Recession Anxiety Impacts Canadian Housing Market: New BMO Data

Table of Contents

H2: BMO Report Highlights Key Indicators of Slowdown

The recent BMO report paints a concerning picture of the Canadian housing market's current state. Several key indicators point to a marked slowdown, directly linked to growing recession anxiety among potential buyers and sellers. The report meticulously analyzes various data points offering a comprehensive overview of the market's weakening momentum.

-

Percentage change in home sales compared to the previous year: The report indicates a significant year-over-year decrease in home sales, with some regions experiencing double-digit declines. This sharp drop signals a considerable shift in buyer activity, reflective of the prevailing economic uncertainty. This decrease is particularly pronounced in previously high-demand areas.

-

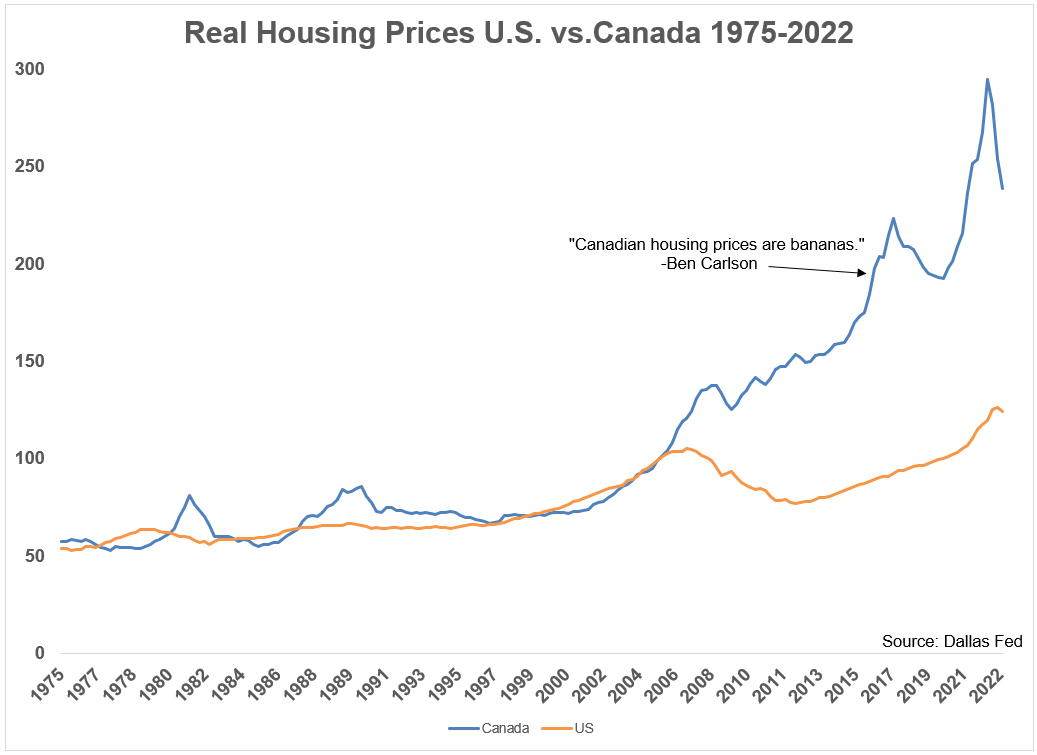

Average price changes in major Canadian cities: While not across the board, many major Canadian cities are experiencing a slowdown in price growth, with some even seeing minor price corrections. This signifies a departure from the rapid price appreciation seen in previous years, a clear consequence of reduced buyer demand fueled by recession anxiety.

-

Changes in the number of new listings: The number of new listings coming onto the market has also shown some fluctuations. In some regions, a slight increase is observed, likely due to sellers entering the market amidst concerns about future price declines. This is a complex dynamic and doesn’t reflect the same uniform pattern as sales volume changes.

-

Specific regions showing the most significant impact: The report highlights that the impact of recession anxiety varies across Canada. Certain regions, typically those most sensitive to economic fluctuations, show a more pronounced slowdown in sales and price growth than others. This underscores the importance of localized analysis when interpreting these national trends.

H2: How Recession Anxiety Fuels Buyer Hesitation

The psychological impact of recession fears on potential homebuyers cannot be overstated. The current climate of economic uncertainty is significantly influencing purchasing decisions. Several intertwined factors contribute to this hesitation:

-

Increased uncertainty about future income: Job security concerns are paramount. The prospect of layoffs or reduced income makes a significant investment like a home purchase a far riskier proposition. Buyers are adopting a wait-and-see approach, delaying purchases until economic conditions become clearer.

-

Higher borrowing costs and mortgage stress: Rising interest rates are making mortgages considerably more expensive. This increases the financial burden on homebuyers, significantly impacting affordability and limiting purchasing power. This increased mortgage stress is contributing to the decline in purchasing power.

-

Reduced consumer confidence impacting purchasing decisions: Overall consumer confidence is falling alongside growing fears of a recession. This affects not only the housing market but also broader economic activity. Reduced consumer confidence naturally translates into less spending across various sectors.

-

The effect of inflation on overall spending habits: Inflation is eroding purchasing power, forcing households to prioritize essential expenditures. This puts discretionary spending, including home purchases, on the back burner. This pressure on household budgets is impacting purchasing decisions across the board.

H2: Impact on Different Housing Market Segments

The impact of recession anxiety is not uniform across all housing market segments. Different sectors are affected differently, requiring nuanced analysis:

-

Analysis of the impact on the condo market versus detached homes: Condo sales have generally shown a more significant drop compared to detached homes in some areas. This could be due to condos being considered a more liquid asset and therefore more readily affected by changes in market sentiment.

-

Regional differences in market sensitivity to recession fears: The impact of recession fears varies geographically. Historically, certain regions experience a more significant impact during economic downturns than others, due to factors like economic diversification and job market stability.

-

Impact on luxury vs. affordable housing segments: The luxury housing segment is usually more sensitive to economic downturns. As the higher end is reliant on buyers with higher disposable incomes, this is naturally the first sector to reflect market anxieties.

H2: Potential Long-Term Effects on the Canadian Housing Market

The current slowdown due to recession anxiety has significant potential long-term implications for the Canadian housing market:

-

Potential for further price adjustments: Depending on the severity and duration of the recession, further price corrections are possible. The extent of the adjustment will depend on several factors, including the strength of the overall economy and future interest rate movements.

-

Impact on future housing supply: The current slowdown could impact future housing supply. If builders experience reduced demand, they might scale back construction projects, leading to potential future housing shortages.

-

Long-term implications for the Canadian economy: The housing market is a significant component of the Canadian economy. A prolonged slowdown could have broader implications for economic growth and stability. This interdependence necessitates continuous monitoring of the situation.

3. Conclusion:

Recession anxiety is undeniably impacting the Canadian housing market, as evidenced by recent BMO data revealing a significant slowdown in sales and potential price corrections. Job insecurity, rising interest rates, and inflation are all contributing factors to buyer hesitation. The long-term effects remain uncertain, but the current climate necessitates careful observation and strategic planning.

Call to Action: Stay informed about the evolving impact of recession anxiety on the Canadian housing market by regularly checking for updated reports and analyses from trusted sources like BMO. Understanding this complex situation is crucial for both buyers and sellers navigating this challenging real estate climate. Monitor key indicators and adapt your strategies accordingly to make informed decisions in the face of economic uncertainty. Understanding the nuances of the Canadian housing market in relation to recession anxiety is key to navigating this period effectively.

Featured Posts

-

Brak Odpowiedzialnosci Za Smierc Piecioosobowej Rodziny Na Przejezdzie Kolejowym

May 07, 2025

Brak Odpowiedzialnosci Za Smierc Piecioosobowej Rodziny Na Przejezdzie Kolejowym

May 07, 2025 -

Kogda Ovechkin Pobet Rekord Grettski Obnovlenniy Prognoz N Kh L

May 07, 2025

Kogda Ovechkin Pobet Rekord Grettski Obnovlenniy Prognoz N Kh L

May 07, 2025 -

Rihannas Chic Winter Outfit Bundled Up For Dinner In Santa Monica

May 07, 2025

Rihannas Chic Winter Outfit Bundled Up For Dinner In Santa Monica

May 07, 2025 -

How Apple Watches Are Enhancing Nhl Game Officiating

May 07, 2025

How Apple Watches Are Enhancing Nhl Game Officiating

May 07, 2025 -

Speculation Ps 5 And Ps 4 Games At The March 2025 Nintendo Direct

May 07, 2025

Speculation Ps 5 And Ps 4 Games At The March 2025 Nintendo Direct

May 07, 2025

Latest Posts

-

The Strategic Importance Of Middle Management In Modern Organizations

May 08, 2025

The Strategic Importance Of Middle Management In Modern Organizations

May 08, 2025 -

Bof As Take On High Stock Market Valuations A Reason For Investor Optimism

May 08, 2025

Bof As Take On High Stock Market Valuations A Reason For Investor Optimism

May 08, 2025 -

Exploring The Value Of Middle Management Benefits For Companies And Their Workforces

May 08, 2025

Exploring The Value Of Middle Management Benefits For Companies And Their Workforces

May 08, 2025 -

Why Middle Managers Matter A Critical Analysis Of Their Impact On Companies And Employees

May 08, 2025

Why Middle Managers Matter A Critical Analysis Of Their Impact On Companies And Employees

May 08, 2025 -

Why Stretched Stock Market Valuations Shouldnt Deter Investors A Bof A Analysis

May 08, 2025

Why Stretched Stock Market Valuations Shouldnt Deter Investors A Bof A Analysis

May 08, 2025