Leveraged Semiconductor ETFs: Investor Exodus Before Recent Gains

Table of Contents

The Recent Investor Exodus: Understanding the Why

The initial flight from Leveraged Semiconductor ETFs wasn't entirely unexpected. Several factors contributed to this cautious retreat:

-

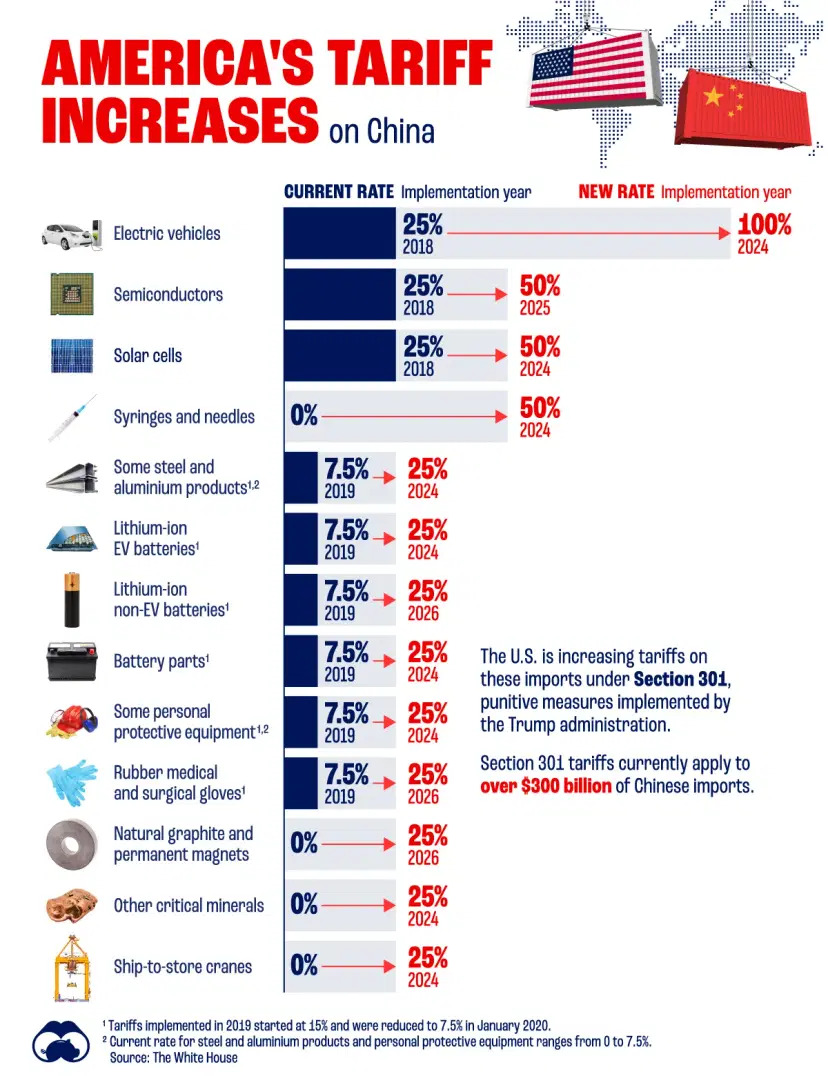

Market Volatility and Uncertainty: The semiconductor industry is notoriously cyclical, prone to periods of intense growth followed by sharp corrections. Uncertainty surrounding global economic conditions, geopolitical tensions, and supply chain disruptions fueled investor anxiety. The inherent volatility of the semiconductor market is significantly magnified in leveraged ETFs, making them a riskier proposition during turbulent times.

-

Concerns about Sustainability: The rapid growth experienced by the semiconductor sector in recent years led some to question its sustainability. Concerns about a potential bubble and the subsequent correction heightened apprehension among investors considering leveraged semiconductor ETF investments.

-

Fear of Significant Losses: The leveraged nature of these ETFs is a double-edged sword. While they amplify gains during bull markets, they also amplify losses during bear markets. This inherent risk made many investors hesitant, particularly during periods of increased market uncertainty. Many investors lacked the experience or risk tolerance needed for leveraged investing in a volatile sector.

-

Alternative Investment Opportunities: The availability of other investment options, such as broader market ETFs or individual semiconductor stocks offering a more controlled exposure, drew investors away from the higher-risk leveraged semiconductor ETF market.

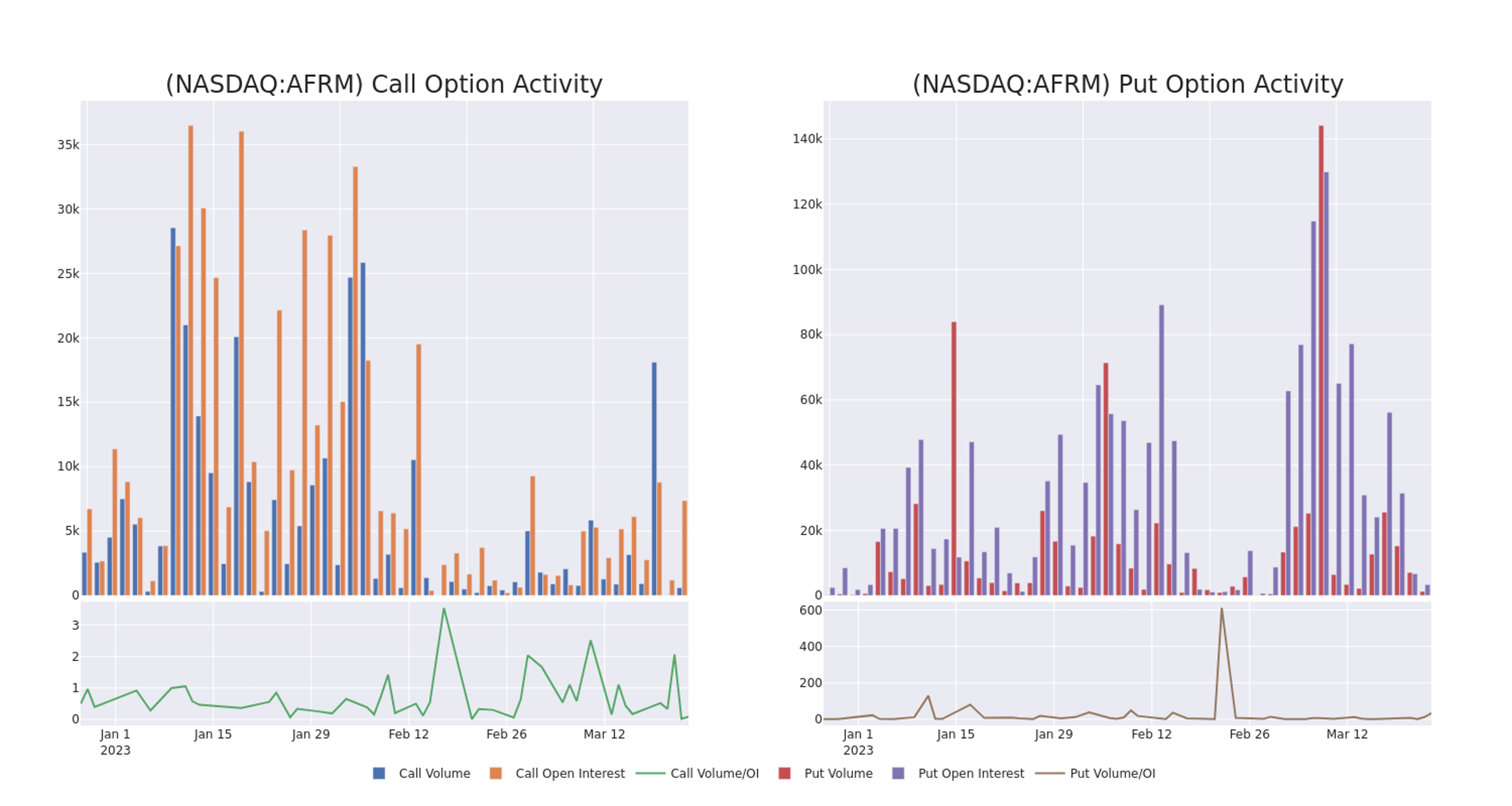

Data from ETF flow reports throughout Q1 and Q2 of 2023 (replace with actual data and sources if available) clearly illustrate this investor exodus. The net outflow from several key leveraged semiconductor ETFs underscores the prevailing sentiment of caution. Keywords like "semiconductor ETF," "leveraged investing," and "market volatility" were heavily searched around this time, reflecting the public's heightened awareness.

The Unexpected Rebound: Analyzing Recent Gains

Despite the initial exodus, Leveraged Semiconductor ETFs have recently experienced a significant surge in prices. This unexpected rebound can be attributed to several factors:

-

Positive Earnings Reports: Strong earnings reports from major semiconductor companies have injected renewed confidence into the sector. These positive results signaled robust demand and profitability, boosting investor sentiment and driving up the price of related ETFs.

-

Increased Demand: Growing demand for semiconductors across various sectors, including automotive, consumer electronics, and artificial intelligence, has contributed to the price increase. This increased demand outweighed earlier concerns about oversupply and market saturation.

-

Government Policies and Investments: Government initiatives aimed at boosting domestic semiconductor production and technological advancement have further supported the sector's growth and investor confidence.

Specific events, like the announcement of a major new semiconductor fabrication plant (replace with real example if available), triggered significant upward movements in leveraged semiconductor ETF prices. Comparing the performance of leveraged semiconductor ETFs to their unleveraged counterparts reveals a clear amplification effect, demonstrating the power (and risk) of leverage in this volatile market. Keywords such as "ETF performance," "market rebound," "semiconductor stocks," and "investment strategy" are key terms to help investors discover and understand this.

Risk Management in Leveraged Semiconductor ETFs

Investing in Leveraged Semiconductor ETFs necessitates a thorough understanding of the inherent risks:

-

Volatility Decay: This is a crucial concept for long-term investors. Because leveraged ETFs reset their leverage daily, prolonged periods of sideways or slightly negative movement can lead to significant erosion of capital, even if the underlying index eventually recovers.

-

Diversification and Risk Tolerance: Diversification is paramount. Relying solely on Leveraged Semiconductor ETFs exposes investors to considerable risk. A well-diversified portfolio that includes other asset classes can mitigate potential losses. Investors should carefully assess their risk tolerance before allocating any funds to these types of ETFs.

-

Alternative Investment Strategies: Investors seeking exposure to the semiconductor industry may consider alternative strategies, such as investing in individual semiconductor stocks or unleveraged sector ETFs, to better manage their risk.

Keywords like "risk assessment," "volatility decay," "investment risk," and "diversification strategy" are important for readers researching this investment option.

Future Outlook: Are Leveraged Semiconductor ETFs a Buy?

Predicting the future of any investment is inherently challenging. However, by analyzing market trends and expert forecasts, we can offer a balanced perspective:

-

Market Trends and Predictions: The semiconductor industry is projected to continue its growth, albeit at a potentially moderated pace. However, geopolitical uncertainties and cyclical market fluctuations remain significant risks.

-

Potential Risks and Rewards: Leveraged Semiconductor ETFs offer the potential for significant returns, but the risks are equally substantial. Understanding the magnified impact of market volatility is crucial.

-

Different Scenarios and Implications: Various scenarios—ranging from sustained growth to a market correction—should be considered, along with their respective implications for investors in leveraged semiconductor ETFs.

Keywords such as "market outlook," "future predictions," "investment opportunities," and "semiconductor market forecast" will help attract potential readers searching for information on future trends.

Conclusion: Leveraged Semiconductor ETFs: Navigating the Volatility

The recent volatility in Leveraged Semiconductor ETFs highlights the importance of understanding the risks involved in leveraged investing. While these ETFs offer the potential for amplified returns, they also amplify losses. The recent investor exodus and subsequent rebound underscore the need for careful analysis and a realistic assessment of one's risk tolerance. Before committing capital, thorough research is essential. Learn more about leveraging your investment strategy with leveraged semiconductor ETFs and make informed decisions based on your risk profile. (Insert link to relevant resources here)

Featured Posts

-

Miami Open 2024 Sabalenka Claims Victory Over Pegula

May 13, 2025

Miami Open 2024 Sabalenka Claims Victory Over Pegula

May 13, 2025 -

Sneak Peek Elsbeth And The Family Business In S02 E14

May 13, 2025

Sneak Peek Elsbeth And The Family Business In S02 E14

May 13, 2025 -

5 1 Hollywoodi Par Akik A Kepernyon Szerelmesek Voltak De A Valosagban Nem Birtak Egymast

May 13, 2025

5 1 Hollywoodi Par Akik A Kepernyon Szerelmesek Voltak De A Valosagban Nem Birtak Egymast

May 13, 2025 -

Cubs Vs Dodgers 2 05 Ct Game Lineups Tv Schedule And Live Discussion

May 13, 2025

Cubs Vs Dodgers 2 05 Ct Game Lineups Tv Schedule And Live Discussion

May 13, 2025 -

Deconstructing Ethan Slaters Part In Elsbeth Season 2 Episode 17

May 13, 2025

Deconstructing Ethan Slaters Part In Elsbeth Season 2 Episode 17

May 13, 2025

Latest Posts

-

Analysis How Tariffs Are Stifling Initial Public Offerings

May 14, 2025

Analysis How Tariffs Are Stifling Initial Public Offerings

May 14, 2025 -

Tariff Wars Freeze Ipo Market Understanding The Economic Impact

May 14, 2025

Tariff Wars Freeze Ipo Market Understanding The Economic Impact

May 14, 2025 -

Robust Trading Volume Propels Ice Nyse Parent To Beat Q1 Profit Estimates

May 14, 2025

Robust Trading Volume Propels Ice Nyse Parent To Beat Q1 Profit Estimates

May 14, 2025 -

The Trump Tariff Effect How It Changed The Landscape For Fintech Ipos Like Affirm Holdings Afrm

May 14, 2025

The Trump Tariff Effect How It Changed The Landscape For Fintech Ipos Like Affirm Holdings Afrm

May 14, 2025 -

Ipo Activity Halts Amid Tariff Driven Market Chaos A Deep Dive

May 14, 2025

Ipo Activity Halts Amid Tariff Driven Market Chaos A Deep Dive

May 14, 2025