Leadership Change At CFP Board: CEO To Retire

Table of Contents

The Retiring CEO's Legacy and Accomplishments

The outgoing CEO's tenure has been marked by significant achievements that have profoundly shaped the CFP Board and the financial planning profession. Their leadership has overseen a period of substantial growth and positive change. Let's look at some key highlights:

-

Significant growth in CFP professionals: Under their leadership, the number of CFP professionals has experienced a considerable increase, reflecting a growing demand for certified financial planners. This expansion showcases the increasing recognition and value placed on the CFP certification within the industry.

-

Implementation of key initiatives to improve the CFP certification process: The CEO spearheaded several initiatives designed to enhance the rigor and relevance of the CFP certification process. These efforts likely included streamlining application procedures, enhancing examination content, and strengthening continuing education requirements. These changes ultimately benefited consumers by ensuring a higher standard of professionalism among CFP professionals.

-

Strengthening of the CFP Board's regulatory role and ethical standards: The CEO played a pivotal role in reinforcing the CFP Board's commitment to ethical conduct and professional responsibility. This included strengthening enforcement mechanisms and promoting a culture of compliance amongst CFP professionals. This emphasis on ethics builds public trust and enhances the reputation of the CFP certification.

-

Successful navigation of significant industry challenges: The outgoing CEO expertly guided the CFP Board through various industry challenges, including [mention specific examples, e.g., regulatory changes, economic downturns, technological advancements]. Their decisive leadership ensured the CFP Board remained a stable and influential force within the financial planning landscape.

Their impact on the financial planning profession is undeniable, leaving a legacy of strengthened standards and increased professional recognition.

The Search for a New CEO and Leadership Transition

The CFP Board will now embark on a crucial process: finding a successor to the retiring CEO. The search process will likely involve:

-

Internal vs. External Search: The board will determine whether to prioritize internal candidates with existing knowledge of the organization or cast a wider net by conducting an external search to attract fresh perspectives and leadership styles.

-

Prioritized Qualities and Experience: The ideal candidate will likely possess a blend of leadership experience, a deep understanding of the financial planning industry, a commitment to ethical conduct, and a strategic vision for the future of the CFP Board. Strong communication and collaboration skills will be vital.

-

Timeline for the Transition Process: A clear timeline for the search and transition will be essential to minimize disruption and ensure a smooth handover of responsibilities. This involves establishing deadlines for applications, interviews, and the final selection.

-

Interim Leadership Arrangements: To ensure operational continuity during the search, the CFP Board may appoint an interim CEO or leadership team to manage the organization's day-to-day operations.

The transition period presents both challenges and opportunities. Challenges may include potential uncertainty among CFP professionals and stakeholders. Opportunities lie in the chance to refresh the organization's strategic direction and adapt to the evolving financial planning landscape.

Implications for CFP Professionals and the Financial Planning Industry

The CFP Board CEO retirement and the subsequent leadership change will have significant implications for CFP professionals and the broader financial planning industry:

-

Changes in Strategic Direction: The new CEO may bring a different strategic vision, potentially leading to changes in the CFP Board's priorities and initiatives. This could impact areas such as continuing education requirements, advocacy efforts, and technological investments.

-

Potential Impact on CFP Certification Requirements and Renewal Processes: While maintaining high standards, the new leadership may introduce modifications to the CFP certification process, potentially impacting requirements for initial certification or renewal.

-

Effect on Ongoing Efforts to Promote Financial Planning as a Profession: The leadership change might affect the CFP Board's approach to promoting the financial planning profession and raising public awareness of the value of CFP professionals.

-

Opportunities for CFP Professionals to Engage with the New Leadership: CFP professionals will have opportunities to engage with the new leadership through various channels, such as board meetings, conferences, and online forums. This active engagement can contribute to shaping the future direction of the CFP Board.

The change in leadership could also influence the wider financial planning landscape, impacting regulatory developments, industry collaborations, and the overall perception of the CFP certification.

Maintaining Standards and Ethical Practices Post-Retirement

Maintaining the highest ethical standards is paramount for the CFP Board. The organization must ensure continuity in upholding its commitment to ethical financial planning:

-

Ongoing Enforcement of the CFP Board’s Code of Ethics and Professional Responsibility: Rigorous enforcement of the Code of Ethics remains crucial to maintaining public trust and upholding the integrity of the CFP certification.

-

Maintenance of Robust Disciplinary Processes for CFP Professionals: Disciplinary actions against CFP professionals who violate the Code of Ethics must remain a priority to deter unethical behavior and protect consumers.

-

Commitment to Continuous Professional Development and Education for CFP Certificants: Continuous professional development is crucial for CFP professionals to stay abreast of industry changes and maintain their competency.

The CFP Board's commitment to ethical conduct must remain unwavering, regardless of leadership changes.

Conclusion

The CFP Board CEO retirement signifies a critical juncture for the organization and the financial planning profession. The successful transition to new leadership will depend on a smooth handover, a thoughtful search process, and a clear vision for the future. It is crucial that the CFP Board maintains its commitment to rigorous ethical standards and continued support for CFP professionals. Staying informed about the progress of the search for the next CEO and engaging with the CFP Board during this transition is vital for all those involved in financial planning. Follow reputable sources for updates on the CFP Board CEO retirement and the selection of the next leader. The future success of the CFP Board hinges on a seamless transition and a continued dedication to upholding the highest ethical standards within the financial planning profession.

Featured Posts

-

Why The Appeal Of Expensive Offshore Wind Projects Is Fading

May 03, 2025

Why The Appeal Of Expensive Offshore Wind Projects Is Fading

May 03, 2025 -

Riot Fest 2025 Green Day And Weezer Lead The Charge

May 03, 2025

Riot Fest 2025 Green Day And Weezer Lead The Charge

May 03, 2025 -

Tensions Rise As Farage Battles Teaching Union Over Far Right Allegations

May 03, 2025

Tensions Rise As Farage Battles Teaching Union Over Far Right Allegations

May 03, 2025 -

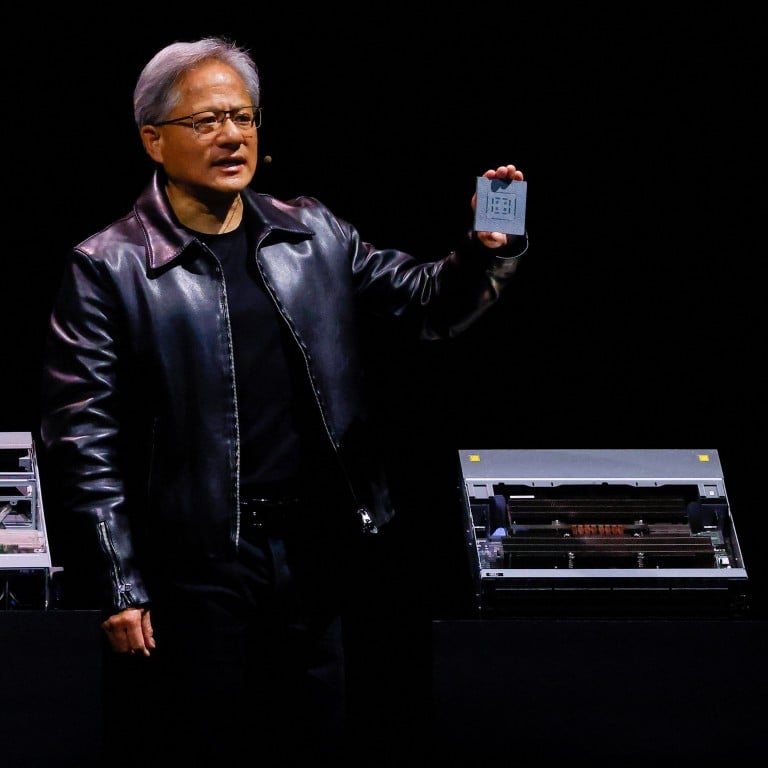

Nvidia Ceo Calls For Change In Ai Chip Export Regulations Under Trump

May 03, 2025

Nvidia Ceo Calls For Change In Ai Chip Export Regulations Under Trump

May 03, 2025 -

Reform Uks Growing Political Power Insights From Nigel Farage

May 03, 2025

Reform Uks Growing Political Power Insights From Nigel Farage

May 03, 2025

Latest Posts

-

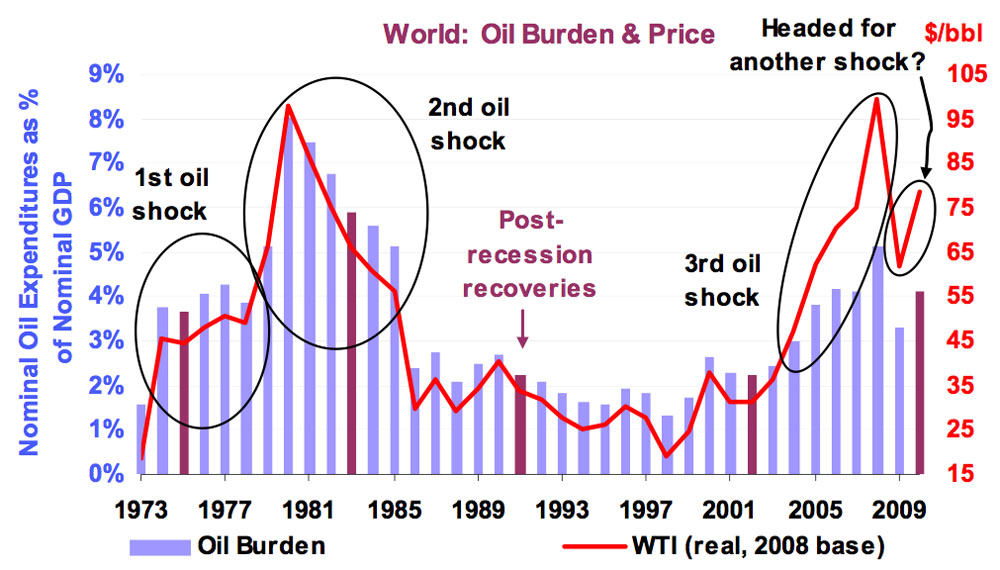

The Airline Industrys Vulnerability To Oil Supply Chain Instability

May 04, 2025

The Airline Industrys Vulnerability To Oil Supply Chain Instability

May 04, 2025 -

Oil Price Volatility And Its Effect On Airline Profitability

May 04, 2025

Oil Price Volatility And Its Effect On Airline Profitability

May 04, 2025 -

Soaring Fuel Costs The Airline Industrys Response To Oil Supply Shocks

May 04, 2025

Soaring Fuel Costs The Airline Industrys Response To Oil Supply Shocks

May 04, 2025 -

Tomatin Affordable Housing Strathdearn Community Project Marks Significant Progress

May 04, 2025

Tomatin Affordable Housing Strathdearn Community Project Marks Significant Progress

May 04, 2025 -

Pupils Celebrate Groundbreaking Of New Tomatin Affordable Housing In Strathdearn

May 04, 2025

Pupils Celebrate Groundbreaking Of New Tomatin Affordable Housing In Strathdearn

May 04, 2025