Always conduct independent research before investing):

- ETF Name & Ticker Symbol: InnovateTech ETF (INNOV)

- Top holdings related to autonomous driving technology: Nvidia (NVDA), Mobileye (MBLY), Aptiv (APTV)

- Expense Ratio: 0.45%

- Investment Strategy: Growth

- Potential risks and benefits: High growth potential, but also higher volatility.

- ETF Name & Ticker Symbol: GlobalAutoTech ETF (AUTOT)

- Top holdings related to autonomous driving technology: Tesla (TSLA), Ford (F), Bosch (BOSCH)

- Expense Ratio: 0.35%

- Investment Strategy: Blend of Growth and Value

- Potential risks and benefits: More diversified than INNOV, but potentially lower growth.

Analyzing ETF Performance and Risk Factors

Analyzing ETF performance is crucial before investing. While past performance isn't indicative of future results, it provides insight into an ETF's historical volatility and returns. Key performance indicators (KPIs) to consider include:

- Past Performance: Examine the ETF's historical returns over various time periods (e.g., 3-year, 5-year).

- Volatility: Measure the ETF's price fluctuations using metrics like standard deviation. Higher volatility indicates greater risk.

- Diversification: Assess the ETF's holdings for diversification across different companies and sectors.

- Regulatory Risk: Changes in regulations can significantly impact the autonomous vehicle industry.

- Technological Risk: Technological advancements are rapid, and companies may fail to keep up with the competition.

- Market Risk: Broader market downturns can affect the performance of even the most promising ETFs.

Diversification Strategies for Minimizing Risk

Diversification is essential to mitigate investment risk. Instead of concentrating investments in a single ETF, consider a diversified portfolio approach:

- Combining ETFs: Combine ETFs focused on autonomous driving technology with broader market ETFs (e.g., S&P 500 index funds) to balance risk and reward.

- Sector Diversification: Invest in different sectors within the autonomous driving ecosystem, such as sensor technology, mapping, software development, and infrastructure.

- Geographical Diversification: Consider ETFs with exposure to companies operating in various countries to reduce geographic risk.

Conclusion

Investing in Uber's autonomous future through ETFs offers considerable potential returns but also carries inherent risks. By understanding Uber's AV strategy, carefully selecting relevant ETFs, analyzing their performance, and implementing a diversified portfolio, investors can navigate this exciting sector effectively. Remember to conduct thorough research, understand your risk tolerance, and consult a financial advisor before making any investment decisions. Start Investing in Uber's Autonomous Future today by exploring the ETFs discussed and conducting further research into other suitable options. Don't miss the opportunity to participate in this transformative technological revolution!

Featured Posts

-

Presiden Macron Palestina Dan Dinamika Politik Timur Tengah Terbaru

May 18, 2025

Presiden Macron Palestina Dan Dinamika Politik Timur Tengah Terbaru

May 18, 2025 -

60 000 Square Foot Pickleball Center Coming To Brooklyn City Pickles New Complex

May 18, 2025

60 000 Square Foot Pickleball Center Coming To Brooklyn City Pickles New Complex

May 18, 2025 -

Red Sox Closers Free Agency The Untold Story

May 18, 2025

Red Sox Closers Free Agency The Untold Story

May 18, 2025 -

Should Investors Worry About Elevated Stock Market Valuations Bof As View

May 18, 2025

Should Investors Worry About Elevated Stock Market Valuations Bof As View

May 18, 2025 -

Home Renovation Stress Finding Solutions With A House Therapist

May 18, 2025

Home Renovation Stress Finding Solutions With A House Therapist

May 18, 2025

Latest Posts

-

Pet Friendly Uber Rides Now Available In Delhi And Mumbai A Heads Up For Tails Partnership

May 19, 2025

Pet Friendly Uber Rides Now Available In Delhi And Mumbai A Heads Up For Tails Partnership

May 19, 2025 -

Understanding Ubers April Stock Performance A Detailed Analysis

May 19, 2025

Understanding Ubers April Stock Performance A Detailed Analysis

May 19, 2025 -

Why Did Uber Stock Jump Over 10 In April A Deep Dive

May 19, 2025

Why Did Uber Stock Jump Over 10 In April A Deep Dive

May 19, 2025 -

Investing In Ubers Autonomous Vehicle Future Etf Opportunities

May 19, 2025

Investing In Ubers Autonomous Vehicle Future Etf Opportunities

May 19, 2025 -

Foodpanda Taiwan Acquisition Blocked Uber Cites Regulatory Problems

May 19, 2025

Foodpanda Taiwan Acquisition Blocked Uber Cites Regulatory Problems

May 19, 2025