Is Uber Stock Undervalued Given Its Robotaxi Ambitions?

Table of Contents

Uber's Current Financial Performance and Market Position

Understanding Uber's current financial health is critical to evaluating its stock. Analyzing recent financial reports reveals key insights into its revenue growth, profitability, and overall market position within the competitive ride-sharing landscape.

-

Revenue and Profitability: Examining Uber's revenue streams, including ride-hailing, Uber Eats, and freight, is crucial. Profitability, or the lack thereof, needs careful consideration. Are they showing consistent growth, and is this growth sustainable? Looking at key financial metrics such as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and net income offers a clearer picture.

-

Market Share and Competition: Uber's market share in ride-sharing needs to be compared against competitors like Lyft and regional players. A shrinking market share could signal weakening competitive advantages. The intensity of competition and the pricing strategies employed by these rivals significantly impact Uber's profitability and overall financial health.

-

Operational Costs: Fluctuating fuel prices and driver costs are major factors impacting Uber's bottom line. Understanding how effectively Uber manages these costs is crucial in assessing the sustainability of its business model. Rising fuel prices, for instance, can directly squeeze profit margins if not effectively offset.

-

Overall Business Health: Assessing the overall stability and health of Uber's core ride-sharing business is paramount. Are there signs of significant operational challenges or vulnerabilities? A strong, stable core business will provide a more solid foundation for its robotaxi ambitions.

The Potential of Uber's Robotaxi Technology

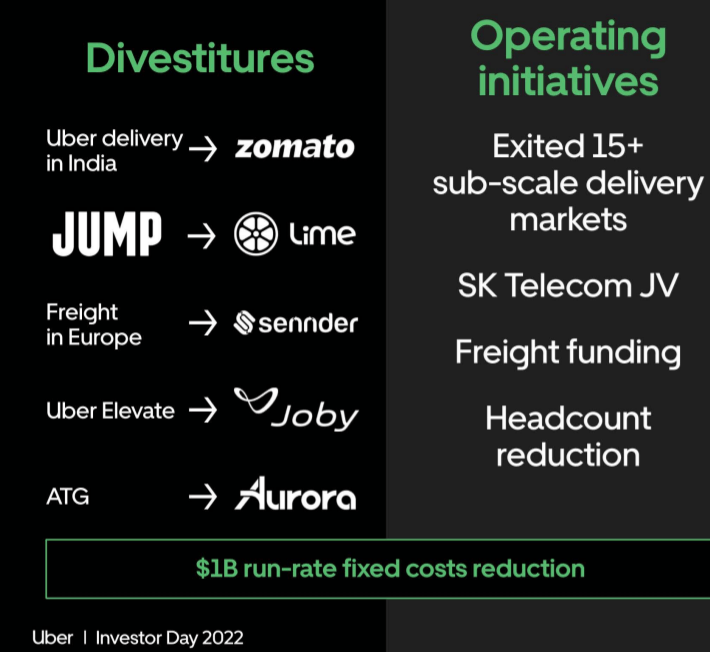

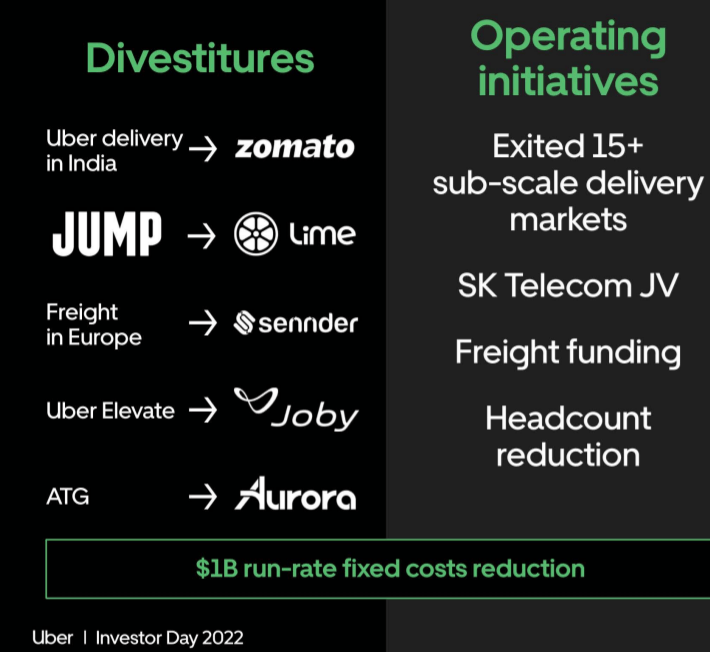

Uber's foray into autonomous vehicles, primarily through its Advanced Technologies Group (ATG), represents a potentially transformative element for the company's future. The success or failure of this venture significantly impacts the valuation of Uber stock.

-

ATG Progress and Investment: Assessing Uber's investment in ATG, its technological progress, and the milestones achieved provides crucial insight into the feasibility of its robotaxi plans. Are they on track to meet their projected timelines? What are the key challenges they are facing?

-

Cost Savings and Efficiency: The potential cost savings associated with autonomous driving are enormous, primarily through the reduction of labor costs, a significant expense in the ride-sharing model. This cost reduction has the potential to significantly boost profitability.

-

Scalability and Market Size: Robotaxis offer the potential for significant scalability and efficiency gains. However, realizing this potential depends on successful technological development and regulatory approvals. Analyzing the potential market size for robotaxis in various regions is crucial to estimating the long-term revenue potential.

-

Regulatory and Technological Hurdles: The deployment of autonomous vehicles faces significant regulatory hurdles and technological challenges. Autonomous driving technology is complex and requires careful consideration of safety, security, and ethical implications. Regulatory approvals may vary across different jurisdictions, adding another layer of complexity.

Valuation and Investment Considerations

Analyzing Uber's valuation requires a comprehensive approach considering both its current financial performance and the potential future impact of its robotaxi program.

-

Stock Price and Valuation Metrics: Uber's current stock price and key valuation metrics, such as the price-to-earnings ratio (P/E ratio) and market capitalization, provide a starting point for assessing its value. However, these metrics alone do not provide a complete picture.

-

Valuation Models: Using various valuation models, like discounted cash flow (DCF) analysis, is necessary to incorporate future growth projections, particularly concerning the potential contribution of robotaxis. These models allow for a more nuanced valuation incorporating the uncertainty surrounding future earnings.

-

Risk Assessment: Investing in Uber stock involves significant risk. The risk profile needs to consider both the stability of the existing ride-sharing business and the uncertain future prospects of the robotaxi technology. Technological challenges, regulatory delays, and competitive pressures are all substantial risk factors.

-

Competitor Comparison: Comparing Uber's valuation to competitors in the transportation and technology sectors provides valuable context. How does Uber's valuation stack up against its peers, considering their growth prospects and market positions?

-

Impact of Robotaxi Deployment: The successful deployment of robotaxis could dramatically increase future earnings and, subsequently, the stock price. However, failure to deliver on this ambitious goal could have severely negative consequences.

Analyzing the Long-Term Growth Potential

The long-term growth potential of Uber is intrinsically linked to the success of its robotaxi program and its ability to navigate the evolving landscape of the transportation industry.

-

Leadership in Autonomous Vehicles: Uber aims to become a leader in the autonomous vehicle market. Assessing its potential to achieve this ambition requires careful consideration of its technological capabilities, competitive landscape, and regulatory environment.

-

Long-Term Growth of Robotaxis: The long-term growth prospects of the robotaxi industry are substantial, offering potentially disruptive changes to transportation. Understanding the growth trajectory of this sector is essential for assessing Uber’s potential.

-

Strategic Partnerships and Acquisitions: Strategic partnerships and acquisitions can accelerate Uber's progress in the autonomous vehicle space. Analyzing its ability to forge such collaborations is key.

Conclusion

This analysis of Uber's financial performance, its autonomous vehicle technology progress, and associated valuation metrics suggests that the true valuation of Uber stock remains uncertain. The significant potential of robotaxis presents both substantial risk and potentially high reward for investors. While its core ride-sharing business provides a stable foundation, the long-term success hinges largely on the successful implementation of its robotaxi program.

Call to Action: Further research into Uber's financial disclosures and technological advancements is crucial before making any investment decisions. Thoroughly investigate whether Uber stock is truly undervalued based on your own assessment of its robotaxi ambitions and broader market position. Remember to conduct your own due diligence before investing in any stock, including Uber.

Featured Posts

-

Xrp On The Verge Of A Parabolic Run 3 Important Indicators

May 08, 2025

Xrp On The Verge Of A Parabolic Run 3 Important Indicators

May 08, 2025 -

Jayson Tatums Respect For Steph Curry All Star Game Insights

May 08, 2025

Jayson Tatums Respect For Steph Curry All Star Game Insights

May 08, 2025 -

Double Trouble In Hollywood Writers And Actors Strike Brings Industry To Standstill

May 08, 2025

Double Trouble In Hollywood Writers And Actors Strike Brings Industry To Standstill

May 08, 2025 -

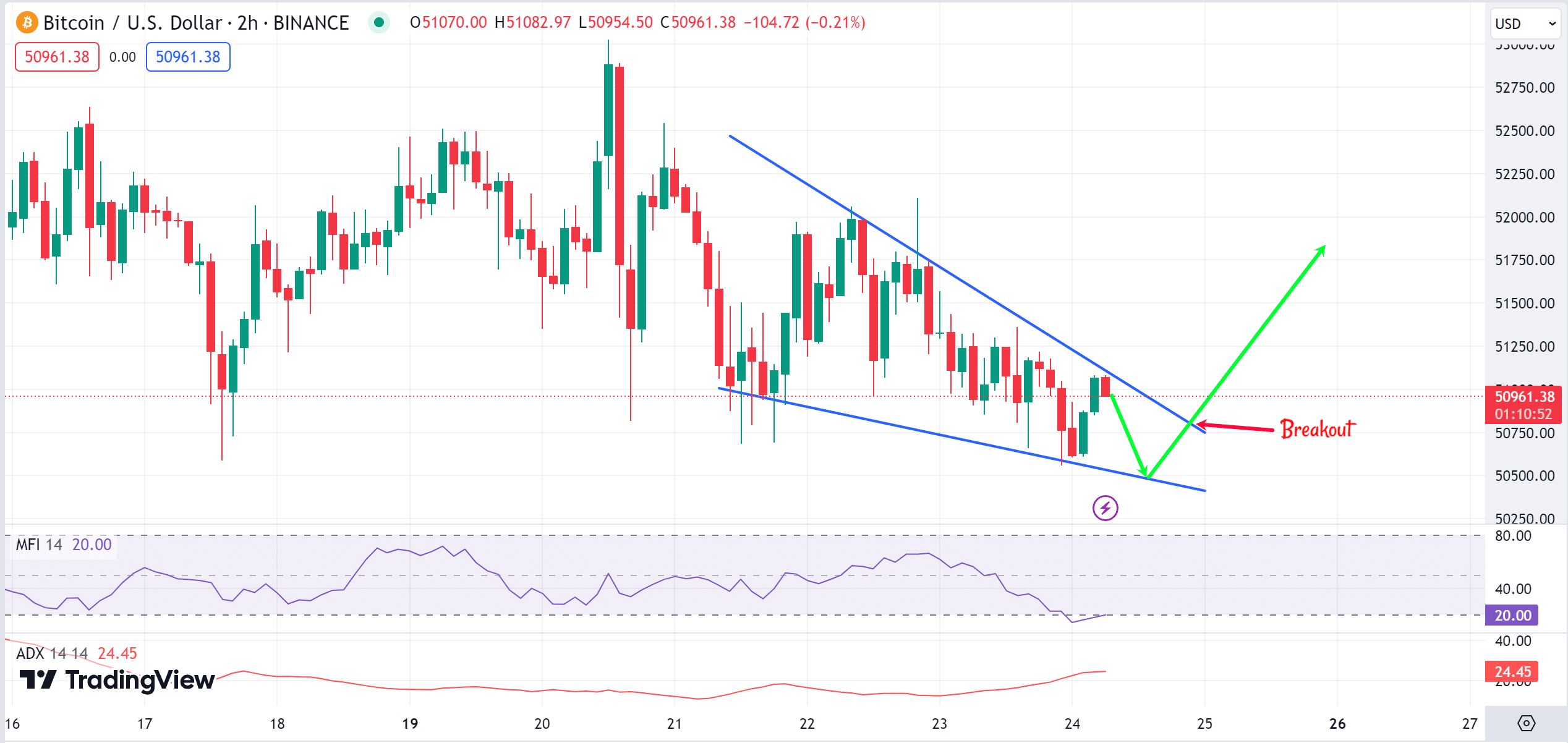

Binance Bitcoin Trading Buyers Dominate After Six Month Slump

May 08, 2025

Binance Bitcoin Trading Buyers Dominate After Six Month Slump

May 08, 2025 -

Trump Appointees Bold Bitcoin Prediction After Market Surge

May 08, 2025

Trump Appointees Bold Bitcoin Prediction After Market Surge

May 08, 2025