Power Finance Corporation Announces FY25 Dividend On March 12th

Table of Contents

Key Details of the PFC FY25 Dividend Announcement

This section outlines the essential aspects of the recently announced PFC dividend.

Dividend Amount and Type

Power Finance Corporation declared a dividend of INR X per share (replace X with the actual amount). This is a (specify: interim, final, or special) dividend, paid out in cash.

- Total Dividend Payout: The total dividend payout amounts to INR Y (replace Y with the actual amount).

- Tax Implications: The dividend is subject to applicable taxes as per the prevailing Indian tax laws. Investors should consult their tax advisors for specific guidance.

Record Date and Payment Date

The record date for the PFC FY25 dividend is (Insert Date). This is the crucial date that determines which shareholders are eligible to receive the dividend. The payment date, when shareholders will receive their dividend, is (Insert Date).

- Ex-Dividend Date: The ex-dividend date is (Insert Date). Shares purchased on or after this date will not be eligible for the dividend.

- Potential Delays: While PFC aims for timely payment, unforeseen circumstances could lead to minor delays. Shareholders should monitor official PFC announcements for any updates.

Impact on PFC Share Price

While it's impossible to predict with certainty, dividend announcements often have both short-term and long-term impacts on a company's share price.

- Typical Market Reactions: Generally, dividend announcements can cause a slight dip in share price immediately before the ex-dividend date, followed by potential stabilization or even a slight increase if the market perceives the dividend as a positive sign of the company's financial health.

- Relevant News Sources: For more detailed market analysis and commentary on the impact of the dividend announcement on PFC's share price, refer to reputable financial news sources like (link to relevant news sources).

PFC's Financial Performance in FY25

Understanding PFC's financial health during FY25 is crucial for evaluating the dividend announcement.

Profitability and Growth

PFC demonstrated (describe the performance – strong, moderate, etc.) profitability and growth in FY25. (Insert specific figures for Net Profit, Revenue, and percentage growth compared to the previous fiscal year).

- Key Financial Ratios: Relevant financial ratios such as Return on Equity (ROE) and Profit Margin were (insert figures and analysis).

- Official Sources: These figures are derived from PFC's official financial reports available on (link to the official PFC website).

Debt and Liquidity

PFC maintains a (describe the debt position – healthy, manageable, etc.) debt level and a strong liquidity position, ensuring its capacity to pay out dividends without compromising its financial stability.

- Credit Ratings: PFC holds credit ratings of (mention credit ratings and agencies).

- Significant Investments: During FY25, PFC undertook significant investments in (mention key investments or acquisitions, if any).

Future Outlook for Power Finance Corporation

PFC's future performance significantly influences the sustainability of its dividend policy.

Growth Prospects

The Indian power sector's projected growth, coupled with supportive government policies, presents promising growth prospects for PFC.

- Upcoming Projects: PFC is involved in several upcoming projects focusing on (mention key project areas).

- Potential Challenges: The company may face challenges relating to (mention potential challenges like regulatory changes, competition, etc.).

Dividend Policy

PFC's dividend policy aims to (describe the policy – provide consistent returns to shareholders, etc.).

- Historical Payout Ratio: PFC's historical dividend payout ratio has been (mention the average ratio).

- Management Statements: PFC management (mention any statements made by management regarding future dividends and their outlook).

Conclusion

The Power Finance Corporation FY25 dividend announcement, released on March 12th, offers valuable insights into the company's financial standing and future trajectory. Investors must carefully assess the dividend details—amount, record date, and payment date—along with PFC's financial performance and future prospects. This comprehensive analysis aids informed investment decisions concerning PFC shares. Continue monitoring Power Finance Corporation's announcements and financial reports to make well-informed investment choices. Remember to consult your financial advisor before making any investment decisions related to the Power Finance Corporation dividend or its shares.

Featured Posts

-

El Regreso Triunfal De Bencic Campeona A Nueve Meses De Ser Madre

Apr 27, 2025

El Regreso Triunfal De Bencic Campeona A Nueve Meses De Ser Madre

Apr 27, 2025 -

Belinda Bencics Post Maternity Return Abu Dhabi Final

Apr 27, 2025

Belinda Bencics Post Maternity Return Abu Dhabi Final

Apr 27, 2025 -

Canadas Calculated Wait Assessing Leverage In Us Trade Talks

Apr 27, 2025

Canadas Calculated Wait Assessing Leverage In Us Trade Talks

Apr 27, 2025 -

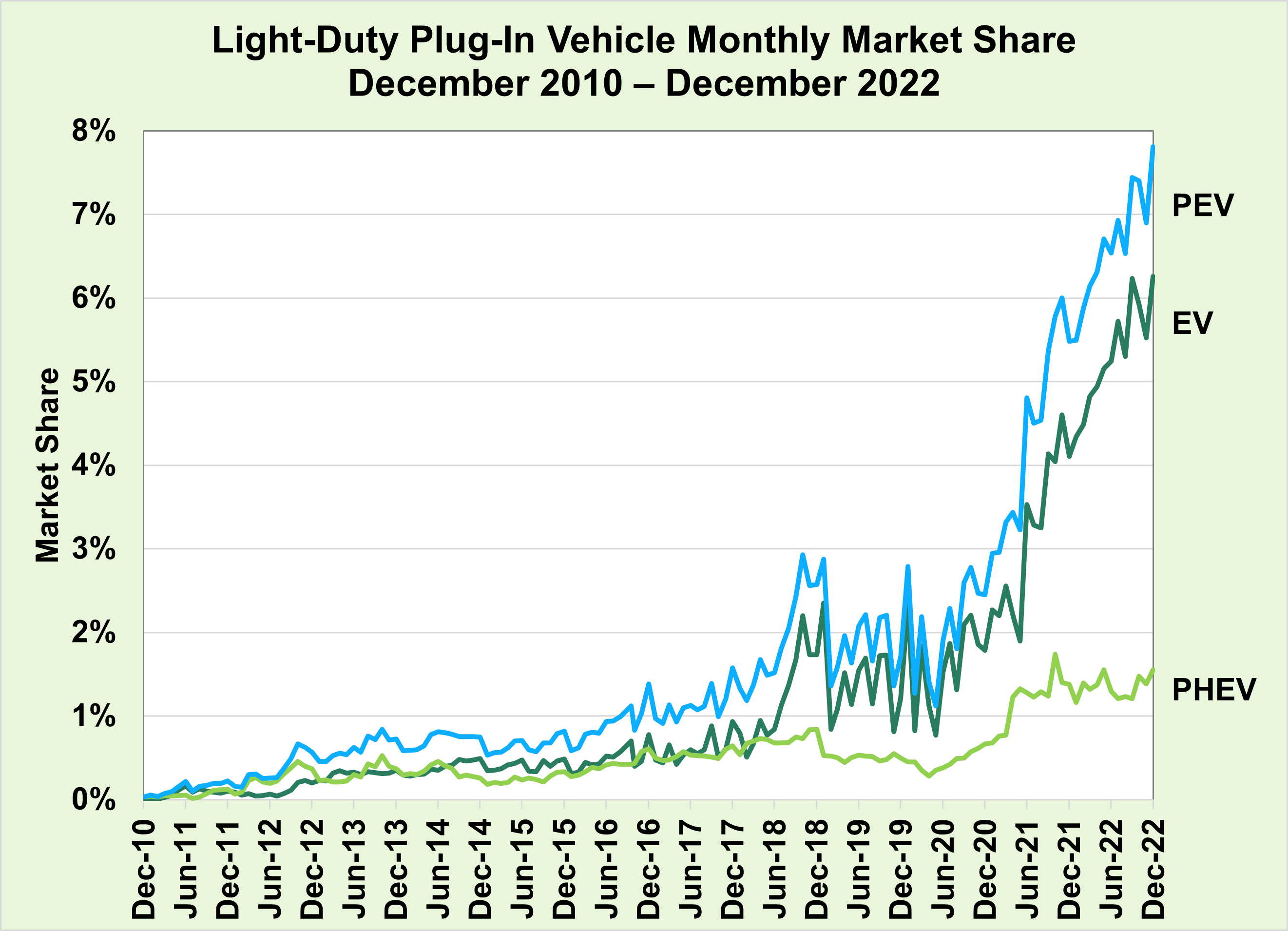

Teslas Canadian Price Hike Pre Tariff Vehicle Sales Strategy

Apr 27, 2025

Teslas Canadian Price Hike Pre Tariff Vehicle Sales Strategy

Apr 27, 2025 -

Ariana Grandes Dip Dyed Ponytail A Look At The Swarovski Campaign

Apr 27, 2025

Ariana Grandes Dip Dyed Ponytail A Look At The Swarovski Campaign

Apr 27, 2025

Latest Posts

-

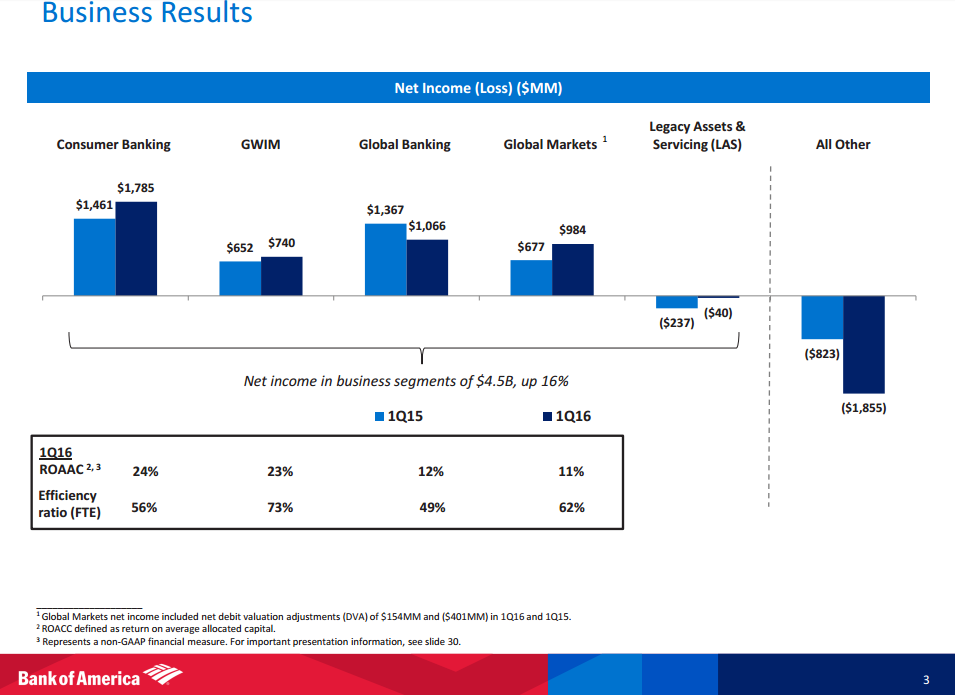

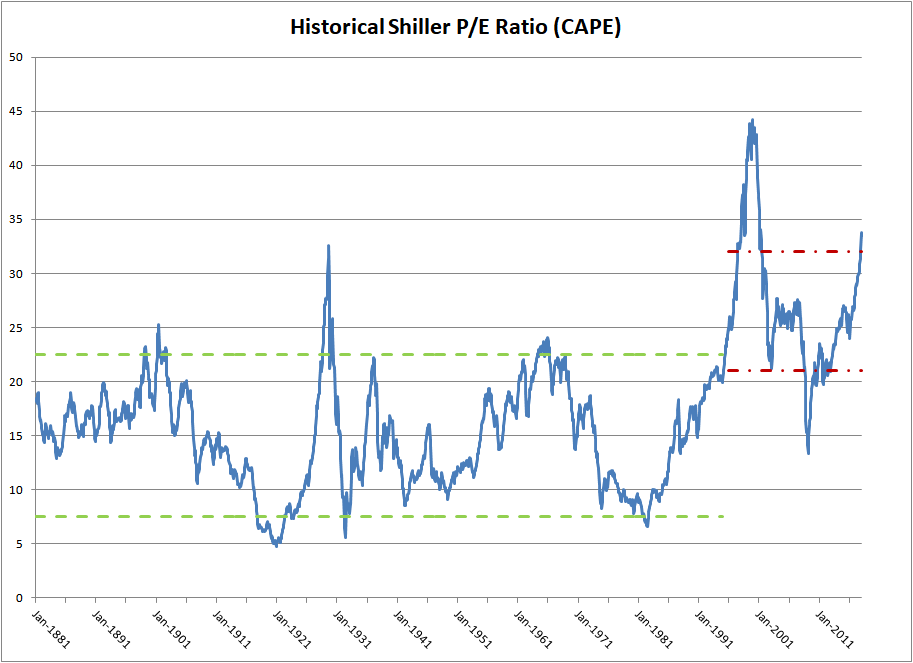

Why Current Stock Market Valuations Shouldnt Deter Investors A Bof A View

Apr 27, 2025

Why Current Stock Market Valuations Shouldnt Deter Investors A Bof A View

Apr 27, 2025 -

Stock Market Valuation Concerns Bof A Offers A Reason For Optimism

Apr 27, 2025

Stock Market Valuation Concerns Bof A Offers A Reason For Optimism

Apr 27, 2025 -

Understanding High Stock Market Valuations A Bof A Analysis For Investors

Apr 27, 2025

Understanding High Stock Market Valuations A Bof A Analysis For Investors

Apr 27, 2025 -

Bof A On Stock Market Valuations Why Investors Should Remain Confident

Apr 27, 2025

Bof A On Stock Market Valuations Why Investors Should Remain Confident

Apr 27, 2025 -

Dismissing Stock Market Valuation Concerns Insights From Bof A

Apr 27, 2025

Dismissing Stock Market Valuation Concerns Insights From Bof A

Apr 27, 2025