Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is the Amundi Dow Jones Industrial Average UCITS ETF?

The Amundi Dow Jones Industrial Average UCITS ETF is a passively managed exchange-traded fund that aims to replicate the performance of the Dow Jones Industrial Average (DJIA). This index comprises 30 of the largest and most influential publicly traded companies in the United States, offering investors broad exposure to the American economy. As a UCITS (Undertakings for Collective Investment in Transferable Securities) compliant ETF, it adheres to strict European regulatory standards, ensuring investor protection. Key features include a typically low expense ratio, making it a cost-effective investment option, and a straightforward replication method, often using a full replication strategy to mirror the index's composition.

This ETF is suitable for a range of investor profiles, including those seeking diversified exposure to large-cap US equities, long-term investors building a portfolio, and those looking for a relatively low-cost way to track the performance of a well-established market benchmark.

- Investment Objective: To track the performance of the Dow Jones Industrial Average.

- Underlying Assets: Shares of the 30 companies comprising the Dow Jones Industrial Average.

- Expense Ratio: (Check Amundi's website for the most up-to-date expense ratio). This is a key factor to consider when comparing ETFs.

- Trading Symbol: (Check your brokerage platform for the specific trading symbol).

How is the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Calculated?

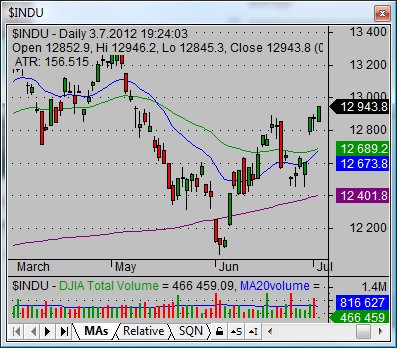

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF, like other ETFs, is calculated daily, typically at the market close. This calculation reflects the net asset value of the fund's holdings. The process involves determining the market value of all underlying assets (the 30 DJIA stocks) and then subtracting any liabilities and expenses incurred by the fund.

- Market Value of Underlying Assets: This is calculated by multiplying the number of shares of each company held by the ETF by the closing price of that share on the relevant exchange.

- Liabilities and Expenses: This includes management fees, administrative costs, and any other outstanding liabilities of the fund.

- Calculation Frequency: Daily, usually at market close.

- Factors Influencing NAV Fluctuations: The primary driver is the performance of the Dow Jones Industrial Average itself. Other factors, though generally smaller in impact, include currency exchange rates (if the ETF holds international assets), dividend payouts from the underlying companies, and corporate actions such as mergers or stock splits. The bid and ask price you see when trading the ETF will differ slightly from the NAV due to market supply and demand.

Where to Find the Daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF?

Accessing the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. You can find this crucial information from several reliable sources:

- Amundi's Official Website: Amundi, the fund manager, typically publishes daily NAVs on their investor relations section of their website.

- Major Financial Data Providers: Reputable financial news websites and data providers (like Bloomberg, Yahoo Finance, etc.) usually list ETF NAVs, including that of the Amundi DJIA ETF.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the NAV will usually be displayed alongside other relevant information on your account statement.

- Data Aggregators: Several websites specialize in aggregating financial data, offering comprehensive information on ETFs, including NAVs.

It's crucial to access the NAV at the correct time of day – usually at or near the market close – to get the most accurate reflection of the fund's value. Using outdated NAV data could lead to inaccurate investment decisions.

Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

The primary driver of the Amundi Dow Jones Industrial Average UCITS ETF's NAV is the performance of the Dow Jones Industrial Average itself. If the DJIA rises, the ETF's NAV generally rises as well, and vice-versa. Other factors influence the NAV to a lesser degree:

- Dow Jones Industrial Average Performance: This is the most significant factor. Positive movements in the DJIA generally result in a corresponding increase in the ETF's NAV.

- Currency Exchange Rates: While the DJIA is denominated in USD, currency fluctuations could impact the NAV if the ETF holds assets in other currencies.

- Dividend Payouts: Dividends paid by the underlying companies in the DJIA will generally increase the NAV (though may be offset by the simultaneous decrease in the share price due to ex-dividend date).

- Corporate Actions: Mergers, acquisitions, stock splits, and other corporate actions involving the underlying companies can also impact the ETF's NAV.

Conclusion: Monitoring the Net Asset Value (NAV) for Informed Investment Decisions

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is essential for making informed investment decisions. By regularly monitoring the Amundi DJIA ETF NAV from official sources, you can accurately track the performance of your investment and adjust your strategy accordingly. Remember to consult the official Amundi website and reputable financial data providers for the most accurate and up-to-date information on the Amundi Dow Jones Industrial Average UCITS ETF NAV and other relevant details. Regularly monitoring the Amundi DJIA ETF NAV empowers you to make more confident investment choices. Stay informed and optimize your investment strategy! [Link to Amundi's Website] [Link to a reputable financial news source]

Featured Posts

-

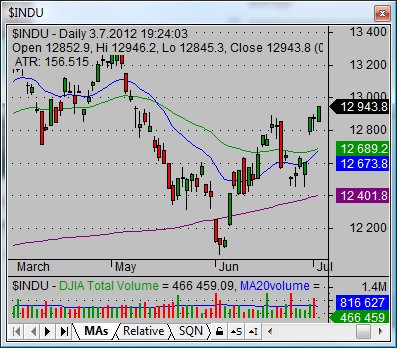

Apple Stock Price How Tariffs Affected Buffetts Investment

May 24, 2025

Apple Stock Price How Tariffs Affected Buffetts Investment

May 24, 2025 -

Over 1 500 Expected At Bangladesh Showcase In The Netherlands

May 24, 2025

Over 1 500 Expected At Bangladesh Showcase In The Netherlands

May 24, 2025 -

Porsche Atidare Nauja Elektromobiliu Ikrovimo Stoti Europoje

May 24, 2025

Porsche Atidare Nauja Elektromobiliu Ikrovimo Stoti Europoje

May 24, 2025 -

Ferrarin Uusi Kyky 13 Vuotias Kuljettaja Liittyy Tiimiin

May 24, 2025

Ferrarin Uusi Kyky 13 Vuotias Kuljettaja Liittyy Tiimiin

May 24, 2025 -

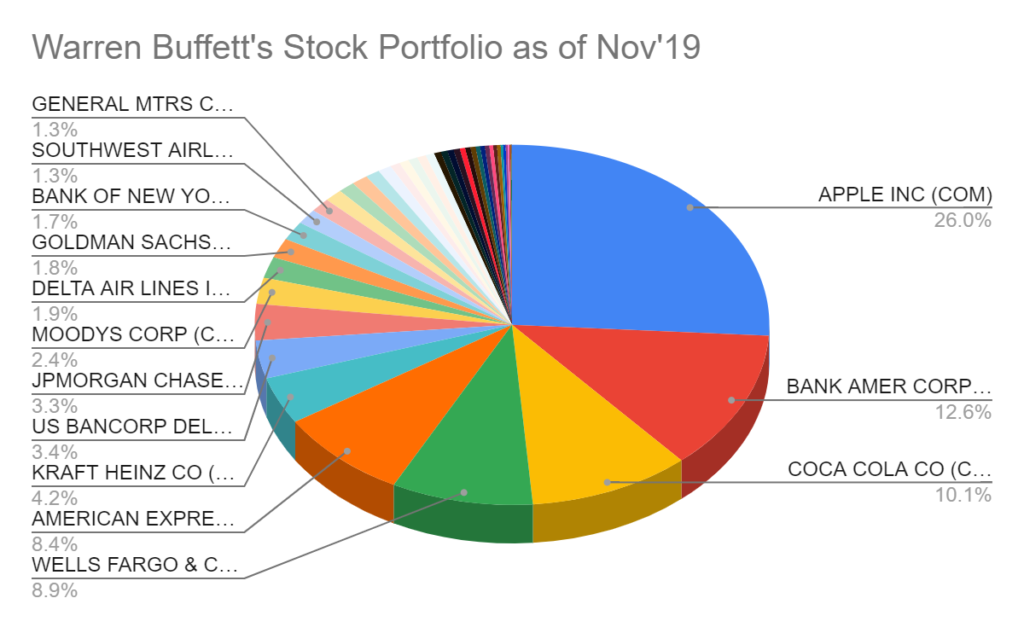

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025

Latest Posts

-

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025 -

Mia Farrow Demands Trumps Arrest For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrow Demands Trumps Arrest For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrow Calls For Trumps Imprisonment Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Imprisonment Over Venezuelan Deportations

May 24, 2025 -

17 Famous Faces Overnight Reputation Ruins

May 24, 2025

17 Famous Faces Overnight Reputation Ruins

May 24, 2025 -

The Downfall 17 Celebrities Whose Images Were Tarnished

May 24, 2025

The Downfall 17 Celebrities Whose Images Were Tarnished

May 24, 2025