Ontario's $14.6 Billion Deficit: Tariff Impacts And Economic Outlook

Table of Contents

The Role of Tariffs in Ontario's Deficit

Tariffs, taxes imposed on imported goods, have played a significant role in widening Ontario's $14.6 billion deficit. Understanding this impact is crucial for grasping the complexities of the province's financial situation.

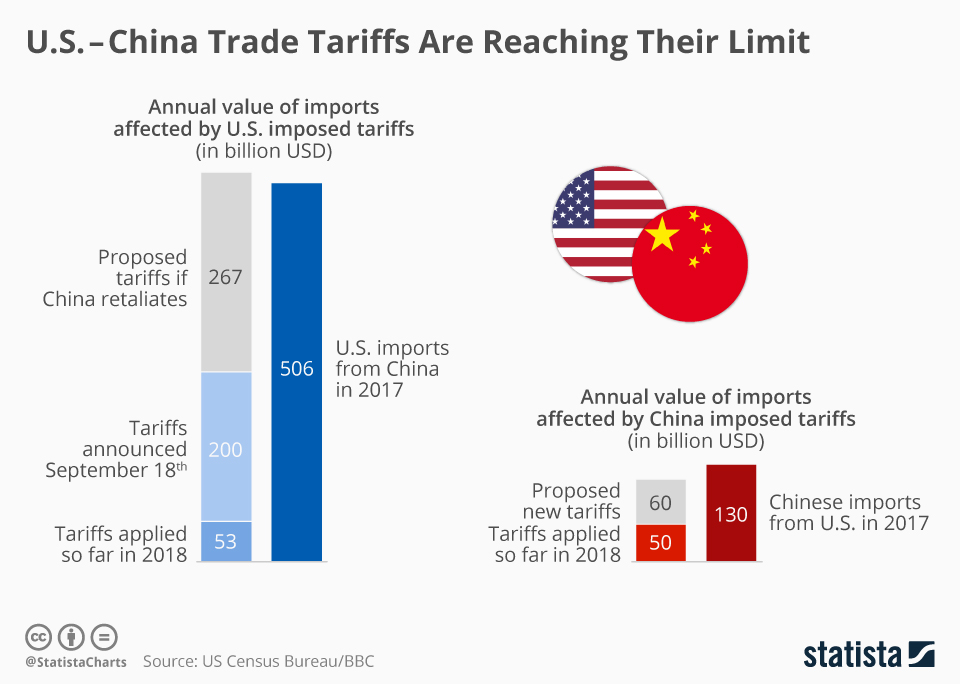

Impact of International Trade Wars

International trade disputes and retaliatory tariffs have dealt a considerable blow to key Ontario industries. These trade wars, particularly those involving major trading partners, have disrupted supply chains, increased input costs, and reduced export opportunities.

- Automotive Sector: The automotive industry, a cornerstone of Ontario's economy, has been severely impacted by tariffs imposed during trade disputes. Increased costs for imported parts have squeezed profit margins and reduced competitiveness.

- Manufacturing Sector: Many manufacturing businesses rely on imported raw materials and components. Tariffs on these inputs have driven up production costs, making Ontario-made goods less price-competitive in both domestic and international markets.

- Steel and Aluminum: Tariffs on steel and aluminum have had a ripple effect across various sectors, impacting construction, automotive manufacturing, and other industries reliant on these materials. This has led to job losses and reduced economic activity.

The financial losses stemming from these tariffs are substantial. Statistics from [insert reputable source, e.g., the Conference Board of Canada] illustrate the negative impact on GDP growth and employment within affected sectors. This highlights the interconnectedness of the Ontario economy and the significant consequences of trade disruptions.

Increased Costs for Businesses and Consumers

Tariffs don't just impact businesses; they directly affect consumers as well. Increased costs for imported goods translate into higher prices for everyday items, reducing consumer purchasing power.

- Everyday Goods: Tariffs on imported goods such as clothing, electronics, and furniture lead to higher prices at retail, impacting household budgets.

- Inflationary Pressure: The cumulative effect of tariffs on various imported goods contributes to inflationary pressures across the economy, eroding the value of wages and savings.

- Reduced Consumer Spending: Higher prices and reduced purchasing power lead to decreased consumer spending, dampening economic growth and further contributing to the deficit.

Analyzing the Current Economic Outlook for Ontario

Understanding Ontario's economic outlook requires a comprehensive analysis of government spending, the job market, and long-term projections.

Provincial Government Spending and Revenue

Ontario's government spending priorities and revenue streams are key factors influencing the deficit. While the government has implemented various cost-cutting measures and revenue-generating initiatives, the effectiveness of these policies remains a subject of ongoing debate.

- Healthcare Spending: A significant portion of Ontario's budget is dedicated to healthcare. Balancing the need for quality healthcare with fiscal responsibility is a major challenge.

- Infrastructure Investment: Investments in infrastructure are crucial for long-term economic growth. However, these investments contribute to government spending and can exacerbate the deficit in the short term.

- Tax Revenue: The province relies on various tax streams, including personal and corporate income taxes, to fund government programs. Economic downturns can reduce tax revenue, further widening the deficit.

Job Market and Unemployment Rates

Ontario's job market is a critical component of its economic health. Analyzing unemployment rates and sector-specific employment trends reveals the relationship between the deficit and job creation/loss.

- Unemployment Rates: High unemployment rates reduce tax revenue and increase demand for social programs, placing further strain on the provincial budget.

- Sectoral Employment Trends: Understanding employment trends in specific sectors helps identify areas of economic strength and weakness, informing policy decisions. For example, the decline in manufacturing jobs due to tariff impacts further contributes to the deficit.

Long-Term Economic Projections

Predicting Ontario's long-term economic growth considering the existing deficit requires careful consideration of various factors.

- Economic Forecasts: Reputable economic institutions offer projections that consider factors like global economic conditions, technological advancements, and government policies. These projections offer insights into potential risks and opportunities.

- Technological Advancements: Technological advancements can drive economic growth and create new job opportunities, potentially offsetting some of the challenges posed by the deficit.

- Global Economic Conditions: Global economic uncertainty and fluctuations can significantly impact Ontario's economic outlook, influencing investment, trade, and employment.

Conclusion

Ontario's $14.6 billion deficit is a complex issue with multiple contributing factors. Tariffs, through their impact on key industries and consumer spending, have exacerbated the province's financial challenges. The economic outlook for Ontario requires careful monitoring of government spending, the job market, and long-term projections, considering potential risks and opportunities. Understanding the complexities of Ontario's $14.6 billion deficit, including the impact of tariffs and the ongoing economic outlook, is crucial for both businesses and residents. Stay informed about government policies and participate in the conversation to help shape a more sustainable economic future for Ontario. Addressing Ontario's budget deficit and mitigating the ongoing economic challenges requires collaborative effort and informed discussion.

Featured Posts

-

Free Live Stream Seattle Mariners Vs Chicago Cubs Spring Training

May 17, 2025

Free Live Stream Seattle Mariners Vs Chicago Cubs Spring Training

May 17, 2025 -

Anchor Brewings Closure A Legacy Lost After 127 Years

May 17, 2025

Anchor Brewings Closure A Legacy Lost After 127 Years

May 17, 2025 -

Finding Serenity In Tokyo Soundproof Apartments And Quiet Spaces

May 17, 2025

Finding Serenity In Tokyo Soundproof Apartments And Quiet Spaces

May 17, 2025 -

Wednesdays Market Winners Rockwell Automation Among Top Performers

May 17, 2025

Wednesdays Market Winners Rockwell Automation Among Top Performers

May 17, 2025 -

Investigacion Sobre El Esquema Ponzi De Koriun Inversiones

May 17, 2025

Investigacion Sobre El Esquema Ponzi De Koriun Inversiones

May 17, 2025

Latest Posts

-

112

May 17, 2025

112

May 17, 2025 -

40

May 17, 2025

40

May 17, 2025 -

Valerio Therapeutics Update On 2024 Financial Statement Approval

May 17, 2025

Valerio Therapeutics Update On 2024 Financial Statement Approval

May 17, 2025 -

13 Analysts Weigh In A Comprehensive Look At Principal Financial Group Pfg

May 17, 2025

13 Analysts Weigh In A Comprehensive Look At Principal Financial Group Pfg

May 17, 2025 -

Valerio Therapeutics 2024 Annual Financial Report Publication Delayed

May 17, 2025

Valerio Therapeutics 2024 Annual Financial Report Publication Delayed

May 17, 2025