Public Meets Private: How BRB's Banco Master Acquisition Will Impact Brazilian Banking

Table of Contents

Increased Market Share and Competition

BRB's acquisition of Banco Master significantly boosts its market share, particularly in the Distrito Federal and surrounding regions. This increased presence intensifies competition within the Brazilian banking sector, potentially leading to more innovative products and services for Brazilian consumers. The competitive landscape Brazil is about to change significantly.

-

Synergistic Opportunities: Both BRB and Banco Master had overlapping client bases, particularly in specific segments like small and medium-sized enterprises (SMEs). The merger offers opportunities to leverage these synergies for increased efficiency and market penetration.

-

Competitive Dynamics: Pre-acquisition, BRB held a solid position, but Banco Master's specialized services and client portfolio add a new dimension. The combined entity now poses a more formidable challenge to larger national banks, potentially reshaping the competitive dynamics within the Brazilian banking sector.

-

Market Share Analysis: By combining their resources and client bases, BRB is projected to increase its market share by [insert projected percentage], solidifying its position as a major player in the Brazilian financial market. This expansion challenges existing market leaders and promises a more dynamic competition in the years to come. This increased competition should theoretically benefit customers.

Impact on Consumers and Services

The BRB Banco Master acquisition will undoubtedly influence the banking experience for Brazilian consumers. While the integration process unfolds, it's crucial to analyze potential changes impacting customer service, fees, and interest rates.

-

Interest Rates and Fees: Banco Master clients might see adjustments in interest rates and banking charges as services are integrated with BRB’s offerings. While BRB might strive to maintain or even lower some fees to attract customers, this is not guaranteed. Transparency in these changes will be key to maintaining customer satisfaction.

-

Digital Banking Transformation: Banco Master's technology and digital banking infrastructure can complement BRB's existing systems, potentially resulting in enhanced online and mobile banking experiences. This could include improved user interfaces, more sophisticated features, and streamlined processes.

-

Customer Service Enhancement: The combined entity's larger scale could allow for investments in improved customer service infrastructure. This could include expanded branch networks, increased staffing levels, and enhanced digital support channels, leading to better accessibility and responsiveness for customers.

-

Customer Experience: The success of the integration will heavily depend on effective communication and a smooth transition for Banco Master clients. A positive customer experience during and after the merger is critical for retaining clients and building trust in the newly combined institution.

Financial Implications and Economic Effects

The BRB Banco Master acquisition carries significant financial implications for BRB itself, as well as broader effects on the Brazilian economy.

-

BRB's Financial Performance: The acquisition's success will depend on effective integration, cost-cutting measures, and synergistic opportunities. This will directly influence BRB's financial performance and overall stability in the coming years.

-

Economic Growth & Investment: A stronger, more competitive BRB could positively contribute to the Brazilian economy by facilitating greater credit availability to businesses and consumers. Increased investment and lending could stimulate economic growth and employment.

-

Regulatory Compliance: The merger must receive all necessary regulatory approvals and comply with Brazilian banking regulations. Any regulatory hurdles or delays could significantly affect the timeline and success of the integration.

-

Sector Consolidation: This merger could be a precursor to further consolidation within the Brazilian banking sector. The potential for future mergers and acquisitions, spurred by this deal, will need to be closely monitored.

Strategic Considerations and Future Outlook

BRB's acquisition of Banco Master is a strategic move aiming to expand market share and enhance its service offerings. This acquisition reflects broader trends in Brazilian banking towards consolidation and expansion.

-

BRB's Strategic Goals: The acquisition aligns with BRB's goal to become a more significant player in the national banking scene. This expansion strategy demonstrates an ambition for growth and diversification beyond its traditional regional focus.

-

Future Acquisitions: This successful acquisition could signal further expansion plans for the combined entity. BRB might explore other acquisitions or strategic partnerships to consolidate its market dominance.

-

Future of Brazilian Banking: This merger provides a valuable case study for understanding future trends in the Brazilian banking sector. It highlights the increasing importance of technology, digital services, and strategic consolidation as key drivers of growth and competition.

Conclusion

The BRB's acquisition of Banco Master is a pivotal moment in Brazilian banking, presenting both opportunities and challenges. The ultimate impact on consumers, the wider economy, and the competitive landscape will depend on successful integration, strategic decision-making, and the prevailing economic climate. Understanding the intricate details and long-term implications of this BRB Banco Master acquisition is vital for anyone involved in or observing the dynamic Brazilian financial market. Stay informed about the evolving landscape by following further analysis of this significant development and its impact on the future of Brazilian banking.

Featured Posts

-

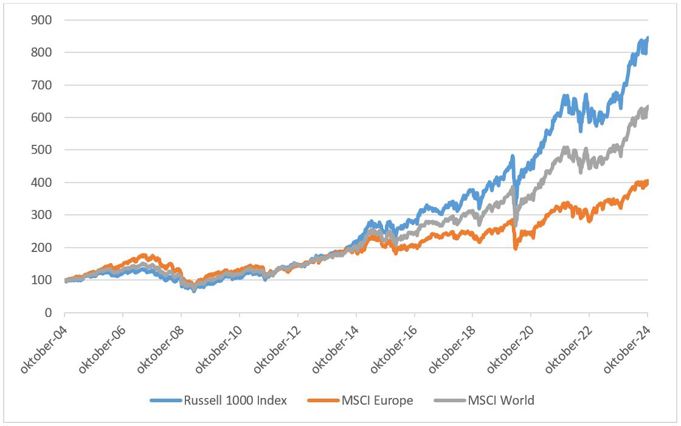

Europese Aandelen En Wall Street Wat Betekenen De Recente Prijsbewegingen

May 24, 2025

Europese Aandelen En Wall Street Wat Betekenen De Recente Prijsbewegingen

May 24, 2025 -

Apple Stock Key Levels Breached Before Q2 Results

May 24, 2025

Apple Stock Key Levels Breached Before Q2 Results

May 24, 2025 -

Under 1 Million Your Dream Country Escape Awaits

May 24, 2025

Under 1 Million Your Dream Country Escape Awaits

May 24, 2025 -

Porsche 911 80 Millio Forintos Extrak

May 24, 2025

Porsche 911 80 Millio Forintos Extrak

May 24, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc A Comprehensive Guide To Net Asset Value

May 24, 2025

Amundi Msci All Country World Ucits Etf Usd Acc A Comprehensive Guide To Net Asset Value

May 24, 2025

Latest Posts

-

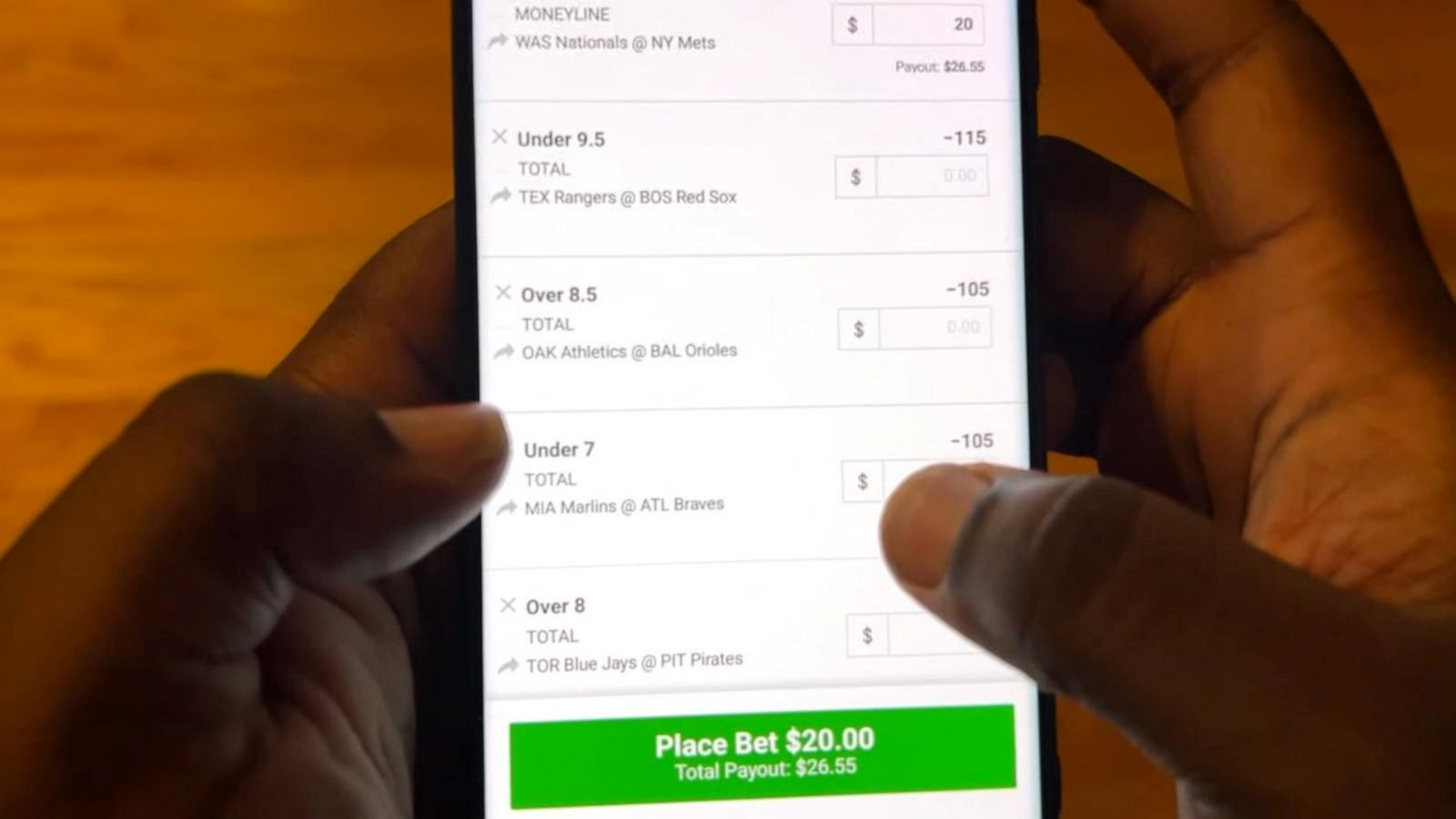

Los Angeles Wildfires Gambling On Catastrophe A Growing Concern

May 24, 2025

Los Angeles Wildfires Gambling On Catastrophe A Growing Concern

May 24, 2025 -

Analysis G 7s Deliberations On De Minimis Tariffs For Chinese Products

May 24, 2025

Analysis G 7s Deliberations On De Minimis Tariffs For Chinese Products

May 24, 2025 -

Sag Aftra Strike Hollywood Production Faces Complete Shutdown

May 24, 2025

Sag Aftra Strike Hollywood Production Faces Complete Shutdown

May 24, 2025 -

Secret Service Investigation Cocaine Discovery At The White House Resolved

May 24, 2025

Secret Service Investigation Cocaine Discovery At The White House Resolved

May 24, 2025 -

Ftc Appeals Activision Blizzard Acquisition Decision Whats Next

May 24, 2025

Ftc Appeals Activision Blizzard Acquisition Decision Whats Next

May 24, 2025