Network18 Media & Investments: Share Price, Technical Analysis, And Forecasts (April 21, 2025)

Table of Contents

Current Share Price Analysis of Network18 Media & Investments

As of April 21, 2025, the Network18 Media & Investments share price stands at [Insert Current Share Price Here]. This represents a [Percentage Change]% change from its closing price yesterday. Over the past week, the share price has exhibited [Describe the movement - e.g., a slight upward trend, significant volatility, etc.], while the month-to-date performance shows a [Percentage Change]%. Looking back at the past year, the stock has experienced [Describe the overall trend - e.g., substantial growth, a period of consolidation, a significant decline]. A recent news event regarding [Mention a specific news event, if applicable] contributed to a [Describe the impact - e.g., sharp drop, modest increase] in the share price. Understanding these fluctuations is crucial for informed investment decisions.

- 52-Week High: [Insert Value]

- 52-Week Low: [Insert Value]

- Trading Volume Analysis: [Analyze trading volume trends – high volume may indicate strong buying or selling pressure. Low volume might suggest a lack of interest.]

- Comparison to Sector Peers: Network18 Media & Investments' share price performance compared to its competitors [mention competitors and relative performance] suggests [draw conclusions – e.g., outperformance, underperformance, in-line performance]. This analysis considers the live share price and stock quote to ensure accuracy. The current market capitalization is [Insert Market Cap].

Technical Analysis of Network18 Media & Investments Stock

Technical analysis provides valuable insights into potential future price movements. We utilized several key technical indicators, including moving averages (e.g., 50-day and 200-day), the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD), to analyze the Network18 Media & Investments stock chart.

- Moving Averages: The 50-day moving average is currently [Value] and the 200-day moving average is [Value]. [Interpret the relationship between the moving averages – e.g., a bullish crossover suggests upward momentum].

- RSI: The RSI is currently at [Value]. [Interpret the RSI value – e.g., values above 70 suggest overbought conditions, while values below 30 indicate oversold conditions].

- MACD: The MACD line is [State the position of the MACD line relative to the signal line]. [Interpret the MACD signal – e.g., a bullish crossover suggests a potential upward trend].

- Support and Resistance Levels: Key support levels are observed at [Values], while resistance levels are located at [Values]. [Explain what these levels mean in terms of potential price reversals].

- Chart Patterns: [Identify any observable chart patterns, e.g., head and shoulders, double bottom, and their implications for future price movement]. Detailed candlestick patterns analysis could provide further insight.

Fundamental Analysis of Network18 Media & Investments

A thorough fundamental analysis complements the technical perspective. Network18 Media & Investments' financial health is assessed by examining its revenue, profit margins, and debt-to-equity ratio. The company's competitive landscape within the media and investment sectors also plays a crucial role.

- Key Financial Ratios: [Provide and analyze key financial ratios such as Profit Margin, Return on Equity (ROE), Debt-to-Equity Ratio, etc. Explain what these ratios indicate about the company’s financial strength and stability].

- Business Model & Strategy: Network18 Media & Investments' business model [explain the core business model]. The company's strategic direction [explain current strategies and their impact].

- Management Assessment: The effectiveness of the management team is crucial. [Analyze management’s track record, key decisions, and overall leadership].

Network18 Media & Investments Share Price Forecasts & Predictions

Based on the combined technical and fundamental analyses, we offer the following short-term and long-term share price forecasts for Network18 Media & Investments.

- Short-Term Forecast (Next 3 Months): We predict a [Percentage Change]% change in the share price, with a potential range between [Lower Bound] and [Upper Bound]. This is based on [explain the reasoning behind the prediction].

- Long-Term Forecast (Next 12 Months): Our long-term forecast anticipates a [Percentage Change]% change, with price targets ranging from [Lower Bound] to [Upper Bound]. Factors influencing this projection include [List key factors].

Potential Scenarios:

- Bullish Scenario: [Describe conditions that would lead to a bullish scenario].

- Bearish Scenario: [Describe conditions that would lead to a bearish scenario].

- Neutral Scenario: [Describe conditions that would lead to a neutral scenario].

Disclaimer: These forecasts are not financial advice. Thorough research and professional guidance are recommended before making any investment decisions.

Conclusion: Investing in Network18 Media & Investments: A Final Look at Share Price and Forecasts

Our analysis of Network18 Media & Investments reveals a complex picture influenced by both market dynamics and the company's internal performance. While our forecasts suggest [summarize the key forecasts], it is crucial to acknowledge the inherent risks and uncertainties associated with any investment. Remember, the share price is subject to fluctuation based on various factors, including broader market conditions and company-specific news. Conduct your own thorough research and consider consulting a financial advisor before committing to any investment in Network18 Media & Investments. Stay informed about the latest developments in Network18 Media & Investments share price and future forecasts by subscribing to our newsletter!

Featured Posts

-

Top Stake Casino Alternatives In 2025 Best Replacements And Sites

May 17, 2025

Top Stake Casino Alternatives In 2025 Best Replacements And Sites

May 17, 2025 -

Giants Vs Mariners April 4 6 Series Injury Concerns And Lineup Projections

May 17, 2025

Giants Vs Mariners April 4 6 Series Injury Concerns And Lineup Projections

May 17, 2025 -

Parents Less Worried About College Costs But Student Loans Still A Factor Survey Results

May 17, 2025

Parents Less Worried About College Costs But Student Loans Still A Factor Survey Results

May 17, 2025 -

Microsoft Streamlines Surface Which Product Is Next

May 17, 2025

Microsoft Streamlines Surface Which Product Is Next

May 17, 2025 -

Wednesdays Market Winners Rockwell Automation Among Top Performers

May 17, 2025

Wednesdays Market Winners Rockwell Automation Among Top Performers

May 17, 2025

Latest Posts

-

Is The Doctor Who Christmas Special Scrapped Bbc Remains Silent

May 17, 2025

Is The Doctor Who Christmas Special Scrapped Bbc Remains Silent

May 17, 2025 -

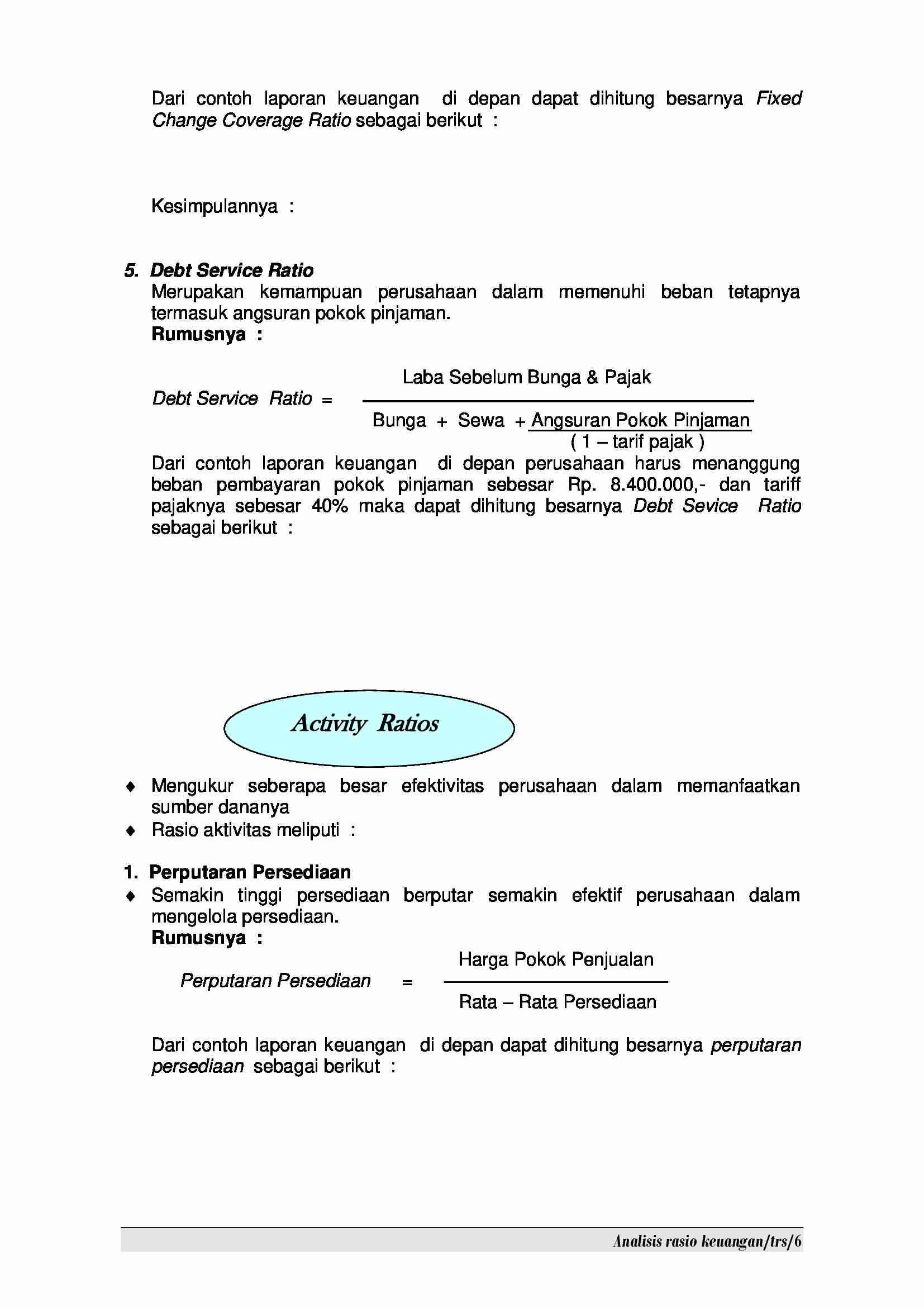

Panduan Lengkap Memahami Dan Menggunakan Laporan Keuangan

May 17, 2025

Panduan Lengkap Memahami Dan Menggunakan Laporan Keuangan

May 17, 2025 -

Killer Cartoons And A New Companion What The Doctor Who Season 2 Trailer Shows Us

May 17, 2025

Killer Cartoons And A New Companion What The Doctor Who Season 2 Trailer Shows Us

May 17, 2025 -

Doctor Who Season 2 Trailer Reveals The Fifteenth Doctor And His New Companions First Adventure

May 17, 2025

Doctor Who Season 2 Trailer Reveals The Fifteenth Doctor And His New Companions First Adventure

May 17, 2025 -

Menganalisis Laporan Keuangan Untuk Pengambilan Keputusan Bisnis Yang Lebih Baik

May 17, 2025

Menganalisis Laporan Keuangan Untuk Pengambilan Keputusan Bisnis Yang Lebih Baik

May 17, 2025