Jim Cramer's Foot Locker (FL) Pick: A Genuine Winner?

Table of Contents

Cramer's Rationale Behind the Foot Locker (FL) Recommendation

Understanding the reasoning behind Cramer's recommendation is crucial. While specific dates and quotes may change, the core arguments generally revolve around Foot Locker's potential for a turnaround. Cramer likely highlighted the company's efforts to adapt to the changing retail landscape, potentially focusing on its:

- Specific quotes or paraphrased statements from Cramer regarding FL: While precise quotes require referencing specific broadcast dates, Cramer's arguments likely emphasize Foot Locker's renewed focus on exclusive collaborations, improved inventory management, and a strengthened omnichannel strategy. He might have mentioned the potential for increased profitability through these initiatives.

- Mention the date and source of Cramer's recommendation: (Insert date and source of Cramer's recommendation here – e.g., "During a segment on Mad Money on October 26, 2023, Cramer stated...")

- Highlight any specific aspects of Foot Locker's business that Cramer emphasized: Cramer may have pointed towards Foot Locker's strong brand recognition and its potential to capitalize on the enduring popularity of athletic footwear and apparel.

Foot Locker's (FL) Recent Financial Performance and Key Metrics

Analyzing Foot Locker's recent financial reports provides a clearer picture of its current standing. Let's examine some key metrics:

- Revenue growth or decline: (Insert data on Foot Locker's revenue growth or decline from recent quarterly and annual reports. Use percentage changes and compare to previous periods. For example: "Foot Locker experienced a 5% year-over-year revenue increase in Q3 2023, exceeding analyst expectations.")

- Earnings per share (EPS): (Provide data on EPS. For example: "EPS rose to $1.20 in Q3 2023, a significant improvement from $0.80 in the same period last year.")

- Profit margins: (Present data on gross and net profit margins. For example: "Gross profit margin improved to 30%, reflecting cost-cutting measures and efficient inventory management.")

- Debt-to-equity ratio: (Provide the debt-to-equity ratio and its implications for the company's financial health. For example: "A debt-to-equity ratio of 0.7 suggests a manageable level of debt.")

- Key performance indicators (KPIs) relevant to the footwear and apparel industry: (Mention relevant KPIs such as same-store sales growth, average transaction value, and inventory turnover. Provide data and context).

Competitive Landscape and Market Analysis for Foot Locker (FL)

Foot Locker operates in a fiercely competitive market. Understanding its position against giants like Nike, Adidas, and other major retailers is critical:

- Market share analysis for Foot Locker and its competitors: (Provide market share data for Foot Locker and its main competitors. For example: "Foot Locker holds approximately X% of the athletic footwear retail market.")

- Impact of e-commerce and online retail on Foot Locker's sales: (Discuss the influence of online shopping on Foot Locker's performance, highlighting its omnichannel strategy and success in this area.)

- Discussion of current consumer spending habits and their influence on FL's performance: (Analyze consumer trends and their impact on Foot Locker’s sales, including factors such as changing fashion preferences and economic conditions.)

- Analysis of supply chain challenges and their effect on the company: (Discuss any supply chain disruptions and their impact on Foot Locker's ability to meet consumer demand).

Future Prospects and Potential Risks for Foot Locker (FL) Stock

Investing in Foot Locker involves considering both its potential and associated risks:

- Discussion of Foot Locker's strategic initiatives and their potential impact: (Analyze Foot Locker's long-term strategies, such as expansion into new markets or partnerships, and assess their potential success).

- Assessment of the company's brand strength and customer loyalty: (Evaluate the strength of the Foot Locker brand and its ability to retain customers in a competitive environment).

- Potential impact of inflation and rising interest rates on Foot Locker: (Discuss how macroeconomic factors such as inflation and interest rates could affect Foot Locker's profitability and consumer spending).

- Analysis of any pending legal or regulatory issues impacting the company: (Assess any potential legal or regulatory risks that could negatively affect the company's performance).

Conclusion

Jim Cramer's positive outlook on Foot Locker (FL) is valuable, but it shouldn't be the sole basis for your investment decision. While Foot Locker shows signs of recovery, demonstrated by improvements in key financial metrics and strategic initiatives, risks remain, including competition and macroeconomic headwinds. The competitive landscape is intense, and consumer spending habits are dynamic.

Therefore, before investing in Foot Locker (FL) stock or any similar investment in the athletic apparel sector, conduct your own thorough due diligence. Carefully weigh the pros and cons presented in this analysis, consider your personal risk tolerance, and consult with a qualified financial advisor. Remember, thorough research is paramount when considering any investment in Foot Locker (FL).

Featured Posts

-

The Unexpected Rival How One App Challenges Metas Empire

May 15, 2025

The Unexpected Rival How One App Challenges Metas Empire

May 15, 2025 -

Key Dodgers Minor League Players To Watch Evan Phillips Sean Paul Linan Eduardo Quintero

May 15, 2025

Key Dodgers Minor League Players To Watch Evan Phillips Sean Paul Linan Eduardo Quintero

May 15, 2025 -

Kid Cudi Memorabilia Sells For Staggering Sums At Recent Auction

May 15, 2025

Kid Cudi Memorabilia Sells For Staggering Sums At Recent Auction

May 15, 2025 -

Evaluating Jim Cramers Assessment Of Foot Locker Inc Fl

May 15, 2025

Evaluating Jim Cramers Assessment Of Foot Locker Inc Fl

May 15, 2025 -

School Record Broken Ndukwe Named Pbc Tournament Mvp

May 15, 2025

School Record Broken Ndukwe Named Pbc Tournament Mvp

May 15, 2025

Latest Posts

-

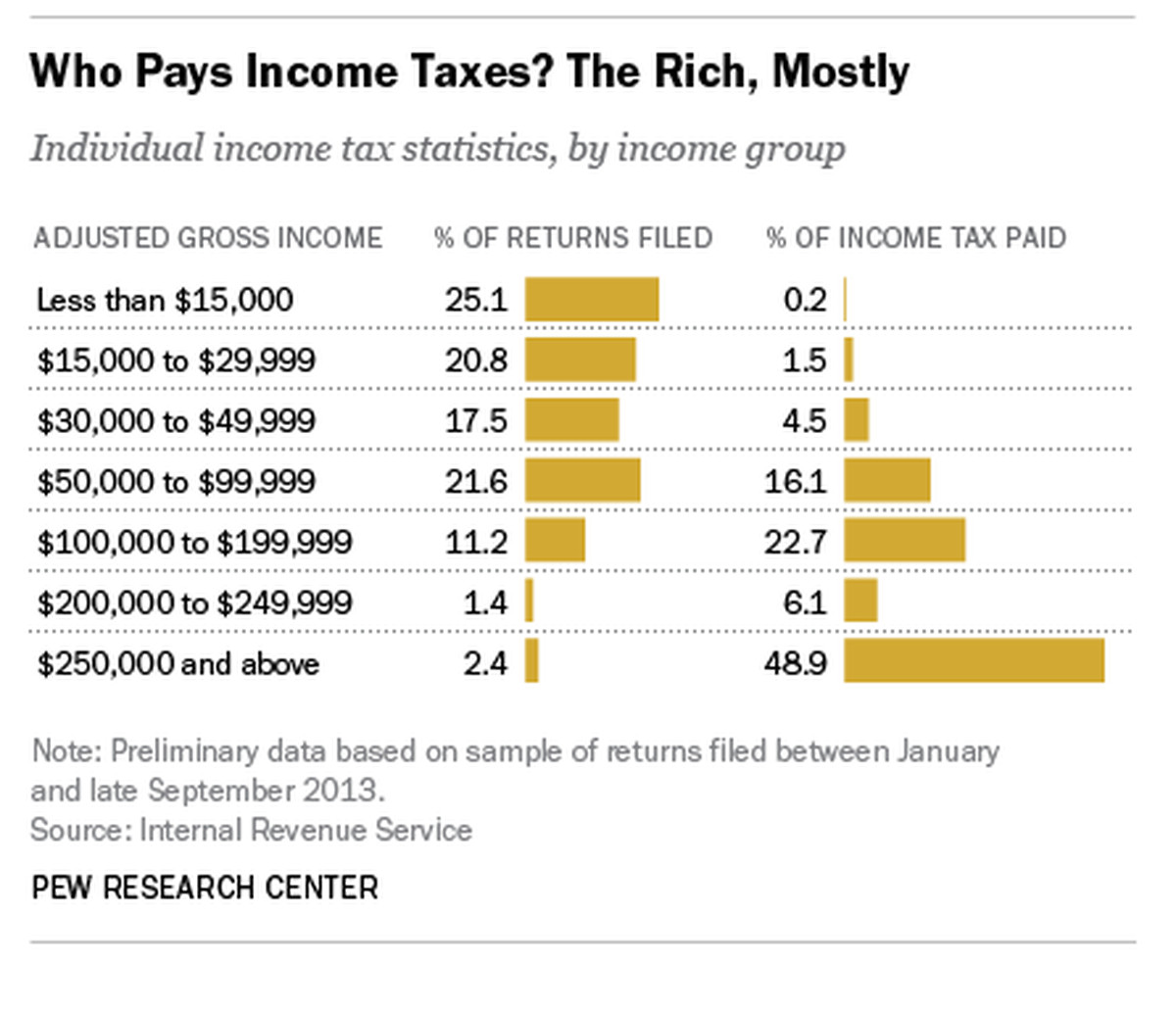

Analysis The House Gops Trump Tax Plan Breakdown

May 16, 2025

Analysis The House Gops Trump Tax Plan Breakdown

May 16, 2025 -

Menendez Brothers Resentencing A Possibility Following Judges Decision

May 16, 2025

Menendez Brothers Resentencing A Possibility Following Judges Decision

May 16, 2025 -

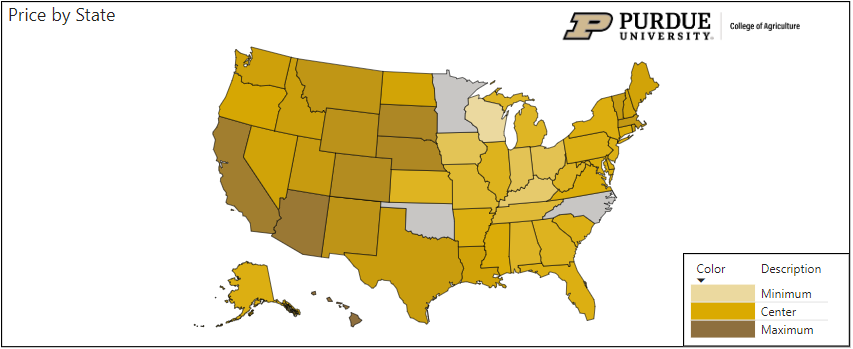

From Joke To Reality The Truth About The Rising Cost Of Eggs

May 16, 2025

From Joke To Reality The Truth About The Rising Cost Of Eggs

May 16, 2025 -

Examining The Accuracy Of Trumps Egg Price Forecast

May 16, 2025

Examining The Accuracy Of Trumps Egg Price Forecast

May 16, 2025 -

Details Emerge House Gops Unveiling Of Trump Tax Proposals

May 16, 2025

Details Emerge House Gops Unveiling Of Trump Tax Proposals

May 16, 2025