Net Asset Value (NAV) Fluctuations: Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the total value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. It reflects the intrinsic value of each share. Regularly monitoring the NAV helps investors gauge the ETF's performance and compare it to its market price. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, understanding NAV fluctuations is essential because this ETF tracks the MSCI World Index, a broad global equity market benchmark, and therefore is subject to various market forces.

The Amundi MSCI World II UCITS ETF USD Hedged Dist offers investors exposure to a large number of global companies, providing diversification across various sectors and geographies. Its USD hedging strategy aims to mitigate the impact of currency fluctuations for US dollar-based investors. This article will delve into the factors that influence the NAV of this specific ETF.

Factors Influencing NAV Fluctuations in the Amundi MSCI World II UCITS ETF USD Hedged Dist

Several factors contribute to the fluctuations in the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist. Understanding these factors is vital for informed investment decisions.

Market Performance

- Global Market Movements: The primary driver of NAV changes is the performance of the underlying assets—the global equities within the MSCI World Index. Positive market movements generally lead to NAV increases, while negative movements result in decreases. Significant market events, like economic recessions or bull markets, directly affect the NAV.

- Macroeconomic Factors: Broad economic trends such as interest rate changes, inflation rates, and geopolitical instability significantly impact global market sentiment and, consequently, the ETF's NAV. High inflation, for example, can lead to decreased investor confidence and lower NAVs.

- Sector Performance: The MSCI World Index comprises companies from various sectors. Strong performance in certain sectors (e.g., technology) can boost the overall NAV, while underperformance in others (e.g., energy) can negatively impact it.

Currency Fluctuations

- USD Hedging Impact: The "USD Hedged" aspect of the ETF aims to minimize the effect of currency exchange rate fluctuations between the USD and other currencies represented in the underlying index. However, this hedging is not perfect and residual currency risks remain.

- Exchange Rate Volatility: Fluctuations in exchange rates between the USD and other currencies can still affect the NAV, even with hedging in place. Significant shifts in exchange rates can create gains or losses that impact the overall NAV.

- Hedging Strategy Effectiveness: The effectiveness of the USD hedging strategy employed by Amundi is a crucial consideration. Investors should understand the methodology used and its limitations.

ETF Expenses and Management Fees

- Expense Ratio Impact: The ETF's expense ratio, which covers management fees and operational costs, directly impacts the NAV over time. A higher expense ratio eats into returns, resulting in a lower NAV compared to an ETF with a lower expense ratio.

- Management Fees: Management fees are a significant part of the expense ratio. Understanding these fees and how they affect long-term returns is crucial for evaluating the ETF's overall value proposition.

Supply and Demand

- Trading Volume and Investor Sentiment: High trading volume often indicates strong investor interest, potentially pushing the market price above the NAV. Conversely, low trading volume may result in a market price below the NAV. Investor sentiment also plays a role. Positive sentiment can drive up the market price, while negative sentiment can lead to declines.

- ETF Trading Price vs. NAV: While the NAV represents the intrinsic value, the market price can fluctuate due to supply and demand. Arbitrage opportunities can sometimes exist where the market price deviates significantly from the NAV, allowing for short-term profit opportunities for sophisticated traders.

Analyzing Historical NAV Data for the Amundi MSCI World II UCITS ETF USD Hedged Dist

Analyzing historical NAV data is crucial for understanding the ETF's performance and potential risks.

Data Sources

Reliable sources for accessing historical NAV data include:

- Amundi's Website: The official website of Amundi is a primary source for accurate and up-to-date NAV information.

- Financial News Websites: Major financial news providers, such as Yahoo Finance or Google Finance, typically offer historical ETF data, including NAV.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform will usually provide historical NAV and price information.

Interpreting Data

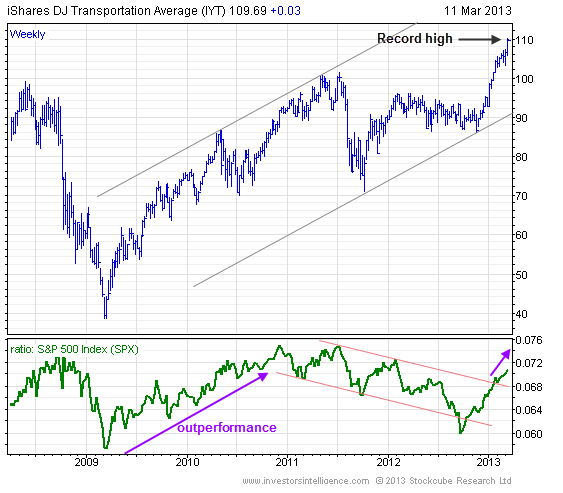

Examine historical NAV charts to identify trends, such as upward or downward trends, periods of high volatility, and significant changes. Compare the NAV's movement to relevant market indices to understand how the ETF's performance relates to the broader market.

Comparing to Benchmarks

Compare the ETF's NAV performance to its benchmark index (MSCI World). This comparison reveals how effectively the ETF tracks its target index and identifies any significant deviations. This comparison is essential for evaluating the ETF manager's performance.

Risk Management and NAV Fluctuations

Managing risk is crucial when investing in ETFs like the Amundi MSCI World II UCITS ETF USD Hedged Dist.

Diversification

Diversifying your investment portfolio across different asset classes reduces the impact of potential NAV fluctuations in a single ETF. Don't put all your eggs in one basket.

Long-Term Investing

A long-term investment approach helps mitigate the effects of short-term NAV volatility. Focus on the long-term growth potential rather than reacting to short-term market fluctuations.

Understanding Your Risk Tolerance

Assess your risk tolerance honestly. If you're averse to significant fluctuations, consider a less volatile investment strategy.

Conclusion: Managing Your Investment in the Amundi MSCI World II UCITS ETF USD Hedged Dist

The NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is influenced by various factors, including global market performance, currency fluctuations, ETF expenses, and supply and demand. Understanding these factors is crucial for making informed investment decisions. Regularly monitoring the NAV, comparing it to the benchmark index, and diversifying your investments are key strategies to manage risk effectively. Before investing, conduct thorough research, analyze historical Net Asset Value (NAV) data, and consider consulting a qualified financial advisor to determine if this ETF aligns with your investment goals and risk tolerance. Remember, understanding Net Asset Value fluctuations is vital for successful long-term investing.

Featured Posts

-

Your Escape To The Country Starts Here A Step By Step Plan

May 25, 2025

Your Escape To The Country Starts Here A Step By Step Plan

May 25, 2025 -

Investigating Burys Missing M62 Link Road

May 25, 2025

Investigating Burys Missing M62 Link Road

May 25, 2025 -

Sejarah Produksi Porsche 356 Di Zuffenhausen Jerman

May 25, 2025

Sejarah Produksi Porsche 356 Di Zuffenhausen Jerman

May 25, 2025 -

Us Band Hints At Glastonbury Performance Unconfirmed Gig Sparks Online Buzz

May 25, 2025

Us Band Hints At Glastonbury Performance Unconfirmed Gig Sparks Online Buzz

May 25, 2025 -

1 Million Country Homes A Realistic Look At The Market And Available Properties

May 25, 2025

1 Million Country Homes A Realistic Look At The Market And Available Properties

May 25, 2025

Latest Posts

-

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Their Significance

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Their Significance

May 25, 2025 -

Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025

Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025 -

Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf A Comprehensive Guide

May 25, 2025

Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf A Comprehensive Guide

May 25, 2025 -

She Waits By The Phone A Tale Of Anticipation

May 25, 2025

She Waits By The Phone A Tale Of Anticipation

May 25, 2025 -

Waiting For The Call A Personal Narrative

May 25, 2025

Waiting For The Call A Personal Narrative

May 25, 2025