Japan's Q1 Economic Shrinkage: Assessing The Pre-Tariff Situation

Table of Contents

Domestic Consumption Slowdown

Weakening domestic consumer spending emerged as a primary driver of Japan's Q1 economic shrinkage. This slowdown in consumer spending Japan reflects a confluence of factors impacting domestic demand and overall retail sales Japan.

- Decreased Retail Sales Figures: Official data revealed a significant drop in retail sales across various sectors, indicating reduced consumer purchasing power and confidence. This decline is especially concerning given Japan's already mature consumer market.

- Declining Consumer Confidence Indices: Surveys consistently showed a decrease in consumer confidence, reflecting anxieties about future economic prospects and the rising cost of living. This uncertainty led to consumers delaying major purchases and reducing discretionary spending.

- Impact of Rising Prices (Inflation): Persistent inflation, although relatively modest compared to some other nations, eroded consumer purchasing power. The rising cost of essential goods and services forced households to cut back on spending, further contributing to the economic slowdown in Japan.

- Impact of Changing Demographics: Japan's aging population and shrinking workforce are long-term factors contributing to reduced consumer spending. A smaller working-age population translates to lower overall consumption.

Investment Weakness

Reduced business investment played a significant role in Japan's Q1 economic contraction. This weakness in investment sentiment reflects several underlying factors affecting capital expenditure and corporate profits Japan.

- Lower-than-Expected Capital Expenditure: Businesses demonstrated reluctance to invest in new equipment and expansion projects due to uncertainty regarding future economic growth. This cautious approach to capital expenditure directly impacted overall economic activity.

- Decreased Corporate Profits: Many companies reported lower-than-anticipated profits in Q1, leading to reduced investment capacity. The combination of weak domestic demand and rising input costs squeezed profit margins, hindering investment decisions.

- Uncertainty about Future Economic Prospects: Global economic uncertainty and geopolitical risks created an environment of caution among businesses, discouraging long-term investments. This uncertainty further dampened investment sentiment.

- Impact of Global Economic Slowdown: The global economic slowdown, impacting major trading partners, contributed to reduced export demand and hindered Japanese businesses' investment plans.

Impact of Global Economic Headwinds

External factors significantly impacted Japan's Q1 economic performance. The global economy's instability created substantial headwinds, affecting everything from supply chain disruptions to geopolitical risks.

- Impact of Rising Energy Prices: Soaring energy prices globally, exacerbated by geopolitical events, increased production costs for Japanese businesses and squeezed consumer budgets. The dependence on energy imports made Japan particularly vulnerable to these price fluctuations.

- Disruptions to Global Supply Chains: Lingering supply chain disruptions caused by the pandemic and geopolitical instability continued to affect Japanese businesses, leading to production delays and increased input costs.

- The War in Ukraine: The ongoing war in Ukraine added to global uncertainty and contributed to rising energy and commodity prices, negatively impacting the Japanese economy.

- Slowing Growth in China: China's economic slowdown, a major trading partner for Japan, reduced export demand and further hampered Japanese economic growth.

Pre-Tariff Considerations

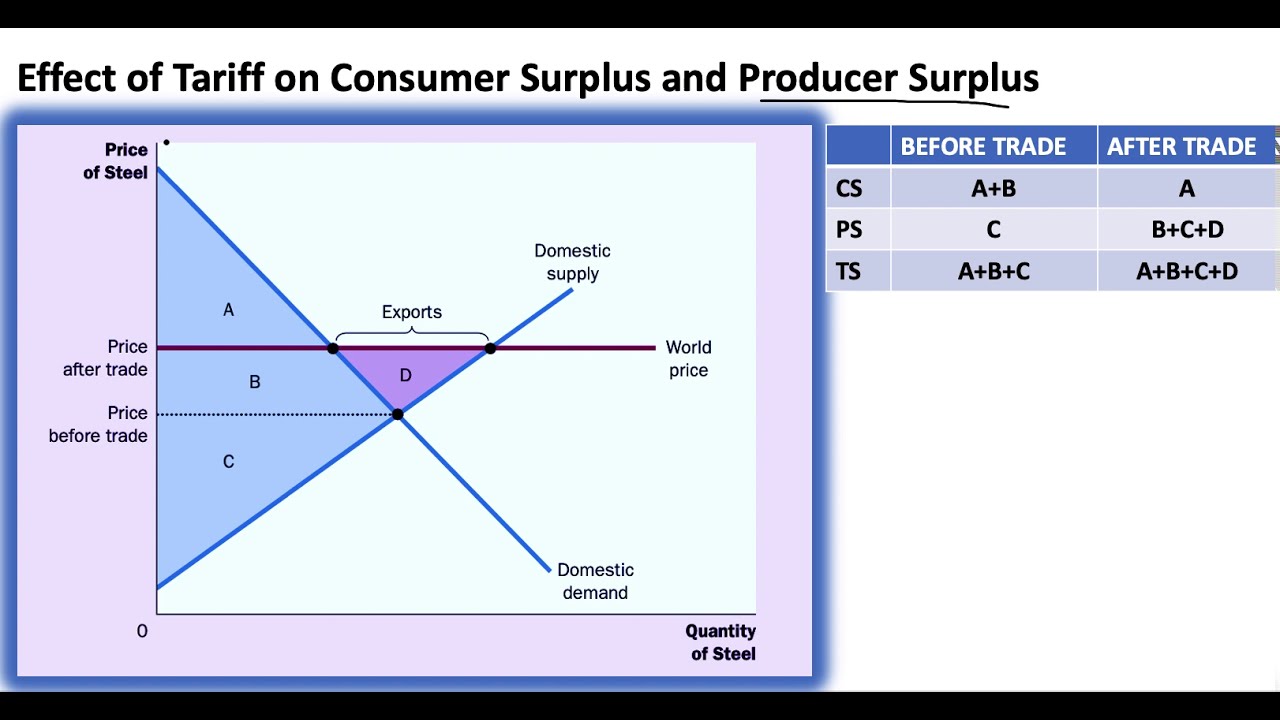

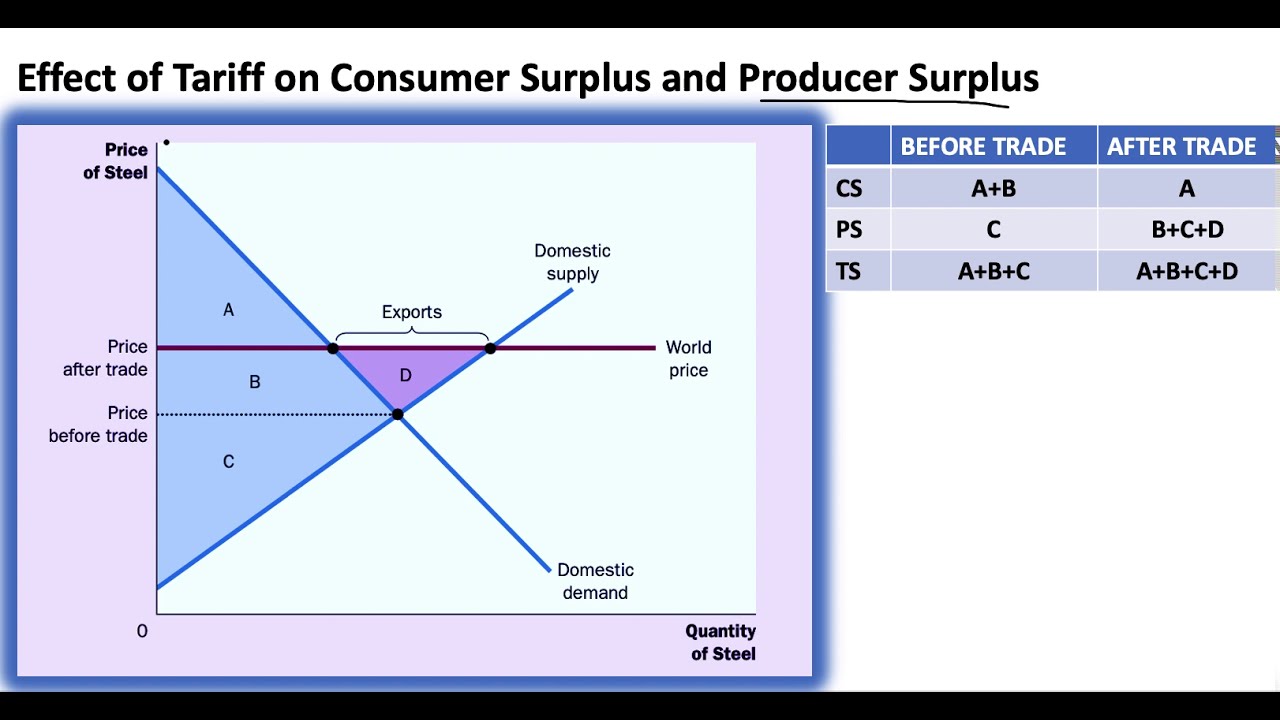

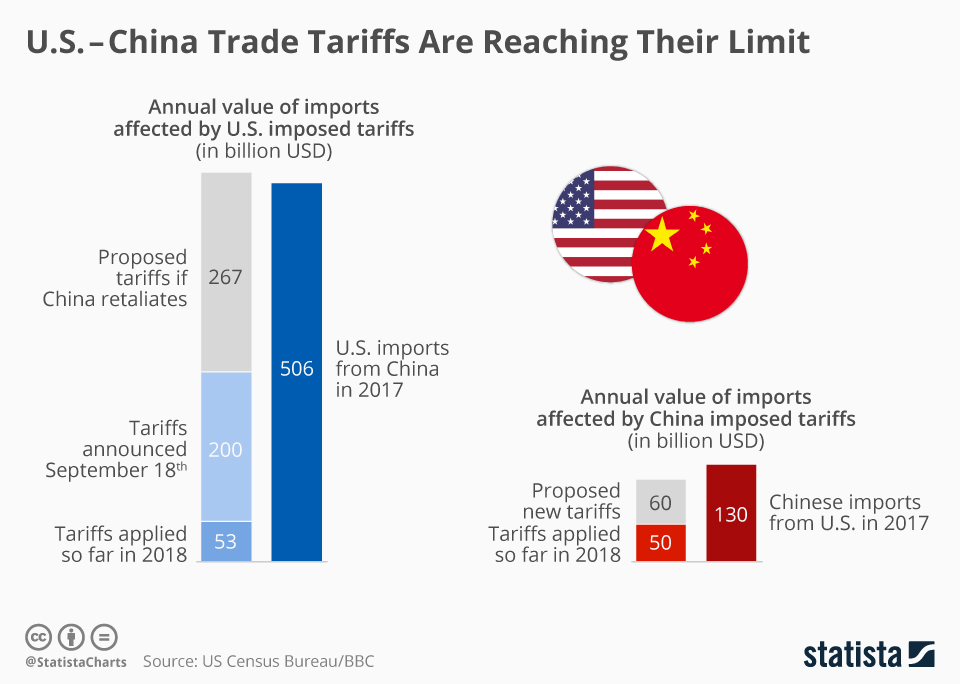

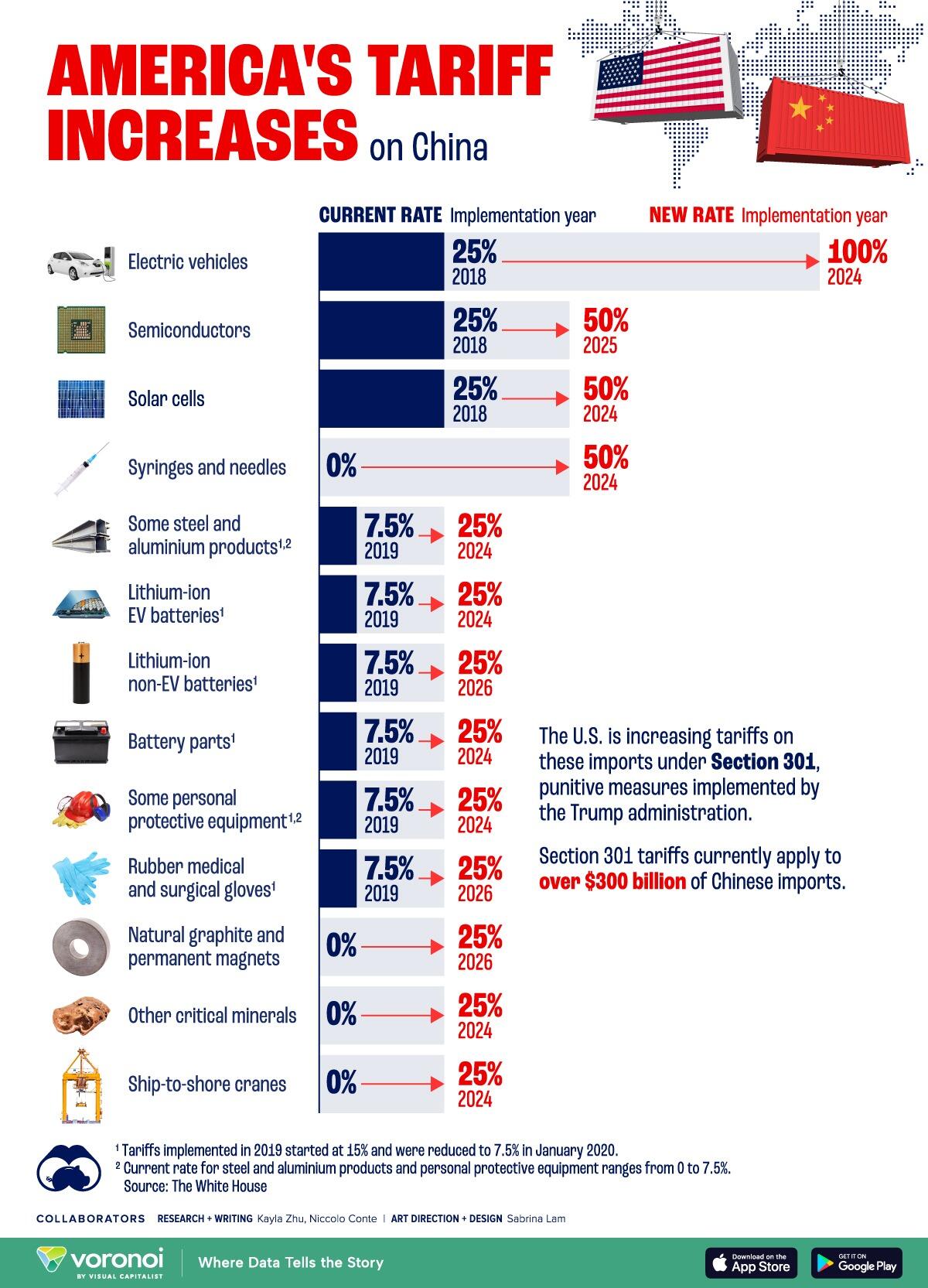

While this analysis focuses on the pre-tariff economic landscape, it's crucial to acknowledge the potential for future tariffs to exacerbate the existing challenges. Potential tariff impact Japan, including a potential trade war, could lead to a further decline in exports and increased import costs, potentially worsening the economic slowdown. This analysis provides a baseline understanding before such external factors further influence the Japanese economy.

Conclusion

Japan's Q1 economic shrinkage resulted from a complex interplay of weak domestic consumption, sluggish investment, and significant global headwinds. This assessment provides a pre-tariff analysis, focusing on the internal and external factors contributing to the decline before any potential exacerbation from new tariffs. The combination of decreased consumer spending, reduced business investment, and the impact of global economic uncertainties paints a challenging picture for the Japanese economy. To stay informed about further developments in the Japanese economy and the potential impact of tariffs on Japanese economic growth, we encourage you to subscribe to our updates or read our future analyses on Japan's economic shrinkage and the impact of tariffs on the Japanese economy. Understanding the pre-tariff situation is key to predicting the effects of future trade policies on Japan's economic recovery.

Featured Posts

-

Ontarios 14 6 Billion Deficit Tariff Impacts And Economic Outlook

May 17, 2025

Ontarios 14 6 Billion Deficit Tariff Impacts And Economic Outlook

May 17, 2025 -

Canadas New Tariffs On Us Goods Plummet Near Zero Rates With Key Exemptions

May 17, 2025

Canadas New Tariffs On Us Goods Plummet Near Zero Rates With Key Exemptions

May 17, 2025 -

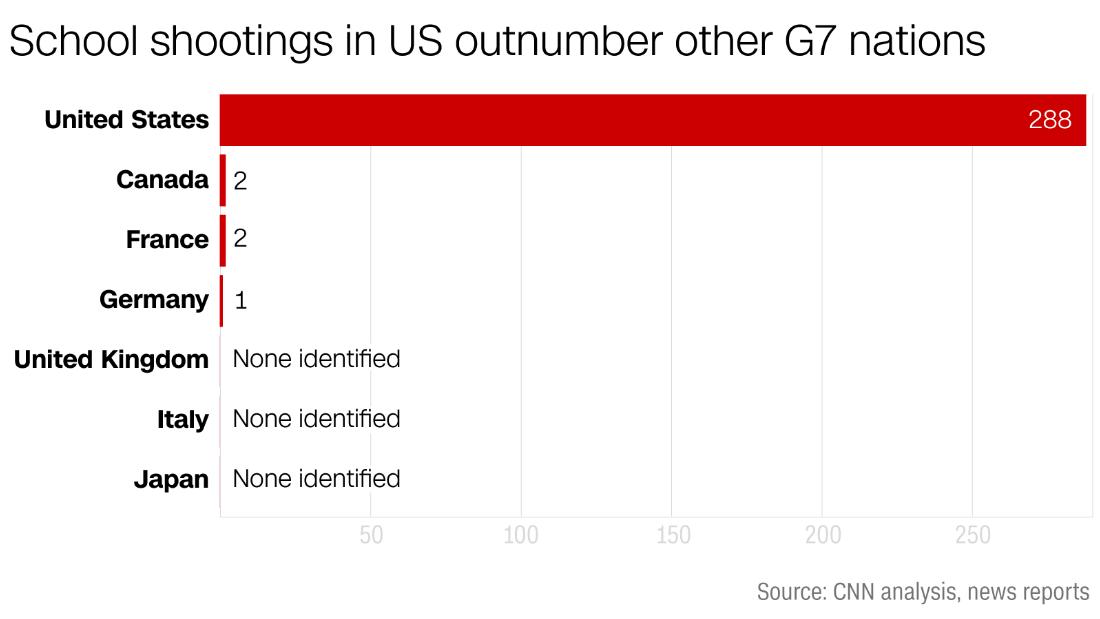

Florida School Shootings Lockdown Procedures And Generational Impact

May 17, 2025

Florida School Shootings Lockdown Procedures And Generational Impact

May 17, 2025 -

Buying A House Understanding The Impact Of Student Loan Debt

May 17, 2025

Buying A House Understanding The Impact Of Student Loan Debt

May 17, 2025 -

Smart Shopping Getting Quality On A Budget

May 17, 2025

Smart Shopping Getting Quality On A Budget

May 17, 2025

Latest Posts

-

Srbi Kupuju Stanove Preko Granice Popularne Lokacije I Trendovi

May 17, 2025

Srbi Kupuju Stanove Preko Granice Popularne Lokacije I Trendovi

May 17, 2025 -

Analiz Rynka I Strategii Dlya Industrialnykh Parkov S Vysokoy Plotnostyu Predpriyatiy

May 17, 2025

Analiz Rynka I Strategii Dlya Industrialnykh Parkov S Vysokoy Plotnostyu Predpriyatiy

May 17, 2025 -

Kak Vyzhit I Protsvetat V Usloviyakh Vysokoy Konkurentsii Industrialnykh Parkov

May 17, 2025

Kak Vyzhit I Protsvetat V Usloviyakh Vysokoy Konkurentsii Industrialnykh Parkov

May 17, 2025 -

Network18 Media And Investments Share Price Technical Analysis And Forecasts April 21 2025

May 17, 2025

Network18 Media And Investments Share Price Technical Analysis And Forecasts April 21 2025

May 17, 2025 -

Uspekh V Perepolnennykh Industrialnykh Parkakh Klyuchevye Faktory

May 17, 2025

Uspekh V Perepolnennykh Industrialnykh Parkakh Klyuchevye Faktory

May 17, 2025