Is XRP Ready To Explode? 3 Factors Pointing To A Parabolic Move

Table of Contents

1. Favorable Regulatory Developments

The regulatory landscape significantly impacts XRP's price. Two key areas warrant close attention: the ongoing SEC lawsuit and the evolving global regulatory environment for cryptocurrencies.

H3: Securities and Exchange Commission (SEC) Lawsuit Update

The Ripple SEC lawsuit has cast a long shadow over XRP. However, recent developments hint at a potentially favorable outcome for Ripple. The ongoing legal battle centers around whether XRP is a security. A positive resolution could dramatically boost XRP's price.

- Recent court filings show Ripple presenting strong arguments against the SEC's classification of XRP as a security.

- Expert legal analyses suggest a growing likelihood of Ripple winning at least some aspects of the case, leading to regulatory clarity.

- Potential scenarios include a partial or complete dismissal of the SEC's case, which could trigger a significant price surge. This could lead to increased "Ripple win" headlines and dramatically affect XRP's price trajectory.

H3: Global Regulatory Landscape for Crypto

While the US regulatory environment remains complex, other jurisdictions are embracing cryptocurrencies more openly. This global adoption could significantly benefit XRP.

- Countries like Singapore and Switzerland have established clear regulatory frameworks for crypto, providing a more welcoming environment for XRP and similar assets.

- Regions with strong crypto adoption like the EU and parts of Asia could see increased XRP usage, especially if regulatory uncertainty in the US subsides. This increased "global crypto adoption" could benefit XRP's price.

- Ripple's proactive approach to regulatory compliance positions XRP favorably compared to other cryptocurrencies facing similar challenges. This "XRP regulatory compliance" focus is vital in the current environment.

2. Increasing Adoption and Utility

Beyond regulatory developments, the increasing adoption and utility of XRP are driving factors that could fuel a parabolic price increase.

H3: Growing Institutional Interest

More and more financial institutions and payment providers are recognizing XRP's potential.

- Partnerships with major payment processors allow for faster and cheaper cross-border transactions using XRP's "on-demand liquidity" solution. These "XRP partnerships" demonstrate real-world adoption.

- Growing use of XRP in real-world applications shows that it's not just a speculative asset, but a tool with increasing utility.

- Increasing institutional investment demonstrates growing confidence in XRP's long-term potential. This "institutional investor" interest suggests a strong foundation for future growth.

H3: Technological Advancements

The XRP Ledger (XRPL) continues to evolve, improving its performance and scalability.

- Upgrades to the XRPL enhance transaction speeds and reduce fees, making it more competitive against other blockchain networks.

- Improved security features build trust and confidence in the platform, attracting new users and developers. These "XRPL upgrades" are pivotal for XRP's long-term success.

- Enhanced scalability allows for a larger number of transactions to be processed efficiently, crucial for handling increased demand. This improved "transaction speed" and increased "scalability" are essential factors.

3. Technical Analysis Suggests a Breakout

Technical analysis suggests that XRP may be poised for a significant move.

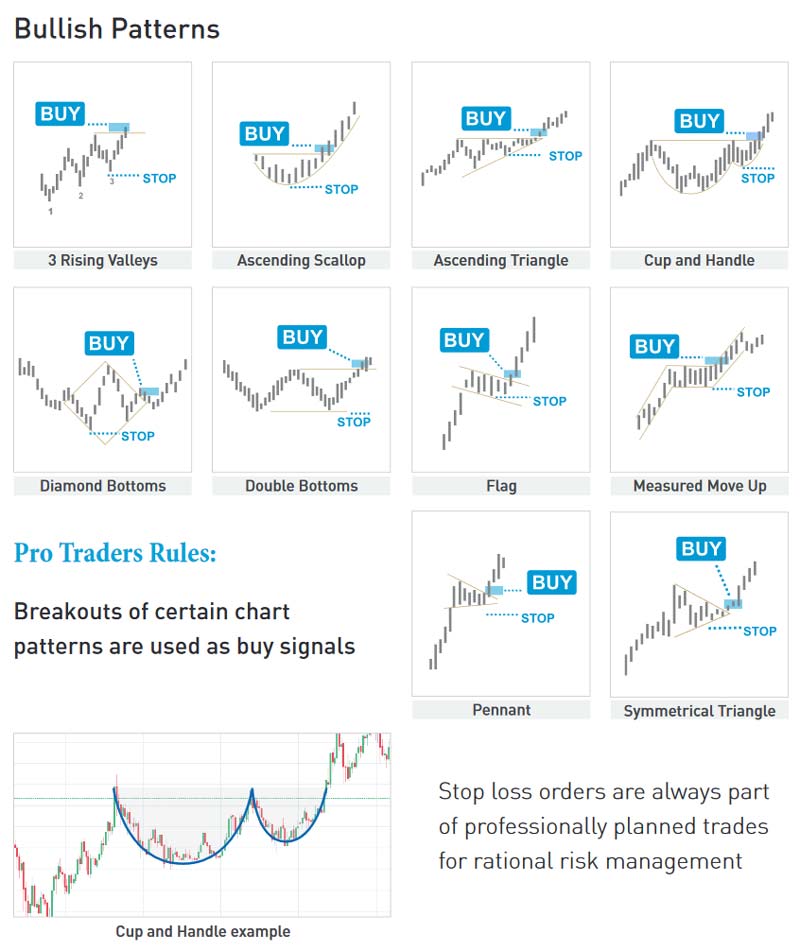

H3: Chart Patterns and Indicators

While we avoid definitive price predictions, certain patterns on the XRP chart are noteworthy.

- Specific chart patterns, such as a potential cup and handle formation, could indicate a bullish breakout. This "XRP technical analysis" suggests a potential upward trend.

- Support and resistance levels offer insight into potential price targets. Tracking "support levels" and "resistance levels" helps to interpret market sentiment.

- Technical indicators like RSI and MACD might signal an imminent upward movement. Identifying "bullish signals" is crucial for technical analysis.

H3: On-Chain Metrics

Positive on-chain metrics further support the possibility of a price increase.

- Increasing transaction volume indicates growing usage and network activity.

- Higher network activity suggests greater engagement with the XRP ecosystem. This "XRP on-chain analysis," showing increased "transaction volume" and "network activity," points towards a healthy and growing network.

3. Conclusion

Is XRP ready to explode? Based on favorable regulatory developments, increasing adoption and utility, and positive technical indicators, the potential for significant XRP price growth is certainly compelling. While no one can predict the future with certainty, the confluence of these factors suggests a potential bullish outlook. Conduct further research on XRP, monitor XRP price, and stay updated on XRP news to make informed decisions. The journey to understand XRP's potential is ongoing, so continue your exploration to fully grasp its possible trajectory.

Featured Posts

-

Universal Credit Back Payments Could You Be Owed Money

May 08, 2025

Universal Credit Back Payments Could You Be Owed Money

May 08, 2025 -

Could A 10x Bitcoin Multiplier Reshape Wall Street Chart Analysis

May 08, 2025

Could A 10x Bitcoin Multiplier Reshape Wall Street Chart Analysis

May 08, 2025 -

Rusya Merkez Bankasi Kripto Para Islemlerini Uyariyor Guevenlik Ve Yasal Riskler

May 08, 2025

Rusya Merkez Bankasi Kripto Para Islemlerini Uyariyor Guevenlik Ve Yasal Riskler

May 08, 2025 -

Market Analysis Bitcoin Rally Predicted May 6 Chart Review

May 08, 2025

Market Analysis Bitcoin Rally Predicted May 6 Chart Review

May 08, 2025 -

The Impact Of Unscripted Moments On Saving Private Ryans Legacy

May 08, 2025

The Impact Of Unscripted Moments On Saving Private Ryans Legacy

May 08, 2025