Operation Sindoor: Pakistan Stock Market Plunges Over 6%, KSE 100 Halted

Table of Contents

Understanding "Operation Sindoor": The Context and Speculation

The term "Operation Sindoor" itself emerged organically within the market, its origins shrouded in speculation and rumor. "Sindoor," a traditional red powder worn by married Hindu women, has been interpreted in various ways within this context, ranging from symbolic representations of a sudden, impactful event to suggestions of a clandestine operation affecting the market. The lack of official confirmation surrounding the term only adds to the intrigue and uncertainty surrounding the event.

Several narratives and rumors circulated alongside the market plunge. These included:

- Speculation regarding government intervention: Some believed the crash was a result of deliberate government action to curb speculation or address specific economic concerns.

- Impact of political instability: The existing political climate in Pakistan, often marked by uncertainty, was cited as a significant contributing factor by many analysts.

- Role of international factors: The global economic slowdown and international pressure on Pakistan's economy were also considered potential triggers.

- Influence of specific sectors: Certain sectors within the KSE 100 were disproportionately affected, leading to speculation about targeted actions or vulnerabilities within those industries.

The KSE 100 Index: A Detailed Analysis of the Plunge

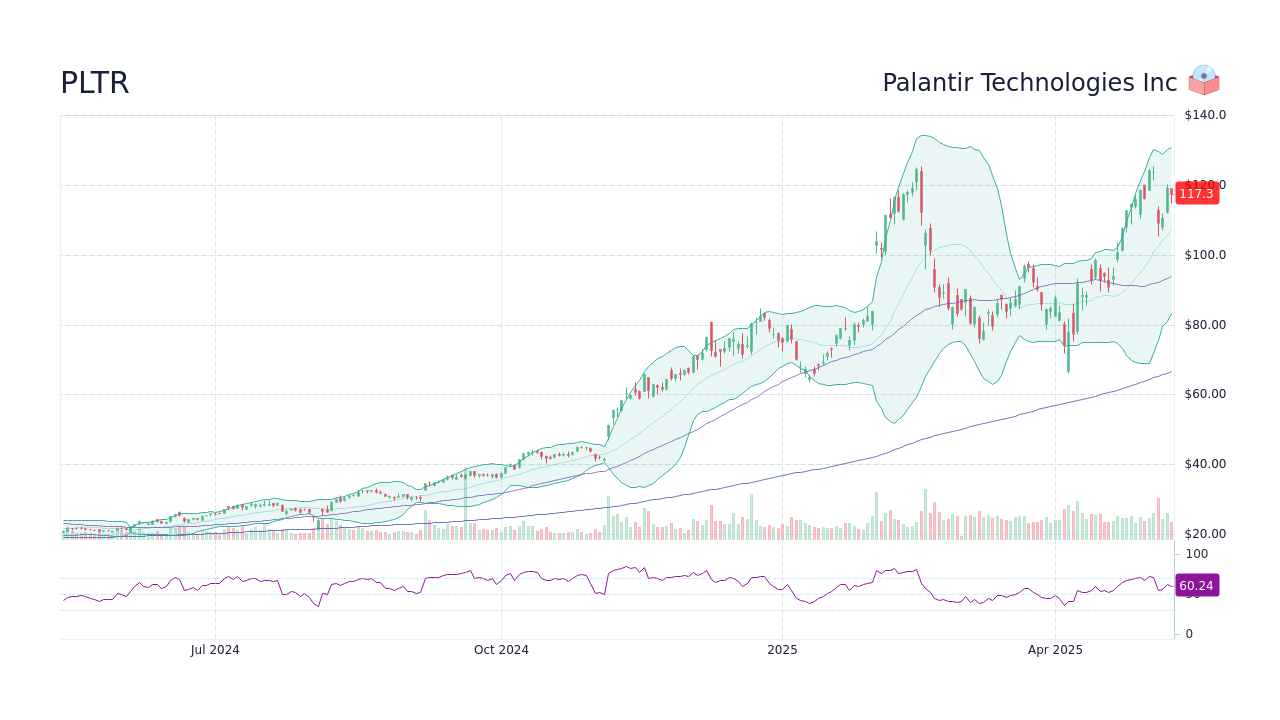

The KSE 100 index experienced a catastrophic drop of over 6% on [Insert Date], a significant event in the history of the Pakistan Stock Market. Trading volume surged as investors reacted to the unfolding crisis, creating a volatile and chaotic trading environment. [Insert chart or graph illustrating the KSE 100 plunge].

The impact wasn't uniform across sectors:

- Breakdown of losses across different sectors: [Specify which sectors were hit hardest, providing data if available].

- Most affected companies: [List the companies that experienced the most significant losses].

- Impact on investor confidence: The crash severely eroded investor confidence, creating widespread uncertainty and fear.

- Comparison with previous market crashes in Pakistan: [Compare the severity and impact of this crash with previous significant events in the Pakistani stock market].

Causes of the Pakistan Stock Market Crash: Unpacking the Factors

The precipitous fall of the KSE 100 index was likely a confluence of several internal and external factors. Pinpointing a single cause is impossible, but the following factors played significant roles:

- Economic instability and inflation: Pakistan's struggling economy, grappling with high inflation and a depreciating currency, made the market vulnerable to shocks.

- Political uncertainty and governance issues: Political instability and uncertainty further exacerbated the economic fragility.

- Foreign exchange reserves depletion: Low foreign exchange reserves limited Pakistan's ability to mitigate economic pressures.

- Impact of global economic slowdown: The global economic slowdown and rising interest rates added to the existing pressures.

- Specific policy decisions or announcements: [Mention any specific government policies or announcements that might have triggered or contributed to the crash].

Consequences and Implications of the Market Crash: Short-term and Long-term Effects

The "Operation Sindoor" event had immediate and far-reaching consequences for Pakistan's economy and its citizens.

- Impact on investor wealth: Countless investors experienced significant losses, eroding their savings and retirement funds.

- Effect on foreign investment: The crash likely deterred foreign investment, further impacting Pakistan's economic recovery prospects.

- Ripple effects on other sectors of the economy: The market crash sent shockwaves through other sectors, potentially hindering economic activity and growth.

- Potential government responses and recovery strategies: The government’s response and the effectiveness of its recovery strategies will be crucial in determining the long-term outcome.

- Long-term implications for economic growth: The crash could have long-term implications for Pakistan's economic growth trajectory, potentially hindering development for years to come.

Expert Opinions and Future Outlook: Analyzing the Path Forward

Financial experts and analysts offer diverse perspectives on the future trajectory of the Pakistan Stock Market following the "Operation Sindoor" event. [Include quotes and analysis from reputable sources].

The outlook remains uncertain, with several potential scenarios:

- Expert predictions on market recovery: [Summarize expert predictions regarding the speed and nature of market recovery].

- Potential government interventions: [Discuss potential government measures to stabilize the market].

- Strategies for investors to navigate the uncertainty: [Provide guidance for investors on navigating this turbulent period].

- Long-term prospects for the PSX: [Offer an outlook on the long-term prospects for the PSX].

Conclusion

The "Operation Sindoor" event, marked by the dramatic plunge of the KSE 100 index, represents a significant crisis for the Pakistan Stock Market. The crash was likely a result of a complex interplay of factors, including economic instability, political uncertainty, and global economic headwinds. The consequences are far-reaching, impacting investor wealth, foreign investment, and the overall economic health of Pakistan. Understanding the dynamics behind this significant event – the causes, consequences, and potential future implications of this "Operation Sindoor" – is critical.

Call to Action: Stay informed about the evolving situation regarding the Pakistan Stock Market and "Operation Sindoor." Follow reputable financial news sources for updates and in-depth analysis on the KSE 100 and the overall economic outlook in Pakistan. Understanding the complexities of the Pakistan Stock Market and events like "Operation Sindoor" is crucial for making informed investment decisions.

Featured Posts

-

Les Verts Visent La Mairie De Dijon Aux Municipales 2026

May 10, 2025

Les Verts Visent La Mairie De Dijon Aux Municipales 2026

May 10, 2025 -

Disney Parks And Streaming Fuel Increased Profit Projections

May 10, 2025

Disney Parks And Streaming Fuel Increased Profit Projections

May 10, 2025 -

Easing Regulations For Bond Forwards A Boon For Indian Insurers

May 10, 2025

Easing Regulations For Bond Forwards A Boon For Indian Insurers

May 10, 2025 -

Palantir Stock Forecast 2025 Is A 40 Rise Realistic

May 10, 2025

Palantir Stock Forecast 2025 Is A 40 Rise Realistic

May 10, 2025 -

Coastal Erosion And Flooding The Impact Of Rising Sea Levels

May 10, 2025

Coastal Erosion And Flooding The Impact Of Rising Sea Levels

May 10, 2025