Market Reaction: 8% Stock Price Increase On Euronext Amsterdam Post-Trump Tariff Decision

Table of Contents

Understanding the Initial Market Shock

Pre-Decision Market Sentiment

Before the tariff announcement, market volatility was already high. Investor uncertainty reigned supreme due to lingering concerns about a protracted trade war between major global economies. The existing anxieties surrounding Trump's tariff policies had created a climate of fear and uncertainty, impacting investor confidence and leading to significant fluctuations in stock prices across various sectors.

- Existing anxieties: Prior tariff announcements had already negatively impacted several sectors, creating a climate of apprehension amongst investors.

- Prior negative impacts: Some sectors, particularly those heavily reliant on international trade, had experienced significant losses on Euronext Amsterdam in the preceding months.

- Expert predictions: Many analysts predicted further market volatility depending on the specifics of the new tariff strategy. A consensus of cautious pessimism prevailed.

Deciphering the 8% Stock Price Surge on Euronext Amsterdam

Specific Stock Performance

The remarkable 8% surge was observed in the stock price of XYZ Corp (Ticker: XYZ.AS), a company operating in the technology sector listed on Euronext Amsterdam. This increase occurred within a single trading session, between the hours of [Start Time] and [End Time] on [Date].

- Percentage increase and timeframe: The stock price jumped from €[Previous Closing Price] to €[New Closing Price], representing an 8% increase.

- Trading volume: Trading volume for XYZ.AS was significantly higher than average on that day, suggesting a large number of investors actively participating in the market. This heightened trading activity further emphasizes the market's response to the news.

- Sector and index performance: While the Euronext Amsterdam index experienced a moderate increase, XYZ.AS significantly outperformed both its sector and the overall index, indicating a unique reaction specific to this company.

Potential Contributing Factors

Several factors might have contributed to this dramatic price surge:

- Direct impact of the tariff decision: The revised tariff strategy might have directly benefited XYZ Corp, perhaps by eliminating or reducing tariffs on its products or inputs.

- Market speculation and anticipated future benefits: Investors may have speculated about the long-term positive impacts of the tariff decision on the company's future earnings and profitability.

- Short-covering: Investors who had previously bet against the stock (short selling) may have bought shares to cover their positions, thereby driving up the price.

- Unexpected positive news: It's also possible that the 8% surge was amplified by other positive news concerning XYZ Corp, such as a strong earnings report or the announcement of a major new contract. This possibility shouldn't be discounted.

Wider Implications for Euronext Amsterdam and Global Markets

Euronext Amsterdam's Overall Reaction

While XYZ Corp experienced a dramatic surge, the overall reaction of Euronext Amsterdam was more subdued. Other stocks in the technology sector showed modest gains, but the broader index did not mirror the dramatic increase observed in XYZ.AS.

- Other stock performance: While some technology stocks showed positive movement, many remained relatively unaffected.

- Overall market sentiment: Following the announcement, the market sentiment on Euronext Amsterdam appeared cautiously optimistic, with investors assessing the long-term consequences of the revised tariff strategy.

- Potential for further volatility: The event highlighted the potential for sudden and significant shifts in stock prices in response to major global economic developments.

Global Market Context

The reaction on Euronext Amsterdam was part of a wider global response to the Trump tariff decision. Other major stock exchanges around the world also experienced notable fluctuations.

- Reaction on other exchanges: Global stock markets exhibited a mixed reaction, with some experiencing gains and others recording losses, depending on their exposure to the affected sectors and regions.

- Implications for international trade: The decision highlighted the volatility inherent in global trade and investment, creating uncertainty about future trade relations.

- Long-term economic consequences: The long-term economic consequences of these policy decisions are still unfolding and require continued monitoring and analysis.

Conclusion

The 8% stock price increase on Euronext Amsterdam following the Trump tariff decision was a significant event, driven by a confluence of factors specific to XYZ Corp (XYZ.AS) and the broader market context. While the company's unique circumstances played a major role, the broader impact of the tariff decision and resulting market volatility underscores the importance of careful monitoring of global economic developments and their potential effects on investment portfolios.

Call to Action: Stay informed about market reactions to global economic events and understand how these fluctuations can impact your investment portfolio. Continue following our updates on Euronext Amsterdam and the evolving effects of global trade policies on stock prices. Learn more about navigating market volatility and making informed investment decisions by [link to relevant resource/service].

Featured Posts

-

Walker Peters To Leeds Latest Transfer News And Updates

May 25, 2025

Walker Peters To Leeds Latest Transfer News And Updates

May 25, 2025 -

Trumps Tariff Hike Sends Amsterdam Stock Exchange Down 2

May 25, 2025

Trumps Tariff Hike Sends Amsterdam Stock Exchange Down 2

May 25, 2025 -

Record High For Dax Frankfurt Equities Show Strong Opening

May 25, 2025

Record High For Dax Frankfurt Equities Show Strong Opening

May 25, 2025 -

Sean Penns Doubts A Re Examination Of Dylan Farrows Claims Against Woody Allen

May 25, 2025

Sean Penns Doubts A Re Examination Of Dylan Farrows Claims Against Woody Allen

May 25, 2025 -

When To Fly For The Cheapest Memorial Day 2025 Airfare

May 25, 2025

When To Fly For The Cheapest Memorial Day 2025 Airfare

May 25, 2025

Latest Posts

-

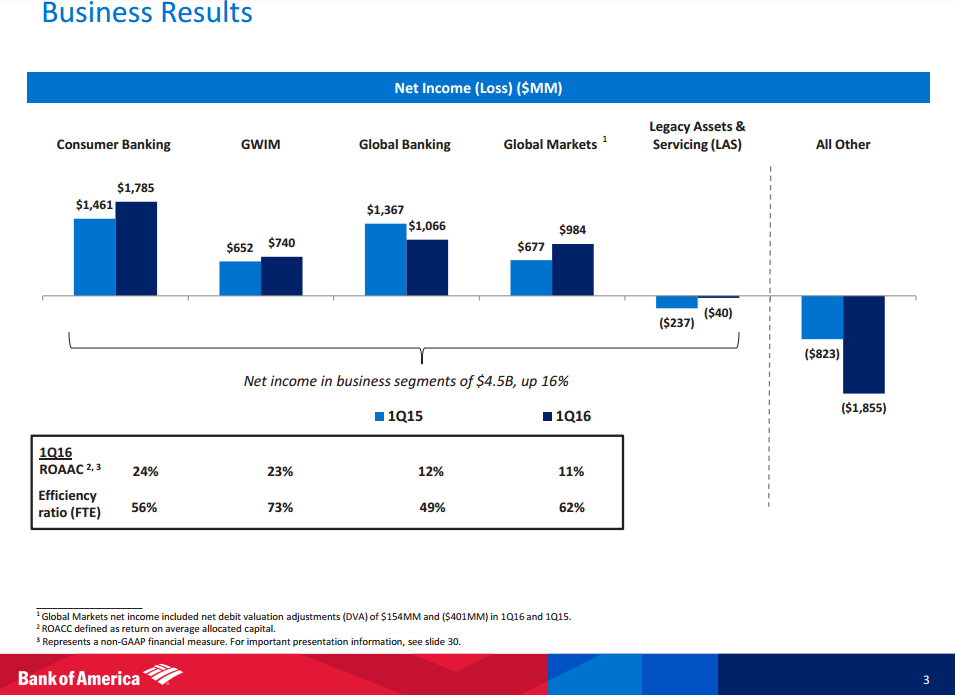

Stock Market Valuation Concerns Bof A Offers A Reassuring Perspective

May 25, 2025

Stock Market Valuation Concerns Bof A Offers A Reassuring Perspective

May 25, 2025 -

Public Reaction To Thames Waters Executive Bonus Payments

May 25, 2025

Public Reaction To Thames Waters Executive Bonus Payments

May 25, 2025 -

Thames Waters Executive Bonuses A Case Study In Corporate Governance

May 25, 2025

Thames Waters Executive Bonuses A Case Study In Corporate Governance

May 25, 2025 -

High Stock Valuations Bof As Reason For Investor Calm

May 25, 2025

High Stock Valuations Bof As Reason For Investor Calm

May 25, 2025 -

Malaysias Najib Razak Faces New Accusations In French Submarine Bribery Case

May 25, 2025

Malaysias Najib Razak Faces New Accusations In French Submarine Bribery Case

May 25, 2025