Is $3.40 The Next Target For Ripple (XRP)? Analysis And Prediction

Table of Contents

Current Market Conditions and XRP's Performance

The current cryptocurrency market is exhibiting a degree of volatility. While exhibiting periods of bullish momentum, overarching bearish sentiment remains a significant factor affecting many digital assets, including XRP. Analyzing recent XRP price action reveals key support and resistance levels. Technical indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), offer additional insights into potential price trends.

- Current XRP Price: (Insert current XRP price at the time of publishing)

- Recent Highs and Lows: (Insert data on recent price peaks and troughs)

- Trading Volume Analysis: (Analyze trading volume trends, highlighting periods of high and low activity and correlating them to price movements)

- Market Capitalization Changes: (Discuss changes in XRP's market capitalization and its implications for price.)

Analyzing these data points provides a crucial base for assessing the potential for XRP to reach $3.40.

Factors Influencing XRP Price

Several key factors significantly influence XRP's price:

Regulatory Landscape

The ongoing legal battle between Ripple and the Securities and Exchange Commission (SEC) casts a long shadow over XRP's price. A favorable ruling could trigger a significant price surge, while an unfavorable outcome might lead to further declines.

- SEC Lawsuit Status: (Summarize the current status of the lawsuit and potential outcomes.)

- Regulatory Uncertainty: (Discuss the impact of regulatory uncertainty on investor sentiment and XRP price.)

- Global Regulatory Trends: (Mention any global regulatory developments impacting cryptocurrencies that could influence XRP.)

Adoption and Partnerships

The increasing adoption of XRP in payment and remittance systems is a positive factor. Partnerships with financial institutions and businesses could significantly boost XRP's utility and, consequently, its price.

- Key Partnerships: (List notable partnerships and collaborations involving Ripple and XRP.)

- Adoption Rate: (Discuss the growth rate of XRP adoption in different regions and sectors.)

- On-Chain Activity: (Analyze on-chain metrics such as transaction volume and network usage to gauge real-world adoption.)

Technological Developments

Upgrades and improvements to the XRP Ledger, such as enhanced scalability and security features, can attract more users and developers, leading to increased demand and potentially higher prices.

- XRP Ledger Upgrades: (Mention any recent or planned upgrades to the XRP Ledger.)

- Technological Advantages: (Highlight any technological advantages that XRP offers over other cryptocurrencies.)

- Developer Activity: (Discuss the level of developer activity on the XRP Ledger, indicating community support and growth.)

Macroeconomic Factors

Broader economic conditions, such as inflation rates and interest rate policies, can significantly influence cryptocurrency markets. A bearish economic outlook might lead to reduced investment in risky assets, including XRP, while a bullish outlook could attract more investors.

- Inflationary Pressures: (Discuss the influence of inflation on investor sentiment towards cryptocurrencies.)

- Interest Rate Hikes: (Analyze how interest rate changes might impact the cryptocurrency market and XRP specifically.)

- Global Economic Outlook: (Summarize the global economic outlook and its potential effects on the price of XRP.)

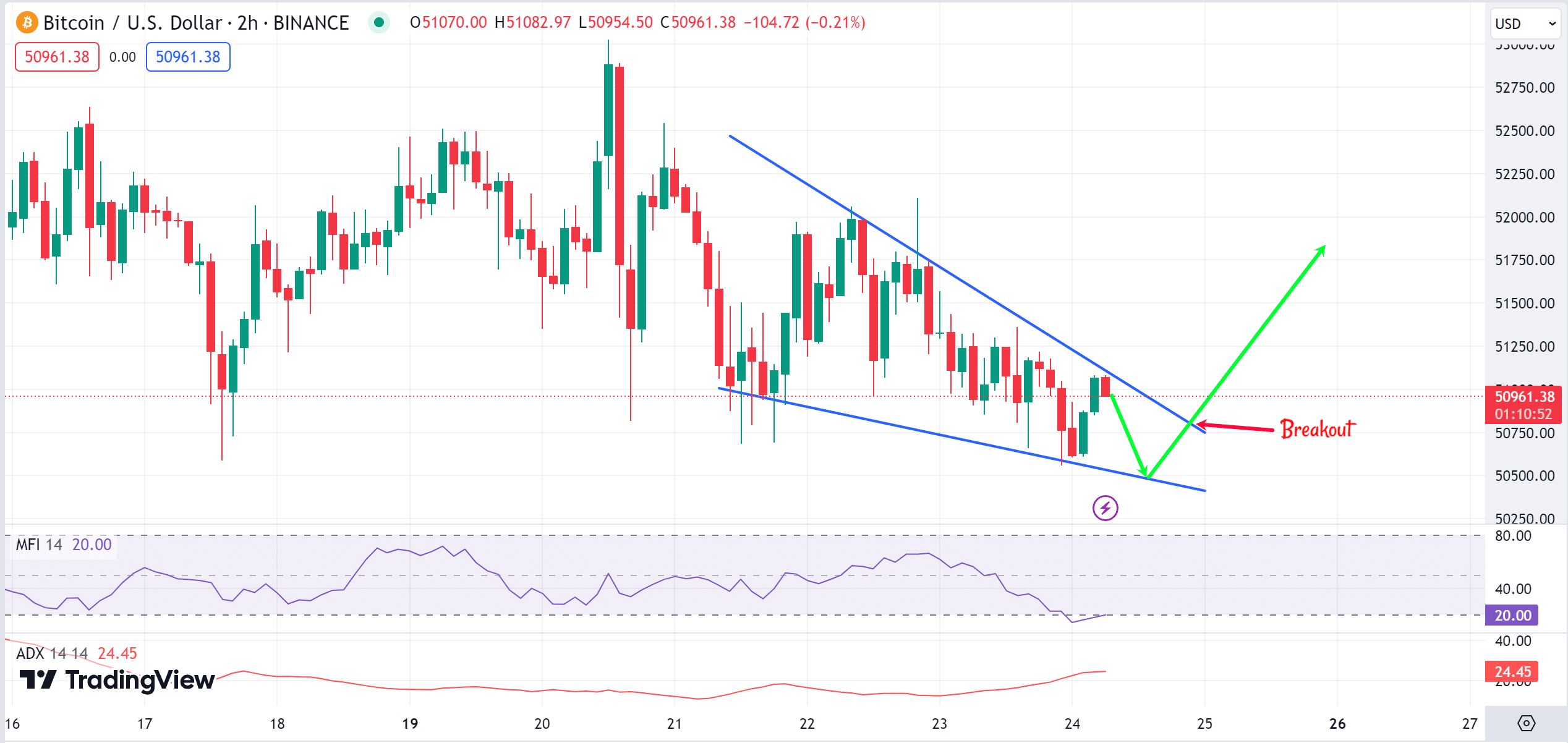

Predictive Modeling and Analysis

Predicting the price of XRP with certainty is impossible. This analysis utilizes a combination of technical and fundamental analysis to create a predictive model. This model considers the factors discussed above, assigning weights based on their perceived influence. The model suggests a probability of XRP reaching $3.40 within (specify timeframe), but this is not a guarantee.

(Include a chart or graph visually representing the prediction model and its assumptions)

Potential hurdles include the ongoing SEC lawsuit, overall market volatility, and unforeseen technological challenges.

Alternative Scenarios and Risk Assessment

Several alternative scenarios exist:

- Best-Case Scenario: A favorable SEC ruling, coupled with increased adoption and positive macroeconomic factors, could drive XRP significantly higher than $3.40.

- Worst-Case Scenario: An unfavorable SEC ruling, combined with decreased adoption and negative market sentiment, could result in XRP falling below its current price.

Investing in XRP involves significant risk. Risk mitigation strategies include diversifying your portfolio, conducting thorough research, and only investing what you can afford to lose.

Conclusion: Is $3.40 a Realistic Target for XRP? Final Thoughts and Next Steps

Based on our analysis, reaching $3.40 for XRP is plausible, but not guaranteed. The outcome hinges heavily on the SEC lawsuit, adoption rates, technological advancements, and broader macroeconomic conditions. While our predictive model suggests a certain probability, remember that cryptocurrency markets are notoriously volatile.

Investing in cryptocurrencies, including XRP, involves significant risk. This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own thorough research and consider seeking advice from a qualified financial advisor before making any investment decisions. Stay updated on the latest news and developments concerning Ripple (XRP) and its potential to reach $3.40 or other price targets. Continue your research into Ripple price prediction and XRP price analysis to make informed investment decisions. Remember to monitor the $3.40 XRP target and adjust your strategies accordingly.

Featured Posts

-

Trump Appointees Bold Bitcoin Prediction After Market Surge

May 08, 2025

Trump Appointees Bold Bitcoin Prediction After Market Surge

May 08, 2025 -

Celtics Nets Game Jayson Tatums Availability And Injury News

May 08, 2025

Celtics Nets Game Jayson Tatums Availability And Injury News

May 08, 2025 -

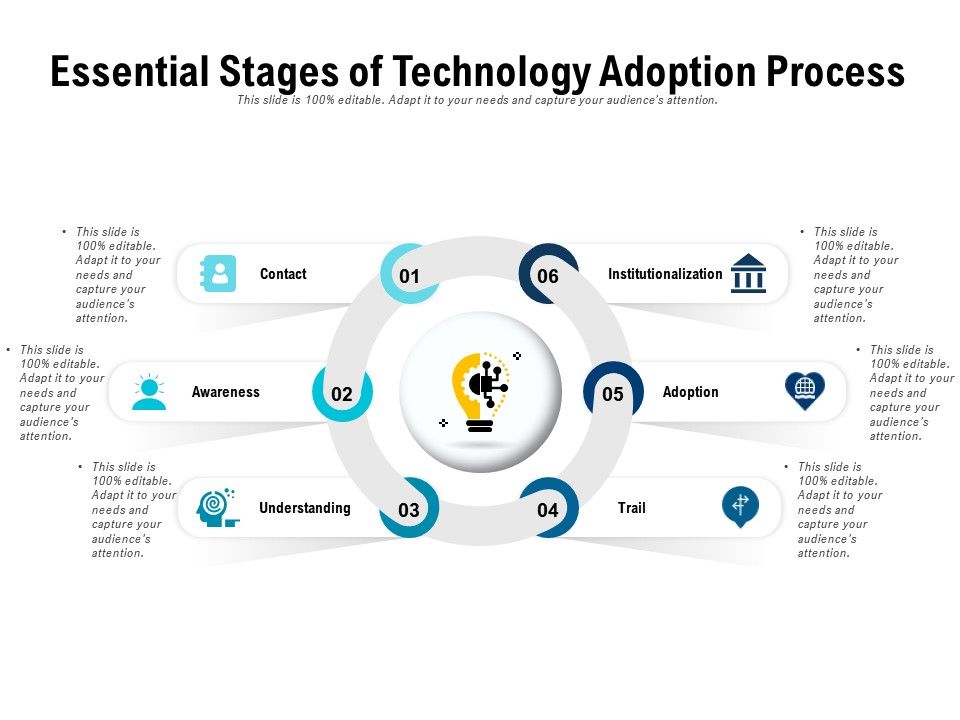

Technology Adoption Ahsans Plan To Strengthen Made In Pakistan Exports

May 08, 2025

Technology Adoption Ahsans Plan To Strengthen Made In Pakistan Exports

May 08, 2025 -

The Ripple Effect Evaluating Xrp As A Long Term Investment Strategy

May 08, 2025

The Ripple Effect Evaluating Xrp As A Long Term Investment Strategy

May 08, 2025 -

Microsoft Surface Pro 12 Everything You Need To Know

May 08, 2025

Microsoft Surface Pro 12 Everything You Need To Know

May 08, 2025