Palantir Stock: Buy Before May 5th Earnings Report?

Table of Contents

Analyzing Palantir's Recent Performance and Future Outlook

Recent Financial Performance & Key Metrics

Palantir's recent financial reports reveal a mixed bag. While the company has shown consistent revenue growth, profitability remains a key area of focus for investors. For example, in their last quarterly report, Palantir reported a [Insert specific revenue figures and percentage growth]. This represents a [positive/negative] change compared to the same period last year. However, the company's earnings per share (EPS) were [insert EPS figures], leading to [positive/negative] investor reaction. Key performance indicators (KPIs) like customer acquisition cost and average contract value are also crucial to monitoring Palantir's long-term growth trajectory. Analyzing these metrics alongside revenue and EPS provides a holistic view of Palantir's financial health. Tracking "Palantir revenue," "Palantir earnings per share," and "Palantir growth rate" over time allows investors to assess the trend and predict future performance.

- Revenue Growth: [Insert data and analysis]

- Profitability: [Insert data and analysis, including gross margin and operating margin]

- Customer Acquisition: [Insert data and analysis]

- Contract Value: [Insert data and analysis]

Upcoming Earnings Expectations and Analyst Predictions

The upcoming May 5th earnings report is highly anticipated, with analysts offering a range of predictions for Palantir's performance. The consensus forecast suggests [insert consensus forecast], but individual predictions vary considerably, ranging from [low estimate] to [high estimate]. This range reflects the uncertainty surrounding Palantir's future growth and the overall economic climate. Positive surprises might center around exceeding expectations in government contracts or significant progress in their commercial sector. However, potential downside surprises could include slower-than-expected growth or increased operating expenses. Keeping tabs on "Palantir earnings forecast," "Palantir earnings expectations," and "analyst predictions Palantir" from reputable sources is essential for informed decision-making.

Assessing the Risks and Rewards of Investing in Palantir Stock

Market Sentiment and Volatility

Market sentiment towards Palantir stock and the broader tech sector is currently [describe current sentiment – bullish, bearish, neutral]. Palantir's stock price has historically shown significant volatility, making it a riskier investment compared to more stable companies. Understanding "Palantir stock volatility" and its potential impact on your investment is crucial. Analyzing historical stock price data can help you gauge the potential for future fluctuations and the risk tolerance needed to invest in Palantir stock. Any "Palantir stock price prediction" should be treated with caution, as future performance is inherently uncertain.

Competitive Landscape and Industry Trends

Palantir operates in a competitive landscape within the data analytics and artificial intelligence industries. Key competitors include [list key competitors], each vying for market share. However, Palantir's unique focus on government and large enterprise clients gives it a distinct niche. Understanding "Palantir competitors" and their strategies is vital. Emerging industry trends like the increasing adoption of cloud computing and the growing demand for AI-powered solutions are likely to significantly influence Palantir's future performance. Keeping abreast of "data analytics market" trends and "AI industry trends" will help gauge Palantir's long-term viability.

Long-Term Growth Potential vs. Short-Term Risks

Palantir's long-term growth potential is substantial, driven by the increasing demand for data analytics and AI solutions. However, investing in Palantir stock before the May 5th earnings report involves significant short-term risk. A negative earnings surprise could lead to a significant drop in the stock price. Conversely, positive results might trigger a substantial price increase. Carefully weighing "Palantir long-term investment" potential against "Palantir stock risk" is vital. Developing a robust "Palantir investment strategy" that considers both short-term volatility and long-term growth is crucial.

Conclusion: Should You Buy Palantir Stock Before May 5th?

Investing in Palantir stock before the May 5th earnings report requires a careful assessment of the risks and rewards. While Palantir exhibits significant long-term growth potential, the inherent volatility and uncertainty surrounding the upcoming earnings announcement present considerable short-term risks. Our analysis highlights the importance of understanding Palantir's recent financial performance, analyst expectations, market sentiment, and the competitive landscape. Remember, this analysis is not a recommendation to buy or sell Palantir stock. Make an informed decision about investing in Palantir stock before the May 5th earnings report by carefully considering the factors discussed above. Remember to conduct your own thorough research before investing in Palantir or any other stock. Thoroughly analyze Palantir stock and its potential before committing your capital.

Featured Posts

-

Benson Boone And Harry Styles Addressing The Similarities In Their Music

May 10, 2025

Benson Boone And Harry Styles Addressing The Similarities In Their Music

May 10, 2025 -

Abcs High Potential Season 1 Finale And Its Impact

May 10, 2025

Abcs High Potential Season 1 Finale And Its Impact

May 10, 2025 -

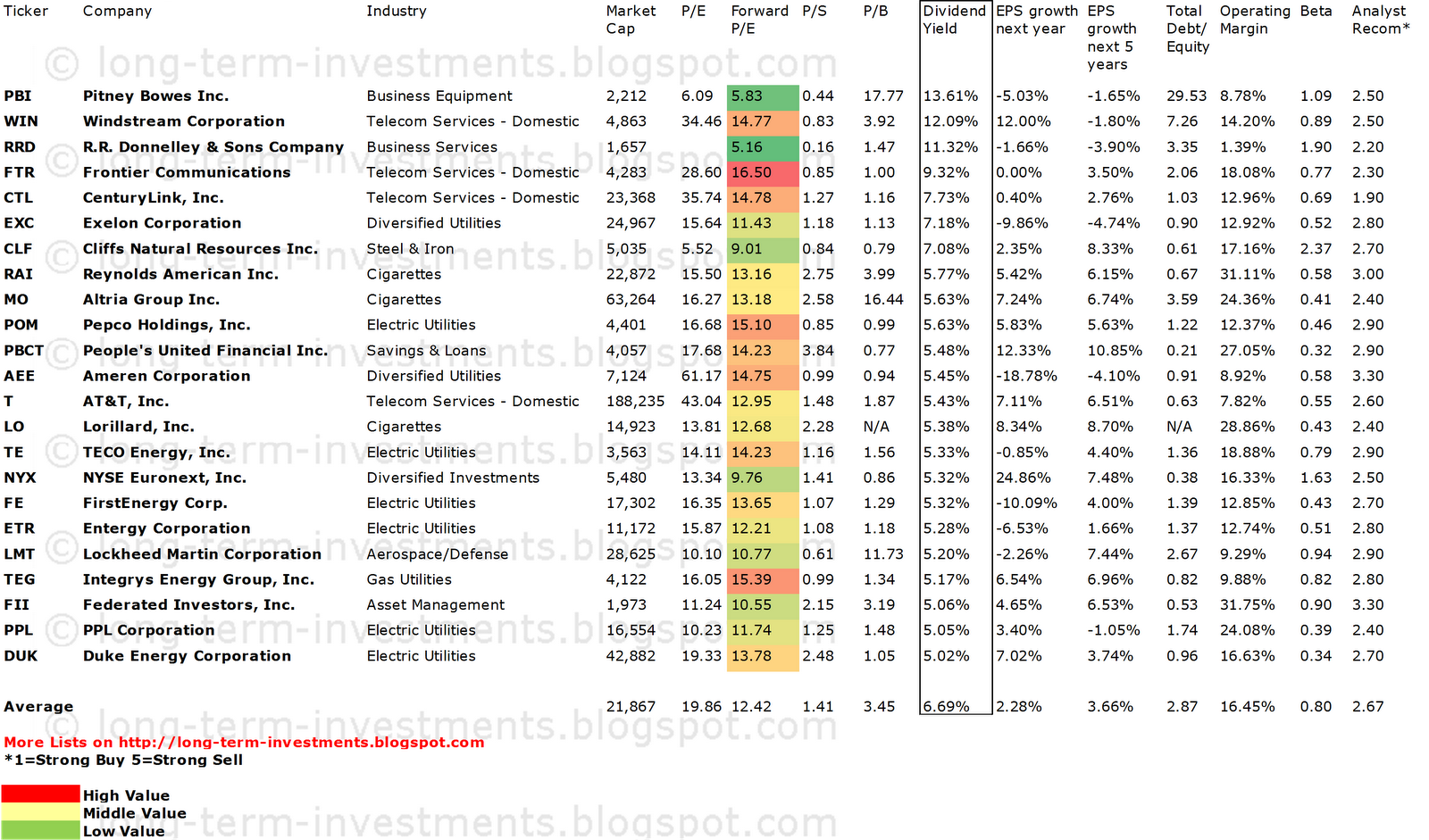

High Yield Dividend Investing A Simple Effective Strategy

May 10, 2025

High Yield Dividend Investing A Simple Effective Strategy

May 10, 2025 -

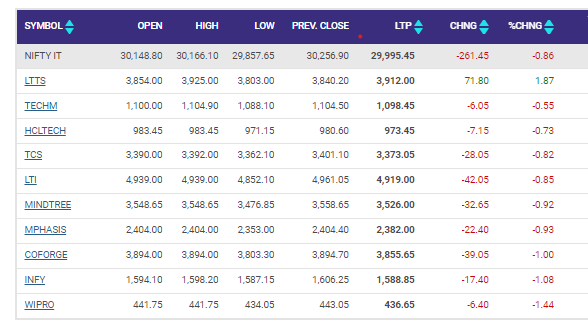

Sensex Today 100 Point Gain Nifty Above 17 950 Market Analysis

May 10, 2025

Sensex Today 100 Point Gain Nifty Above 17 950 Market Analysis

May 10, 2025 -

Njwm Krt Alqdm Waltbgh Qss Mlhmt Webr

May 10, 2025

Njwm Krt Alqdm Waltbgh Qss Mlhmt Webr

May 10, 2025